据估计,全球每年要处理 4680 亿多笔支付卡交易。在每一笔交易的背后(当信用卡被刷卡、扫描或点击时发生),都有两个不同但有关各方:发卡银行和收单银行。

这些金融机构在幕后工作,以确保购买资金可用,并将这些资金从买方的账户转移到卖方帐户。当需要退款时,他们也会退还资金。虽然发卡行和收单行所属交易的不同方,但它们协同工作以使系统运行。

我们将介绍您需要了解的有关收单行和发卡行的信息,包括它们是什么、它们如何运作以及它们之间的区别。

目录

- 什么是发卡行?

- 什么是收单行?

- 收单行和发卡行有什么区别?

什么是发卡行?

发卡行,也称为发卡银行或卡发行者,在交易中代表客户。发卡银行是向个人提供支付卡以启动交易的金融机构。发卡行可以是银行、信用合作社或其他金融机构。

大通银行 (Chase)、美国银行 (Bank of America) 和第一资本 (Capital One) 是五大发卡行中的三家。发卡行也可以是当地金融机构,如地区银行或小型信用合作社。

发卡行通常不是维萨 (Visa)、万事达 (Mastercard)、发现 (Discovery) 或美国运通 (American Express)。虽然这些公司提供处理支付卡交易的网络,但它们不参与个人交易或支付。发卡行和收单行处理给定的交易。

在这些交易中,发卡行承担向个人发放信贷的风险。发卡行必须根据许多因素考虑一个人的信誉,包括信用评分和财务历史。如果发卡行批准了客户,他们就会“发行”一张卡,允许客户获得信用额度。

从本质上讲,这些信用额度是授予持卡人的贷款。它们通常是无抵押贷款(这意味着贷款人不要求借款人提供任何抵押品或担保来保证贷款的偿还),如果贷款没有在一定期限内偿还,通常是在 30 或 60 天之后,发行人会收取利息。如果持卡人无力偿还初始贷款并违约,则发卡行将对债务负责,因此初始交易成为发卡行的责任。

在退款发生时,发卡行也发挥着关键作用,即客户对收费提出异议,要求退还资金或取消交易。在提出退款请求的情况下,发卡行充当仲裁员,确定消费者撤销交易的请求是否合理。发卡行对此没有最终决定权,因为他们的决定可能会受到质疑,但发行者确实可以决定是否应该维持或撤销退款。

什么是收单行?

如果我们认为发卡行在交易中代表客户,那么收单行(也称为收单银行)代表企业。收单行是为公司提供从发卡行收款所需工具的银行或金融机构。收单行顾名思义,他们从发卡行获取资金,并确保将其存入企业账户,从而处理和完成交易。他们还为企业提供了一个唯一的 ID,允许他们与卡组织通信以完成这些交易。

虽然收单行有时充当支付处理商,但更常见的是,它们充当中间人,确保交易到达适当的卡组织并成功完成。通常,它们是卡组织的成员,且通常与多个或所有主要的卡处理商合作。收单行将发卡行提供的资金转入正确的商家账户。例如,Stripe 同时提供支付处理和收单行功能,这消除了企业保护单独的商家帐户或支付网关的需要。

与发卡行一样,收单行也存在一定的财务风险。他们负责实施符合支付卡行业数据安全标准委员会要求的安全标准。如果不这样做,在发生数据泄露或信息或持卡人数据被盗并在交易过程中用于恶意目的时,银行的责任就会增加。

通过退款,收单行有责任偿还发卡行,发卡行将资金返还给客户。这会给收单行带来与审查和履行退款请求所需的内部资源相关的成本。为此,收单行可以保留一个准备金账户,从中发出退款,或向企业提供信用额度以支付这些成本。如果企业资不抵债且无力偿还收单行,收单行必须承担损失。

为了限制这种潜在的责任,收单行通常对他们所代表的任何业务都遵循严格的标准。要考虑,企业必须经过评估其风险的审查程序,之后收单行将决定他们是否代表企业。

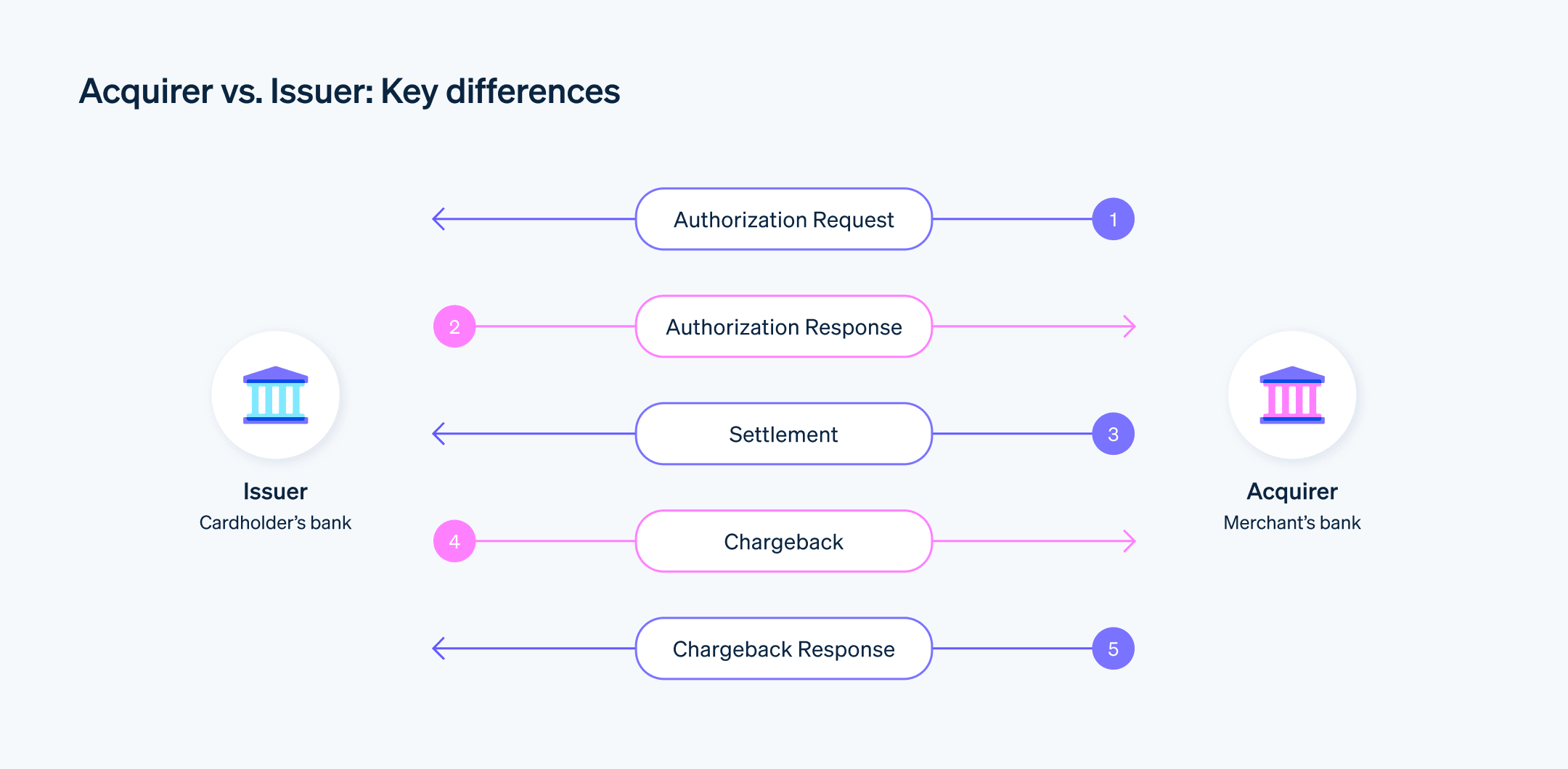

收单行和发卡行有什么区别?

发卡行维护持卡人的借记卡或信用卡账户,为持卡人提供可用于通过卡交易进行支付的资金或信用额度,而收单行则将这笔钱存入企业账户,同时维护交易记录并将任何授权请求转发给相关的卡组织。

以下是这些银行在交易过程中的合作方式:

- 客户通过在销售点 (POS) 终端(如 Stripe 终端)刷卡或点击卡来发起付款。

- 企业的支付处理提供商将交易信息发送给收单行,收单行将其提交给卡组织。

- 卡组织处理请求并询问发卡行资金是否可用,发卡行在检查持卡人的账户后批准或拒绝。

- 该信息被发送到卡组织,卡组织将批准或拒绝通知发送给收单行,收单行将交易状态通知企业。

- 如果获得批准,资金将从发卡行转移到收单行,存入商家账户。

虽然上述示例涉及在 POS 终端上进行的一次性面对面交易,但当交易重复发生时,发卡行和收单行之间的工作关系保持不变,例如按月订阅。这些计费选项也要求发卡行和收单行之间密切沟通,但这些选项是根据批准的经常易自动启动的。像 Stripe 这样的提供商可以为企业管理这些不同类型的计费选项。

在退款的情况下,收单行和发卡行的角色是相反的。持卡人发起退款请求,并向发卡行提交应发放退款的证据。发卡行审核该信息并决定是否处理退款。如果获得批准,发卡行将通过与收单行沟通争议来要求企业返还资金。收单行审查请求并发出退款,然后企业必须通过可用于此类费用的储备金或通过收单行提供的信用额度来支付。

简而言之,发卡行(面向客户的银行)和收单行(面向企业的银行)站在交易的对立面,但共同努力确保成功处理购买或退货。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。