Payment fraud has recently become more widespread and sophisticated. According to a report by the Federal Trade Commission (FTC), there were 2.4 million reports of fraud in 2022, with losses totalling approximately US$8.8 billion. Advances in digital technology are bringing more types of business online, increasing the scale and variety of financial transactions.

As financial transactions move from paper-based methods to digital platforms, the growing complexity of digital transactions also necessitates robust security protocols. For instance, the globalisation of business operations means more companies are engaging in cross-border transactions, which adds complexity and risk due to different regulatory environments and financial systems.

As a result of these shifts, businesses need to implement more comprehensive fraud prevention and security mechanisms. At the same time, customers now expect immediate and error-free financial transactions. Meeting these expectations requires the implementation of thoughtful, interlocking payment solutions that enable quick, precise, secure transactions. One of these solutions is bank account verification – an increasingly important part of financial security protocols.

Here's what you need to know about what bank account verification is, how it works, and how it affects businesses and the financial environments that enable modern payments.

What's in this article?

- What is bank account verification?

- What is bank account verification used for?

- How does bank account verification work?

- Why is bank account verification important?

What is bank account verification?

Bank account verification is a process that confirms the validity of a bank account. This is done for a variety of reasons, including checking to make sure an account is active, confirming that it belongs to the person claiming ownership and verifying that there are sufficient funds for transactions, such as direct deposit or automated payments. Bank account verification is commonly used for online bank payments to reduce the risk of fraud or error.

What is bank account verification used for?

Bank account verification authenticates the ownership and validity of a specific bank account. It is a prerequisite for online transactions – especially electronic funds transfers and Banker Automated Clearing System (BACS) payments – and various other financial activities. The goal is to confirm key details, such as the account holder's name, the account number and the account type (i.e. current or savings). It helps avoid errors, reduce fraud and protect the accuracy of electronic transactions.

How does bank account verification work?

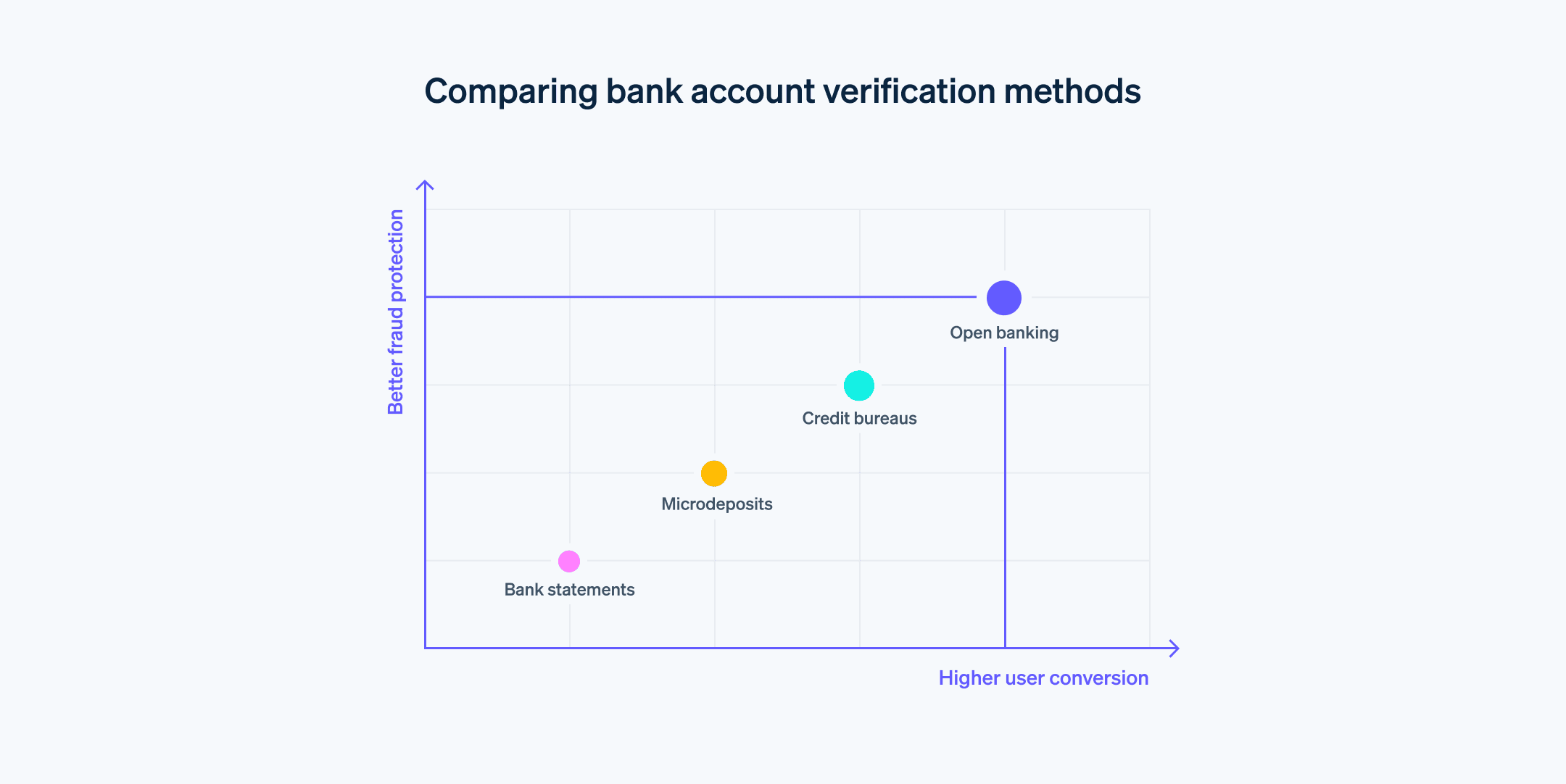

There are multiple verification methods available. These methods might include algorithms to check account number structure according to country or banking institution protocols, direct microdeposits to verify account status, or multifactor authentication techniques to confirm customer identity.

Regardless of verification method, the main objective is to assess the legitimacy of an account and reduce the risk of financial missteps or potentially fraudulent activities. Here are some of the common verification methods:

Instant verification

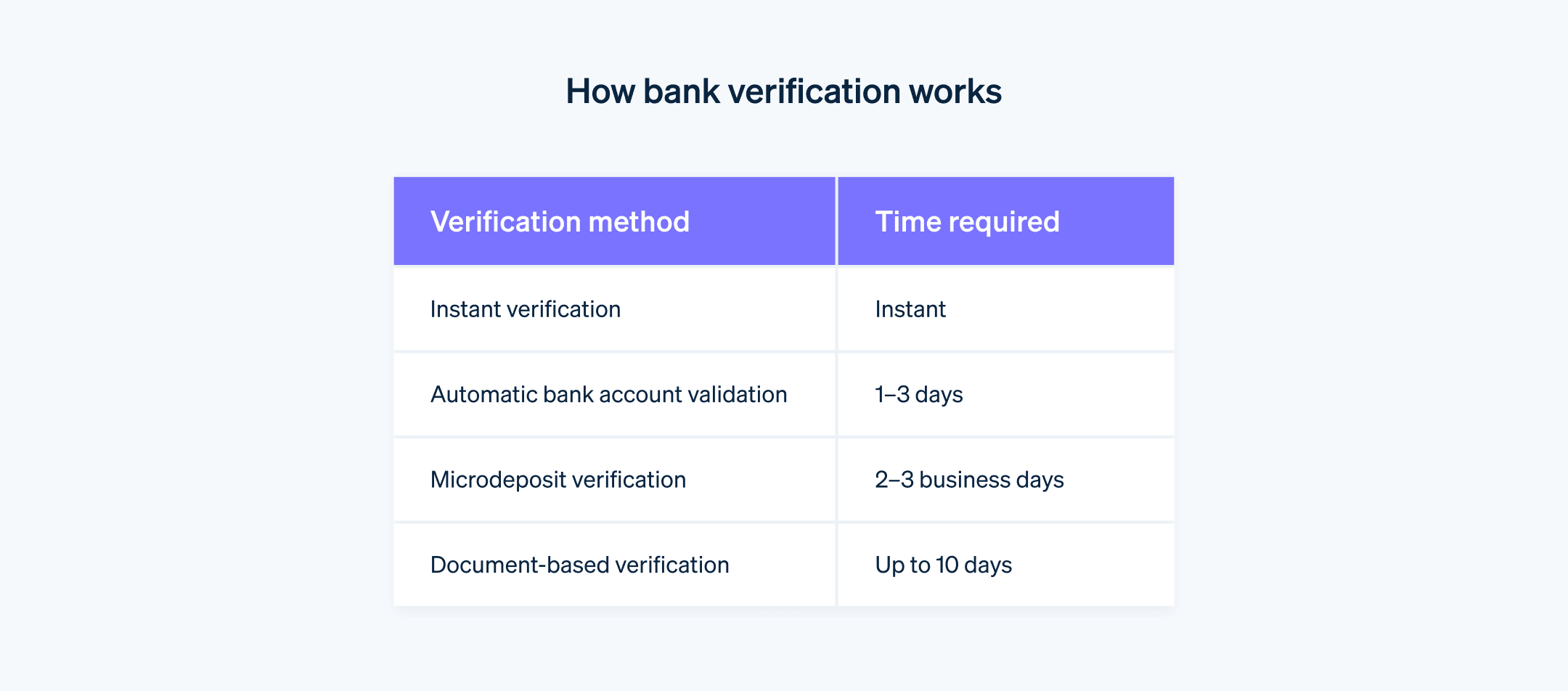

This method uses application programming interface (API) technology to allow a customer to log into their online bank via a third party like Stripe Financial Connections.

OAuth (open authorisation) is the fastest, most secure way for instant verification. OAuth connections employ token-based authentication that allows customers to log in directly to their online bank account without sharing their usernames and passwords. The token is used to safeguard sensitive data by replacing it with a token for businesses to use to validate account credentials. This interface makes account details available immediately, facilitating quick verification.

It’s common to see instant verification used in settings such as:

- Online marketplaces: For faster onboarding, customers can quickly link their bank accounts for payments or deposits.

- E-commerce and subscriptions: Businesses can instantly verify customers’ accounts and start collecting one-time or recurring payments.

- Personal finance apps: These apps offer budgeting advice based on transaction history.

- Investment platforms: Detailed financial history is often necessary for these platforms to function.

Automatic Bank Account Validation

With Automatic Bank Account Validation (ABAV), clients manually enter their bank account details, and a third party validates the account and routing numbers against a database to ensure the account is legitimate. This type of verification is often seen in situations that involve:

- Offline payments: Businesses that take orders over the phone or mail

- Payment between enterprises: Businesses that make large transactions requiring manual contracting and payments

Microdeposit verification

Microdeposit verification involves sending small monetary transfers to the account under scrutiny. Upon receipt, the account holder must verify either the code in the statement descriptor or the exact amounts. Though considered reliable, it’s a slower process that can take two to three business days. This type of verification is often seen in situations that involve traditional financial institutions. Given its long history of use, traditional banks and credit unions – institutions for which a slow turnaround is more acceptable – widely use this method.

Document-based verification

With document-based verification, the account holder provides paper or electronic documents, such as a voided cheque or bank statements, to substantiate their account status and ownership. This is generally a more labour-intensive option and may require manual oversight, potentially delaying the verification process. Some instances where this type of verification might be appropriate include:

- Mortgage loans: The stakes are high for mortgage loans, and lenders prefer thorough documentation to verify the financial standing of an applicant.

- Car loans: Similar to mortgage lending, car loans often require robust documentation for verification.

Why is bank account verification important?

Bank account verification helps establish trust in and accuracy of payment processing systems by supporting the safety, efficiency and legality of financial transactions. Here is how bank account verification accomplishes this:

Establishing account legitimacy

Establishing the legitimacy of an account helps avoid fraudulent transactions or deter deceptive behaviour. For financial institutions and businesses, accurate account verification protects against financial irregularities that could have costly repercussions.

Facilitating automated and digital payments

Verification ensures that the account information is correct, enabling smoother processing of transactions such as direct debits, automated bill payments and online purchases. Faulty information can lead to transaction failures, incurring fees and disrupting financial operations for both customers and businesses.

Upholding regulatory compliance

Regulatory frameworks such as the United States' Bank Secrecy Act and Europe's PSD2 mandate certain verification steps for financial institutions. Failure to comply can result in hefty fines and reputational damage for the offending organisation. Verification acts as a built-in mechanism to fulfil these regulatory requirements, and it's a necessity for operating within the law.

Increasing data accuracy

Businesses and financial institutions collect a lot of data for analysis, decision-making and service improvement. Verification contributes to the accuracy of this data, making it more reliable for future business decisions and customer interactions.

Maintaining account holder relationships

Verification reassures account holders that measures are in place to confirm the legitimacy of transactions and protect against potential financial mishaps.

Stripe's approach to fraud prevention uses integrated machine-learning technology and additional authentication to help separate real customers from fraudulent actors.

Learn more about how you can fight fraud with Stripe.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.