From debit cards to ATMs to wire transfers, it’s now widely accepted that electronic transfers are a secure and efficient way to send funds, but the various types of transfers available can make it difficult to decipher which is the best method for your business. For example, what’s the difference between an electronic funds transfer (EFT) and an Automated Clearing House (ACH) payment? And when is one better to use than the other?

We’ll cover the differences and overlaps between EFTs and ACH payments, what each type is used for, and what you should know about electronic payment methods for your business.

What's in this article?

- What is an EFT?

- What is an ACH payment?

- ACH vs EFT: What’s the difference?

What is an EFT?

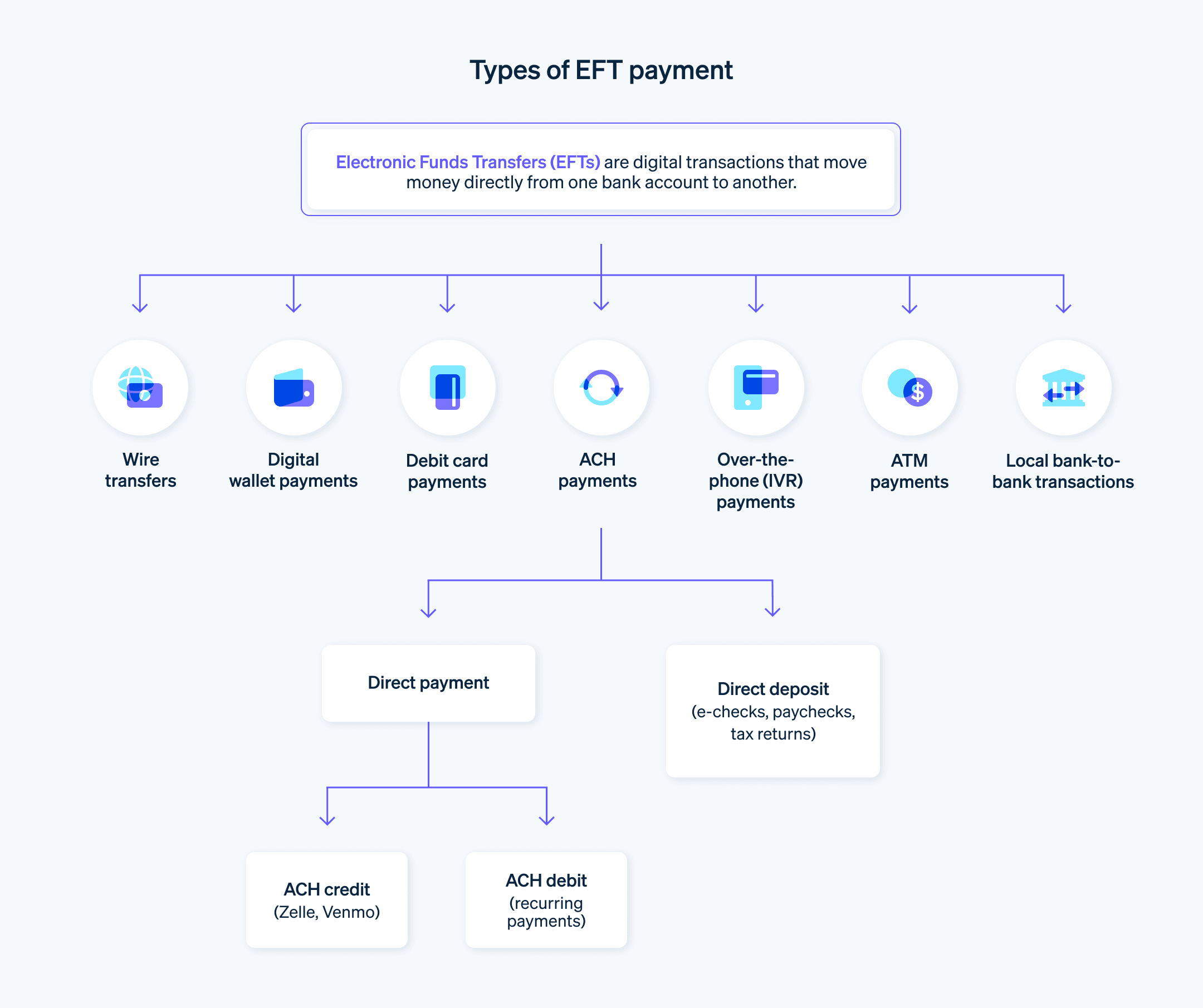

EFTs are transactions that move funds electronically between different financial institutions, bank accounts or individuals. EFTs are commonly referred to as electronic bank transfers, e-checks and electronic payments.

Types of EFT:

- ACH transfers

- Wire transfers

- ATM transactions (withdrawals, deposits and transfers)

- Debit card transactions

- Peer-to-peer payments

What is an ACH payment?

ACH payments are electronic transfers of funds sent using the Automated Clearing House, a centralised US financial network for banks and credit unions used for sending and receiving electronic payments and money transfers. The ACH network is operated and governed by the National Automated Clearing House Association (Nacha), an independent organisation of banks, credit unions and payment processing companies.

ACH payments are a highly flexible way to send and receive funds for a wide range of uses. In 2021, more than 426 million payments totalling US$2 trillion were made using the ACH network, an increase of almost 18% from 2020.

Types of ACH payments:

ACH direct deposit

Referring to any kind of transfer from a government entity or business to a consumer, an ACH direct deposit allows employers to transfer payroll funds directly into their employees’ bank accounts. According to Nacha, 93% of US workers receive their pay cheques via ACH direct deposit.

Other types of direct deposit:

- Employer-reimbursed expenses

- Government benefits

- Tax refunds

- Annuity payments

- Interest payments

ACH direct payments

Direct payments allow consumers and businesses to issue payments straight from their bank accounts. These payments can be used for anything from paying bills to buying goods and services.

ACH vs EFT: What’s the difference?

The terms "ACH transfers" and "EFT" are not interchangeable, but they are strongly related. ACH transfers are a type of EFT, and EFTs include ACH transfers but are not limited to them.

There are additional differences between ACH payments and other types of EFTs:

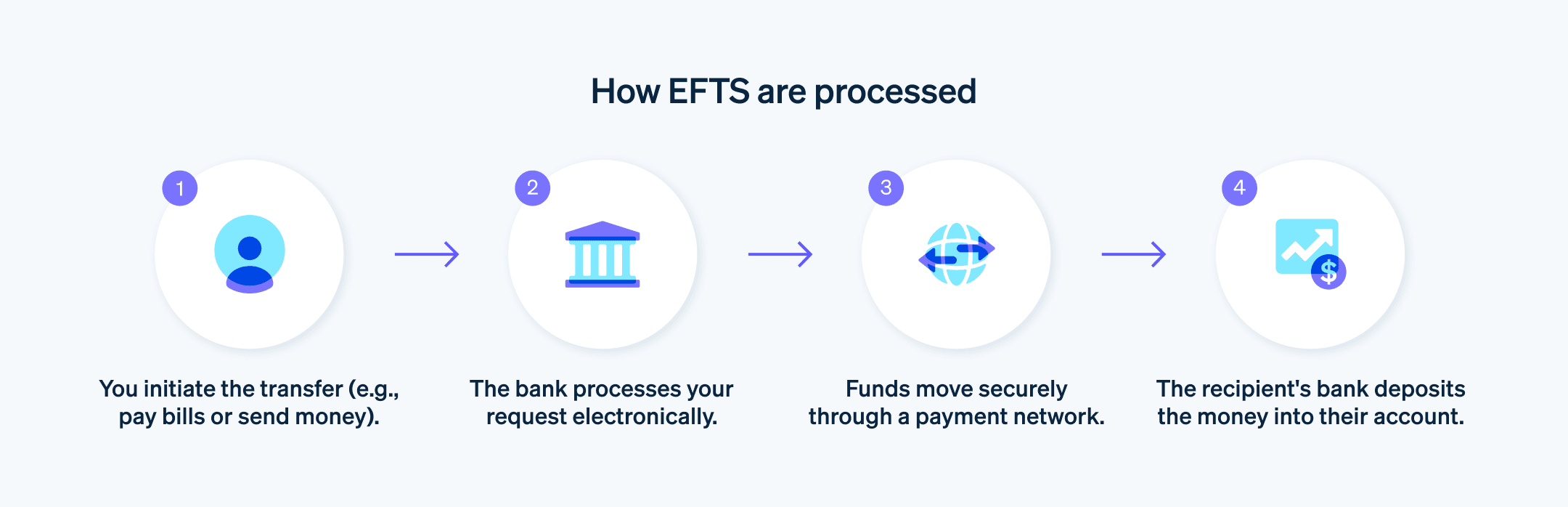

How they’re processed

While wire transfers are processed individually in real time, ACH transfers are settled in batches. Every transfer request that comes into the ACH network joins a queue – several times during business days, the transfers in this queue are processed together.Transfer speed

Some EFTs, such as digital wallets, ATM transactions and debit card payments, are authorised and completed within a few seconds. Wire transfers typically take anywhere from a few hours up to two working days. ACH payments are generally considered to take longer than wire transfers, but updates to Nacha’s operating rules in the past few years have greatly expanded access to same-day ACH transfers.Cost

EFT costs and fees vary considerably, depending on the type of EFT, where the transfer is originating from, where the transfer is heading and the amount of money involved. ATM transactions and payments sent using peer-to-peer apps usually carry per-transaction fees of just a few dollars, whereas international wire transfers can cost as much as US$50 per transfer. Some ACH transfers are free, and some cost a few dollars.

The differences between types of EFTs speak to the expansive range of products and services that falls under this umbrella term. Understanding the various options available for transferring funds will help you make smart, practical decisions about which type of EFT is the ideal vehicle for your payment needs.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.