Dynamic currency conversion (DCC) is a financial service used in international transactions, when a customer from one country makes a credit or debit card purchase in another. DCC allows the transaction to be processed at the point of sale in the currency of the cardholder's home country. The global credit card payments market is forecast to jump from US$524.9 billion in 2022 to US$1.2 trillion by 2032, and cross-border payments are an important part of that growth.

Below, we'll explain what businesses should know about dynamic currency conversion, including how it works, how it compares with traditional currency conversion, and the pros and cons of implementing dynamic currency conversion.

What's in this article?

- How does dynamic currency conversion work?

- Dynamic currency conversion vs traditional currency conversion

- Benefits of using dynamic currency conversion for businesses

- Challenges of dynamic currency conversion

- Dynamic currency conversion best practices

- Does Stripe enable dynamic currency conversion?

How does dynamic currency conversion work?

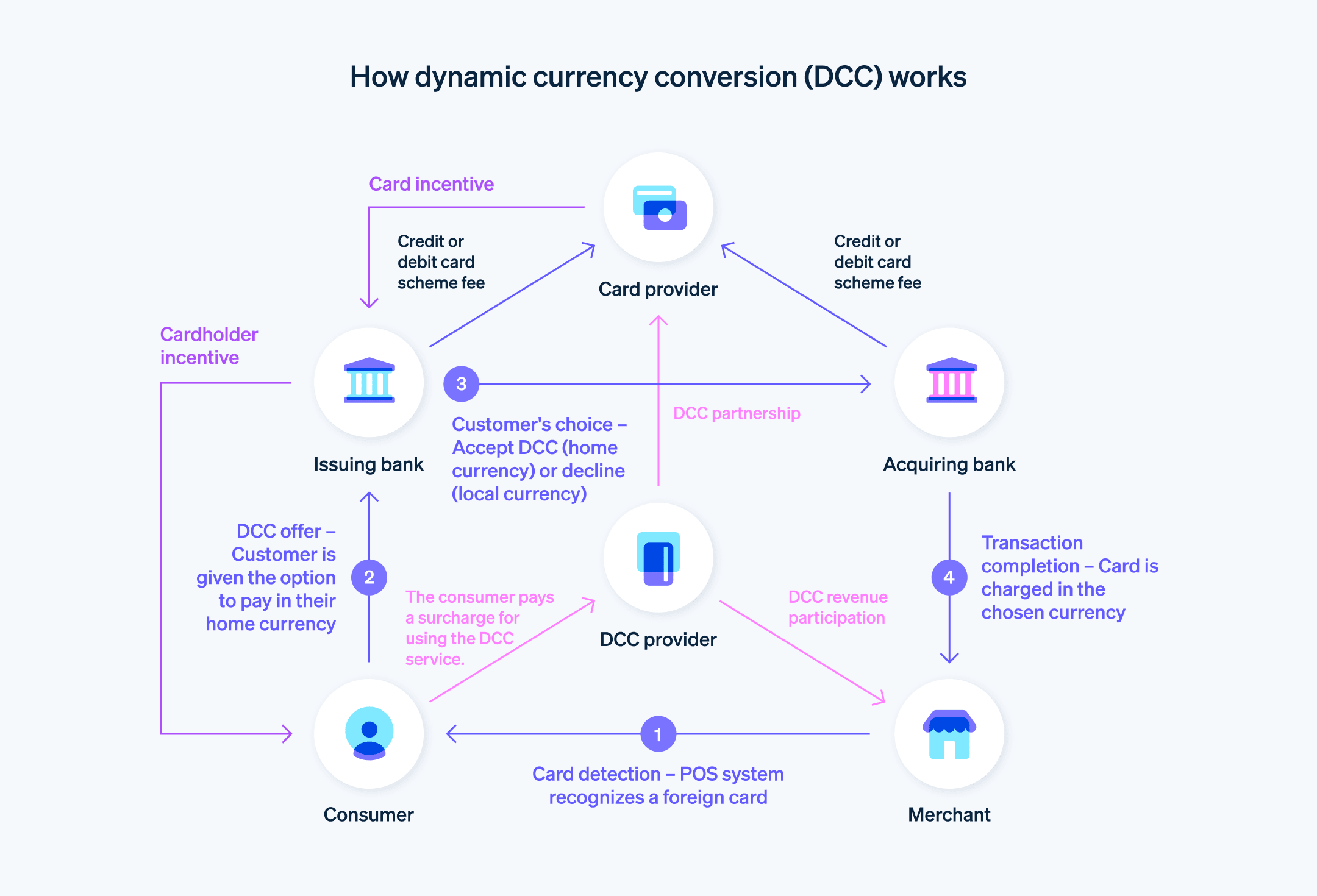

DCC provides cardholders with a convenient and immediate understanding of transaction costs in their home currency, although it may involve higher costs because of exchange rate markups and fees. For businesses and financial institutions, DCC offers a chance to earn additional revenue. Here's how it works:

The DCC process

Card detection: When a customer uses a foreign credit or debit card on a business's point-of-sale (POS) system or an e-commerce platform, the system identifies the card's country of origin.

DCC offer: The business's system, equipped with DCC technology, automatically offers the cardholder the option to complete the transaction in their home currency. The amount includes the conversion rate and any additional fees involved in the conversion.

Customer's choice: The cardholder can either accept the DCC offer and pay in their home currency or decline it and pay in the local currency.

Transaction completion: If the customer chooses DCC, the transaction is processed and the card is charged in the cardholder's home currency using the exchange rate displayed. If the cardholder declines DCC, the transaction is processed in the local currency and the cardholder's bank will convert it using the bank's exchange rate.

Roles and benefits

Businesses: Businesses benefit from DCC by earning additional revenue through commissions or fees associated with the currency-conversion process.

Financial institutions: Banks or financial service providers that offer DCC set the exchange rates and fees. These rates often include a markup over the standard exchange rate.

Technological integration

Payment processing technology: DCC technology enables the automatic detection of foreign cards and real-time currency conversion, making DCC an easy option at POS systems and online.

POS systems and e-commerce integration: DCC is integrated into modern POS systems and online payment gateways, allowing businesses to offer this service to international customers in shops and online.

For example, consider an American tourist in Italy who wants to buy an item that costs €100. The POS system recognises the credit card as American and offers to charge US$120 (which includes the DCC exchange rate and fees). The tourist can choose to pay US$120, knowing the exact cost in their currency, or pay €100, leaving the conversion to their bank.

Dynamic currency conversion vs traditional currency conversion

Dynamic currency conversion and traditional currency conversion are two distinct methods that are used in international card transactions. Each has its own implications for exchange rates, fees, customer choice and the business's profit. Here's how they differ:

Differences in exchange rates and fees

Dynamic currency conversion

Exchange rates: The exchange rates in DCC often include a markup over the daily bank exchange rate. This markup is a combination of the currency-conversion fee and a profit margin for the business or the DCC provider.

Fees: DCC transactions typically involve additional fees, which are bundled into the exchange rate offered to the customer. These fees can vary depending on the businesses and the DCC service provider.

Traditional currency conversion

Exchange rates: In traditional currency conversion, the exchange rate is determined by the customer's bank or card issuer after the transaction has been processed. This rate is usually closer to the interbank exchange rate, which tends to be more favourable to the customer.

Fees: Traditional conversions might include foreign transaction fees the customer's bank charges. These fees are usually a percentage of the transaction amount and are separate from the exchange rate.

Impact on customer choice and experience

Dynamic currency conversion

Immediate clarity: DCC offers immediate clarity on how much a transaction will cost in the cardholder's home currency. This can be particularly appealing for those who prefer to know the exact cost up front without worrying about future fluctuations in the exchange rate.

Potential for higher costs: Because of the higher exchange rates and bundled fees, customers might end up paying more than they would with a traditional currency conversion. A 2017 study from the European Consumer Organisation found that customers using DCC in Europe paid between 2.6% and 12% more, highlighting why customers are often advised to opt out of DCC.

Traditional currency conversion

Potential savings: Customers might save money because of more favourable exchange rates and the possibility of lower fees overall.

Uncertainty in costs: The exact cost in the home currency is unknown at the point of sale and will depend on future fluctuations in the exchange rate and bank fees.

Pros and cons for businesses

Pros of DCC for businesses

Additional revenue: Businesses earn commissions or fees from DCC transactions, providing an extra revenue stream.

Customer convenience: The option to use DCC can improve the customer's shopping experience by providing them with more payment options and clarity on pricing in their home currency.

Cons of DCC for businesses

Implementation and compliance: Using DCC requires integration with payment systems and adherence to various international regulations, which can be complex and costly for businesses.

Customer perception: Some customers might view DCC unfavourably if they feel as though they are being charged an excessive amount because of higher exchange rates and fees.

Pros and cons of traditional currency conversion

Simplicity: For businesses, traditional conversion is simpler to manage because it does not require the integration of DCC systems.

Less revenue opportunity: Unlike DCC, traditional conversion does not provide additional revenue from currency conversion fees.

DCC offers immediate pricing transparency in the customer's home currency but often at a higher cost because of exchange rate markups and bundled fees. Traditional conversion might be more cost-effective for the customer, but it lacks the up-front pricing clarity of DCC. DCC offers an additional revenue stream for businesses and can be more convenient for customers, but it also involves complexities in terms of implementation and potential customer pushback because of the high costs perceived.

Benefits of using dynamic currency conversion for businesses

DCC offers many benefits to businesses that deal with international shoppers, including increased customer convenience and additional revenue. Let's take a look:

Convenience for international shoppers

Ease of transactions: DCC simplifies the purchasing process for international customers by letting them see prices and pay in their home currency. This eliminates the need for mental currency conversion and provides a more intuitive shopping experience.

Familiarity and comfort: Paying in a familiar currency can be reassuring for customers, especially in an international setting where different currencies can complicate a purchase.

Immediate understanding of costs: DCC provides customers with the exact cost in their own currency at the point of sale, eliminating uncertainties related to fluctuating exchange rates or unknown fees that the customer's bank might charge.

Transparency in currency exchange rates

Up-front exchange rate information: With DCC, the exchange rate is presented to the customer at the time of the transaction, making it clear which rate will be used for the currency conversion.

Informed decisions: Getting this information up front lets customers make informed decisions about whether to proceed with DCC or use the standard conversion process through their bank.

Avoidance of hidden fees: Although DCC rates may include a markup, the overall structure of the transaction is transparent, helping customers to avoid the hidden fees that can sometimes occur with bank conversions.

Potential rewards and benefits for businesses

Additional revenue stream: Businesses can earn additional income from DCC transactions, from a share of the conversion fees or from adding markups to the exchange rate.

Better customer service: DCC can be seen as a value-added service, enhancing the overall customer experience. This can be particularly beneficial in sectors in which international transactions are common, such as tourism, hospitality and e-commerce.

Competitive advantage: By providing DCC, businesses can differentiate themselves from competitors who do not offer this service, potentially attracting more international customers.

Simplified accounting: For businesses, processing transactions in their home currency simplifies accounting and financial reporting by eliminating the need to convert foreign sales into local currency.

Challenges of dynamic currency conversion

Although dynamic currency conversion offers several benefits, it also comes with a number of challenges for customers and businesses. Businesses that are considering DCC should be aware of these challenges:

Higher costs for customers

Unfavourable exchange rates: DCC often involves exchange rates that are less favourable compared with standard bank rates. This markup can lead to higher costs for customers, making purchases more expensive than they would be if they were processed in the local currency.

Lack of awareness: Customers might not be fully aware of the additional costs associated with DCC. They might use it without understanding that it could be more expensive than letting their bank handle the currency conversion.

Transparency and consent concerns

Inadequate disclosure: There are instances in which the terms of DCC (including the exchange rate and fees) are not communicated clearly to the customer, leading to confusion and potential dissatisfaction.

Consent issues: In rare cases, customers are opted in to DCC automatically, without explicit consent, which is considered unethical. Customers whose transactions are processed using DCC should have chosen it themselves over a traditional conversion.

Regulatory and compliance requirements

Complex regulations: Businesses offering DCC must work through and comply with complex international financial regulations, which can be resource intensive.

Constant monitoring: Exchange rates fluctuate continually, requiring constant monitoring and adjustment of DCC rates for businesses to remain competitive and fair.

Impact on customer perception

Negative customer experience: If customers feel as if they were misled or overcharged because of DCC, it can lead to a negative perception of the business, thus affecting customer loyalty and brand reputation.

Educational requirement: Businesses that use DCC must educate staff and customers. Misunderstandings or misinformation can lead to a poor customer experience.

Technical and operational challenges

Integration with POS systems: Implementing DCC requires integration with POS systems, which can be challenging and costly.

Currency management: Businesses need to manage multiple currencies efficiently, which can complicate accounting practices and financial management.

Market variability

- Dependence on tourism and international trade: Businesses that rely heavily on DCC might face challenges during periods of reduced international travel or trade fluctuations.

Dynamic currency conversion best practices

Understanding and compliance

Regulatory compliance: Your business will need to adhere to all relevant local and international regulations regarding currency conversion and financial transactions.

Education: Staff should be well informed about DCC, including how it works, the benefits it offers and the implications it has for the business and customers.

Transparent customer communication

Informed choice: Always offer customers a choice between paying in their home currency or the local currency. Avoid defaulting to DCC without consent.

Clear explanation: Provide a concise and clear explanation of what DCC is and how it affects the transaction.

Display rates: Show the exchange rates and any associated fees up front.

Competitive and fair pricing

Fair exchange rates: Use competitive exchange rates. Overcharging can lead to customer dissatisfaction and damage your reputation.

Fee structure: Keep the fee structure reasonable and competitive. Exorbitant fees can deter customers.

Technology and integration

Smooth integration: Make sure that DCC is integrated into your payment systems without causing any delays or complications in the transaction process.

Security: Implement security measures to protect transaction data and comply with various standards, such as the Payment Card Industry Data Security Standard (PCI DSS).

Monitoring and analysis

Transaction monitoring: Monitor DCC transactions on a regular basis for any unusual activity or patterns that might suggest errors or fraud.

Performance analysis: Analyse the performance of DCC in your business. Look at customer uptake, the revenue generated and any customer feedback.

Customer support and feedback

Support channels: Provide easy-to-access customer support for queries related to currency conversion.

Feedback mechanism: Have a system to gather and analyse customer feedback relating specifically to customers' experiences with DCC.

Marketing and promotion

Targeted marketing: Consider targeted marketing that promotes the benefits of DCC for specific regions.

Promotional offers: Use DCC as an opportunity for promotional offers, such as reduced fees for first-time users or during certain periods.

Continual improvement

Stay informed: Be aware of changes in currency markets, technology and regulations.

Adaptation and evolution: Be prepared to adapt your DCC practices based on new technologies, customer preferences and market trends.

Partnerships

Choosing the right partner: If you're using a third-party service for DCC, choose a reputable provider with a record of transparent and fair practices.

Negotiate terms: Work with your provider to negotiate terms that are favourable to your business and fair to your customers.

Does Stripe enable dynamic currency conversion?

Stripe doesn't offer dynamic currency conversion, but it does offer an automatic currency conversion feature, tailored for businesses operating in the US, Canada, Great Britain and the eurozone. This feature lets businesses present prices in their customer's local currency, using the latest exchange rates as provided by Stripe. Here's how it works:

Currency conversion for over 40 countries: The feature converts prices to a customer's local currency for over 40 countries. This lets businesses display prices in the customer's local currency, enhancing the customer experience and potentially adding payment methods that require local currency presentment.

Choice of currency for customers: Customers have the option to view prices in their local currency or in the original currency set by the business. This flexibility caters to the diverse preferences of international customers, letting them choose the most convenient option.

Fees and exchange rates: Stripe applies the midmarket exchange rate and includes a margin to guarantee this rate for the duration of the Checkout session through to settlement. The standard transaction fees for automatic currency conversion include:

- Fee for cards or payment methods

- Fee for international cards or payment methods, if applicable

- Fee for currency conversion

- Fee for cards or payment methods

Guaranteed exchange rate: The exchange rate is guaranteed from the start of the Checkout or Payment Links session through to settlement – as long as the exchange rate doesn't change by more than 2%. If there's a significant change beyond this threshold, Stripe might apply the latest exchange rate when settling the transaction. This guarantee provides stability in pricing for businesses and their customers.

Handling of refunds and chargebacks: Refunds or chargebacks are issued in the currency that the customer used for payment. However, automatic currency conversion doesn't guarantee the same exchange rate for refunds or chargebacks. The exchange rate provided by Stripe at the time of the refund or chargeback is applied, which could lead to gains or losses for the business depending on fluctuations in the exchange rate.

Stripe's automatic currency conversion feature provides a flexible solution for businesses that are looking to cater to international customers. It simplifies the currency-conversion process, offers transparency in pricing and includes various safeguards, such as guaranteed exchange rates. But it has the potential for additional fees, and businesses must manage refunds and chargebacks carefully. Learn more about Stripe's Adaptive Pricing.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.