An LLC, or “limited liability company,” is a business structure in the United States that combines elements of corporations and partnerships. It provides limited liability protection, which means the owners’ personal assets are protected from business debts and legal actions. Unlike a corporation, an LLC is not required to have a formal management structure such as a board of directors. An LLC is managed either by its members (member-managed) or by designated managers (manager-managed).

When forming an LLC, one of the first important decisions you’ll face is which state to register in. Each US state has its own set of benefits, regulations, and tax implications that can impact the operations and profitability of your LLC. From the business-friendly environments of Delaware and Wyoming to the tax advantages of Nevada, the state you incorporate in can affect your business’s legal liability, financial health, and more.

Whether you’re a US-based entrepreneur or an international businessperson looking to enter the US market, choosing the right state for your LLC can impact your long-term success. Below, we’ll explain what each state offers for LLC formation and how to pick the best state for your business.

What’s in this article?

- What types of businesses are LLCs best for?

- Pros and cons of forming an LLC

- LLC tax basics

- How to pick the right state for your LLC

- Top states for LLCs

- Setting up an LLC as a non-citizen

What types of businesses are LLCs best for?

According to the US Census Bureau, more than 430,000 new businesses were formed in June 2024. While LLCs are suitable for many businesses, they might not be the best option for all. Businesses seeking substantial venture capital funding or planning to go public might find corporations more advantageous. The following business types are most likely to benefit from the features of an LLC.

Professional services: Consultants, freelancers, accountants, lawyers, and other professionals often choose LLCs for their personal liability protection, which separates personal assets from business debts and liabilities.

Small businesses: Many small businesses choose LLCs for their simplicity and pass-through taxation, in which profits and losses pass through to the owners’ personal tax returns, avoiding double taxation.

Real estate: Real estate investors and property management companies often use LLCs to hold properties. This provides liability protection and potential tax advantages.

Startups: Startups with moderate to high growth potential might prefer LLCs as they offer flexibility in ownership structure and profit distribution, which makes them attractive to potential investors.

Family businesses: LLCs can be a good choice for family businesses, because they allow for flexible ownership and management arrangements among family members while protecting personal assets.

High-risk businesses: Businesses with higher liability risks, such as construction or manufacturing, can benefit from the liability protection that LLCs offer.

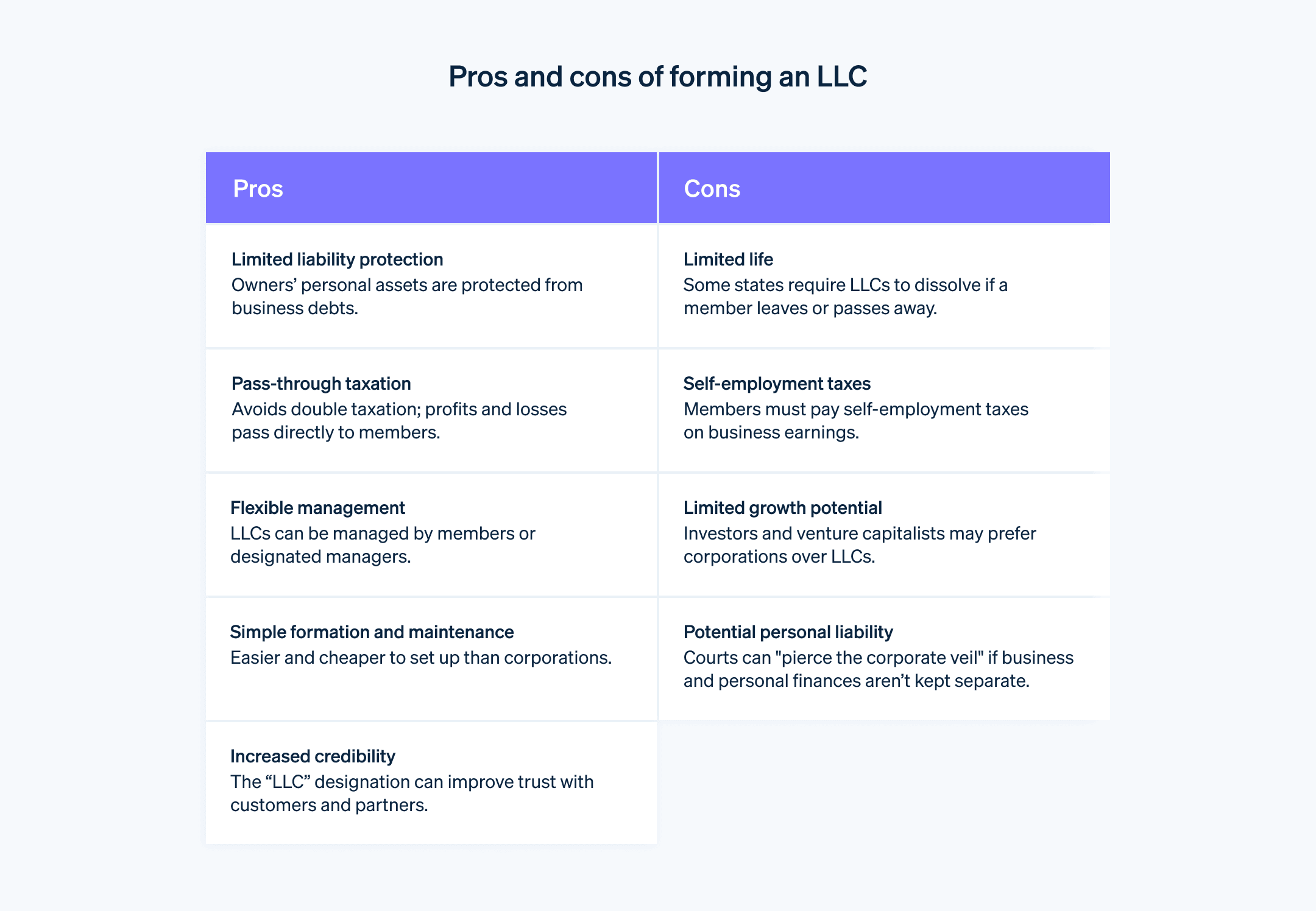

Pros and cons of forming an LLC

Forming an LLC has its advantages and disadvantages. Here are the pros and cons.

Pros

Limited liability protection: Members are not personally liable for the company’s debts or liabilities.

Pass-through taxation: LLCs avoid double taxation by passing profits and losses directly to members’ personal tax returns.

Flexibility: LLCs have flexibility in management structure, profit distribution, and ownership arrangements.

Simplicity: LLCs are generally easier and less expensive to form and maintain than corporations.

Credibility: Having a business name that includes “LLC” can signify credibility and professionalism to customers, partners, and vendors.

Cons

Limited life: In some states, LLCs have a limited lifespan and might need to dissolve if a member leaves or dies.

Self-employment taxes: Members who actively participate in the business are considered self-employed and must pay self-employment taxes.

Limited growth potential: LLCs might not be as attractive to venture capitalists or angel investors as corporations, which could limit their growth potential.

Potential for personal liability: In rare cases, courts can “pierce the corporate veil” and hold members personally liable if they fail to maintain the separation between personal and business assets or engage in fraudulent activities.

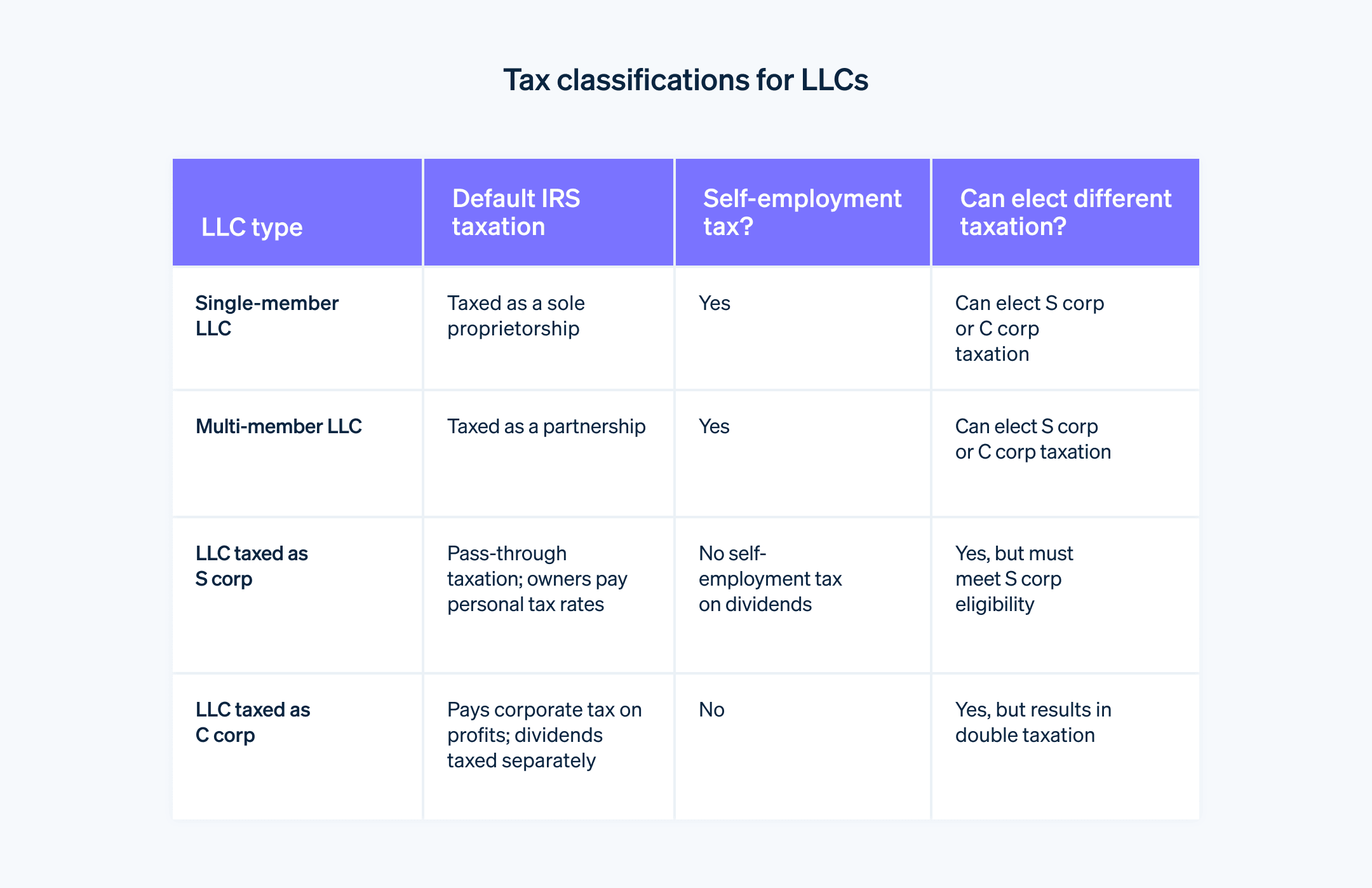

LLC tax basics

The taxation of an LLC depends on the number of members (owners) and the chosen tax classification. When choosing a tax classification for your LLC, it’s best to consult with a tax professional about your specific circumstances and goals, as your classification can substantially impact your overall tax burden and financial situation.

Single-member LLCs

IRS designation: By default, the IRS treats single-member LLCs as disregarded entities, meaning the business income and expenses are reported on the owner’s personal income tax return (Form 1040, Schedule C).

Self-employment taxes: The owner pays self-employment taxes on the LLC’s profits.

Changing tax status: The owner can choose to have the LLC taxed as an S corporation or C corporation instead by filing the appropriate forms with the IRS.

Multi-member LLCs

IRS designation: By default, multi-member LLCs are taxed as partnerships. The LLC files an informational return (Form 1065) to report the income and losses to the IRS, but the business itself doesn’t pay income taxes. Each member reports their share of the income and losses (based on their ownership percentage, and indicated on a Schedule K-1 sent out annually) on their personal tax return.

Self-employment taxes: Each member pays self-employment taxes on their share of the LLC’s profits.

Changing tax status: Multi-member LLCs can elect to be taxed as an S corporation or C corporation instead by filing the necessary forms with the IRS.

Alternate tax classifications

S corporation: Choosing to be taxed as an S corporation offers potential tax benefits by allowing owners to receive a salary and dividends, potentially reducing self-employment taxes.

C corporation: Choosing to be taxed as a C corporation means becoming subject to double taxation. The corporation will have to pay income tax on its profits and shareholders will also have to pay taxes on dividends received.

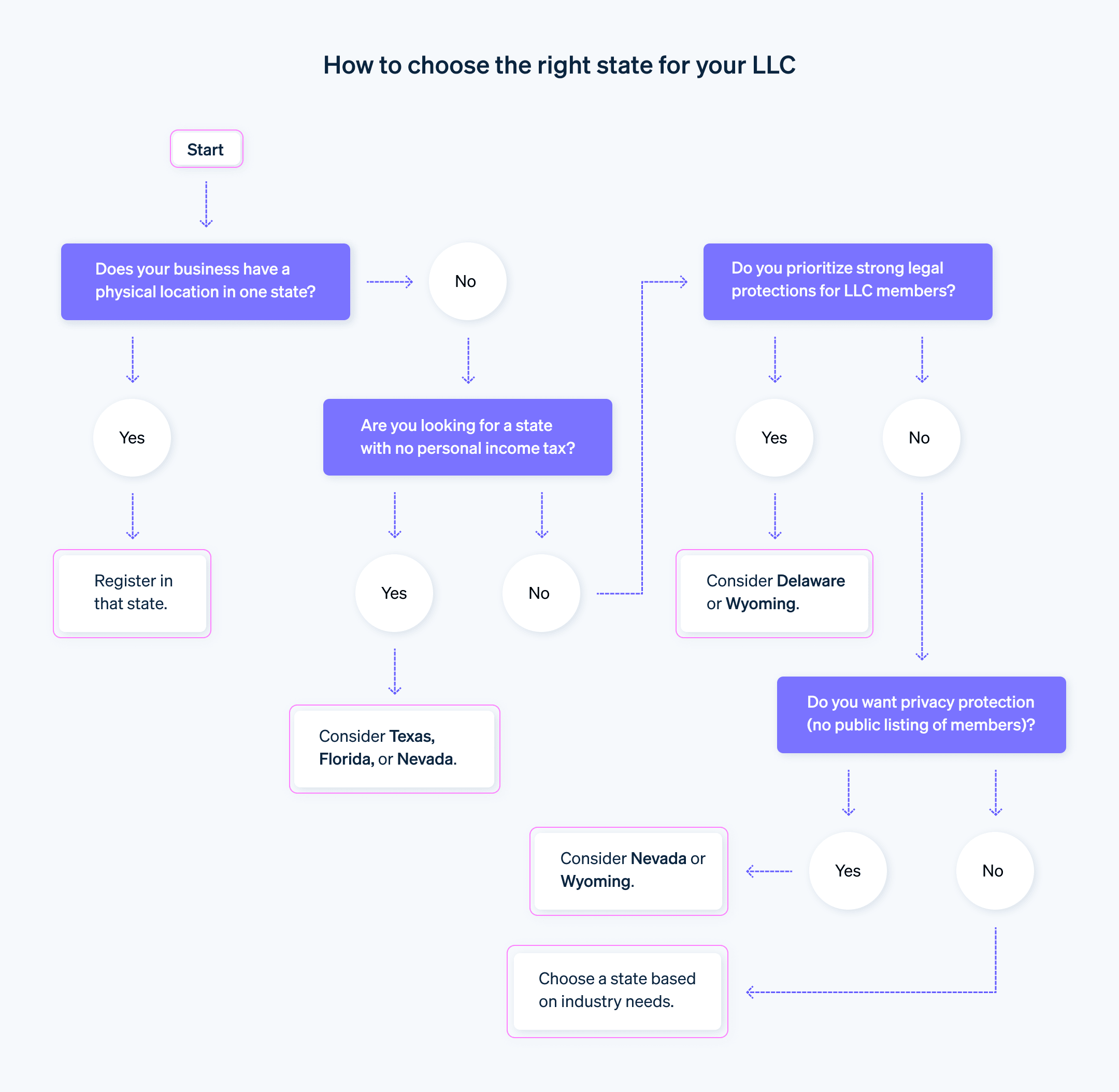

How to pick the right state for your LLC

When choosing which state to register your LLC in, it’s a good idea to consult with a business lawyer or tax professional who understands the nuances of state-specific LLC laws and can provide tailored advice. In addition to professional advice, consider the following factors when determining which state is the best fit for your business’s needs.

Physical presence: If your business has a physical shopfront, office, or major operations in a particular state, it makes sense to register your LLC in that state because you will need to comply with local laws and tax requirements regardless of where the LLC is officially formed.

State taxes: Consider the tax environment of the state. Some states such as Texas, Florida, and Nevada do not have personal income tax, which might be beneficial depending on your LLC’s tax structure.

State-specific laws: Each state has its own set of laws and regulations governing different aspects of LLCs such as liability protections, reporting requirements, and governance. Some states, such as Delaware and Nevada, are popular for their business-friendly laws and well-established legal precedents that protect LLC members.

Costs: Each state will have its own initial formation fees, annual report fees, franchise taxes, and other costs associated with maintaining an LLC. These fees vary widely from state to state.

Investor considerations: If you’re seeking investment, some states might be more attractive to investors. For example, many investors prefer Delaware for its predictable legal system and extensive body of corporate law.

Privacy: Some states, such as Wyoming and Nevada, have greater privacy protections for LLC owners, and don’t require the disclosure of member information in public filings.

Future business needs: Consider the scalability of your business and future needs. If you plan to expand to multiple states, it might be worth considering a state with a regulatory environment that facilitates easier expansion.

Convenience and familiarity: Registering an LLC in your home state can provide the benefit of convenience and familiarity with local laws and practices. This can also simplify operations if most of your business activities and banking are local.

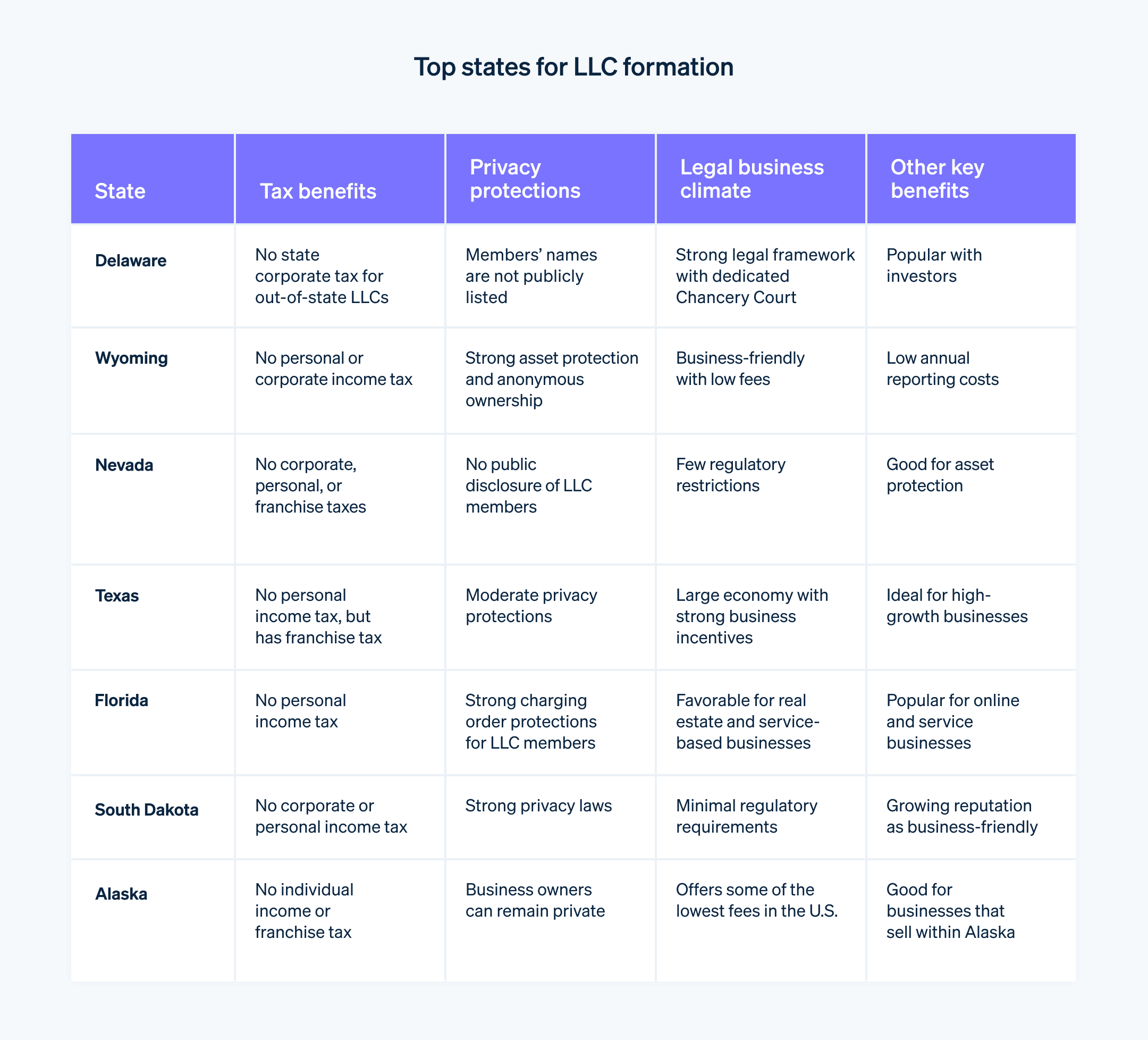

Top states for LLCs

Several states offer LLCs favourable business environments, legal protections, and tax policies. Here are some of the top states for LLCs.

Delaware: Delaware is renowned for its advanced and flexible business laws, particularly in corporate law. Many large corporations and LLCs prefer Delaware due to its well-established Chancery Court, which deals exclusively with business law and provides quick resolutions to corporate disputes. Delaware has no state corporate income tax for Delaware entities that operate out of state and doesn’t require LLC members to list their names publicly. It also has a structure that allows for separate “series” under one LLC.

Wyoming: Wyoming has strong asset protection and privacy laws, including charging order protection for LLC members and the option for anonymous LLC ownership through a trust. It was the first state to establish the LLC and continues to be a pro-business jurisdiction with low regulatory burdens. Wyoming has no personal or corporate state income taxes, no franchise tax, and low fees for business operation.

Nevada: Nevada has strong asset protection laws and privacy protection. It does not require the disclosure of LLC members, and has few restrictions on LLC management and ownership. Nevada has no state corporate income tax, personal income tax, or franchise tax.

Texas: Texas has a large market, a strong economy, and a business-friendly environment with numerous incentives for small businesses and startups. Texas has no personal state income tax and relatively low business taxes, although it does have a franchise tax based on earnings. LLCs in Texas can be member-managed or manager-managed, and LLC formation has no publication requirement, which can save businesses time and money.

Florida: Florida has a growing economy and a favourable tax structure, with no personal state income tax. Similar to Delaware, it allows for separate series under one LLC. It also has charging order protection for LLC members, which protects personal assets from liability. It’s particularly popular with real estate investors and service-based businesses.

South Dakota: South Dakota has started to gain recognition for its favourable business climate, including minimal regulatory requirements and strong privacy laws. It has no corporate or personal state income taxes, low fees for business formation, and unique trust structures for additional asset protection.

Alaska: Alaska is unique for its lack of state sales tax, which can be beneficial for businesses that do a large amount of in-state sales. Alaska’s other tax incentives include no individual income tax or franchise tax. The state’s low population density and abundant natural resources can be an advantage for certain types of businesses.

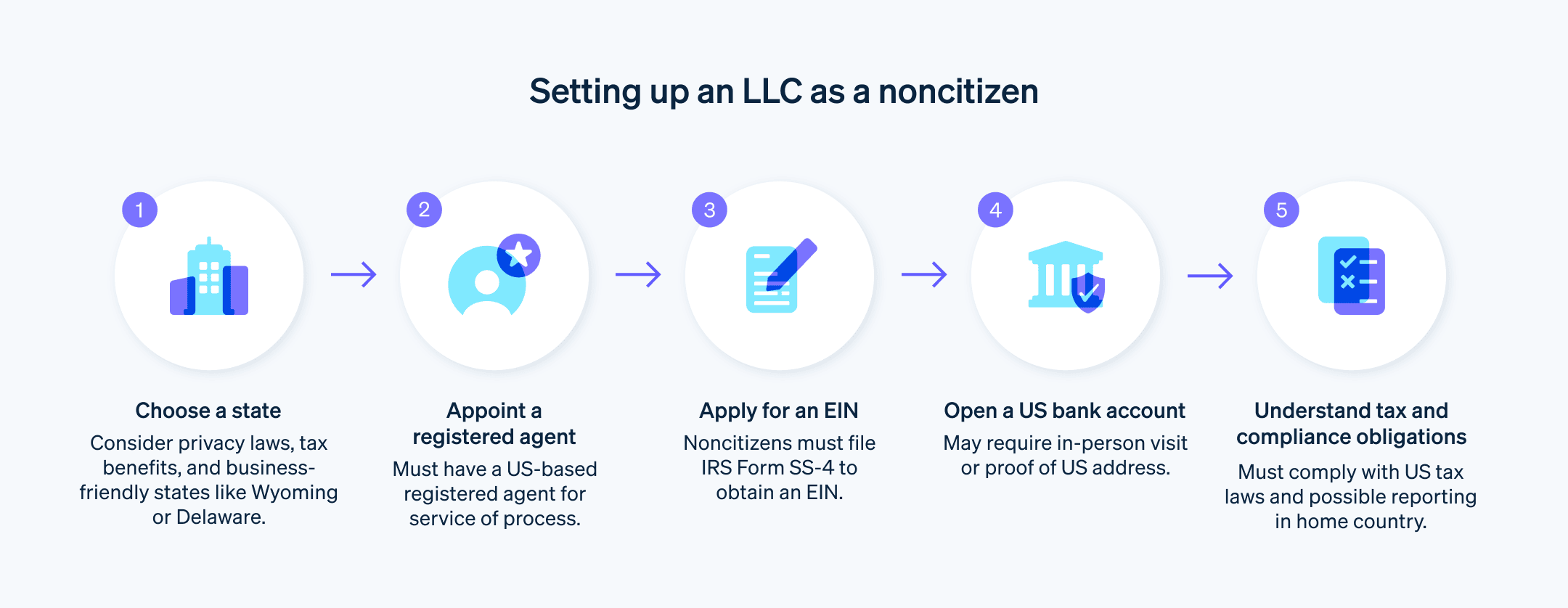

Setting up an LLC as a non-citizen

While non-citizens can set up an LLC in the US, the process involves careful planning and compliance with legal and tax obligations. To help navigate this process, consider speaking with legal and financial experts familiar with both US and international business law. Here’s a quick look at how the LLC formation process is different for non-US citizens.

Identification requirements: Because non-citizens do not have a Social Security Number (SSN) with which to obtain an Employer Identification Number (EIN), they must apply for an EIN by filing IRS Form SS-4 (and following up with the IRS by phone, when necessary).

Banking challenges: Opening a bank account for an LLC tends to be more complicated for non-citizens. Most US banks require the account opener to be physically present and to provide proof of a US address, which can be difficult for non-residents. Non-citizens might need to travel to the US to fulfil these requirements.

Registered agent requirements: While both citizens and non-citizens need a registered agent for their LLC, non-citizens who lack a physical address in the US often need to use a registered agent service rather than assigning this role internally.

Tax obligations: Non citizens can face more complicated and costly tax obligations. They are subject to US taxes on the income earned from the LLC and might have to report and pay taxes in their home country as well. Non-citizens also need to comply with tax laws such as the Foreign Account Tax Compliance Act (FATCA).

Ownership and management: There are no citizenship or residency requirements to be a member of an LLC, but the presence of foreign members can affect the LLC’s eligibility for certain tax classifications. S corporations, for example, can have only US citizens or permanent residents as shareholders.

Compliance and disclosure: Non-citizens might have additional compliance and disclosure requirements. For instance, if the LLC is owned by a foreign entity, it might need to file Form 5472 to report transactions between the LLC and its foreign owner.

Visa status: Non-citizens who wish to actively manage their LLC within the US must maintain an appropriate visa status.

How Stripe Atlas can help

Stripe Atlas sets up your company's legal foundations so you can fundraise, open a bank account and accept payments within two business days from anywhere in the world.

Join 75K+ companies incorporated using Atlas, including startups backed by top investors like Y Combinator, a16z and General Catalyst.

Applying to Atlas

Applying to form a company with Atlas takes less than 10 minutes. You'll choose your company structure, instantly confirm whether your company name is available and add up to four co-founders. You'll also decide how to split equity, reserve a pool of equity for future investors and employees, appoint officers and then e-sign all your documents. Any co-founders will receive emails inviting them to e-sign their documents, too.

Accepting payments and banking before your EIN arrives

After forming your company, Atlas files for your EIN. Founders with a US Social Security number, address and mobile phone number are eligible for IRS expedited processing, while others will receive standard processing, which can take a little longer. Additionally, Atlas enables pre-EIN payments and banking, so you can start accepting payments and making transactions before your EIN arrives.

Cashless founder stock purchase

Founders can purchase initial shares using their intellectual property (e.g. copyrights or patents) instead of cash, with proof of purchase stored in your Atlas Dashboard. Your IP must be valued at US$100 or less to use this feature; if you own IP above that value, consult a lawyer before proceeding.

Automatic 83(b) tax election filing

Founders can file an 83(b) tax election to reduce personal Income taxes. Atlas will file it for you – whether you are a US or non-US founder – with USPS Certified Mail and tracking. You'll receive a signed 83(b) election and proof of filing directly in your Stripe Dashboard.

World-class company legal documents

Atlas provides all the legal documents you need to start running your company. Atlas C corp documents are built in collaboration with Cooley, one of the world's leading venture capital law firms. These documents are designed to help you fundraise immediately and ensure your company is legally protected, covering aspects like ownership structure, equity distribution and tax compliance.

A free year of Stripe Payments, plus $50K in partner credits and discounts

Atlas collaborates with top-tier partners to give founders exclusive discounts and credits. These include discounts on essential tools for engineering, tax, finance, compliance and operations from industry leaders like AWS, Carta and Perplexity. We also provide you with your required Delaware registered agent for free in your first year. Plus, as an Atlas user, you'll access additional Stripe benefits, including up to a year of free payment processing for up to $100K in payments volume.

Learn more about how Atlas can help you set up your new business quickly and easily and get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.