Holding qualified small-business stock (QSBS) in the US can radically change the capital gains tax liability for startup founders and early investors. They can receive as much as a 100% exemption on US federal capital gains taxes up to US$10 million, or 10 times the original investment. More and more, savvy entrepreneurs are using QSBS to maximise financial returns.

According to a report by the National Venture Capital Association, the average deal value for US startup acquisitions in 2022 was below US$200 million, an ideal range of deal values where potential QSBS tax exemptions or reductions can have a significant impact. But not all small businesses and their stakeholders are aware of how to make full use of this tax advantage – from acquiring QSBS shares to their eventual sale.

Below, we'll discuss qualifying for QSBS, the tax benefits it offers in the US and the conditions that could disqualify a stock from being considered QSBS. We'll cover which valuation methods businesses should use at the time of stock issuance, ongoing compliance checks, and the limits and risks associated with holding QSBS. Here's what founders and early investors in the US need to know.

What's in this article?

- What is qualified small-business stock (QSBS) for founders in the US?

- QSBS eligibility criteria

- How QSBS is acquired

- How QSBS is sold

- QSBS tax benefits

- QSBS limits and risks

What is qualified small-business stock (QSBS) for founders in the US?

Qualified small-business stock (QSBS) is a type of share issued by a C corporation (C corp) that meets requirements in the United States Internal Revenue Code, specifically Sections 1202 and 1045. QSBS offers substantial tax benefits to shareholders, particularly founders and early investors. If someone owns this type of stock and then sells it, they could avoid paying US federal income taxes on the money made from the sale, up to a certain amount.

QSBS eligibility criteria

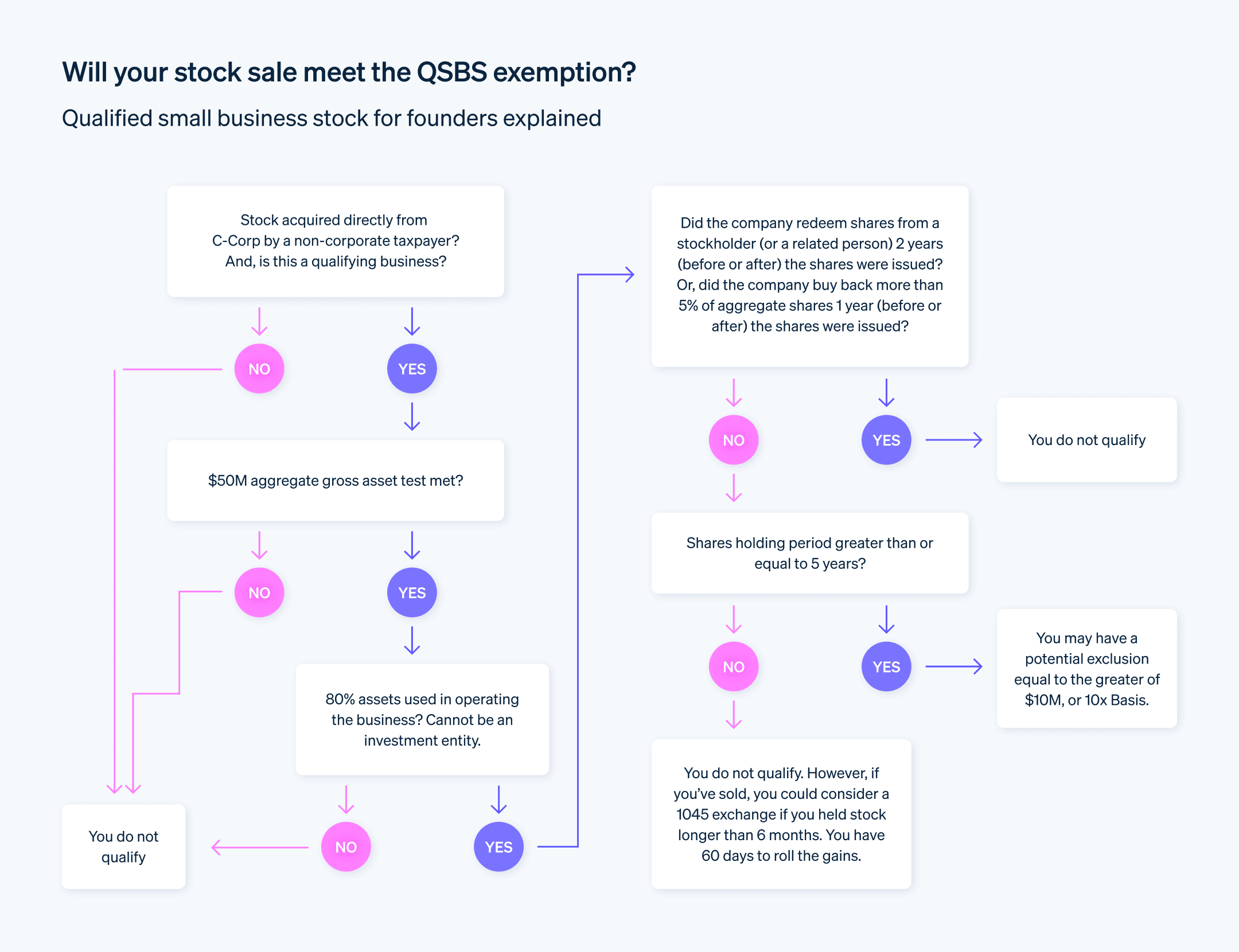

To qualify for the substantial tax benefits under QSBS, both the issuing company and the investor need to meet a set of detailed requirements. These rules have specific parameters, and failing to meet even one could result in forfeiting the tax advantages. Here’s an overview of the eligibility requirements:

Type of business

- C corporation: The stock must be issued by a C corporation. S corporations and LLCs don’t qualify for issuing QSBS.

- Domestic: The company should be based in the US. Foreign corporations are not eligible.

Asset test

- Gross assets: The corporation’s gross assets must not exceed $50 million at the time of stock issuance and immediately thereafter. This includes cash and also all other assets valued at their original cost.

Operational criteria

- Active business requirement: At least 80% of the company’s asset value must be used for active conduct of one or more qualified businesses. This excludes passive income activities such as owning real estate for rent.

Stock criteria

- Original issue: The investor must purchase the stock directly from the corporation. Second-hand purchases are not eligible.

- Stock type: Common or preferred stock can qualify as long as other criteria are met.

Holding period

- Five-year rule: The investor must hold the stock for a minimum of five years to fully benefit from the QSBS tax exemption. However, they can employ certain rollover strategies for shares held for shorter periods of time.

Limits on exclusions

- Exclusion cap: The amount of gain eligible for the tax exclusion is limited to $10 million or 10 times the tax basis of the stock.

Documentation

- Paperwork: Both the issuing corporation and the shareholder should maintain meticulous records, including stock certificates and financial statements, to establish QSBS eligibility.

This is a lengthy and highly specific list of requirements – but for founders and early investors, the financial benefits are often sufficient motivation to adhere to them.

How to acquire QSBS

Acquiring QSBS involves a series of carefully considered steps. Compliance with tax rules is key, but there are also strategic considerations that could shape your tax liabilities and asset growth over the long term. The substantial tax advantages of acquiring QSBS can make it well worth the detailed financial, legal and administrative work required.

Here's an overview of the process for acquiring QSBS:

Form a C corp

Where businesses choose to incorporate can have a significant effect on regulatory compliance and operational flexibility. For instance, the US state of Delaware is a top choice because its well-established corporate law is both predictable and favourable to businesses.

Regardless of where US businesses form their C corp, they'll need to file articles of incorporation with the secretary of state. These should define key organisational elements clearly, such as the business purpose, the total number of authorised shares and the par value of each share. They'll also need to develop comprehensive corporate bylaws to govern internal procedures, such as the conduct of board meetings, voting rights, and the roles and responsibilities of officers.

Financial review

A detailed financial review is a prerequisite for QSBS qualification. Businesses will need to work closely with financial advisors or auditors to assess their assets, and this is usually best represented by having a comprehensive balance sheet. You'll also need to confirm that the corporation's total assets don't exceed the US$50 million limit both before and immediately after issuing the stock. This might require third-party asset valuations or even a full-blown audit for maximum accuracy.

Legal counsel

Businesses should engage a legal team specialising in securities law to work through the complexities of stock issuance and QSBS compliance. An engagement letter will formalise the relationship and define the scope of work clearly. The team should perform a compliance review to be sure that all elements of stock issuance adhere to both federal and state regulations in the US. This usually involves checking for securities exemptions and preparing the necessary filings.

Stock documentation

Contracts then need to be drafted, such as stock purchase agreements (SPAs) and shareholders' agreements to outline the terms of the stock sale and subsequent ownership. The SPA will specify the purchase price, number of shares and any restrictions, such as vesting schedules. The shareholders' agreement can protect interests by detailing various matters, such as voting rights, preemptive rights to new shares, and tag-along or drag-along provisions.

It is mandatory for businesses to maintain a stock ledger and a capitalisation table for tracking share ownership and making their case in any potential IRS audits.

Board approval

The issuance of stock must be approved by the board of directors, and the agenda for this meeting should list the related action items explicitly. After approving the issuance, the board must document these resolutions in the meeting minutes, which are subsequently archived as part of the official corporate records.

Stock issuance

Businesses need to document each issued share of stock precisely. Traditional stock certificates serve as proof of ownership and must contain specific details, such as the issuance date, par value and any restrictions. However, some companies opt for digital tokens based on blockchain technology as a secure and easily transferable representation of ownership.

Ongoing compliance

Businesses must monitor for compliance with QSBS criteria on an ongoing basis. To do this, they should conduct regular financial assessments to ensure that the company's asset value remains within bounds. They'll also need to consult legal advisors periodically to confirm that their business activities continue to meet QSBS qualifications, as these activities can change as the business grows.

How to sell QSBS

When selling QSBS, businesses should plan carefully and follow the steps thoroughly to preserve all available tax benefits and complete the transaction smoothly. The sale process has many regulatory stipulations, intricate legal frameworks and complex tax implications – but it's doable with the right planning and support from tax advisors. Here's how QSBS can be sold:

Holding period verification: the first step is to confirm that the business has satisfied the five-year holding requirement. This period begins on the original issue date of the stock and ends on the day of the sale. The calculation is straightforward but absolutely necessary for businesses to qualify for QSBS tax benefits. Work closely with tax advisors to confirm the holding period and discuss possible tax implications.

Tax analysis: next, businesses should thoroughly examine the tax consequences of the sale. They should familiarise themselves with the tax rates that apply to QSBS, as they differ significantly from ordinary income tax rates in the US. Businesses should factor in the potential tax benefits, such as exclusion from capital gains tax up to a certain limit, into their cost-benefit analysis.

Documentation review: before initiating the sale, businesses need to review all the documents related to the stock ownership. This will include stock purchase agreements, shareholder agreements and stock certificates, if they were issued. Identify and address any restrictions or rights affecting the sale of the stock, such as preemptive rights for other shareholders.

Legal consultation: businesses should engage a legal team that is well-versed in securities transactions to prepare and review all the paperwork necessary for the stock sale. This often includes a purchase-and-sale agreement which outlines the terms of the deal, from the selling price to the closing conditions, as well as any representations and warranties from both parties.

Due diligence for buyers: if the stock sale involves an external buyer, businesses need to anticipate that the buyer will perform their own due diligence. As a result, businesses need to be prepared to provide all the required documentation, which could range from financial statements to intellectual property agreements. They should cooperate fully, while also taking appropriate steps to protect sensitive information.

Final approvals: the final stage of the sale will probably require formal approval from the board of directors and possibly a vote from the shareholders, depending on the company's bylaws and US state law. Businesses need to make sure that this approval process is documented to establish a clear paper trail.

Closing transaction: the sale needs to be finalised by executing all the required documents, which often include the stock purchase agreement, corporate resolutions confirming the sale and the payment transfer. Each party will need to retain copies of all final, executed documents for recordkeeping and potential future audits.

Post-sale filings and notifications: once the sale has been finalised, the business needs to update the corporate stock ledger to reflect the change in ownership. They'll also need to make any required regulatory filings to document the sale and update shareholder records.

Tax filings: finally, they'll need to report the sale of QSBS on their tax return. Form 8949 and Schedule D of Form 1040 are generally required for documenting capital transactions in the US. Businesses should enlist strong tax advisors to ensure that they get all of the details right.

Each step of the QSBS sale process has complexities and overlooking any of them can jeopardise potential tax benefits. Remaining compliant throughout the process and getting the best financial outcome is much easier if businesses have support from legal and tax advisors.

QSBS tax benefits

Although handling QSBS can be tedious, it's typically worth the effort for US businesses because of the many financial benefits. These include:

Capital gains exclusion

One of the most appealing aspects of QSBS for businesses in the US is the ability to exclude a substantial portion of the capital gains from federal taxation. Specifically, in the US, the IRS allows an exclusion of 100% of the gain up to US$10 million, or 10 times the adjusted basis of the stock, whichever is greater.Alternative minimum tax (AMT) relief

In the US, the AMT is a separate income tax calculation which ensures that individuals and corporations with high incomes cannot avoid a minimum level of tax liability through deductions and exemptions. Typically, capital gains exclusions could trigger AMT considerations. However, the exclusion for QSBS is also effective for AMT purposes, providing double relief for the investor.Rollover provision

If you decide to sell your QSBS and reinvest the proceeds into another QSBS within 60 days, you can defer recognition of the capital gains. This allows for tax-efficient reinvestment and portfolio adjustment without immediate tax consequences.State tax benefits

Several US states conform to the federal QSBS rules, providing state tax benefits that are similar to federal tax benefits. However, conformity is not universal, and businesses need to conduct a state-by-state analysis to optimise potential tax savings.Eligibility for reduced federal rates

If the stock doesn't meet the criteria for full exclusion, the gain may still be eligible for reduced federal capital gains tax rates, which can be significantly lower than ordinary US income tax rates.Tax-free dividends

US companies that issue QSBS are often in a growth phase and are likely to reinvest profits rather than distribute them as dividends. This shifts the strategy to long-term capital appreciation, which is tax-free up to the exclusion limit.Transferability of exclusions

In some scenarios, the QSBS tax benefits can be transferred to trusts or passed on to heirs, maintaining the tax efficiency across generations.Loss handling

While the primary focus with QSBS is gain, losses can get special treatment as well. In certain conditions, losses on the sale of QSBS can qualify as ordinary losses rather than capital losses, offering more favourable tax treatment.Investment via pass-through entities

QSBS can also be held through certain pass-through entities, such as partnerships or S corps. The tax benefits can flow through to the individual members, with some complexity and restrictions.

The true advantage of QSBS comes from integrating these benefits into a coherent, multi-layered tax strategy. Each benefit is amplified when combined with the others, driving even greater asset growth and risk mitigation.

QSBS limits and risks

Although QSBS has many financial benefits, it also has drawbacks which businesses must consider. Here's what businesses should know to avoid mistakes when acquiring, holding and selling QSBS:

Holding period

One of the main restrictions is the five-year holding period requirement. To qualify for QSBS treatment, the stock must be held for more than five years. Falling short of this time frame can lead to the forfeiture of tax benefits.Asset limit

QSBS status applies to companies with gross assets that do not exceed US$50 million immediately after the stock issuance. Exceeding this limit may nullify the QSBS status of new shares.Eligible businesses

Not all industries are eligible for QSBS. Service businesses such as health care, law and finance generally don't qualify. Find more details on which types of businesses are and are not eligible.Tax rate changes

QSBS benefits are tied to tax codes, which are subject to change. Legislation could revise or eliminate the benefits, making long-term planning somewhat uncertain.Ownership percentage

There are limits on how much QSBS an individual can exclude from gross income, which often depends on the percentage of company ownership. Investors should be aware of these nuances to avoid surprises during tax filing.State tax

While QSBS offers federal tax benefits, state tax treatment can vary widely across the US. Some US states conform to federal rules, while others do not recognise QSBS benefits at all – most notably California.Capital loss

If the business fails, the loss on QSBS is considered to be a capital loss, which has its own set of tax rules and limitations. Unlike ordinary business losses, capital losses have restrictions on their deductibility.

How Stripe Atlas can help

Stripe Atlas sets up your company's legal foundations so you can fundraise, open a bank account and accept payments within two business days from anywhere in the world.

Join 75K+ companies incorporated using Atlas, including startups backed by top investors like Y Combinator, a16z and General Catalyst.

Applying to Atlas

Applying to form a company with Atlas takes less than 10 minutes. You'll choose your company structure, instantly confirm whether your company name is available and add up to four co-founders. You'll also decide how to split equity, reserve a pool of equity for future investors and employees, appoint officers and then e-sign all your documents. Any co-founders will receive emails inviting them to e-sign their documents, too.

Accepting payments and banking before your EIN arrives

After forming your company, Atlas files for your EIN. Founders with a US Social Security number, address and mobile phone number are eligible for IRS expedited processing, while others will receive standard processing, which can take a little longer. Additionally, Atlas enables pre-EIN payments and banking, so you can start accepting payments and making transactions before your EIN arrives.

Cashless founder stock purchase

Founders can purchase initial shares using their intellectual property (e.g. copyrights or patents) instead of cash, with proof of purchase stored in your Atlas Dashboard. Your IP must be valued at US$100 or less to use this feature; if you own IP above that value, consult a lawyer before proceeding.

Automatic 83(b) tax election filing

Founders can file an 83(b) tax election to reduce personal Income taxes. Atlas will file it for you – whether you are a US or non-US founder – with USPS Certified Mail and tracking. You'll receive a signed 83(b) election and proof of filing directly in your Stripe Dashboard.

World-class company legal documents

Atlas provides all the legal documents you need to start running your company. Atlas C corp documents are built in collaboration with Cooley, one of the world's leading venture capital law firms. These documents are designed to help you fundraise immediately and ensure your company is legally protected, covering aspects like ownership structure, equity distribution and tax compliance.

A free year of Stripe Payments, plus $50K in partner credits and discounts

Atlas collaborates with top-tier partners to give founders exclusive discounts and credits. These include discounts on essential tools for engineering, tax, finance, compliance and operations from industry leaders like AWS, Carta and Perplexity. We also provide you with your required Delaware registered agent for free in your first year. Plus, as an Atlas user, you'll access additional Stripe benefits, including up to a year of free payment processing for up to $100K in payments volume.

Learn more about how Atlas can help you set up your new business quickly and easily and get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.