A platform is a type of business model that provides an online place for sellers of products, services, and information to connect with potential buyers.

In recent years, the acceleration of artificial intelligence (AI) combined with lifestyle changes many have made due to the pandemic have led to a rapid shift in digital platforms across a range of industries. Platforms as a business model have been gaining popularity in Japan, with many companies creating innovative services.

In this article, we’ll explain the basics of platform businesses, including the different types, pros and cons, examples from Japan, and future trends in the platform business market.

What's in this article

- Platform businesses explained

- Types of platform businesses and success stories

- Platform business models

- Advantages of platform businesses

- Notes on platform businesses

- The keys to a successful platform

- The future of the platform business market

Platform businesses explained

Typically, the word “platform” refers to a foundation or point for transport. In the same way a train platform provides a place for passengers to enter and exit a train, a digital platform provides a place—albet it a digital one—where people can access services.

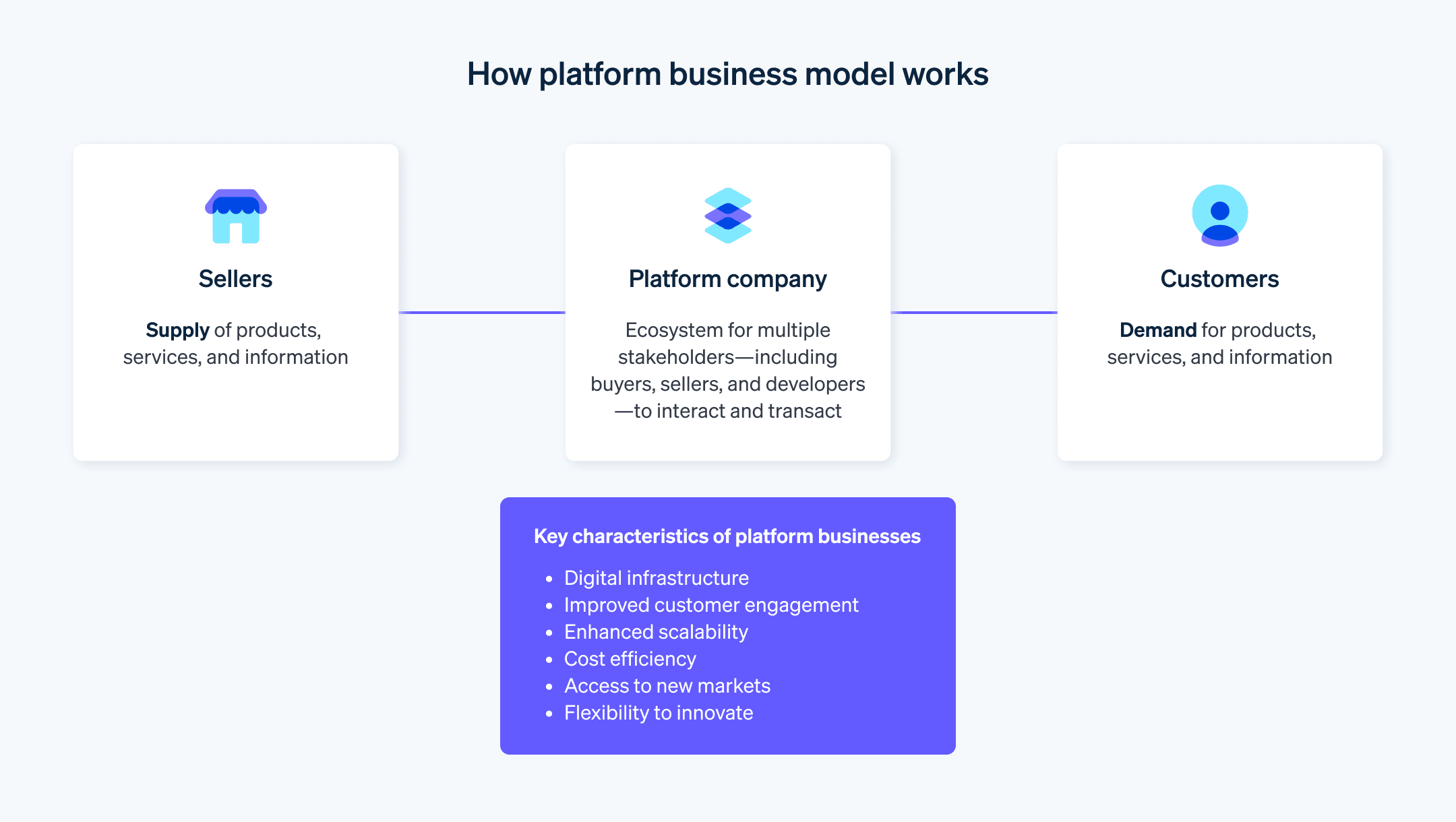

As previously mentioned, the platform business model provides a place on the internet that connects sellers (companies, sole proprietors, etc.) with users (consumers) of products and services. Platform owners do not develop or sell any products, but rather provide the platform itself as a service.

For example, social media that allows users to exchange information and stream videos, as well as marketplaces where users can buy and sell products, are types of platform businesses.

Owners of these platforms grow their businesses by attracting a huge number of sellers and buyers, and increasing interactions, such as transactions and communication, between the two parties. Typical platform businesses include Amazon, Uber, and Airbnb, which connect businesses with a large number of users, and have a major impact on the market.

In the platform business model, platform owners generate revenue by collecting fees from sellers offering products and services, and from advertisers. In some industries, companies might also charge customers fees.

Types of platform businesses and success stories

There are four main types of platform businesses.

Intermediary platforms

As the name suggests, intermediary platforms act as intermediaries between providers and buyers of goods and services. Sellers and buyers registered on the platform can conduct transactions through it. There are successful examples of this type of platform not only in the business-to-business (B2B) and business-to-consumer (B2C) spaces, but also consumer-to-consumer (C2C).

Success stories: Mercari, Uber Eats, Airbnb, and Lancers

Operating system-based platforms

Operating system-based platforms provide systems and applications developed by third parties and other companies. They also include the operating systems themselves, which act as the foundations for running systems and apps. These platforms collect a fee from the providers of the apps and systems.

Success stories: Google’s “Google Play” and “Android,” and Apple’s “App Store,” “iOS,” and “Android”

Content-based platforms

Content-based platforms provide users with digital content such as movies and music. Social media, which consists of posts, images, videos, and other media, also falls into this category. The pandemic drove growth in content-based platform services, in particular, and there are a large number of users. This kind of platform business is highly competitive.

Success stories: U-Next and LINE

Solution-based platforms

Solution-based platforms provide digital tools, apps, systems, and software with designated functions, and charge users a fee to use them. They are characterized by their ability to simplify business operations and provide long-term support for various business activities. Internet of Things (IoT) technology, which supports smart agriculture, is an example of a solution-based platform.

Success stories: Payment systems such as Rakuten Pay and PayPay, and AgriTech by inaho Inc.

Platform business models

Platform businesses fall into four business models.

Per-transaction fee platforms

A per-transaction fee platform charges the seller a fee on transactions. The fee varies according to the plan the seller has selected, the amount and frequency it is used, and the transaction amount. Per-transaction fee business models are often used on intermediary platforms, such as flea market apps. Usually, the fee is a fixed percentage of the transaction amount, so the higher the transaction amount, the higher the fee. However, sometimes the fee percentage varies according to the transaction amount.

Freemium platforms

The term “freemium” is a portmanteau of “free” and “premium.” This platform type provides both free options and paid options. A company provides basic services and functions free of charge, but users can switch to a paid plan if they want to access more advanced features.

One example of a freemium business model is a news website. Articles on news sites can often be viewed for free, but many will only allow you to read a portion of the article. You can only access the full article if you register as a paying member.

Monthly subscription platforms

A monthly subscription platform is a business model where users are charged a fixed monthly fee for a service. Businesses that often use this platform type are content distribution services (e.g., video and music streaming, or e-book rental businesses). Registering usually allows users unlimited access to a variety of content. With subscriptions, users pay a fixed monthly fee, making it easy for them to keep track of their expenses, as they don’t have to worry about the amount changing from month to month. For this reason, the market size of subscription services has been expanding.

Pay-as-you-go platforms

A pay-as-you-go platform, or recurring platform, is a business model in which fees are collected each time a customer uses a service or function. This model is beneficial for users as they don’t pay anything if they don’t use the service, but the downside for business owners is that income fluctuates and sales are unpredictable. For example, with cloud storage, the fee is calculated based on the amount of data stored. In some cases, only paying members can use this type of metered billing system.

Advantages of platform businesses

Here, we’ll explain the advantages of platform businesses.

Relatively low startup costs and effort

Platforms allow you to start an online business quickly. Since platforms don’t create their own products or services, they require no physical space—such as land, buildings, or warehouses—like you would need for a physical store. And because there are no costs or labor involved in developing products or services, startup costs for platform businesses are relatively low.

Quality and convenience improve as user numbers grow

The more companies and stores there are on the platform, the easier it is to attract customers. As the number of customers increases, competition between sellers also becomes more intense, which can lead to improvements in the quality and convenience of the products and services offered. Customer loyalty and trust increase as service quality improves, creating a virtuous circle that can lead to even more customers.

If a platform becomes more active through increased interaction between sellers and buyers, it can lead to a significant increase in revenue for platform owners.

Access to big data

As explained earlier, platforms gather large numbers of users into one place, including providers of goods and services, such as companies and sole proprietors, and consumers who use these goods and services. As a result, these platforms gather a huge amount of user data on attributes such as age and gender, as well as behavioral patterns.

You can analyze this data in detail to find out which services are in demand or what trends are current in user behavior and patterns, making it easier to create marketing strategies and use them to improve the platform’s user experience (UX). You can also use this data to develop new business models that are different from existing platforms.

Notes on platform businesses

While there are advantages to platform businesses, there are some important things to consider about them, as well.

Attracting customers costs money in the beginning

We previously explained how the quality and convenience of a platform can improve as the number of users grows. This means that if there are no users, the platform will not create value. It will take time and money to attract your first customers, and you might not make a profit until you’ve gained some momentum.

Try to anticipate how long it will take to attract a certain number of users, and make sure you have enough money to cover the initial stages of operation.

The later you enter the market, the more difficult it becomes

It can be difficult to enter an industry as a platform owner when other companies are already well established and hold most of the market share. Many major companies already exist in this space. You’ll need to differentiate yourself from existing platforms if you want to grow your business.

When entering the market later than other businesses, it’s important to carefully analyze and plan a strategy so that you can provide unique added value.

Ensure you understand the legal requirements

When starting a platform business, you’ll need to know which laws and regulations apply.

For example, when a seller operates a flea market app on a platform, the platform owner is sometimes required to have the seller submit a license and personal information. In Japan, the Antimonopoly Act and Act on Specified Commercial Transactions are examples of laws and regulations that apply to platform businesses.

As with the example above, some types of businesses need to obtain certain licenses or complete various formalities. So to avoid accidentally breaking any laws or regulations, make sure to check which ones apply to your platform and what you need to do to comply.

The keys to a successful platform

Here we’ll explain four key points to help make your platform a success. These are important factors to consider to differentiate yourself and develop organizational resilience as a platform business in the market in Japan.

Decide on a market and target to differentiate yourself

Though you could say the same for any type of business, the key to leading a platform business to growth is differentiating your company from your competitors. After deciding on the market you want to enter and your target customer group, you should formulate a strategy for providing added value that is unique to your company. For example, you might be able to achieve results by using your platform’s features to fill in gaps not covered by your competitors, or to address issues customers have with other companies’ products.

Understand consumer trends by age group

The platform market in Japan has users of all ages, which vary depending on business type. And different age groups require different approaches. For example, young people tend to be attuned to the latest technology and trends. They are also active when it comes to watching social networking videos and making purchases on social media using mobile devices. On the other hand, older people tend to prioritize safety and simplicity. For this reason, older users tend to prefer platforms they know and trust.

To make your platform attractive to a wide range of users, it’s important to have a flexible approach that caters to the different habits and preferences of people of different ages.

Make sure you know which parts of the business drive your profits

To make a profit, make sure you understand what kind of business model is most suitable for your platform business before you get started. This includes understanding things like how a business model is structured and where, when, and how you can generate revenue with it.

The main revenue drivers for platforms include sales commissions and monthly fees, as previously discussed. However, it’s best to choose revenue drivers that match the scale and characteristics of your platform. It’s also possible to adopt multiple business models at the same time to make a business profitable.

Introduce a convenient payment infrastructure

Every platform needs a reliable payment system. When launching a platform business, remember to consider the needs of users and choose a payment service provider (PSP) that specializes in online businesses.

Building your own in-house payment system can be difficult and costly in terms of time and money. Choosing a system that matches your company’s needs is key to getting your business off to a running start. It can also be more reassuring to use a service that has a well-developed support system for starting, operating, and managing platforms.

Stripe provides a wide range of tools and functions that support the efficiency of payment operations, including the introduction of various payment methods, information processing, and revenue management. For example, if you are a business owner considering a platform business, by introducing Stripe Payments—which can flexibly handle online payments—you can create a payment environment that suits your business style without having to develop your own system.

The future of the platform business market

In this article, we explored platform businesses, including the different types, business models, and advantages and disadvantages.

Online platforms have gained attention in recent years for their ability to create both huge communities and economies. Online businesses, including platforms, marketplaces, and subscription services, are expected to continue growing. Consumers in Japan, in particular, have strong opinions about products and services and high expectations for them. This can contribute to the improvement of services in the platform market.

Simply providing a “place” is not enough to grow a platform business and lead it to success. Aspiring platform owners need to provide a platform with a full range of functions and services that meet the needs of both service providers and consumers.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.