The terms “collective invoice” and “cumulative invoice” are often used interchangeably. However, this is not correct. They are two different invoice formats that serve different functions. In this article, we explain what collective and cumulative invoices are, how they differ, and what advantages they offer to German companies.

What’s in this article?

- What is a collective invoice?

- What is a cumulative invoice?

- How do collective invoices differ from cumulative invoices?

- What are the advantages of collective invoices and cumulative invoices?

What is a collective invoice?

A collective invoice is a document that combines several individual services, deliveries, or orders within a given period into a single invoice. In other words, it is a “normal” invoice, with the only difference being that several customer orders within a certain period of time are invoiced.

Collective invoices are particularly suitable for companies that regularly receive orders from the same customers. For example, instead of individually billing 10 product orders per month, they are aggregated over a month and billed periodically.

Examples of collective invoices

Information technology (IT) service providers

An IT service provider regularly maintains the computers and servers of a medium-sized company. The work includes minor repairs, software updates, and security checks. Instead of invoicing each service separately, a single invoice is issued at the end of the month for all services performed during the month.

Wholesale florist

An agency organizes various events and regularly orders flower arrangements from a floral wholesaler. Since the orders vary depending on the event, the wholesaler collects the delivery notes and issues a collective invoice to the event agency at the end of each month for all products delivered.

Copywriter

An independent copywriter regularly writes articles for a trade publication. Since the number of articles varies greatly from month to month, both parties have agreed to a collective invoice. Once a quarter, the copywriter submits a collective invoice that includes all the articles from the previous three months.

Creating a collective invoice

Invoicing parties are not required to use collective invoices. The decision to use collective invoicing is voluntary, but it is recommended, especially if you have a high volume of invoices. If you wish to issue collective invoices, you should always obtain the consent of your customers.

The mandatory information for invoices listed in Section 14 of the German Value-Added Tax (VAT) Act (UStG) also applies to the collective invoice. This includes:

Full name and address of the recipient of the product or service

Full name and address of the company providing the product or service

Date of the invoice

Date of delivery of the product or service

One-time consecutive invoice number

Tax number issued to the supplying company by the tax office or the VAT identification number (VAT ID) issued by the Federal Central Tax Office (BZSt)

Quantity and type of products delivered or the scope and type of service provided

Applicable tax rate and the corresponding tax amount or, in the case of a tax exemption, a reference to the tax exemption

However, there are a few special features to consider when creating a collective invoice. The first requirement for this type of periodic invoicing is that the billing period has been clearly agreed upon with the customer. This will be noted on the invoice along with the individual service dates. The latter can be added to the chronological list of items. Individual deliveries should be documented with delivery notes. It is also important that the invoice shows the individual amounts as well as the resulting total of all charges.

For more information, see our article on invoicing.

What is a cumulative invoice?

A cumulative invoice is a form of invoicing in which partial services or partial deliveries of a project are invoiced step by step. The total amount already invoiced is continuously added up. Each cumulative invoice builds on the previous invoice and includes the new items as well as the total of all services or deliveries performed so far.

Cumulative invoices are particularly useful for long-term projects where partial services are invoiced during implementation. For example, they are used in construction projects, machine manufacturing, or complex service contracts.

Examples of cumulative invoices

Construction companies

A construction company is hired to build an apartment building. The construction takes place in several phases, such as laying the foundation, building the structure, and finishing the interior. At the completion of each phase, the company issues an invoice detailing the partial services performed to date. The next invoice builds on the previous one and includes the newly added services as well as the total amount up to that point.

Engineering company

A machine manufacturer produces a special machine for a customer. Since the production takes several months, the individual steps—for example, the design, the production of the individual parts, and the assembly—are invoiced successively. Each new invoice includes the cost of the new steps and adds them to the previously invoiced services. In this way, the customer can always see the cumulative total of the services provided so far.

Software development freelancer

A freelancer develops custom software for a startup company. The project is invoiced in stages, (e.g., after completion of individual modules). Each cumulative invoice includes the cost of the current stage and shows the total of all previous stages.

Creating a cumulative invoice

The creation of a cumulative invoice is optional, as is the creation of a collective invoice. In this case as well, it is particularly important to obtain the customer’s consent. The mandatory information listed above according to Section 14 of the UStG is also mandatory on a cumulative invoice.

The special feature of the cumulative invoice is that it provides a detailed breakdown of the individual partial services and payments already made. It includes both the amounts invoiced in previous cumulative invoices and the costs of newly rendered services supplemented by the net amount, VAT, and total invoice amount. For the sake of clarity, items should be listed in chronological order, and references—such as reference numbers to previous invoices—should be provided. Amounts already invoiced must be clearly identified and deducted from the total amount to avoid double invoicing.

For example, as part of an IT project, a company has 10 new servers installed at a net price of $10,000 each. The project is divided into five phases, and an invoice is issued after each phase.

In the first phase, two servers are installed. The invoice lists these two servers as a single line item for $23,800, including taxes. In the second phase, two additional servers are installed. Instead of billing only these two servers, the invoice now lists all four servers delivered so far. The amount of the first invoice is listed below the total and deducted.

The same procedure is followed for invoices after the third and fourth phases of the project. The final invoice after the fifth phase contains all 10 servers. The amounts of the four previous partial invoices are listed and deducted with their respective invoice numbers below the total.

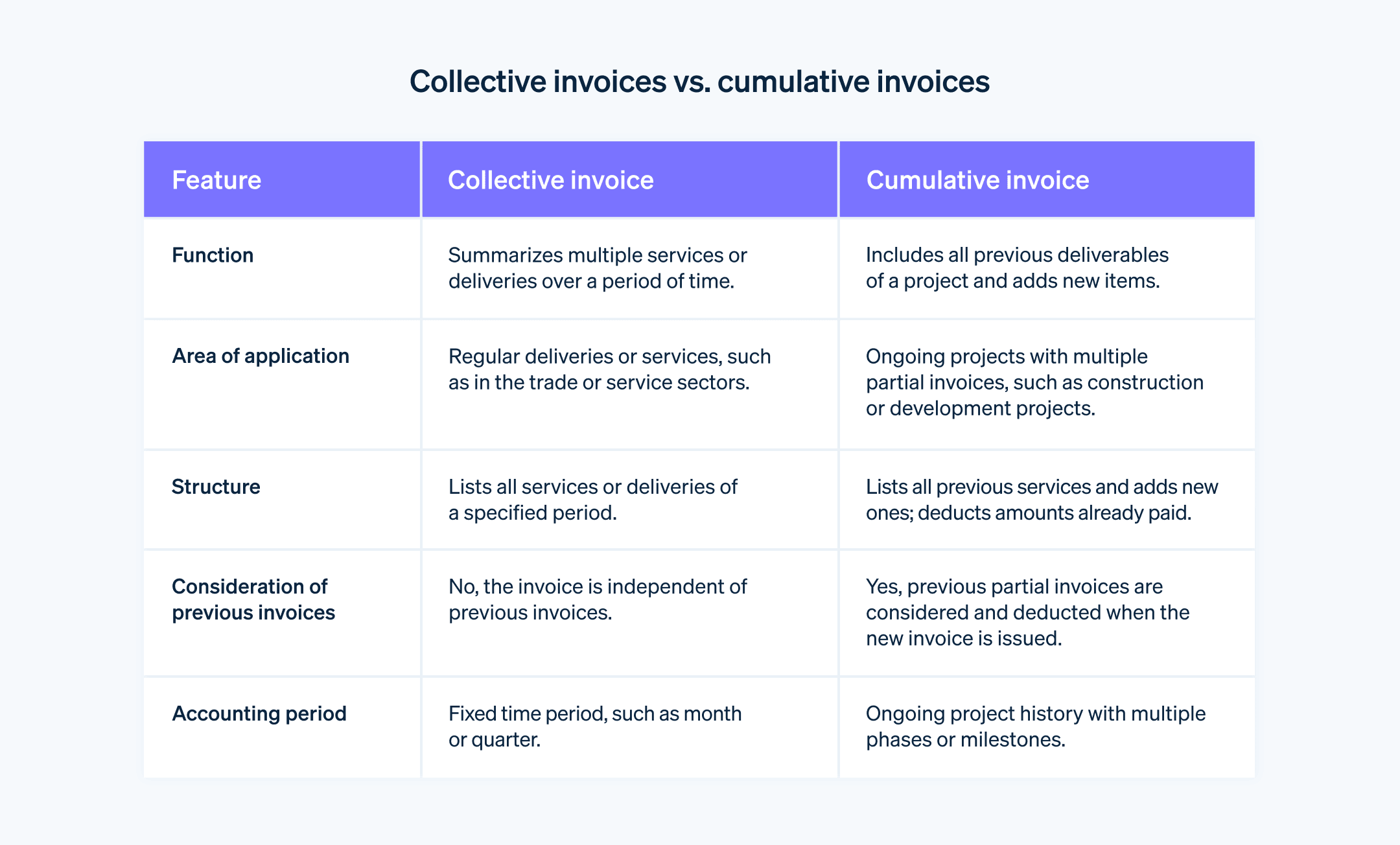

How do collective invoices differ from cumulative invoices?

Collective invoices and cumulative invoices differ in their function, use, and structure. The following is an overview of the most important points.

Creating collective and cumulative invoices is more complicated than creating a standard single invoice. If you want to simplify and automate your invoicing, use Stripe Invoicing. With Invoicing, you can create and send collective and cumulative invoices, as well as individual invoices, quickly, easily, and compliantly.

What are the advantages of collective invoices and cumulative invoices?

Collective invoices and cumulative invoices can be beneficial for both the issuer and the recipient. Here is an overview of the key points:

Advantages of collective invoices

Reduced administration: One invoice is created instead of multiple individual invoices. This reduces the number of accounting transactions and saves time for both parties. Fewer documents need to be created, reviewed, and managed.

Cost savings: The issuer of the invoice can reduce costs by saving time and eliminating mailing costs (if the invoices are sent by mail).

Transparency: Despite the fact that several deliveries or services are combined in one invoice, the collective invoice stands for transparency. All items are listed in detail, ideally in chronological order. Customers benefit from a clear and easy to understand invoice. Billing companies can get a better handle on their finances because they have fewer account transactions to track.

Ease of payment: Instead of having to transfer many individual amounts, bill recipients can transfer larger amounts once. This saves time and reduces the likelihood of miscalculations. In addition, the reduced hassle can increase customer satisfaction and positively impact the business relationship.

Advantages of cumulative invoices

Clarity: Cumulative invoices provide clear documentation of project progress by clearly listing all deliverables and amounts paid to date. References to previous invoices also facilitate tracking and minimize misunderstandings. Both parties have a complete overview of the current status, total costs, and payment history of the project. Budget overruns can also be detected quickly.

Fewer errors: Cumulative invoices take into account all previous payments and subtract them from the total. This reduces the risk of services being billed twice or not billed at all. This makes cumulative billing less error-prone for both the biller and the receiver.

Distributed financial burden: For long-term projects or engagements with multiple milestones, cumulative invoicing allows for incremental billing. This gives customers more flexibility to pay. The financial burden is spread out because the entire amount is not due at once.

Legal and contractual certainty: For projects with contractually defined installments, cumulative invoices can help to document agreements in a precise and legally compliant manner. They can be used as evidence in the event of a dispute. Questions or ambiguities about previous services can be resolved directly from a cumulative invoice, as they provide a complete history.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.