自动清算所 (ACH) 支付是美国使用的一种电子资金转账形式。虽然 ACH 网络位于美国并在美国运营,但 ACH 支付可以发送到其他国家,包括加拿大。美国和加拿大之间建立了良好的贸易关系。2024 年,美国与加拿大的商品贸易总额估计为 7618 亿美元,这导致了对便捷支付方式的高需求。

全国自动清算所协会 (Nacha)管理这些交易并设置其规则和标准。ACH 支付通常需要一到两个工作日来处理,但当日 ACH 转账正变得越来越普及。与实时处理的电汇不同,ACH 交易以特定时间间隔批量处理。

下面,我们将解释如何使用 ACH 支付以及如何将它们从美国发送到加拿大。以下是您应该了解的内容。

本文内容

- 您可以将 ACH 支付从美国发送到加拿大吗?

- 如何将 ACH 支付从美国发送到加拿大

- 在美国和加拿大之间转移资金的其他选择

- 美国 ACH 转账与加拿大 EFT 支付

- Stripe Payments 如何提供帮助

您可以将 ACH 付款从美国发送到加拿大吗?

是的,您可以将 ACH 付款从美国发送到加拿大。此过程称为国际 ACH 转账。国际 ACH 转账通常会产生费用,费用可能因提供商而异,而且处理时间可能比国内转账更长,通常需要几个工作日。

将 ACH 付款从美国发送到加拿大时,资金会从美元兑换成加元,银行或转账服务提供的汇率会影响最终收到的金额。并非所有银行都提供国际 ACH 转账服务,有些银行可能对通过 ACH 进行国际转账的金额有限制。

如何将 ACH 付款从美国发送到加拿大

首先,您需要找到提供国际 ACH 转账的银行或专门的汇款服务,例如 Wise 或 OFX。选择银行或服务后,您需要提供有关加拿大收款人的以下信息才能发起付款:

全名

加拿大银行账号

3 位数银行机构编号

5 位数银行转账号码

银行分行地址

SWIFT/BIC 代码(如果涉及中间银行)

在美国和加拿大之间转移资金的其他选择

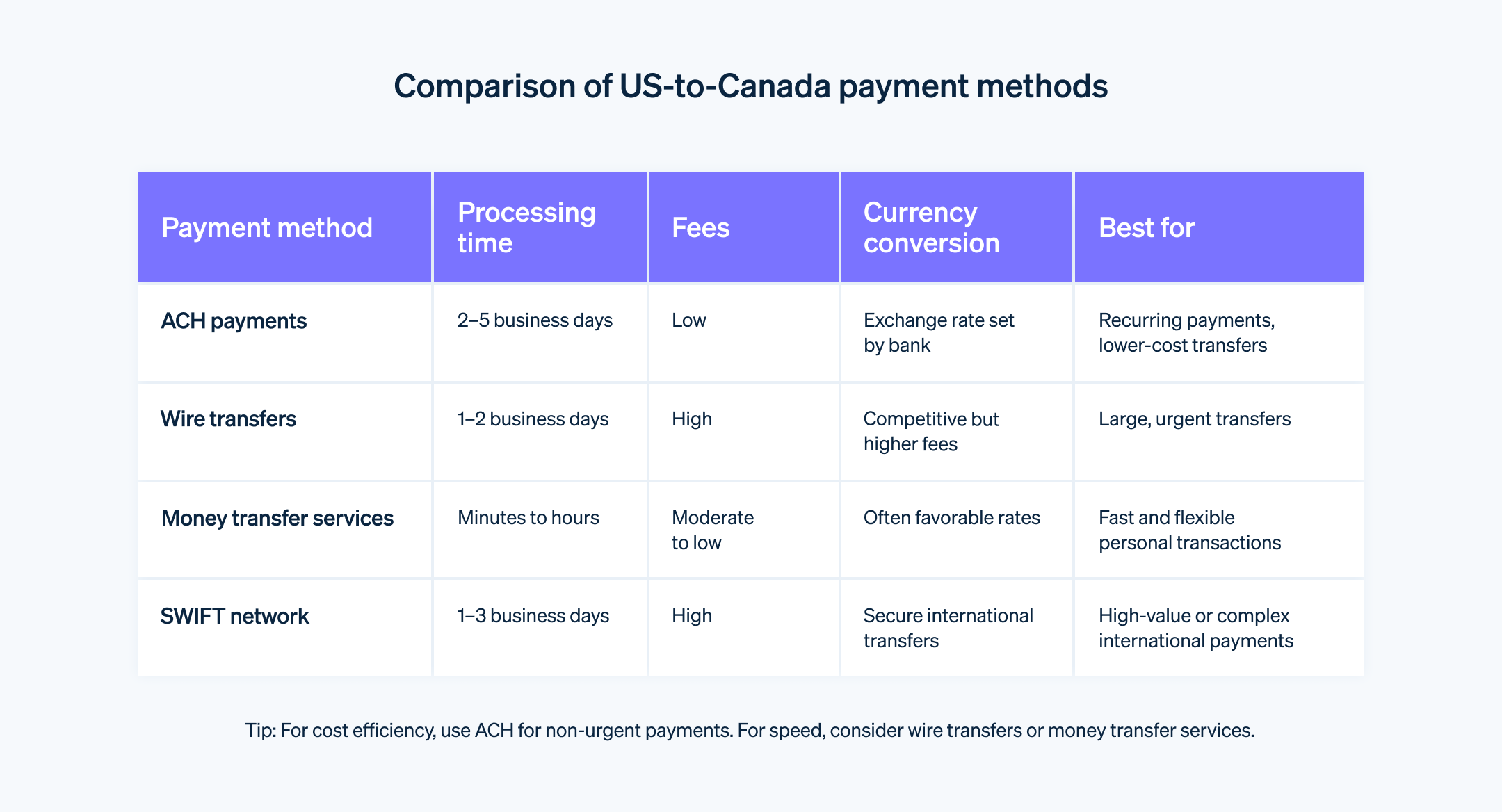

还有其他常见的国际转账方法,包括美国和加拿大之间的转账。

美国 ACH 转账与加拿大 EFT 支付

ACH 转账、加拿大 EFT 支付和电汇都是在金融机构之间以电子方式转移资金。主要区别在于它们使用的支付网络以及资金在账户之间的转移速度。

ACH 转账通过 ACH 网络运行,通常用于工资单、直接存款、账单支付和供应商支付。它们通常需要一到三个工作日来处理,并且在出现错误或欺诈的情况下通常可以撤销。

加拿大 EFT 支付(电子资金转账)的工作原理类似,但它们通过加拿大支付局的 EFT 系统运行。这些支付最常用于工资单、直接存款、供应商支付和预授权借记 (PAD)。EFT 通常会在一到两个工作日内结算,也可以根据特定的处理规则撤销。

Stripe Payments 如何提供帮助

Stripe Payments 让企业能够设置和接受 125+ 支付方式,包括 ACH 转账。它提供了一个一体化的全球支付解决方案,帮助任何企业(从规模化的初创企业到跨国企业)在线、面对面和在全球范围内接受付款。

Stripe Payments 可帮您:

- 更快验证银行账户详情: 在两个工作日内立即验证 ACH Direct Debits 或发送小额存款以验证客户的银行账户详情。

- 简化退款: 退款或将多余资金退还给客户。

- 优化结账体验: 通过预构建的支付用户界面、超过 125 种支付方式以及 Stripe 的数字钱包 Link,营造顺畅的客户体验,并节省数千个小时的工程时间。

- 更快地拓展新市场: 覆盖全球客户,并通过跨境支付选项降低多币种管理的复杂性和成本,服务覆盖 195 个国家、支持 135 种以上货币。

- 整合线下与线上付款: 整合线上与线下渠道,打造统一的商务体验,实现个性化互动、回馈忠实客户并增加收入。

- 优化支付性能: 通过一系列可定制、易于配置的支付工具提升收入,包括无代码的欺诈保护功能与提高授权率的高级功能。

- 依托灵活可靠的平台加速业务增长: 采用专为弹性扩展设计的平台架构,提供 99.999% 正常运行时间与业界领先的可靠性保障。

了解关于 Stripe Payments 如何助力线上与实体支付业务的更多信息,或立即开始使用。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。