Automated Clearing House (ACH) payments are a form of electronic funds transfer used in the United States. While the ACH network is based and operates in the US, ACH payments can be sent to other countries, including Canada. The well-established trade relationship between the US and Canada – the US total goods trade with Canada was an estimated $761.8 billion in 2024 – creates high demand for convenient payment methods.

The National Automated Clearing House Association (Nacha) manages these transactions and sets their rules and standards. ACH payments typically take one to two business days to process, though same-day ACH transfers are becoming more widely available. Unlike electronic transfers, which are processed in real time, ACH transactions are processed in batches at specific intervals.

Below, we'll explain how ACH payments are used and how to send them from the US to Canada. Here's what you should know.

What's in this article?

- Can you send ACH payments from the US to Canada?

- How to send ACH payments from the US to Canada

- Alternatives for transferring funds between the US and Canada

- US ACH transfers vs. Canada EFT payments

- How Stripe Payments can help

Can you send ACH payments from the US to Canada?

Yes, you can send ACH payments from the US to Canada. This process is known as an International ACH Transfer. International ACH Transfers usually incur fees, which can vary between providers, and they might take longer to process than domestic ones – typically a few business days.

When sending an ACH payment from the US to Canada, funds are converted from US dollars to Canadian dollars and the exchange rate offered by the bank or transfer service will affect the final amount received. Not all banks facilitate International ACH Transfers and some banks may have limits on the amount that can be sent internationally via ACH.

How to send ACH payments from the US to Canada

First, you'll need to find a bank or a specialised money transfer service, such as Wise or OFX, that offers International ACH Transfers. Once you've chosen the bank or service, you'll need the following information about your Canadian recipient to initiate the payment:

Full name

Canadian bank account number

Three-digit bank institution number

Five-digit bank transit number

Bank branch address

A SWIFT/BIC code (if there's an intermediary bank involved)

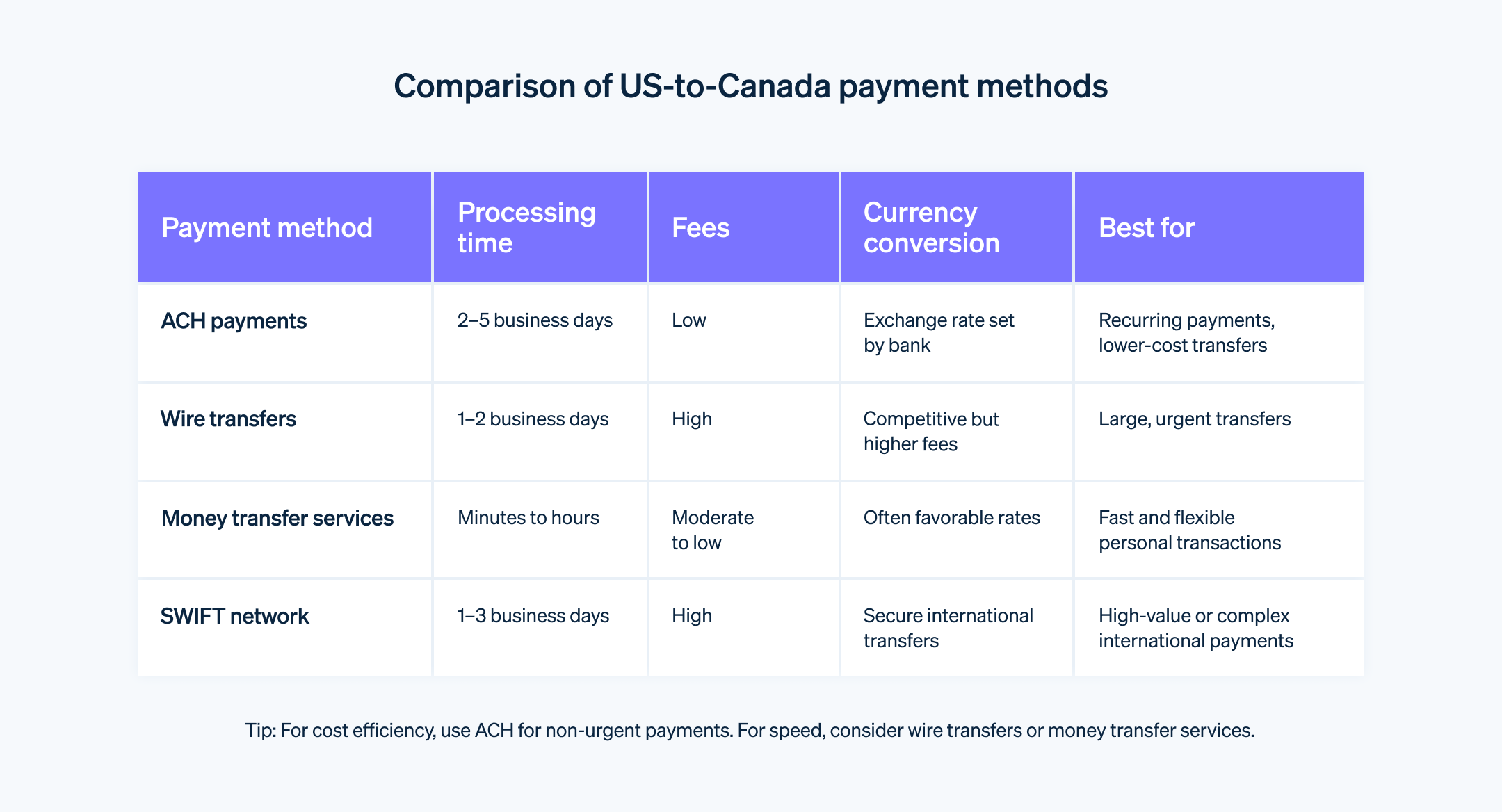

Alternatives for transferring funds between the US and Canada

Other common methods also exist to transfer money internationally, including between the US and Canada.

Electronic transfers: Electronic transfers are a common method for international transactions. They are usually faster than ACH payments but come with higher fees.

International money transfer services: Companies such as Western Union, MoneyGram, PayPal, and others specialise in international money transfers. These services are often more flexible and come with more competitive fees compared to electronic transfers.

Society for Worldwide Interbank Financial Telecommunication (SWIFT): This is a global network used by banks and financial institutions for international money transfers. It facilitates secure and reliable international transactions.

US ACH transfers vs. Canada EFT payments

ACH transfers, Canadian EFT payments, and wire transfers all move money electronically between financial institutions. The main difference lies in the payment networks they use and how quickly funds move between accounts.

ACH transfers operate through the ACH network and are commonly used for payroll, direct deposits, bill payments, and vendor payments. They typically take one to three business days to process and can often be reversed in cases of error or fraud.

Canadian EFT payments (Electronic Funds Transfers) work similarly, but they run through Payments Canada's EFT system. These payments are most often used for payroll, direct deposits, vendor payments, and pre-authorised debits (PADs). EFTs usually settle within one to two business days and can also be reversed under specific processing rules.

How Stripe Payments can help

Stripe Payments enables businesses to set up and accept 125+ payment methods, including ACH transfers. It provides a unified, global payments solution that helps any business – from scaling startups to global enterprises – accept payments online, in person, and around the world.

Stripe Payments can help you:

- Verify bank details faster: Instantly verify ACH Direct Debits or send microdeposits to verify customers' bank account details within two business days.

- Simplify refunds: Make refunds or return excess funds to the customer.

- Optimise your checkout experience: Create a frictionless customer experience and save thousands of engineering hours with prebuilt payment UIs, access to 125+ payment methods and Link, a wallet built by Stripe.

- Expand to new markets faster: Reach customers worldwide and reduce the complexity and cost of multi-currency management with cross-border payment options, available in 195 countries across 135+ currencies.

- Unify payments in person and online: Build a unified commerce experience across online and in-person channels to personalise interactions, reward loyalty and grow revenue.

- Improve payment performance: Increase revenue with a range of customisable, easy-to-configure payment tools, including no-code fraud protection and advanced capabilities to improve authorisation rates.

- Move faster with a flexible, reliable platform for growth: Build on a platform designed to scale with you, with 99.999% uptime and industry-leading reliability.

Learn more about how Stripe Payments can power your online and in-person payments or get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.