银行即服务 (BaaS) 工具的出现,大幅降低了创始人打造新型金融科技公司或企业将金融服务嵌入现有产品的门槛。这使得企业能够将金融服务整合到产品体验中,大幅减少推出贷款、金融账户和银行卡产品所需的开发工作量、产品复杂度和合规负担。

随着技术让打造金融科技公司变得比以往更简单,市场上涌现出大量新公司和新产品,它们都致力于提供针对不同用户需求的金融服务。然而,尽管 BaaS 降低了打造金融科技产品的运营成本和复杂度,但软件开发和工程只是打造新型金融科技企业的一部分。创业者还需考虑产品与市场的契合度、盈利策略、客户获取等问题。

本指南概述了企业打造成功金融科技产品需遵循的部分步骤和最佳实践,重点关注提供金融账户和银行卡服务的金融科技产品。我们结合内部经验和金融科技初创公司的洞见,助力您设计、打造和发展业务。

金融科技基础知识

金融科技企业 (fintech) 是指通过软件向客户提供金融服务(如金融账户、银行卡或贷款)的企业。它既可以指“纯金融科技”企业——核心产品为金融服务(例如,主要提供小型企业贷款的金融科技公司),也可以指将金融服务嵌入现有平台以补充核心产品的企业(例如,一款面向沙龙的预约软件工具,能让沙龙店主处理支付款项以及与支出卡相关的支出)。

随着越来越多的企业开始打造和提供金融服务,判断一家企业是否属于金融科技公司已不再简单。由于金融服务在许多企业的产品和业务战略中占据更重要的地位,如今越来越多的企业可被定义为金融科技公司。

金融科技产品示例

提供金融服务的方式多种多样,包括:

- 成为用户的主要银行合作方: 这类金融科技公司的目标是成为客户的主要银行合作方,取代其现有的银行合作关系(如有)。这类企业通常需要提供广泛的金融产品,满足用户全部或大部分金融需求,包括支票账户、储蓄账户、信用卡、借记卡、贷款等。

- 打造金融科技单点解决方案: 单点解决方案类金融科技公司专注于解决金融服务中的特定问题或满足特定需求,并在某些方面形成与现有产品的差异化优势。例如,简化汇款转账流程、通过贷款提高资金可获得性、借助银行卡实现企业费用管理等。

- 开发金融基础设施: 这类企业为其他金融科技公司改进现有金融服务基础设施,并解决其中的痛点,涵盖提供合规与安全功能、支付与金融服务基础设施等。(Stripe 就是一家金融基础设施企业。)

打造费用卡或消费管理解决方案的企业,如 Ramp、Emburse 和 Brex,均属于金融科技公司(具体而言,是金融科技单点解决方案提供商)。这些公司开发的产品,能帮助企业客户便捷地协助、管理和跟踪员工产生的企业费用。

传统上,企业费用管理流程高度依赖人工操作,耗费大量资源且容易出错。员工需先自掏腰包支付企业费用,提交费用报销单后,还需等待报销款项到账。此外,财务和会计团队需花费大量时间处理费用报销单提交、验证收据以及管理费用报销流程。

现代费用管理解决方案为企业及其员工提供虚拟卡或实体卡,并设置特定的消费控制规则,同时简化和自动化费用管理与报销流程。

费用管理解决方案只是金融科技业务的一种类型。金融科技领域范围广泛且不断发展,市场上还有许多其他类型的金融科技企业,包括新型银行 (neobanks) 和挑战性银行 (challenger banks)、福利发放卡提供商、企业对企业 (B2B) 贷款提供商、汇款公司、账单支付工具、财富管理平台等。通过这些企业,客户可直接在金融科技公司的平台或产品内获取金融服务,无需与传统金融机构打交道。

打造金融科技产品需考虑的关键事项

我们采访了多家金融科技初创公司,了解他们如何确定产品方向、实现盈利、构建技术基础设施以及获取首批客户。在此,我们重点分享他们的洞见和经历,并基于他们的经验,列出您的企业需考虑的关键问题。

1.锁定需求迫切且服务不足的受众

传统银行和金融机构通常面向整个市场开发通用产品(而非针对特定受众打造定制化产品)。因此,许多受众的金融服务需求未得到充分满足,他们难以便捷地获取所需金融服务,也无法利用针对自身业务需求的解决方案。例如,仅有 48% 的小型企业能获得开展业务所需的全部融资, 33% 的企业因金融机构认为其信用记录不足或成立时间过短而被拒绝授信。锁定此类需求迫切且服务不足的客户,能为您的金融科技产品创造发展机会,解决重大问题。

Paperchain 是一款面向创作者的即时支付应用,该公司发现音乐创作者面临一个主要痛点。据 Paperchain 称,创作者是价值 300 亿美元的音乐流媒体行业的核心贡献者,但他们往往面临现金流问题,需要等待长达 18 个月才能收到收入款项。视频流媒体创作者、网红、游戏及应用开发者也面临同样问题,但 Paperchain 决定专注服务音乐创作者,因为他们认为自己最有能力解决音乐创作者的痛点。

Paperchain 的创始人中有三分之二曾是音乐制作人,这让他们对目标受众有着独特的理解——他们此前曾与其他创作者密切合作,亲身体验过他们面临的挑战。他们深知,创作者需要在制作和推广方面投入资金,但由于现金流限制,他们往往需要等待下一笔收入到账才能行动。

因此,Paperchain 打造了一家金融科技企业,专注解决音乐制作人的最大痛点:通过数字钱包和银行卡,让他们能够即时收款。该公司的产品不仅专门针对创作者,其营销策略也聚焦于为这一需求迫切的受众提供优质服务。

图片来源:Paperchain 网站

您的企业需考虑的关键问题:

- 我的目标受众是谁?

- 这个市场或机会有多大?

- 我的潜在客户目前使用哪些金融服务?

- 他们当前面临哪些金融痛点?在哪些环节会遇到阻碍?

2.收集客户反馈,为产品路线图提供参考

在打造核心产品的过程中,深入了解目标受众至关重要。然而,仅仅了解潜在客户的痛点,并不总能帮助您打造出最优质的金融科技产品。发送调查问卷和创建用户画像固然有价值,但很多时候——尤其是在创业初期——最佳做法是直接与客户沟通,了解他们希望您开发什么样的产品。

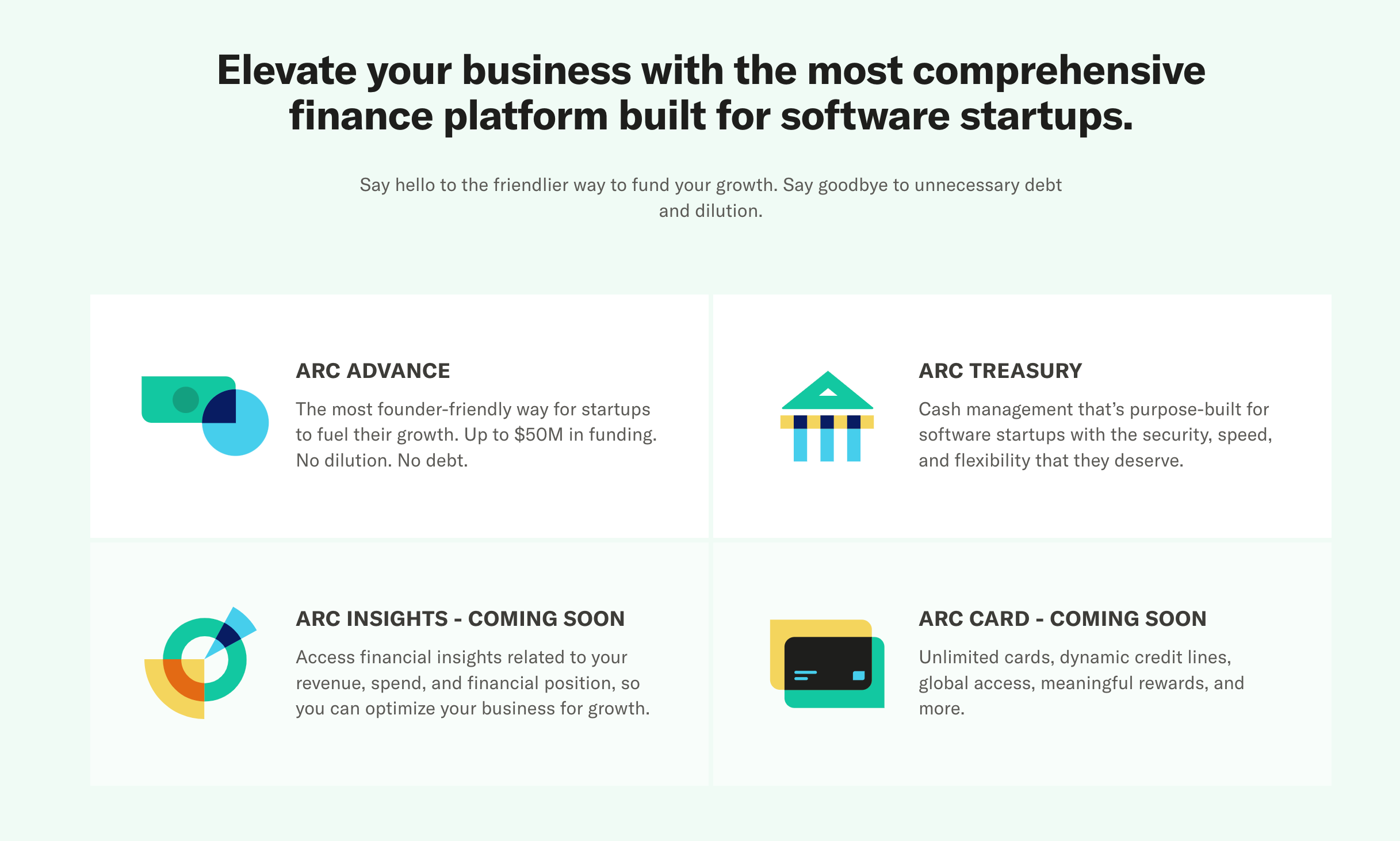

Arc 团队的使命是为初创公司打造金融未来,据该团队表示,这意味着要与“全美数千名创始人”建立联系。通过一对一沟通,团队发现了初创公司融资过程中的主要痛点:融资“耗时过长”、“对本就精力有限的创始人造成极大干扰”,且“人脉关系比企业实际经营表现[更重要]”。对于寻求机构资金的创始人而言,现有选择均不理想——他们被迫在两种方式中抉择:一种是传统债务融资,会“让初创公司背负全部资产留置权、限制性条款、交易费用和认股权证负担”;另一种是出售股权,需承担“无上限的股权稀释成本和控制权丧失风险”。随着 Arc 平台新增数百名付费客户,团队很快发现这些高增长早期企业面临着一个更大的痛点。Arc 团队表示:“困扰初创公司融资的那些繁琐、线下化、手动化流程,在整个企业对企业 (B2B) 金融体系中同样存在。”

这些洞见,再加上团队助力初创公司成长的使命,推动 Arc 打造了一个垂直整合的融资、现金管理和洞见平台。借助 Arc,初创公司可无缝“利用未来收入流获取非稀释性资金,将这些资金存入由 Evolve 银行(美国联邦存款保险公司 (FDIC) 成员)托管的虚拟资金账户,并即时拨付资金以推动业务增长”——所有操作均通过一个数字化原生账户完成。

图片来源:Arc 网站

您的企业需考虑的关键问题:

- 我的金融科技产品如何解决目标用户的痛点?

- 与用户现有的金融服务相比,我的产品有哪些改进?

- 我是否已就产品理念与潜在用户沟通过?是否已通过用户测试该理念?

- 用户喜欢和不喜欢我的理念的哪些方面?他们认为有哪些缺失的功能?

3. 实现收入来源多元化

与所有其他企业一样,金融科技公司也需要实现盈利(或拥有明确的盈利路径)。根据您打造的金融科技业务类型,有多种盈利手段可供选择。以下是部分选项:

- 交换费: 如果贵公司提供银行卡产品,则可以从每笔银行卡交易产生的交换费中分一杯羹。

- 贷款: 您可以通过提供贷款并收取发起费和利息来盈利。

- 资金持有费收入: 如果允许客户存储资金,您可从客户持有的资金中获得一定比例的费用分成。您可以全额获取这部分收入,也可以与客户分享,或采用两者结合的方式。

- 订阅费或服务费: 向客户收取定期订阅费或会员费,为他们提供产品或服务访问权限。

- 资金转移服务加价: 对各类资金转移服务(如快速收款、电汇、货币兑换等)的成本进行加价。

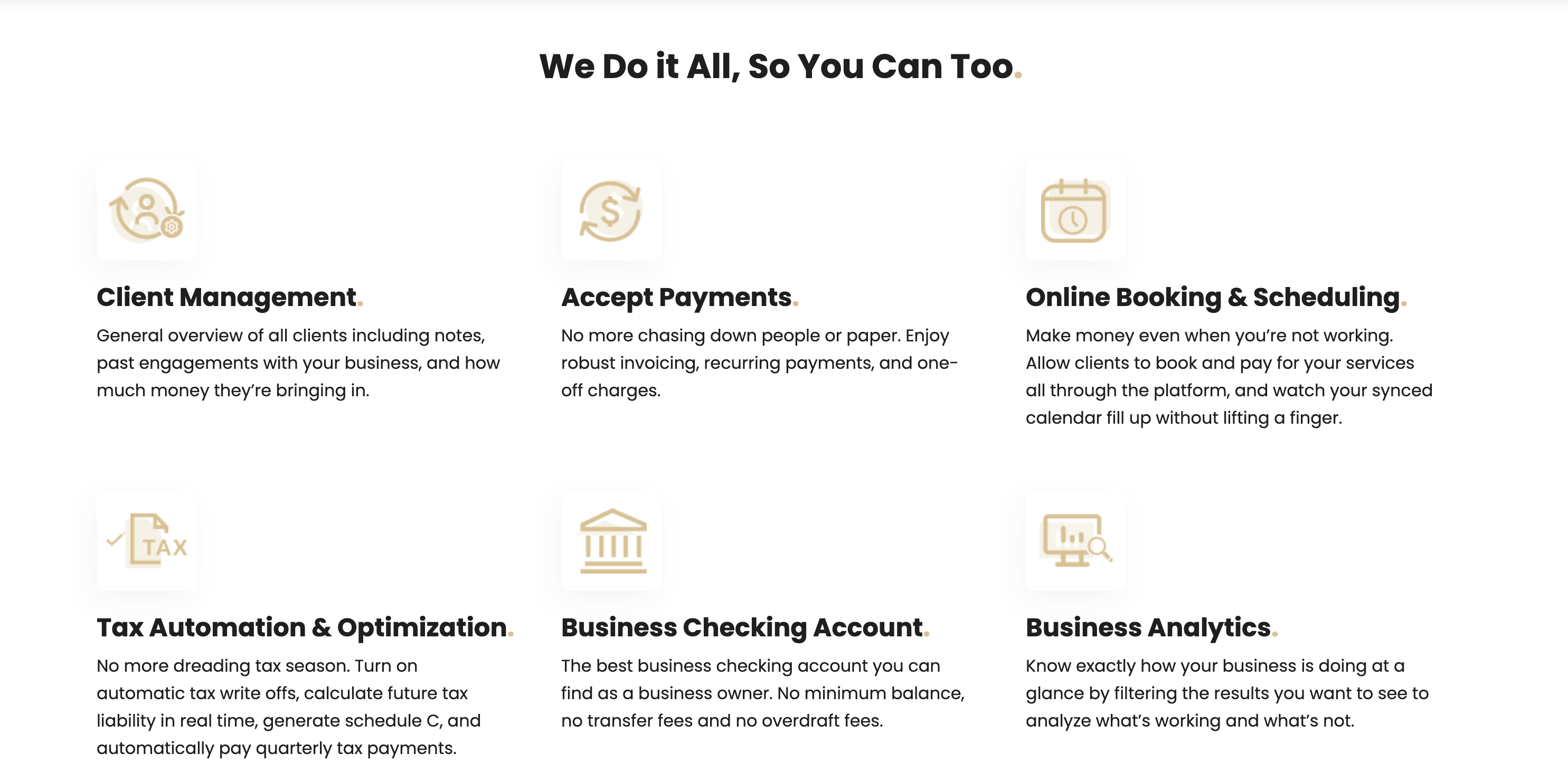

许多金融科技公司会利用上述多种收入来源,实现收入多元化,提高企业盈利能力。他们还可以测试不同的盈利策略,了解长期来看大部分收入来自哪些渠道,并据此调整策略。例如,Persona 是一款面向自雇专业人士和个体企业主的业务管理解决方案,该公司的业务拥有五种收入来源:

- 从 Persona Visa 卡交易中获取部分交换费分成

- 企业在其平台上接受付款时,收取支付处理费

- 从客户在平台金融账户中持有的资金中获取存款费

- 收取短期融资费用

- 与企业开展联盟营销合作,当 Persona 和客户因特定购买行为获得补偿时产生收入

图片来源:Persona 网站

您的企业需考虑的关键问题:

- 我计划何时开始通过产品盈利?是否从一开始就尝试创收?还是先专注于获取用户和优化产品,之后再确定盈利模式?

- 长期来看,我如何通过产品盈利?可利用哪些盈利手段?

- 要成功通过产品盈利,需要满足哪些条件和要求?

- 我的企业单位经济效益如何?

单位经济效益是指企业在单位层面(如单个客户)的收入和成本,用于判断企业的盈利能力和整体财务健康状况。例如,评估客户终身价值 (LTV) 与客户获取成本 (CAC) 的比率,该比率可反映单个客户带来的收入与获取该客户所需成本之间的关系。

4.确定要构建的基础设施

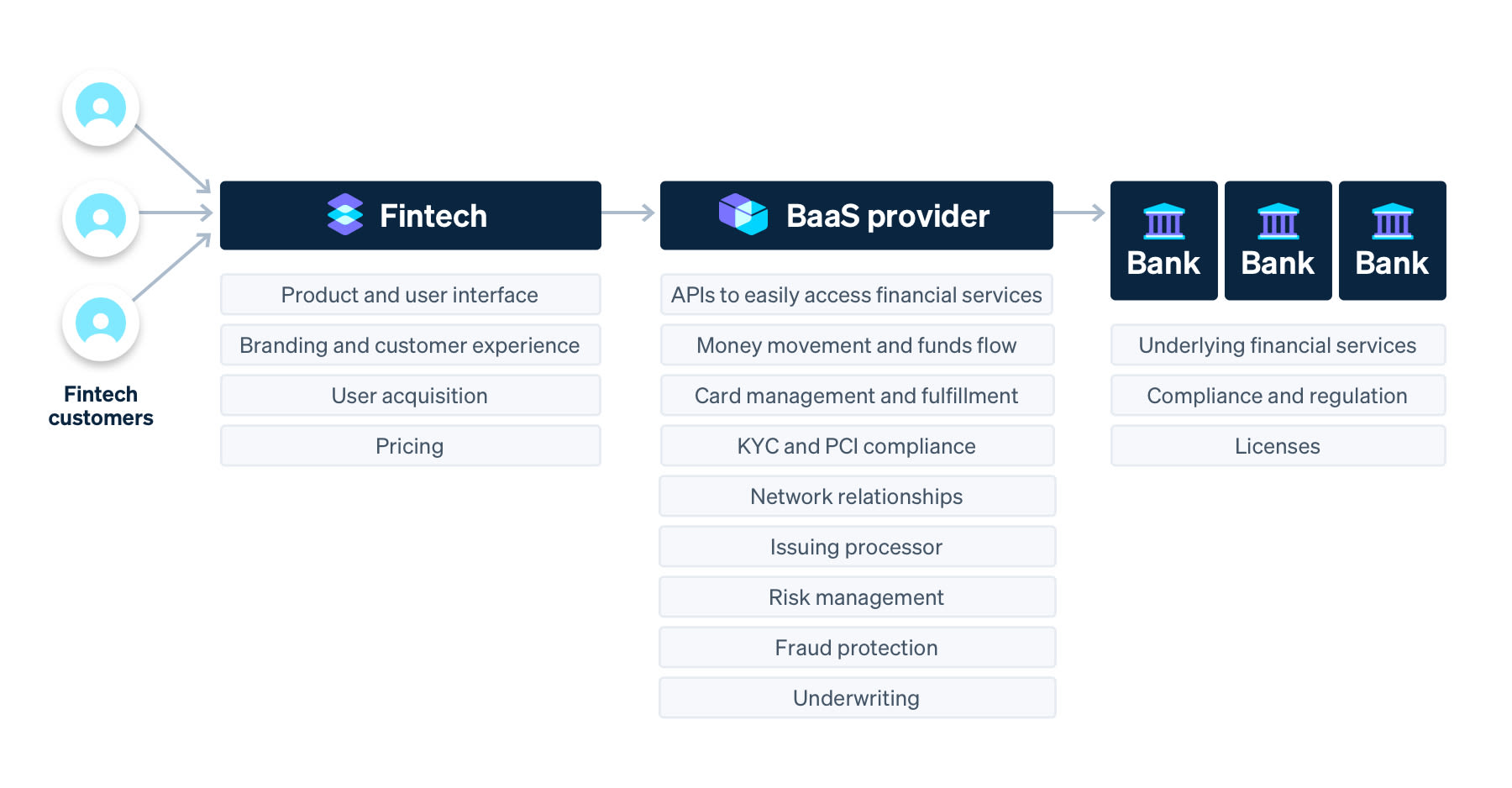

金融科技公司无需拥有所使用的金融基础设施或技术(尽管它们完全可以选择自主拥有)。绝大多数金融科技公司会借助 BaaS 解决方案,更快速、更轻松地打造产品并推向市场。BaaS 提供商充当金融科技企业与银行之间的中介,提供底层基础设施,金融科技公司可以在此基础上构建自己的金融产品。

确定产品方向后,您需要决定如何搭建产品基础架构。这是所有金融科技公司都需做出的关键决策,因为它决定了产品的基础,且一旦开始搭建,更换基础架构的成本会很高。

打造金融科技产品有两种主要方式:

1. 直接与银行合作

与银行合作能让您对金融产品拥有更多控制权,因为所有环节都由您自主搭建。然而,无论是启动阶段还是上线后的持续运营,这都需要投入大量资源和资金。直接与银行合作时,您需自主管理打造新型金融服务的所有环节,包括维护与银行合作伙伴的关系、从零开始搭建核心资金存储和资金转移基础设施、处理合规和监管要求等——此外,您还需打造实际的金融产品。

2.与 BaaS 提供商合作

或者,您也可以与 BaaS 提供商合作,他们提供打造新型金融产品所需的核心基础设施,承担大部分产品和合规复杂度。下图详细展示了 BaaS 提供商如何承担大部分责任,并向金融科技公司大规模提供银行服务。

与 BaaS 提供商合作,可大幅缩短产品上市时间,让您快速找到产品与市场的契合点,并在核心金融产品基础上打造差异化功能。然而,与直接与银行合作伙伴合作相比,您对产品的定制化程度会受限。

在评估 BaaS 提供商时,您需考虑多项因素,例如他们当前及未来计划支持的功能、可靠性、地域覆盖范围、客户服务等。

您选择的合作方式取决于您的优先事项。您可能会认为,与 BaaS 提供商合作能快速构建和扩展业务;或者,您希望通过与银行合作打造更定制化的解决方案,以获得更多控制权。

Persona 决定与 BaaS 提供商合作,因为作为小型初创公司,他们没有足够资源自建银行基础设施。通过与 Stripe 等 BaaS 提供商合作,[他们]“可依托 Stripe 的基础设施,开发出[他们]原本无法独立实现的功能”。此外,Stripe 还提供了他们业务上线时所需的全部功能,以及未来可能需要的功能。Persona 团队表示:“最糟糕的情况是,您选择了一家供应商并开始开发,之后当需要额外功能时,却不得不彻底调整架构。”

您的企业需考虑的关键问题:

- 我是否拥有独立开发金融科技产品所需的工程和开发资源?

- 我对金融生态系统(如 Nacha 运营规则、银行卡 BIN、公平借贷法等)有深入了解吗?我是否愿意负责这方面的工作?

- 我希望产品多久能上线?

- 我的长期产品路线图中,需要(或可能需要)哪些功能或服务?

评估 BaaS 提供商时:

- 他们当前是否提供我所需的功能?未来是否会提供我可能需要的功能?

- 他们在金融科技领域是否是成熟企业?曾支持过哪些其他金融科技公司?

- 他们在金融科技、合规、风险管理和反欺诈方面是否具备专业能力?

- 他们能为我的企业提供何种程度的支持?

5.制定客户获取策略

与大多数新企业一样,营销和上市策略对企业能否成功起着重要作用。您可能会借助一些自然增长和口碑传播获得用户,但仍需制定正式的用户获取策略,以确保客户群体不断扩大。

充分利用可用的相关营销渠道触达目标客户。确定哪些渠道和方法对您的特定受众最有效,并持续尝试不同的营销和品牌推广策略,找到最佳方案。自有渠道(如电子邮件、博客、社交媒体、网站和产品仪表板)成本低且易于尝试。而其他渠道(如付费搜索、再营销广告或展示广告)则需要更多投入和专门预算才能有效推进。

Arc、Paperchain 和 Persona 的营销团队都测试了多种渠道,以找到最适合各自业务的渠道:

- “为保住自己苦心经营的企业所有权,创始人采用非传统融资方式的比例正不断上升。创始人与其过早出让 5%-10% 的股权,不如现在通过利用未来收入流获取增长资金,待未来收入提高、股权市场回暖后,再以更有利的地位进行融资。鉴于当前宏观环境以及 Arc Advance 的非稀释性特点,我们通过现有客户的口碑推荐获得了良好的增长势头。这一情况也影响了我们的内外部营销工作及宣传重点。在未来数月(乃至数年),我们将继续重点展示客户成功案例,并为创始人在业务成长过程中提供支持。”——Arc

- “口碑传播为我们的等待名单带来了 5000 名创作者,我们正集中精力为他们开通服务。在扩大入职流程的同时,我们还借助 B2B 合作伙伴的力量。我们与 UnitedMasters [一家大型音乐发行公司]建立了合作关系,目前已有 10 万名艺人希望使用我们的应用。”——Paperchain

- “我们团队在效果营销和用户获取方面拥有丰富经验,因此我们利用所有主要广告平台开展用户获取活动,并投入大量时间和精力针对特定细分业务领域进行高度优化。与职业学校、工会、证书机构等组织建立合作关系,通过他们的推荐实现增长,这也是一种非常有效的方式。”——Persona

6. 测试和迭代

客户的痛点和需求可能会随时间变化,因此您应随时做好调整和扩展的准备。例如,Karat 团队最初计划开发一款帮助创作者处理税务的软件,但市场反响冷淡。Karat 发现其产品未能解决创作者的迫切需求。在与目标受众沟通时,创作者总是会提出需要 5000 美元或 10,000 美元的预付款,以支付即将到来的账单,因为他们没有足够的营运资金。

基于这一需求,Karat 最初推出了商户现金垫款产品,为创作者提供信贷,但发现该产品并未获得认可。团队了解到,银行卡产品能以创作者期望的方式,让他们便捷地获取资金。这一发现促使团队再次调整产品方向,打造了一款企业费用卡产品,根据创作者从不同数字平台获得的收入为其提供融资。如今,该产品的交易金额已超过八位数。

同样,Persona 团队发现,尤其是在产品初期开发阶段,保持灵活性对初创公司至关重要。

Persona 团队表示:“我们最初规划的那组功能,最终并未全部落地。”他们的应用最初仅支持用户处理支付,但团队发现用户不断提出即时收款需求。基于这一用户反馈和需求,团队将开发平台即时支付 (Instant Pay) 功能列为优先事项。

“Persona 团队表示:“当您首次进入市场时,这是一个学习阶段,您会了解用户真正希望从您的产品中获得什么,以及他们寻求哪些功能。”

Stripe 如何提供帮助

对于企业而言,无论是支付、贷款、银行卡还是银行账户替代服务,Stripe 都是打造并推出自有全功能、可扩展金融科技产品最简单、最灵活的方式。Stripe 的银行即服务 (BaaS) API,以及我们全套金融基础设施产品生态系统,能让企业轻松打造全新金融科技产品,或直接将金融服务嵌入现有软件。

我们的每款 BaaS 产品都提供 API 作为基础构建模块,您可根据客户需求和业务实际情况,以不同方式组合使用这些模块。

- Stripe Issuing 支持您即时创建、管理和分发虚拟卡或实体卡。借助发卡服务,您可打造费用管理平台、先买后付 (BNPL) 融资等金融科技业务。

- Stripe Treasury 提供灵活的 BaaS API,助力您为客户打造全功能金融产品,无论是存储和消费账户还是消费管理服务均可支持。通过 Treasury,您可获得核心构建模块,用于创建金融账户、存储资金、在各方之间转移资金,以及绑定银行卡用于消费。

- Stripe Capital 支持您提供快速灵活的融资服务,帮助客户拓展业务。许多企业难以获得业务扩张所需的融资,而 Stripe 通过单一集成提供完整的贷款方案,为企业消除这一障碍。

- Stripe Connect 允许您嵌入多方支付功能,并提供多种金融服务,如向客户收款以及向第三方付款。平台可通过收取服务费用获取收入。

- Stripe Financial Connections 让您的用户能安全连接其现有金融账户,并向您的平台共享金融数据。

- Stripe Identity 让您能通过程序化方式验证全球用户身份,以符合客户身份验证 (KYC) 法规要求。

请联系我们的团队,了解如何借助 Stripe 打造您的金融科技产品。

Visa® 商业信用卡由犹他州特许工业银行 Celtic 银行发行,该银行是美国联邦存款保险公司 (FDIC) 成员。

Stripe Treasury 由持牌资金转账机构 Stripe Payments Company 提供,资金由 Evolve 银行与信托公司 (Evolve Bank & Trust) 及高盛美国银行 (Goldman Sachs Bank USA) 持有,这两家银行均为美国联邦存款保险公司 (FDIC) 成员机构。

资金贷款由犹他州特许工业银行 Celtic 银行发行,该银行是美国联邦存款保险公司 (FDIC) 成员。所有贷款均需通过信贷审批。