L'avvento degli strumenti di banking-as-a-service (BaaS) ha abbassato in modo significativo la barriera d'ingresso per i fondatori di nuove aziende Fintech e per le attività che vogliono integrare i servizi finanziari nelle loro attuali offerte. Questo consente alle aziende di integrare i servizi finanziari nell'esperienza del loro prodotto, riducendo drasticamente l'impegno di sviluppo, la complessità del prodotto e gli oneri normativi per offrire prestiti, conti finanziari e carte.

Grazie alla tecnologia, che rende più facile che mai costruire un'azienda Fintech, nel mercato sta entrando un'ondata di nuove aziende e prodotti, tutti con l'obiettivo di offrire servizi finanziari su misura per le esigenze di diversi utenti. Tuttavia, sebbene il BaaS abbia ridotto le spese generali e la complessità della costruzione di una Fintech, lo sviluppo e l'ingegneria del software rappresentano solo una parte della costruzione di una nuova attività Fintech. I fondatori devono anche pensare all'adeguamento del prodotto al mercato, alle strategie di monetizzazione, all'acquisizione dei clienti e altro ancora.

Questa guida illustra alcuni passaggi e best practice per le attività che vogliono costruire una Fintech di successo, basandosi sulle Fintech che offrono conti e carte finanziarie. Abbiamo abbinato le nostre conoscenze interne con le intuizioni delle start-up Fintech per aiutarti a progettare, costruire e far crescere la tua attività.

Nozioni di base sulle Fintech

Una Fintech è un'attività che offre servizi finanziari, come conti finanziari, carte o prestiti, e li rende accessibili ai propri clienti attraverso un software. Può indicare un'attività Fintech "pura", in cui il prodotto principale offerto è un servizio finanziario (ad esempio, una Fintech la cui offerta principale sono i prestiti alle piccole attività). Può anche indicare un'attività che inserisce i servizi finanziari nella propria piattaforma per integrare l'offerta principale (ad esempio, uno strumento software per appuntamenti nei saloni di bellezza che consente anche ai proprietari dei saloni di elaborare i pagamenti e ai clienti di spendere con una carta acquisti).

Con la proliferazione delle aziende che costruiscono e offrono servizi finanziari, non è semplice determinare se un'azienda è una Fintech. Poiché i servizi finanziari svolgono un ruolo sempre più ampio nella strategia di prodotti e commerciale di molte aziende, attualmente sempre più imprese possono essere definite Fintech.

Esempi di Fintech

Ci sono diversi modi in cui puoi offrire servizi finanziari, fra cui:

- Diventare la principale relazione bancaria con gli utenti: l'obiettivo di queste Fintech consiste nel diventare la relazione bancaria principale per i loro clienti, soppiantando le (eventuali) relazioni bancarie esistenti. Queste attività devono disporre generalmente di una vasta gamma di offerte finanziarie che soddisfino tutte, o per la maggior parte, le esigenze finanziarie di un utente, tra cui conti correnti e di risparmio, carte di credito e di debito, prestiti e altre.

- Costruire una soluzione Fintech puntuale: le Fintech puntuali si concentrano sulla soluzione di un problema di servizi finanziari o di un'esigenza mirata, differenziando in qualche modo la loro offerta rispetto a quelle esistenti. Esempi di questo tipo di soluzioni sono la semplificazione dell'invio di denaro con le rimesse, l'aumento dell'accessibilità al capitale attraverso i prestiti, la gestione delle spese aziendali con le carte e altre ancora.

- Sviluppo di infrastrutture finanziarie: queste attività migliorano e risolvono i punti dolenti delle infrastrutture finanziarie esistenti per altre attività Fintech, che possono spaziare dalla fornitura di funzionalità per la conformità e la sicurezza, all'infrastruttura per pagamenti e servizi finanziari, e altre ancora. (Stripe è un esempio di attività che offre un'infrastruttura finanziaria).

Le attività che creano una carta acquisti o una soluzione per la gestione delle spese, come Ramp, Emburse e Brex, sono esempi di Fintech (nel dettaglio, soluzioni Fintech puntuali). Queste aziende hanno realizzato prodotti che consentono ai loro clienti professionali di agevolare, gestire e tracciare facilmente le spese aziendali effettuate dai dipendenti.

Tradizionalmente, la gestione delle spese aziendali è un processo notevolmente manuale, che richiede molte risorse ed è soggetto a errori. I dipendenti devono pagare di tasca propria le spese aziendali, quindi aspettare i rimborsi dopo aver presentato le note spese. Inoltre, i team finanziari e contabili devono dedicare molto tempo alla gestione delle note spese, alla convalida delle ricevute e alla gestione dei rimborsi spese.

Le moderne soluzioni di gestione delle spese forniscono alle attività e ai loro dipendenti carte virtuali o fisiche con controlli specifici sulle spese, il tutto semplificando e automatizzando il processo di gestione delle spese e dei rimborsi.

Le soluzioni di gestione delle spese sono solo un tipo di attività Fintech. Il panorama Fintech è vasto e in continua evoluzione, e sul mercato ci sono molti altri tipi di attività Fintech, tra cui le neobank e le challenger bank, le carte per l'erogazione dei benefit, i fornitori di prestiti business-to-business (B2B), le aziende di gestione delle rimesse, gli strumenti di pagamento delle bollette, le piattaforme di gestione patrimoniale e molti altri. Con tutte queste attività, i clienti possono accedere direttamente ai servizi finanziari nella piattaforma o nel prodotto della Fintech, invece di dover interagire con un'istituzione finanziaria tradizionale.

Elementi fondamentali da considerare quando si costruisce una Fintech

Abbiamo intervistato diverse start-up Fintech per scoprire come hanno identificato la loro offerta di prodotti e come l'hanno monetizzata, come hanno costruito la loro infrastruttura tecnologica e come hanno acquisito i primi clienti. Qui ne mettiamo in evidenza intuizioni e aneddoti, illustrando alcune domande chiave che la tua attività deve considerare sulla base dei loro insegnamenti.

1. Identificare un pubblico poco servito, ma con notevoli esigenze

In genere, le banche e le istituzioni finanziarie tradizionali costruiscono offerte generiche per l'intero mercato (invece di creare prodotti su misura per un pubblico specifico). Di conseguenza, molte persone servite scarsamente non possono accedere facilmente ai servizi finanziari di cui hanno bisogno o sfruttare soluzioni su misura per le specifiche esigenze delle loro attività. Ad esempio, solo il 48% delle piccole attività può acceder a tutti i finanziamenti di cui ha bisogno, e il 33% delle attività si è visto viste negare una linea di credito perché gli istituti finanziari ritenevano che non avessero una storia creditizia sufficiente o che esistessero da troppo poco tempo. L'identificazione di clienti come questi, poco serviti ma con esigenze elevate, crea opportunità che la tua Fintech può perseguire, per risolvere problemi sostanziali.

Paperchain, un'applicazione per pagamenti istantanei dedicata ai creatori, ha identificato un'importante fonte di ostacoli per i creatori di musica. Secondo Paperchain, i creatori di musica forniscono il contributo principale al settore dello streaming musicale che vale 30 miliardi di dollari, ma spesso hanno problemi con i flussi di cassa, poiché attendono fino a 18 mesi i pagamenti dei loro ricavi. Lo stesso vale anche per gli streamer video, gli influencer e gli sviluppatori di giochi e app, ma Paperchain ha deciso di concentrarsi in particolare sui creatori di musica, ritenendo che Paperchain fosse meglio preparata per risolvere i loro punti critici.

Due terzi dei fondatori di Paperchain erano produttori musicali, e questo forniva loro una visione particolare del loro pubblico di riferimento, poiché avevano già lavorato a stretto contatto con altri creatori e avevano vissuto in prima persona le loro difficoltà. Sapevano che i creatori dovevano investire nella produzione e nella promozione, ma spesso aspettavano di incassare il prossimo a causa dei vincoli del flusso di cassa.

Di conseguenza, Paperchain costruì un'attività Fintech incentrata sulla soluzione del principale punto critico dei produttori musicali, consentendo loro di essere pagati istantaneamente attraverso un wallet e una carta. Non solo i loro prodotti si rivolgono specificamente ai creatori, ma anche la strategia di marketing di Paperchain è strettamente focalizzata sulla capacità di servire al meglio questa utenza così esigente.

Fonte dell'immagine: sito web di Paperchain

Domande chiave che la tua attività deve prendere in considerazione:

- Qual è il mio pubblico di destinazione?

- Quanto è grande il mercato o l'opportunità?

- Che cosa utilizzano i miei potenziali clienti per i servizi finanziari?

- Quali sono attualmente i loro punti critici dal punto di vista finanziario? Dove si rilevano le attuali difficoltà?

2. Sollecitare il feedback dei clienti per definire il percorso del tuo prodotto.

È essenziale che tu abbia una profonda comprensione del tuo pubblico di destinazione mentre costruisci il prodotto principale. Tuttavia, la semplice conoscenza dei punti critici dei suoi potenziali clienti non è sempre sufficiente per aiutarti a costruire la migliore offerta Fintech. L'invio di sondaggi e la creazione di personaggi hanno un valore ma in molti casi, soprattutto agli inizi, la migliore linea d'azione consiste nel parlare direttamente con i clienti per scoprire cosa vogliono che tu costruisca.

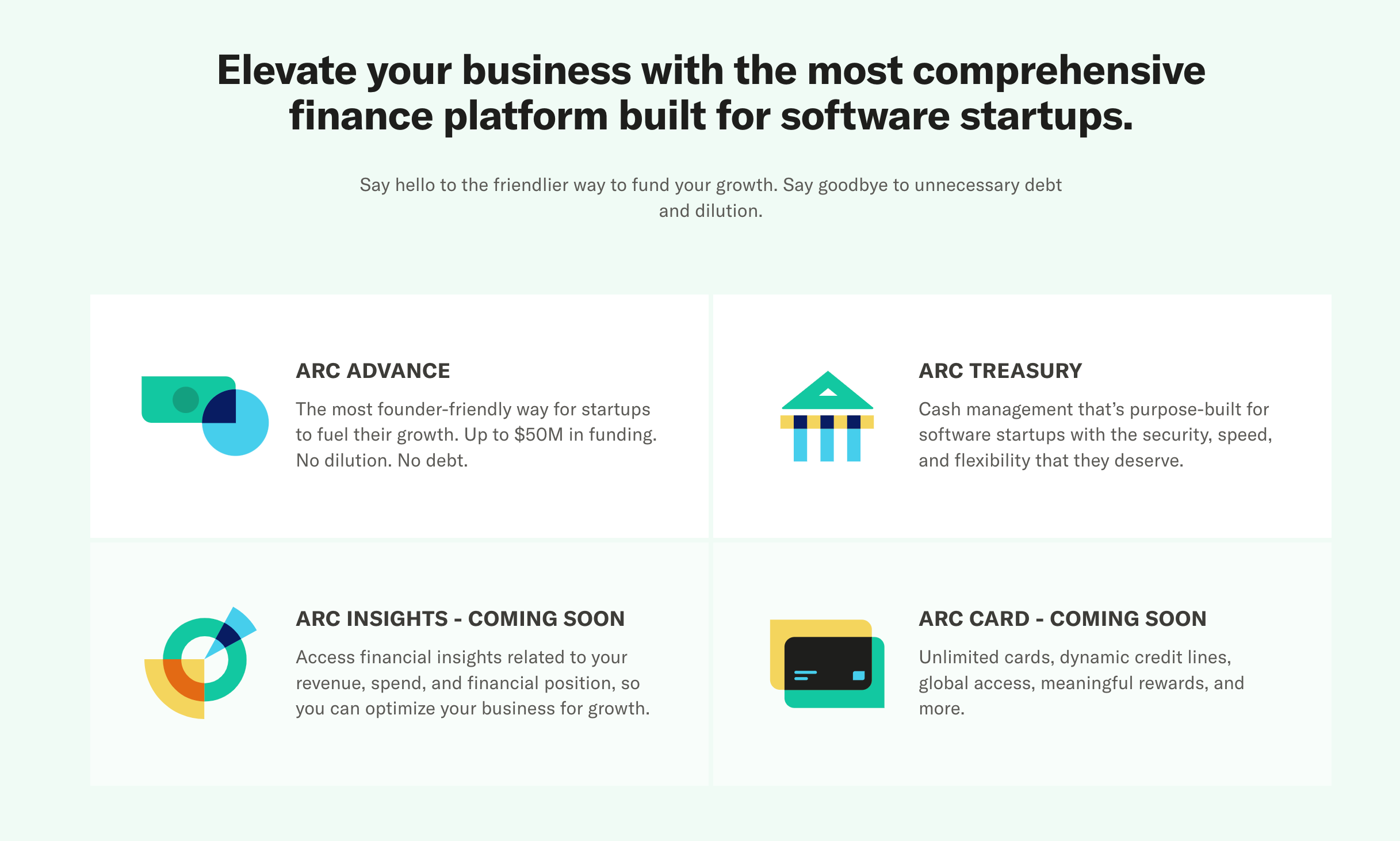

Secondo il team di Arc, la cui missione è costruire il futuro finanziario delle start-up, questo ha significato impegnarsi con "migliaia di fondatori in tutto il Paese". Attraverso le conversazioni individuali, il team ha rilevato i punti critici principali del processo di raccolta fondi delle start-up: Richiede "troppo tempo", è "incredibilmente fuorviante per i fondatori che sono già troppo impegnati" e "le persone che conosci [contano di più] dell'effettivo funzionamento della tua attività". Per i fondatori in cerca di capitali istituzionali, nessuna delle due opzioni disponibili era ideale: erano costretti a scegliere tra debiti tradizionali che "gravano sulle start-up con vincoli su tutti gli asset, accordi, commissioni sulle transazioni e copertura dei warrant" e il "costo senza limitazioni della diluizione e della perdita del controllo" che si ottiene con la vendita delle azioni. Quando Arc ha aggiunto centinaia di clienti paganti alla sua piattaforma, ha scoperto subito un punto critico molto più grave per queste aziende in crescita e in fase iniziale. "Gli stessi processi fuorvianti, offline e manuali che affliggono la raccolta di fondi delle start-up persistono anche nello stack finanziario B2B", ha dichiarato il team di Arc.

Queste intuizioni, unite alla missione del team, favorire la crescita delle start-up, hanno spinto Arc a creare una piattaforma di finanziamento, gestione della liquidità e approfondimenti, integrata a livello verticale. Con Arc, le start-up possono "attingere senza problemi ai loro futuri flussi di entrate per accedere a un capitale non diluitivo, depositare i fondi in un conto di tesoreria virtuale detenuto da Evolve Bank (membro FDIC) e distribuire istantaneamente le spese per stimolare la crescita", il tutto tramite un conto digitale nativo.

Fonte dell'immagine: sito web di Arc

Domande chiave che la tua attività deve prendere in considerazione:

- In che modo la mia offerta Fintech risolve i punti critici del mio utente di destinazione?

- In che modo la mia offerta rappresenta un miglioramento rispetto ai servizi finanziari esistenti?

- Ho parlato della mia idea con i potenziali utenti? Ho verificato l'idea con gli utenti?

- Cosa piace e cosa non piace agli utenti della mia idea? C'è qualcosa che manca secondo loro?

3. Diversificare i flussi dei ricavi

Le Fintech, come tutte le altre attività, devono essere redditizie (o avere un percorso chiaro per la redditività). A seconda del tipo di attività Fintech che stai costruendo, puoi controllare una serie di leve per la monetizzazione. Ecco alcune opzioni:

- Commissioni interbancarie: se offri un prodotto basato su una carta, puoi trattenere una parte delle commissioni interbancarie generate per ogni transazione con la carta.

- Prestiti: puoi guadagnare offrendo prestiti e addebitando le commissioni per l'emissione e gli interessi.

- Commissioni sui fondi depositati: se consenti ai clienti di depositare fondi, puoi guadagnare le commissioni sui fondi depositati. Puoi acquisire tutti i ricavi e condividerli con il cliente, o una combinazione di entrambi.

- Tariffe di abbonamento o di servizio: addebita ai clienti una tariffa ricorrente per abbonamenti o piani di abbonamento in cambio dell'accesso alle tue offerte o ai tuoi servizi.

- Sovrapprezzo applicato a servizi di trasferimento di denaro: applica un sovrapprezzo ai costi di vari servizi di trasferimento di denaro (ad es. accesso accelerato ai fondi, bonifici bancari, cambio valuta, ecc.).

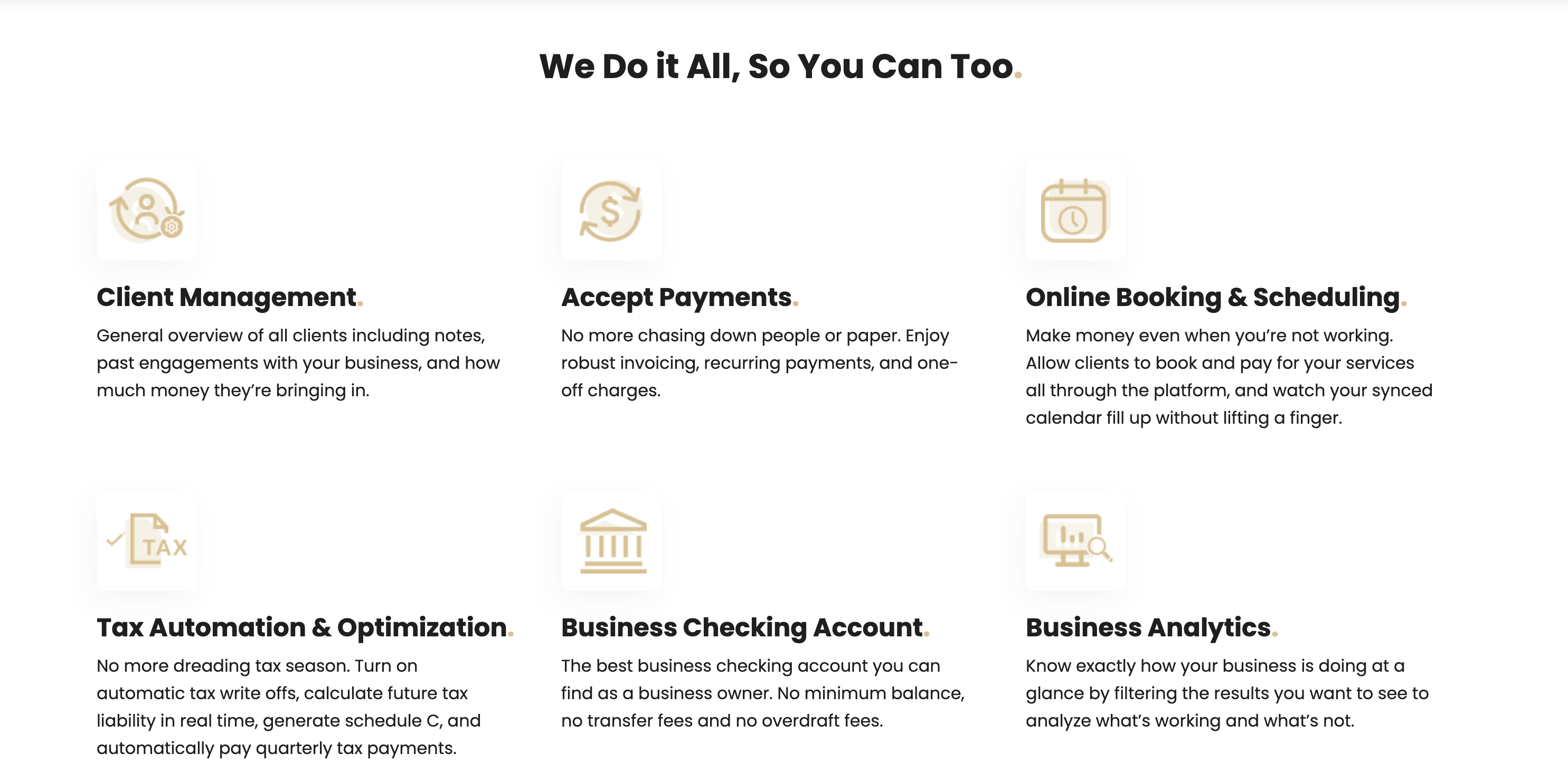

Molte Fintech sfruttano più flussi di ricavi per diversificare le entrate e migliorare la redditività dell'attività. Possono anche testare diverse strategie di monetizzazione e vedere da dove proviene la maggior parte delle loro entrate a lungo termine, adeguando di conseguenza la strategia. Ad esempio, Persona, una soluzione di gestione aziendale per professionisti autonomi e proprietari di attività indipendenti, ha cinque flussi di ricavi per la sua attività:

- Acquisizione di una parte delle commissioni interbancarie sulle transazioni effettuate con la carta Persona Visa.

- Addebito delle commissioni per l'elaborazione dei pagamenti, quando le attività accettano i pagamenti sulla loro piattaforma.

- Generazione delle commissioni di deposito sui fondi depositati nei conti finanziari della piattaforma.

- Addebito di commissioni sui finanziamenti a breve termine

- Offerta di accordi di affiliazione con attività in cui Persona e i suoi clienti vengono ricompensati per acquisti specifici.

Fonte dell'immagine: sito web di Persona

Domande chiave che la tua attività deve prendere in considerazione:

- Quando inizierò a monetizzare la mia offerta? Dovrò cercare di generare ricavi fin dall'inizio? Prima di determinare come monetizzare il mio prodotto dovrò concentrarmi sull'acquisizione degli utenti e sulla sua evoluzione?

- Come posso monetizzare la mia offerta a lungo termine? Quali leve di monetizzazione potrei sfruttare?

- Quali condizioni e requisiti sono necessari per monetizzare con successo la mia offerta?

- Come si presenta nell'insieme l'economia della mia attività?

L'economia unitaria fa riferimento ai ricavi e ai costi della tua attività su base unitaria (ad esempio, un cliente) per determinare la redditività e la salute finanziaria complessiva della tua attività. Un esempio è la valutazione del rapporto tra il valore di tutta la vita del cliente (LTV) e il costo di acquisizione del cliente (CAC), che determina la quantità di ricavi da un cliente rispetto ai costi richiesti per la sua acquisizione.

4. Determinare l'infrastruttura su cui avverrà la costruzione

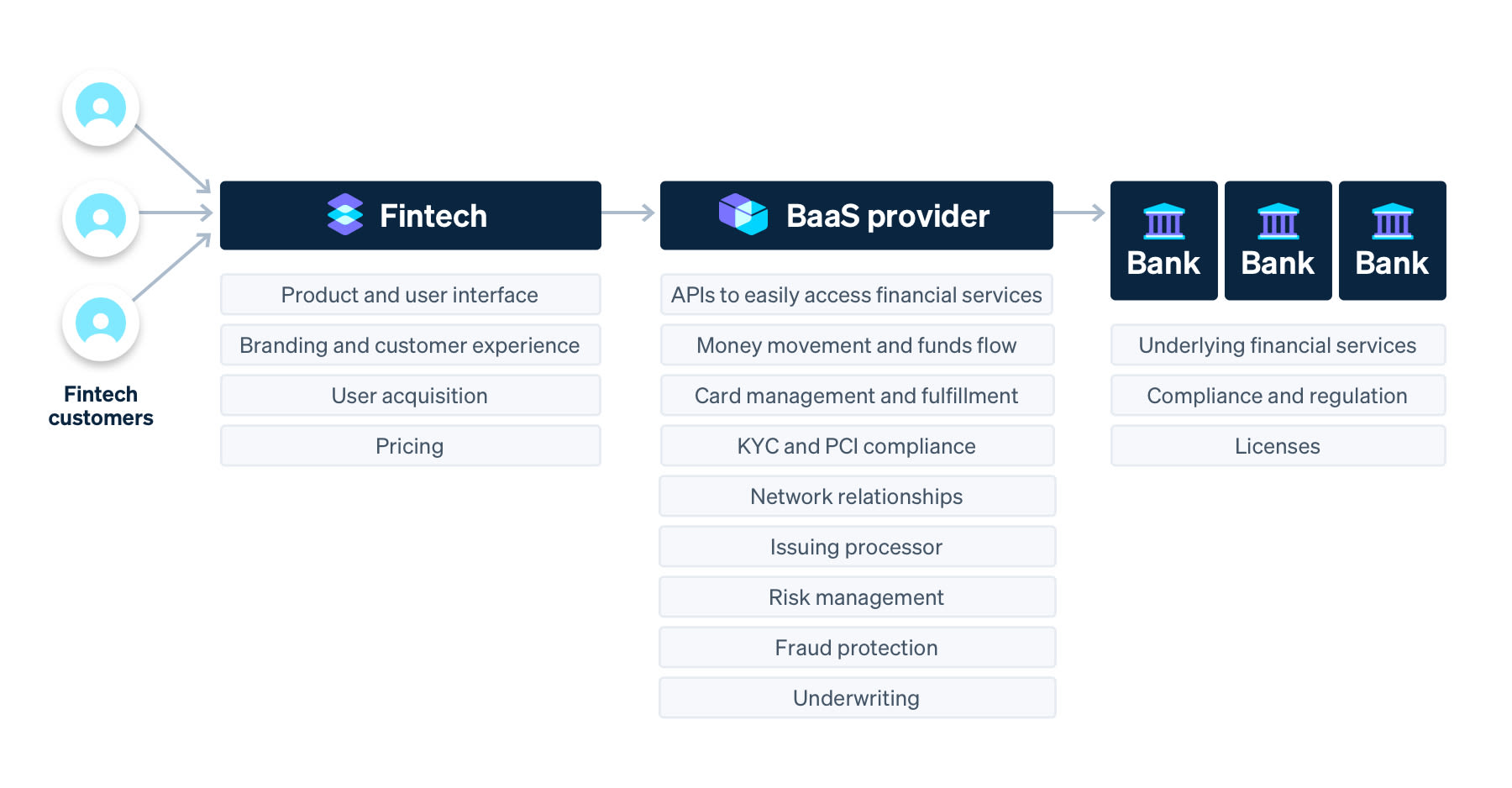

Non è necessario che una Fintech possieda l'infrastruttura finanziaria o la tecnologia che utilizza (anche se certamente può scegliere di farlo). La stragrande maggioranza delle Fintech utilizza una soluzione BaaS per aiutarle a costruire la propria offerta e presentarla sul mercato nel modo più rapido e semplice. I fornitori BaaS agiscono come intermediari tra l'attività Fintech e le banche, fornendo l'infrastruttura su cui le Fintech possono basare i loro prodotti finanziari.

Una volta deciso cosa costruire, devi decidere come costruirlo. Si tratta di una decisione essenziale per ogni Fintech, poiché determina la base del prodotto ed è costoso cambiare l'infrastruttura dopo avere iniziato la costruzione.

Ci sono due modi principali per costruire la tua offerta fintech:

1. Lavorare direttamente con una banca

La collaborazione con una banca ti consente di avere un maggiore controllo sulla tua offerta finanziaria, dal momento che stai costruendo tutto da solo. Tuttavia, questo richiede anche risorse e investimenti significativamente maggiori, sia per iniziare, sia per la gestione continuativa dopo il lancio. Quando lavori direttamente con un partner bancario, devi gestire da solo tutti gli elementi che costituiscono un nuovo servizio finanziario. Questi includono la gestione del rapporto con il partner bancario, la creazione da zero di un'infrastruttura di base per il deposito e il trasferimento del denaro, la gestione della conformità e dei requisiti normativi, e molto altro ancora, oltre alla realizzazione del prodotto finanziario vero e proprio.

2. Collaborare con un fornitore BaaS

In alternativa, puoi collaborare con un fornitore BaaS che ti offra l'infrastruttura di base necessaria per costruire una nuova offerta finanziaria, assorbendo la maggior parte della complessità e della conformità del prodotto. Il diagramma seguente mostra esattamente in che modo un fornitore BaaS si assume la maggior parte delle responsabilità e porta i servizi bancari alle Fintech, adattandoli alla loro scala.

La collaborazione con un fornitore BaaS può ridurre drasticamente il tuo time-to-market, in modo da poter adeguare rapidamente il tuo prodotto al mercato e costruire funzionalità differenzianti basate sulle offerte finanziarie principali. Tuttavia, non è in grado di personalizzare l'offerta nella stessa misura in cui potresti farlo lavorando direttamente con un partner bancario.

Quando valuti i fornitori BaaS, devi considerare alcuni fattori come le funzionalità supportate (attuali o previste in futuro), l'affidabilità, la disponibilità nell'area geografica, l'assistenza alla clientela e altre ancora.

Il percorso che sceglierai dipenderà dalle priorità. Potresti voler costruire e dimensionarti rapidamente con un fornitore BaaS o costruire una soluzione più personalizzata collaborando con una banca per ottenere un controllo maggiore.

Persona ha deciso di lavorare con un fornitore BaaS poiché, come piccola start-up, non aveva le risorse per costruire un'infrastruttura bancaria. Lavorando con un fornitore BaaS come Stripe, ha potuto "fare affidamento sull'infrastruttura di Stripe, che ha permesso [loro] di costruire una serie di funzionalità che in caso contrario non avrebbe[ro] potuto costruire". Stripe offriva anche tutte le funzionalità che occorrevano all'attività al momento del lancio, e sarebbero potute servire in futuro. "L'ultima cosa che si desidera è scegliere un fornitore, iniziare a costruire e poi cambiare completamente l'architettura quando servono funzionalità aggiuntive", ha affermato il team di Persona.

Domande chiave che la tua attività deve prendere in considerazione:

- Ho le risorse tecniche e di sviluppo per costruire un'offerta Fintech in autonomia?

- Ho una conoscenza approfondita dell'ecosistema finanziario (ad esempio, regole operative Nacha, BIN delle carte, leggi sul fair lending, ecc.) Voglio assumermi la responsabile di muovermi in questo ambito?

- Con quale tempistica cerco di rendere operativo il mio prodotto?

- Quali sono le capacità e le funzionalità di cui ho bisogno (o avere bisogno) a lungo termine per il mio percorso?

Quando si valutano i fornitori BaaS:

- Offrono le funzionalità di cui ho bisogno attualmente e quelle che potrebbero servirmi in futuro?

- È un'attività affermata nell'area Fintech? Quali altre Fintech hanno supportato?

- Hanno esperienza nel settore Fintech? Nella compliance? Nella gestione del rischio e nella prevenzione delle frodi?

- Che livello di assistenza possono fornire alla mia attività?

5. Formalizzare la strategia di acquisizione dei clienti

Come avviene per la maggior parte delle nuove attività, il tuo approccio al marketing e all'accesso al mercato giocherà un ruolo significativo nel determinare il successo della tua attività. Potrai beneficiare di qualche adozione organica e del passaparola, ma dovrai avere una strategia formale di acquisizione degli utenti per assicurarti di far crescere la tua base di clientela.

Sfrutta i canali di marketing adeguati a tua disposizione per raggiungere i tuoi clienti di destinazione. Determina quali sono i canali e gli approcci di maggiore impatto per il tuo pubblico particolare e continua a sperimentare le tue strategie di marketing e di sensibilizzazione per vedere cosa funziona meglio. I canali di proprietà, come le email, il blog, i social media, il sito web e la dashboard dei prodotti, sono gratuiti e facili da sperimentare. Altri canali, come le ricerche a pagamento, gli annunci di retargeting o gli annunci a video, richiedono maggiori investimenti e un budget dedicato per essere perseguiti con successo.

I team di marketing di Arc, Paperchain e Persona hanno testato una serie di canali per capire quale fosse il più efficace per le rispettive attività:

- I fondatori stanno adottando finanziamenti alternativi a un ritmo sempre più veloce, per conservare la proprietà dell'attività che hanno costruito con tanta fatica. Piuttosto che rinunciare prematuramente al 5-10% della proprietà, oggi i fondatori possono sbloccare il capitale di crescita attingendo ai flussi di reddito futuri, per raccoglierlo più avanti da una posizione di forza, quando i ricavi saranno più elevati e i mercati azionari torneranno a crescere. Data la natura macro e non diluitiva di Arc Advance, abbiamo riscontrato un forte riscontro attraverso il passaparola dei nostri attuali clienti. Questo ha influito sui nostri sforzi di marketing all'esterno e all'esterno, e sulla nostra messaggistica. Nei prossimi mesi (e anni), continueremo a fare leva sui punti critici dei clienti e a fungere da risorsa per i fondatori nel loro percorso di crescita aziendale". —Arc

- Il passaparola ha aggiunto 5.000 creatori alla nostra lista d'attesa, che stiamo cercando di sbloccare attentamente. Mentre dimensioniamo il nostro processo di inserimento, utilizziamo anche i nostri partner B2B. Abbiamo stretto una partnership con UnitedMasters [un importante distributore di musica] e ora 100.000 artisti vogliono utilizzare la nostra app". —Paperchain

- Il nostro team ha notevole esperienza nel performance marketing e nell'acquisizione degli utenti, quindi sfruttiamo tutte le principali piattaforme pubblicitarie per le campagne di acquisizione utenti e dedichiamo molto tempo e impegno all'estrema ottimizzazione per nicchie ridotte di attività particolari. Le collaborazioni con scuole professionali, sindacati, certificatori e simili organizzazioni sono state un ottimo modo per farci crescere, grazie alle loro segnalazioni". —Persona

6. Test e iterazioni

I punti critici e le esigenze dei tuoi clienti possono evolversi nel tempo, quindi devi sempre essere pronto ad adattarti e dimensionarti secondo le necessità. Ad esempio, il team di Karat inizialmente voleva creare un software che aiutasse i creatori a gestire le imposte, che purtroppo ebbe un'accoglienza tiepida. Karat scoprì che il suo prodotto non rispondeva alle esigenze immediate dei creatori. Quando parlavano con il loro pubblico di riferimento, i creatori chiedevano sempre un prestito anticipato di 5.000 o 10.000 dollari che li aiutasse a coprire le fatture in arrivo, perché non disponevano del capitale circolante necessario.

Basandosi su questa richiesta, Karat lanciò inizialmente un prodotto per erogare anticipi di cassa ai commercianti, che offrisse credito ai creatori, ma riscontrò che il prodotto non aveva un buon riscontro. Compresero che un prodotto basato su carta avrebbe fornito ai creatori un accesso facile ai finanziamenti, così come desideravano i creatori. Questo li portò a far evolvere nuovamente il prodotto e a creare un prodotto basato su carta per le spese aziendali, con cui avrebbero potuto finanziare i creatori in base ai loro ricavi dalle diverse piattaforme digitali. Oggi il loro prodotto ha elaborato transazioni per un totale a più di otto cifre.

Allo stesso modo, il team di Persona scoprì che l'adattabilità era importante per la loro start-up, soprattutto all'inizio della costruzione del prodotto.

"Le funzionalità che abbiamo scelto all'inizio non erano quelle che avevamo alla fine", ha detto il team di Persona. Inizialmente la loro app consentiva agli utenti di elaborare i pagamenti, ma hanno scoperto che i loro utenti chiedevano costantemente di poter ricevere subito i fondi. Facendo seguito ai feedback e alle richieste degli utenti, il loro team assegnò la priorità alla creazione di una funzione Instant Pay per la piattaforma.

"Quando arriva per la prima volta sul mercato, è il momento di apprendere ciò che le persone vogliono effettivamente dal tuo prodotto e le funzionalità che stanno cercando", ha detto il team di Persona.

In che modo Stripe può essere d'aiuto

Stripe è il modo più semplice e flessibile con cui le aziende possono costruire e lanciare una propria Fintech scalabile e completa, sia che si tratti di pagamenti, prestiti, carte o sostituzione di conti bancari. Le API BaaS di Stripe, insieme al nostro intero ecosistema di offerte di infrastrutture finanziarie, consentono alle attività di creare facilmente una nuova offerta Fintech o di incorporare direttamente i servizi finanziari nel software esistente.

Ognuno dei nostri prodotti BaaS mette a disposizione delle API, elementi costitutivi da combinare in modi diversi, a seconda delle esigenze dei clienti e di ciò che ha senso per l'attività.

- Stripe Issuing permette di creare, gestire e distribuire istantaneamente carte virtuali o fisiche. Con Issuing è possibile creare attività Fintech come piattaforme di gestione delle spese; pagamento a rate (BNPL) e altre ancora.

- Stripe Treasury offre un'API BaaS flessibile per costruire un prodotto finanziario completo per i clienti, sia che si tratti di un conto per vendite e acquisti o di un'offerta di gestione delle spese. Treasury mette a disposizione gli elementi fondamentali per creare conti finanziari, archiviare fondi, spostare denaro tra le parti e collegare le carte per gli acquisti.

- Stripe Capital consente di fornire finanziamenti rapidi e flessibili per aiutare i clienti a far crescere la loro attività. Molte attività faticano a ottenere i finanziamenti necessari per crescere, ma Stripe elimina questa barriera con un programma di prestiti completo, implementabile con un'unica integrazione.

- Stripe Connect consente di incorporare pagamenti tra più parti e di offrire una serie di servizi finanziari, come la raccolta dei pagamenti dai clienti e il pagamento di soggetti terzi. Le piattaforme guadagnano con le commissioni per i servizi forniti.

- Stripe Financial Connections consente agli utenti di collegare in modo sicuro i conti finanziari esistenti e di condividere i dati finanziari con la tua piattaforma.

- Stripe Identity ti permette di confermare da programma l'identità degli utenti globali, in modo da rispettare le normative sull'adeguata verifica della clientela (KYC).

Contatta il nostro team per saperne di più su come utilizzare Stripe per costruire la tua Fintech.

Le carte di credito commerciali Visa® sono emesse da Celtic Bank, una banca industriale autorizzata dello Utah, membro FDIC.

Stripe Treasury è fornito da Stripe Payments Company, licenziatario per i trasferimenti di denaro, con fondi depositati presso Evolve Bank & Trust e Goldman Sachs Bank USA, membri FDIC.

I prestiti sul capitale vengono erogati da Celtic Bank, una banca industriale autorizzata dello Utah, membro FDIC. Tutti i prestiti sono soggetti ad approvazione del credito.