挑战

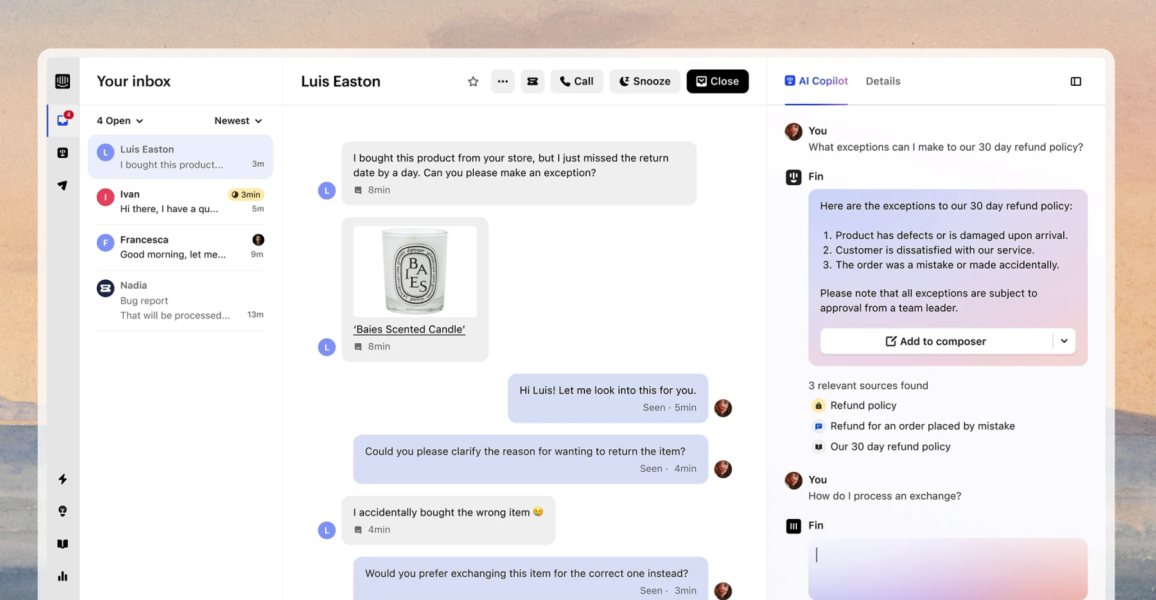

作为一家拥有技术创新历史的公司,Intercom 很早便采用了 AI 和机器学习工具来发展客户服务解决方案。随着 2022 年 12 月 ChatGPT 的推出,Intercom 看到了一个机会,可以利用该模型的先进功能来重塑其产品和商业模式。通过与 ChatGPT 的创建者 OpenAI 合作,Intercom 的工程师从零开始重构其客户服务平台,首个版本在三个月后上线,并逐步发展为包括 AI Agent、AI Copilot 等在内的功能体系。

在开发 AI 工具的同时,Intercom 也意识到需要一套新的账单系统,以应对 AI 驱动产品的快速变化和动态特性。由于客户不愿为可能不稳定的前沿技术预先付费,他们对 Fin 这类产品传统按席位定价的模式并不认可。但同时,单纯按用量计费同样不受欢迎——这意味着当 AI 无法独立解决问题需要人工介入时,客户实际上要为同一问题支付两次费用(既为 AI 服务付费,又为人工干预买单)。因此,Intercom 需要打造能够支持按成果定价的账单系统——即客户只需为成功解决的问题付费。

然而,多年来,Intercom 已经构建了客户账单引擎和内部管理界面,该系统连接到第三方平台以生成客户订阅发票。这种复杂的架构使得 Intercom 难以推出新的定价模式,也难以灵活管理订阅变量(如折扣和按比例定价)。

该系统还因集成和数据同步问题而出错。客户支持团队无法自行解决这些问题,因为将内部账单平台连接至订阅开票工具的 API 不易维护,且缺乏清晰的文档说明。因此,账单错误成为一个技术难题,最后交给七名资深工程师组成的团队负责,每周都需要其中一到两人解决账单错误和运营问题。

Intercom 所需的账单平台,既能更轻松开发新的订阅定价层级,又能支持可选费用、按用量计算的费用和折扣,同时帮助公司将其现有客户迁移到新产品和定价模型中。该平台还需要与 Intercom 技术架构中的其他几个系统实现高效集成,例如 NetSuite 财务软件、Avalara 税务引擎、AWS 数据湖以及 Salesforce 客户关系管理 (CRM) 软件。

与 CRM 系统的双向集成尤为重要,因为 Intercom 有两个销售渠道:小公司通过 Intercom 网站自助订阅,大公司则通过销售团队达成交易。创建一个新的账单平台是统一这两种订阅管理体验的好机会。

最重要的是,新的账单系统必须减少账单错误,让面向客户的团队能够自行解决任何问题,无需求助于工程师。

解决方案

Intercom 选择将其内部和外部账单功能整合到Stripe Billing,该工具能为 Intercom 提供应用于新产品和定价模式的必要功能。它具备灵活性,可轻松与其他关键技术组件实现第三方集成,并与 Intercom 已用于处理信用卡支付的 Stripe Payments 实现无缝连接。

Intercom 还使用了 Stripe 的结账优化套件。其中包括Stripe Elements,这是一套可嵌入的用户界面组件,用于打造流畅的结账流程并提供七种支付方式,包括银行转账、Apple Pay、Google Pay和Cash App Pay。该公司还添加了Link(Stripe 的数字钱包),客户只需保存一次支付信息,后续购买时系统会自动填充这些信息。内置于优化结账套件中的 AI 模型会针对每笔单独购买,判断为该用户展示哪些支付方式以及其排列顺序,以期最大限度提升订阅数量。

Intercom 还可以利用 Billing 中的按用量计费的功能,来支持 Fin 的按成果定价策略——即仅针对已成功解决的问题,进行定义、计量和开单。

Stripe 对账单系统需解决的关键问题有着深刻理解——包括多层级定价、按比例计费、折扣机制、新产品测试能力,以及对多种支付方式的支持。这使 Intercom 相信 Billing 能持续发展以支持公司未来的增长与创新。对 Intercom 和 Stripe 而言,账单系统不仅仅是财务职能的一部分,更是一个重要的平台,必须能够支撑公司的产品开发、核心业务流程、商业模式和客户体验。

在开始迁移之前,Stripe 专业服务团队主导进行了详细的可行性验证,以了解 Intercom 当前面临的挑战、现有技术架构和未来需求。在三个多月时间里,Stripe 与 Billing 平台互动的主要相关者(包括产品经理、账单工程师以及会计和应收账款团队成员)进行了会谈。这些交流有助于确保向 Billing 的迁移能支持各方需求并顺利与 Intercom 复杂的内部系统集成。

可行性评估最终形成了一个三阶段实施计划。第一阶段,Intercom 会为 Billing 中的新客户推出其更新后的产品和定价模式。第二阶段会将现有客户迁移到新的产品和定价模式。第三阶段,Intercom 会将现有客户迁移到 Billing,但他们会继续使用旧定价模式,直至升级到新产品。

为了管理项目的第一阶段,Stripe 专业服务团队组建了一支实施团队,成员包括来自美国、都柏林和伦敦的专家,他们与 Intercom 的技术、财务和运营相关负责人紧密合作,共同规划新的账单架构。Intercom 的新定价模式包含三个订阅层级,采用按席位计价的方式,服务于不同规模的企业,并根据每个层级所包含的功能水平进行差异化定价。该定价体系还包括针对特定功能和渠道的按用量计费,以及可选附加服务的费用——所有这些费用都将在客户的月度账单中统一结算。

在整个实施过程中,Stripe 专业服务团队持续与 Intercom 团队并肩协作,分享技术和运营方面的最佳实践,以确保新系统成功上线。双方团队共同设置了新产品、价格和计费规则,并通过预建连接器与自定义集成相结合的方式,将 Stripe Billing 与 Intercom 技术架构中的其他系统进行对接。例如,实施团队使用 AvaTax for Stripe 预制连接器,将 Billing 与 Intercom 的 Avalara 税务引擎相连。该连接器会监听来自 Stripe Invoicing 的 Webhook 事件,根据发票开具地和客户的所在国家,自动计算并汇缴相应税款。而在将账单系统与 Salesforce 对接时,Intercom 则通过 Stripe API 构建了自定义集成层。

作为 Stripe 用户,Intercom 还获得了访问 Stripe 管理平台的权限,从而能够清晰地查看客户订阅层级、发票数据和支付状态等详细信息。在新账单平台第一阶段正式上线之前,Stripe 实施团队为 Intercom 的账单运营团队进行了培训,指导他们如何使用该管理平台识别账单问题和响应客户请求。

成果

五个月内向新客户推出新定价

得益于对迁移计划的详细规划以及 Billing 提供的灵活集成选项,Intercom 在 2023 年 11 月推出其新定价方案的同时,仅用五个月便完成了迁移的第一阶段。到 2025 年 10 月,Intercom 已成功将其所有订阅客户及收入迁移到 Stripe。

“逐步采用 Stripe Billing 使我们能够加快开发账单系统,同时降低现有业务中断的风险,”Intercom 高级产品工程师 James Treanor 表示,“我们在 Stripe Billing 上开始建立起信心并逐步将客户迁移到新系统,这种高效率、低风险的方法使我们得以稳步推进。”

三个月内集成按使用量计费功能

尽管 Fin 基于结果的计费模式非常复杂,但 Intercom 团队仅用了三个月就完全集成了基于使用量的计费功能。“在引入新的计费指标时,按用量计费大大简化了流程,”Intercom 工程副总裁 Dave Lynch 表示,“我们只需触发事件,Stripe 就能自动处理后续操作。”

新账单平台支持灵活的订阅定价模式

迁移到 Billing 后,Intercom 可以采用简化的按座位计费模式,并能为某些客户提供行项目级别的折扣——这是该公司以前的供应商无法提供的功能。“在 Stripe 上进行折扣管理非常灵活,”Lynch 表示,“我们的团队可以轻松地根据需要调整策略。”

此外,Intercom 还利用 Billing 实现了定价创新。“借助 Stripe 推出我们的新定价模型,能够快速迭代,并在定价上获得所需的灵活性,”Treanor 补充道。

整合至单一平台,让工程师有更多时间专注于新产品开发

通过消除计费引擎与支付系统之间的第三方中间层,Intercom 预计账单错误将大幅减少。“Stripe 为我们管理使用量聚合,”Lynch 表示,“这极大地简化了我们以往的做法,我们能将更多精力集中于直接为客户创造价值。”

更重要的是,由于不再存在一个黑盒式 API 连接这些系统,客服团队可以轻松登录 Stripe,快速解决大多数问题,而无需再将问题上报给工程团队。公司的高级工程师不需要再应对这类日常维护问题,而是可以专注于新产品开发和优化 Intercom 的核心 AI 驱动客服工具。

“与旧系统相比,Stripe 为开发者带来了更好的体验,”Intercom 高级机器学习工程师 Kevin McNally 表示,“它具备更清晰的文档和更直观的订阅管理核心概念,让团队能轻松实现渐进式功能调整。”

通过改用 Stripe,Intercom 使其账单策略与产品和客户体验目标保持一致:打造一个以简洁性为核心、强调持续优化的世界级用户体验,而不是维持现状。

我们的目标是提供简单、透明且灵活的定价方式,始终将客户放在首位。我们选择 Stripe,是因为它不仅提供了丰富的定价模式选项,而且在追求卓越和高效执行方面都秉持着极高的标准。这正是我们希望为客户打造的体验。