Industry

Inside the growth of the top AI companies on Stripe

AI companies are rewriting the rules of growth. In our new report, Indexing the AI economy, we explore the latest trends and strategies in the AI space.

AI companies are rewriting the rules of growth. In our new report, Indexing the AI economy, we explore the latest trends and strategies in the AI space.

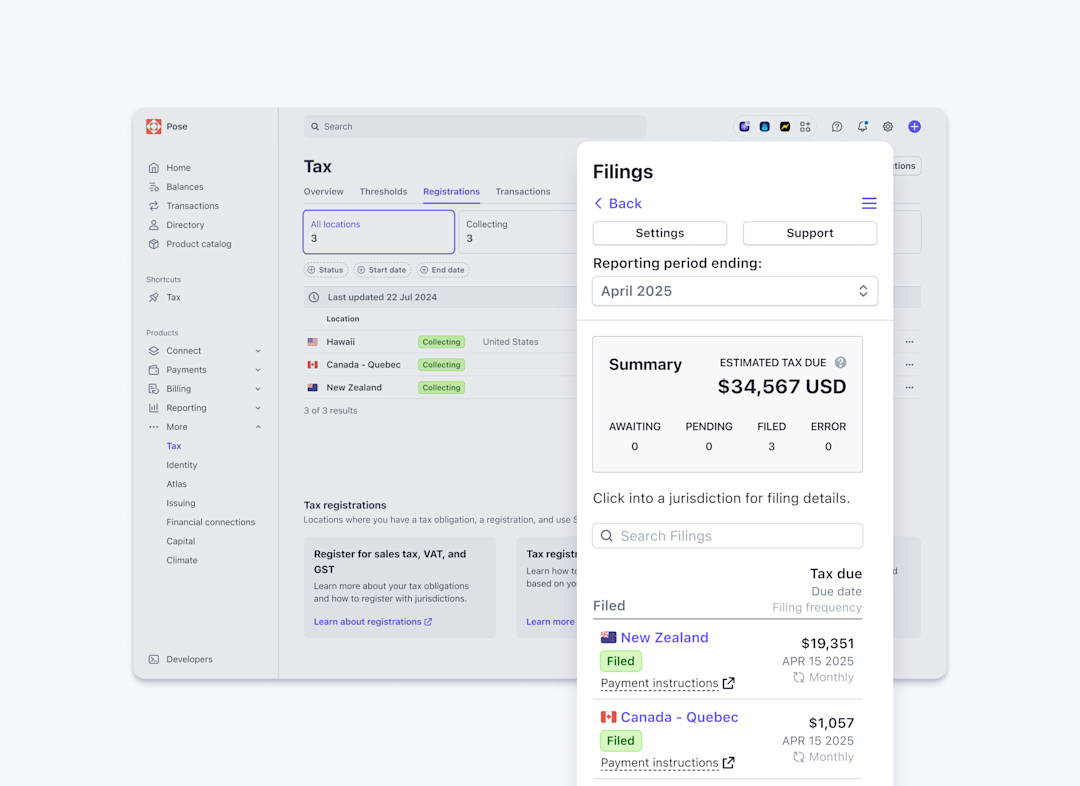

Stripe Tax is now an all-in-one global tax compliance solution, after adding international registration and filing to round out its tax calculation and collection features.

Last month at Stripe Sessions, we announced Global Payouts, which allows you to easily and securely send money to third parties around the world. Global Payouts is part of our biggest-ever upgrade to Stripe to make it less expensive, complex, and time-consuming for you to fund, store, and pay out in multiple currencies.

Earlier this month at Stripe Sessions, we announced Stablecoin Financial Accounts—our largest effort to date in expanding money management capabilities to businesses across the globe. Entrepreneurs and businesses in 101 countries can now easily access a dollar-denominated stablecoin balance to store and move money on crypto or established financial rails right from their Stripe Dashboard.

Stripe has been using AI in our payments products for over a decade, and we’re continuing to expand how we put AI to use on your behalf. Last week at Stripe Sessions, we introduced our Payments Intelligence Suite, which uses AI to make hundreds of automated, real-time decisions to maximize your profits—with no effort required.

We announced the ability to manage multiple payment providers from within Stripe, two new extensibility primitives, support for turnkey consumer issuing programs, new money management capabilities, and a lot more.

Over the last year we’ve seen a 40% increase in the share of noncard payment volume on Stripe. To help you adapt your fraud prevention strategy to this changing set of payment method preferences, we’re extending Radar’s fraud protection to cover ACH and SEPA payments.

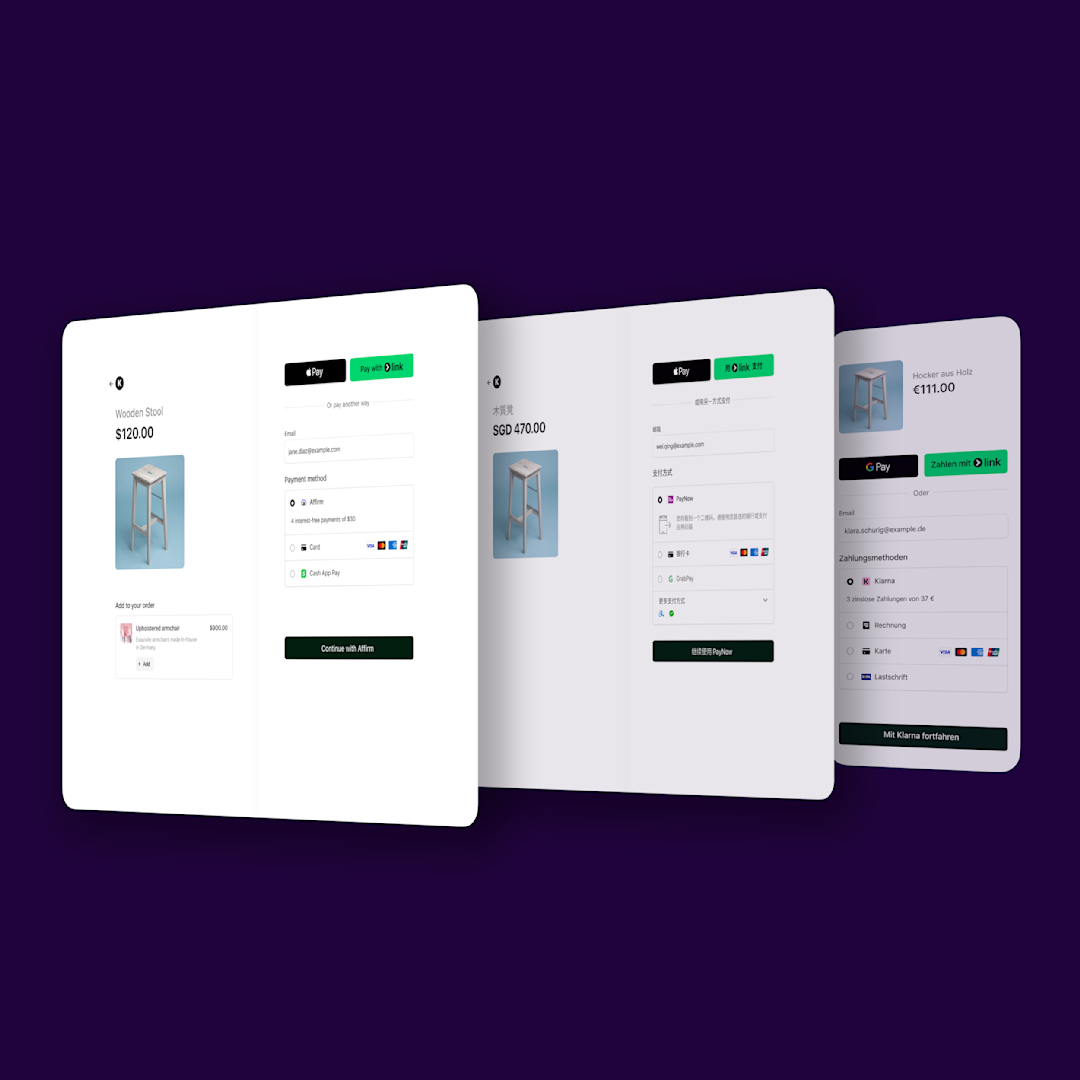

Last week, we shared new data that helps businesses understand the conversion and revenue benefits of offering different payment methods. Now we want to share how we ran the experiment. As we explain in the rest of this post, we had to test millions of combinations of payment methods while ensuring that we maintained a consistent shopping experience for customers.

We have data that shows when at least one additional relevant payment method beyond cards is dynamically surfaced, businesses on average see a meaningful increase in conversion and revenue.

Last month, we improved our AI tooling to give you even more flexibility when combating fraud. Now, Radar’s new rules combine our machine learning models with the issuer’s CVC and postal code response in real time. This can help you minimize fraud while worrying less about accidentally blocking legitimate revenue.

The Optimized Checkout Suite uses AI to personalize the checkout experience—dynamically adjusting everything from payment method ordering to fraud interventions in order to maximize conversion and boost revenue.

Founders can now accept payments immediately after incorporation, while Atlas handles the IRS filings in the background.

Recent AI upgrades to Adaptive Acceptance led to a record $6 billion in false declines recovered in 2024—a 60% year-over-year increase.

With the rise of usage-based billing for AI services, the strategic importance of credits is growing. That’s why we’ve recently added a new credits feature to Stripe Billing.

We created a usage-based billing system with an accurate and highly available revenue ledger; real-time events processing with ultrahigh throughput billing; and the ability to support complex pricing models and accurate billing, even in the face of delayed events. Doing so required reimagining how to build a highly scaled, highly reliable event streaming platform.

With our slice monitoring program, we use machine learning to spot small pockets of performance declines amid the sea of global payments.

While Radar’s models predict the likelihood of fraud or card testing, we needed a new way to recognize verification attacks that were causing higher-than-average authorization rates. Learn about our three-layered approach to combating this new fraud trend.

In the third and final installment in our three-part series, we examine the most important questions for the future of real-time payments: will they ever take off in the US and the UK, and will they emerge as a truly global payment method?

Card testing is one of the most significant fraud threats to Stripe, its users, and the broader financial ecosystem. Stripe’s machine learning–based approach—based on rapid detection and retraining—has led to successful card testing attacks on Stripe decreasing by 80% over the last two years.

To compete with other payment methods for consumer preference, real-time payments are expanding their “bundle” of services to include subscriptions, credit, and in-person transactions.