Efter ett domstolsbeslut i maj 2025 ändrade Apple sina riktlinjer så att utvecklare kan länka från sina appar för att ta emot betalningar på externa webbplatser. Det innebär att du för första gången kan använda en webbaserad kassa för digitala varor eller tjänster, vilket sparar upp till 90 % i inköpsavgifter och omvandlar dessa avgifter till ytterligare intäkter för ditt företag. En webbaserad kassa ger också mer flexibilitet när det gäller priser och kampanjer, närmare relationer med dina kunder, bättre insikt i dina data och möjligheten att uppfylla kundernas förväntningar genom att erbjuda ytterligare sätt att betala – till exempel köp nu, betala senare-alternativ – som inte stöds med Apples IAP-system (In-App Purchase).

För att dra nytta av denna möjlighet berättar apputvecklare för oss att de undersöker hur man snabbt kan gå över till en webbaserad kassa för iOS-appar. De vill dock se till att de behåller kundkonvertering, även om de omdirigerar kunder utanför appen.

Om du vill följa den här vägen kan Stripe hjälpa till. Stripe är en helt integrerad svit med finans- och betalningsprodukter som ger dig möjlighet att hantera hela intäkternas livscykel på ett och samma ställe. Du kan behandla betalningar, skapa anpassningsbara webbaserade kassaflöden, lansera nya prismodeller, automatisera efterlevnaden av skatteregler globalt och få tillgång till enhetlig rapportering.

Stripe har hjälpt tiotals appar att börja behandla externa betalningar under de senaste månaderna, och många rapporterar om tvåsiffriga besparingar i avgifter för betalningsbehandling. I den här guiden har vi sammanställt våra lärdomar för att hjälpa dig att skapa din egen smidiga betalningsupplevelse i appen och på webben. Denna bästa praxis hjälper dig att:

- Omdirigera köp från appen till webben på ett sätt som uppfyller kraven

- Skapa en enhetlig användarupplevelse när du omdirigerar mellan din app och webben

- Bygg en kassaprocess med hög konvertering

- Testa vilka strategier som fungerar bäst för dina kunder

- Hantera aktiviteter efter köpet, t.ex. skatter, återbetalningar och tvister

Vi kommer också att gå igenom hur Stripe kan hjälpa till och lyfta fram hur Stripe Checkout för app-till-webbetalningar införlivar bästa praxis som beskrivs i den här guiden. Låt oss göra en djupdykning.

Obs! Appar som säljer fysiska varor och tjänster – som e-handels-, leverans-, mat och dryckesappar m.m. – kan använda alla betalningssystem från tredje part i sin app. För att behandla betalningar med Stripe, se våra lösningar för betalningar i appen.

Bästa praxis för att skapa en optimerad webbaserad kassa

När du skapar en webbaserad kassa för dina appbetalningar rekommenderar vi att du tar hänsyn till bästa praxis.

Omdirigera kassaflödet från appen till webben på ett sätt som uppfyller gällande bestämmelser

- Länk till en extern webbläsare: Utvecklare som försöker använda en WebView i sin app kommer sannolikt inte att klara av iOS App Store-granskningen. Se istället till att omdirigera till en extern webbläsare för att upprätthålla efterlevnaden.

- Kontrollera ditt distributionsland: Apples uppdaterade riktlinjer gäller för närvarande endast för appar som laddas ner från skyltfönster i USA. Använd StoreKits skylfönsteregenskap för att identifiera från vilket skyltfönster din app laddades ner. Om din app inte finns i skyltfönstret i USA kanske dessa riktlinjer inte gäller.

- Använd en färdig lösning för att säkerställa efterlevnad av regler: Utöver att följa Apples riktlinjer är det viktigt att efterleva tillämpliga myndighets-, bank- och nätverksregler. Dessa inkluderar säkerhetsstandarder som PCI, integritetsregler som EU:s allmänna dataskyddsförordning (GDPR) och California Consumer Privacy Act (CCPA) samt upplysningar som krävs av banker och kreditkortsföretag. Din tredjepartsleverantör av betaltjänster bör kunna ge vägledning om alla dessa.

Skapa en enhetlig användarupplevelse när du omdirigerar mellan appen och webben

- Behåll produktutbudet i appen: Låt kunderna välja sina produkter i appen och dirigera bara om till webben för betalning. På så sätt kan du behålla den välbekanta upplevelsen i appen och undvika att skicka kunder via en traditionell kundvagn, vilket kan skada konverteringen.

- Omdirigera endast till webben vid betalningstidpunkten: Omdirigera endast kunder till webben när det är dags att betala. På så sätt kan du se till att kassaflödet är konsekvent och förenklar eventuella tester som du kan vilja göra på din kassasida, eftersom du bara skulle ändra en del av flödet.

- Bevara autentiseringen vid omdirigeringar: Kunder som loggat in i din app bör förbli inloggade på webben. För en smidig upplevelse bör du implementera en autentiseringstjänst från tredje part – som Logga in med Apple eller Firebase Authentication – som genererar kortlivade token som appen kan skicka via webbadressparametrar. Utan detta skapar det onödig friktion att be kunderna att logga in igen på webben.

- Omdirigera kunder tillbaka till din app automatiskt: Använd universella länkar för att få kunderna tillbaka till din app efter webbkassaprocessen. Universallänkar fungerar bäst i Safari. I Chrome öppnas de i webbläsaren istället för att dirigeras om till appen. Om du vill använda universallänkar i Chrome ska du se till att den första sidan efter omdirigeringen innehåller en knapp som länkar kunderna tillbaka till din app. Inkludera alltid resultatet av betalningen i länken så att appen kan visa rätt skärm. Detta dubbla tillvägagångssätt med universallänkar som stöds och djuplänkning som reserv säkerställer tillförlitlig omdirigering.

- Säkerställ kontinuitet när du omdirigerar till webben: Kunderna kan bli förvånade när din app omdirigerar till en webbläsare istället för att öppna Apple Pay i appen. För att hjälpa dem att förstå att omdirigeringen är avsiktlig, överväg att lägga till en omdirigeringsikon eller ett meddelande i din app och placera appens logotyp, namn och en produktbild på din webbkassasida.

Bygg en kassaprocess med hög konvertering

- Utforma din webbkassa för ett enhetligt utseende: Istället för att designa en responsiv webbsida med generiska webbformulär kan du bygga en webbsida som känns enhetlig med din appupplevelse. Du kan matcha bakgrundsfärgen, teckensnitten och CTA-färgerna i dina appar.

- Led med Apple Pay i den webbaserade kassan: Kunderna är vana vid att betala med Apple Pay i din app, så lyft fram samma betalningsmetod på webben för att öka konverteringen.

- Sparade och populära betalningsmetoder i den webbaserade kassan: En fördel med en webbaserad kassa är möjligheten att erbjuda fler betalningsalternativ. Om en kund inte använder Apple Pay kan visning av sparade betalningsmetoder, till exempel registrerade kort och andra populära alternativ – som Cash App Pay, Link (Stripes e-plånbok) eller köp nu, betala senare – bidra till att förbättra konverteringsgraden.

- Överväg att bygga för liggande orientering på webben: Om din app stöder liggande orientering, hjälp till att upprätthålla en konsekvent kundupplevelse genom att också se till att din webbaserade kassa har stöd för liggande orientering.

- Inkludera kampanjkoder och merförsäljningar på webben: Även om kunderna väljer sina produkter i din app är webbkassan ett utmärkt ställe att erbjuda mervärde. Genom att omdirigera till webben kan du nu låta kunderna ange kampanjkoder eller uppgradera till en högre abonnemansnivå i kassan. Dessa små förbättringar kan öka konverteringen och det genomsnittliga beställningsvärdet.

Testa vilka strategier som fungerar bäst för dina kunder

- Testa med nya kunder först: Börja med att A/B-testa din webbaserade kassa med nya kunder och omdirigera en del av dem till en extern webbsida samtidigt som du övervakar viktiga nyckeltal för företaget. När du är nöjd med resultatet kan du överväga att uppmana befintliga kunder att köpa på webben.

- Välj rätt betalningsstrategi: Med Apples uppdaterade riktlinjer behöver du inte längre erbjuda Apples IAP-system. Utvecklare har sett framgång med olika strategier:

- Erbjud både IAP och webbkassa: Vissa utvecklare erbjuder båda alternativen, ibland med rabatt för att välja webben för att uppmuntra till kostnadseffektiva transaktioner.

- Kassa endast på webben: Andra utvecklare tar bort IAP helt och tar endast emot betalningar via webben för maximala avgiftsbesparingar.

- Erbjud både IAP och webbkassa: Vissa utvecklare erbjuder båda alternativen, ibland med rabatt för att välja webben för att uppmuntra till kostnadseffektiva transaktioner.

- Planera för befintliga abonnemang: Apple tillåter inte export av IAP-betalningsdata, så du kan inte automatiskt migrera aktiva abonnemang till tredjepartsleverantörer som Stripe. Om du vill flytta över kunder kan du överväga att uppmana dem att återuppta abonnemanget via din webbkassa när deras nuvarande abonnemang i appen löper ut, istället för att erbjuda ett förnyelsealternativ i appen.

Hantera din kundresa efter köpet

- Erbjud hantering av abonnemang på webben: Om du säljer abonnemang är det viktigt att ge kunderna ett sätt att hantera dem utanför appen. Ett vanligt mönster är att visa abonnemangsnivån i appen och inkludera en knapp som länkar till en webbaserad portal för hantering av abonnemang. Helst gör webbportalen du bygger det möjligt för kunderna att ändra sin betalningsmetod samt säga upp eller uppgradera sina abonnemang. Detta förbättrar inte bara kundupplevelsen, utan minskar också antalet supportförfrågningar.

- Förbered dig på skatter, tvister och återbetalningar: När du använder Apples IAP-system är Apple ansvarig handlare och hanterar skatter, återbetalningar och tvister. När du övergår till webbaserade betalningar blir ditt företag ansvarig handlare och tar på sig detta ansvar, eller så kan du använda en betalleverantör som också fungerar som ansvarig handlare för ditt företag. Leta efter en betalleverantör som kan hantera följande för din räkning:

- Global efterlevnad av skatteregler: Beräkna, ta ut och betala in rätt skatt i flera jurisdiktioner

- Bedrägerihantering: Implementera system för att upptäcka och förhindra bedrägliga transaktioner

- Tvistlösning: Svara på och hantera kundtvister och återkrediteringar

- Finansiellt ansvar: Att ta på sig juridiskt och ekonomiskt ansvar för varje transaktion

- Kundstöd: Hantera betalningsrelaterade frågor och återbetalningsbegäranden

- Global efterlevnad av skatteregler: Beräkna, ta ut och betala in rätt skatt i flera jurisdiktioner

Om ditt företag redan hanterar webbetalningar kan du ha dessa system på plats. Om inte, överväg en lösning som Stripe Managed Payments, som fungerar som din ansvariga handlare.

Så kan Stripe hjälpa dig att utnyttja den här möjligheten

Att implementera bästa praxis kan vara skrämmande, särskilt om du behöver ersätta den omfattande infrastruktur som Apple tidigare tillhandahöll. Stripe erbjuder en helhetslösning som hjälper dig att snabbt och säkert gå över till webbaserade betalningar:

- Stripe Checkout för app-till-webbetalningar: En färdig, mycket anpassningsbar betalningssida utformad för att ta emot app-till-webbetalningar.

- Stripe Managed Payments: Vår lösning för ansvariga handlare använder Link för att hantera all den komplexitet som är förknippad med att verka som ansvarig handlare. Stripe hanterar krångligheter bakom kulisserna, som global efterlevnad av skatteregler, tvisthantering, bedrägeribekämpning och kundsupport, åt dig – och ger dig den operativa enkelhet som du är van vid.

- Stripe Billing: Hantera och fakturera kunder på önskat sätt. Stripe stöder återkommande, användningsbaserad fakturering och förhandlade avtal för att automatisera dina arbetsflöden för intäktshantering. Stripe stöder också abonnemangshantering online med en särskild kundportal.

Här är mer information om var och en av dessa lösningar:

Stripe Checkout för app-till-webbetalningar

Med Checkout kan du skapa en smidig och pålitlig kassaupplevelse som känns naturlig för din app samtidigt som du får större flexibilitet, kontroll och betalningsmetodtäckning på webben. Stripe Checkout för app-till-webbetalningar är en färdigbyggd, mycket anpassningsbar betalningssida utformad speciellt för mobilappar. Den hjälper dig att implementera bästa praxis direkt och hanterar många av de bästa metoderna som beskrivs i den här guiden.

Den har ett mobilt optimerat användargränssnitt som är skräddarsytt för appanvändare, tillsammans med säker autentisering och omdirigeringshantering för att säkerställa ett smidigt flöde från appen till webben. Stripe Checkout inkluderar också inbyggd support för kampanjkoder och uppgraderingar av abonnemang, vilket möjliggör mer flexibla och konverteringsvänliga köpalternativ.

Med support för över 75 globala betalningsmetoder – inklusive Apple Pay, Link och Cash App Pay – kan du med Checkout tillgodose kundernas preferenser i olika regioner. Återkommande kunder kan dra nytta av sparade betalningsmetoder som påskyndar kassaprocessen och ökar antalet återkommande konverteringar.

Stripe Checkout möjliggör också global integritet, säkerhet och nätverksefterlevnad och hanterar automatiskt status för kundvagnar, autentisering och omdirigeringar. Det stöder modeller för fakturering av både engångsbetalningar och abonnemang, och den levereras med en färdig faktureringsportal som gör att kunderna kan hantera sina abonnemang på webben.

Allt detta backas upp av Stripes kraftfulla motorer för fakturering och skatt, vilket ger dig global efterlevnad av skatteregler och tillförlitlig återkommande fakturering som är klar att använda. När du går till kassan kan du börja ta emot webbetalningar på bara några dagar – utan att behöva bygga allt från grunden.

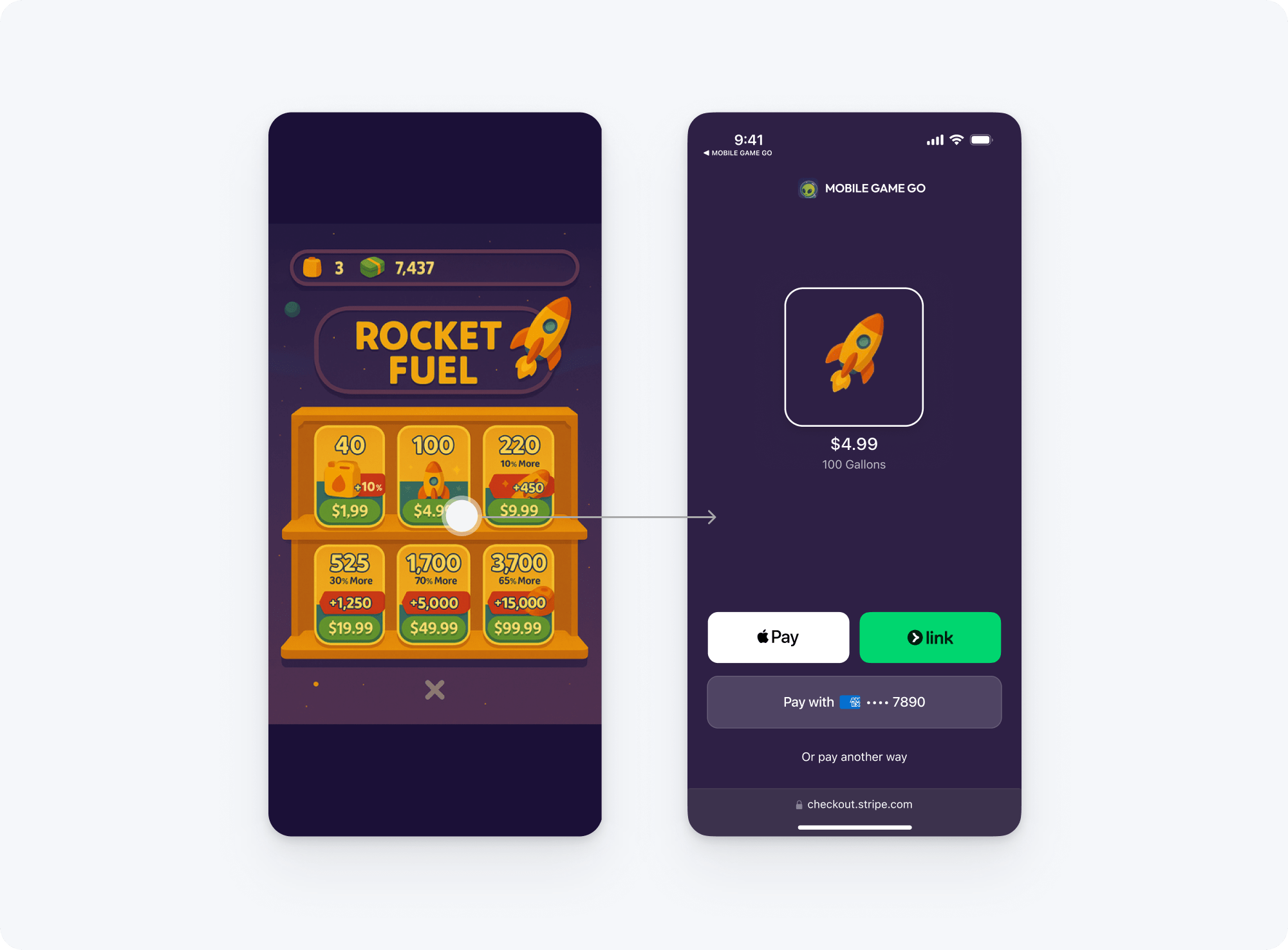

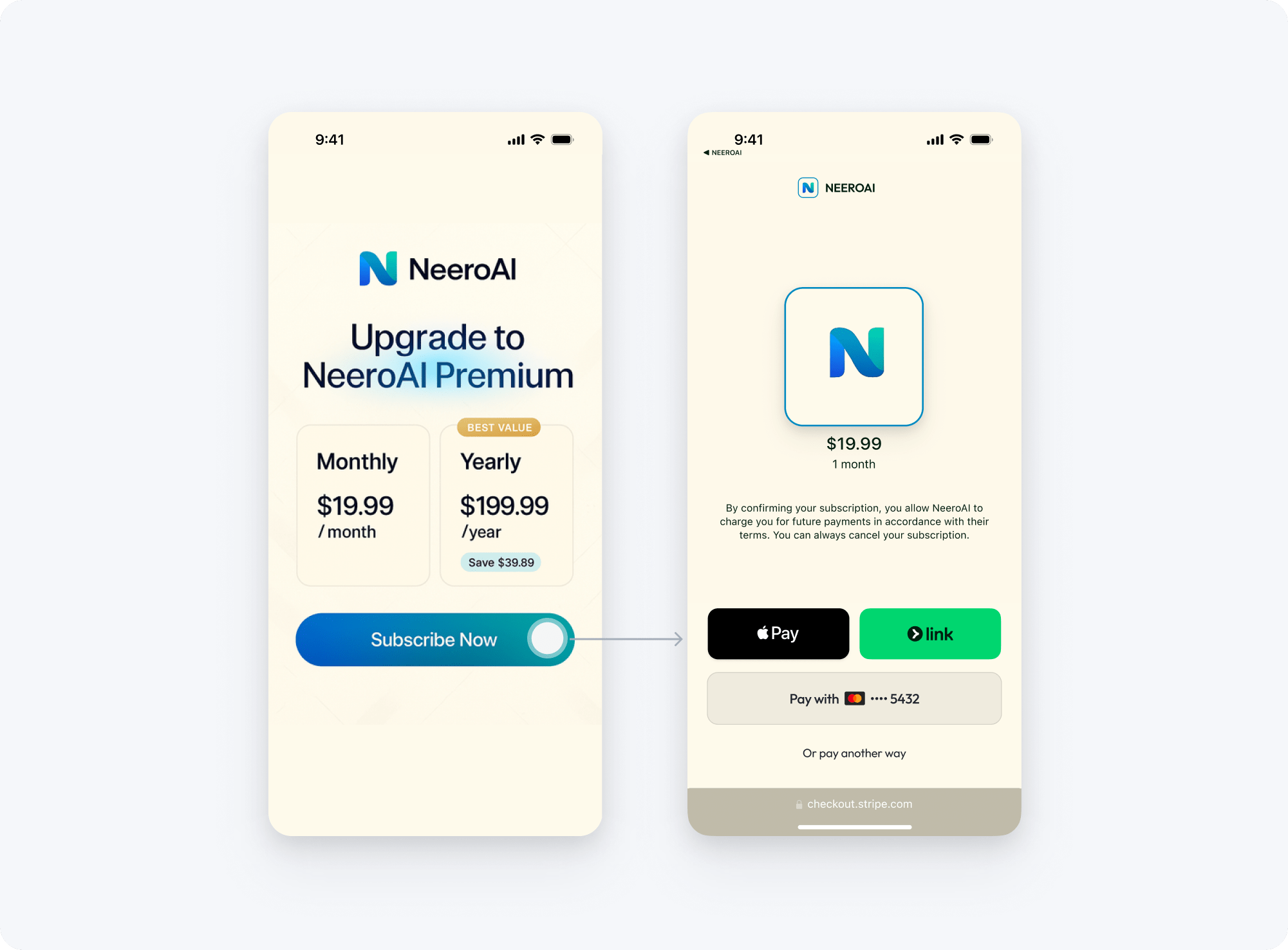

Länk från app för engångsbetalningar

Länk från app för återkommande betalningar eller betalningar för abonnemang

Stripe Managed Payments

Att sälja digitala produkter som SaaS, programvara, innehåll eller nedladdningar via webbetalningar ger mer flexibilitet och kontroll. Men det innebär också nya ansvarsområden som tidigare hanterades av Apple, till exempel efterlevnad av skatteregler och kundsupport.

Stripe Managed Payments är en ansvarig handlarlösning som hanterar dessa komplexa frågor åt dig, så att du kan förenkla din verksamhet samtidigt som du utökar din räckvidd.

En ansvarig handlare är den juridiska enhet som ansvarar för att sälja produkter till kunder. När du använder Managed Payments blir Stripe ansvarig handlare för din räkning och tar på sig det viktigaste ansvaret i samband med digital försäljning. Detta inkluderar:

- Global efterlevnad av skatteregler (moms, GST, omsättningsskatt), inklusive beräkning, debitering och inbetalning

- Bedrägeribekämpning och riskhantering

- Hantering av tvister och återkrediteringar

- Kundstöd och abonnemangshantering

Stripe Managed Payments stödjer dina kunder med en kundportal med Link-varumärket. Om dina kunder använder Link kan de se sin köphistorik, hantera betalningsmetoder och uppdatera eller säga upp abonnemang. Dessutom inkluderar Managed Payments kundsupport på transaktionsnivå via Link. Genom att hantera dessa komplexa uppgifter kan Stripe behålla den operativa enkelhet som tillhandahålls genom köp i appen, samtidigt som du får flexibilitet och kontroll över webbaserade betalningar.

För företag som vill avlasta den operativa bördan med att sälja digitala produkter globalt är Managed Payments den snabbaste vägen framåt. Det gör att du snabbt kan lansera ditt företag utan att bygga komplicerade backend-system, samtidigt som du erbjuder en smidig kassaprocess från app till webb. Med inbyggd efterlevnad av globala skatteregler kan du fokusera på att få ditt företag att växa utan att behöva bli din egen ansvariga handlare.

Stripe Billing

Nu när du kan ta emot betalningar via en extern webbplats har du full kontroll över prissättningen. Med Stripe Billing kan du enkelt anpassa prismodeller som abonnemang, användningsbaserad, användningsbaserad betalning eller engångsdebiteringar för att matcha ditt företags behov.

Om du inte använder Stripe Managed Payments men använder Billing kan dina kunder enkelt hantera sina abonnemang på webben med hjälp av Stripes kundportal. Med den här portalen kan kunderna själva hantera sina betalningar, se fakturor och uppdatera abonnemang – allt på en och samma plats. Om du använder Managed Payments ingår automatiskt en omfattande upplevelse för abonnemangshantering som en del av tjänsten.

Du kan också ge kunderna ett rabatterat introduktionspris så att de kan prova din produkt utan att betala fullt pris, eller ge abonnenter rabatt om de uppgraderar från månadsabonnemang till årsabonnemang. Stripe Billing hjälper dig också att maximera intäkterna och minska kundbortfallet med AI-drivna Smart Retries och automatisering av arbetsflödet för återvinning. Stripes återvinningsverktyg hjälpte användarna att återvinna intäkter på över 3,4 miljarder USD 2023.

Andra fördelar med att använda Stripe

Erbjud en snabb kassaprocess med Link

Med Link, en plånbok byggd av Stripe, kan du upprätthålla en snabb och friktionsfri betalningsupplevelse genom att automatiskt fylla i kundernas betalningsinformation så att de kan gå till kassan på några sekunder. Faktum är att kunder som använder Link går till kassan tre gånger snabbare än kunder som inte använder Link.

Minska behandlingskostnaderna med omedelbara bankbetalningar

Förutom en snabbare kassaprocess kan du även spara in på betalningar med omedelbara bankbetalningar via Link. Med omedelbara bankbetalningar kan dina kunder gå till kassan med Link och betala med sitt amerikanska bankkonto med bara några få klick. Betalningarna bekräftas sedan direkt och avräknas inom två dagar – precis som kortbetalningar – och Stripe garanterar risken för returer som initieras av banken.

Överför medel omedelbart till ditt bankkonto eller bankkort

Tillgång till kontanter är en autentiseringsfråga för alla företag, men det kan vara särskilt svårt för apputvecklare som måste vänta minst 30 dagar för att få tillgång till sina intäkter. Detta bristande kassaflöde kan begränsa din möjlighet att skala upp din app, vilket gör det svårare att investera i nya marknadsföringskampanjer eller funktioner. Stripes Instant Payouts löser denna autentiseringsfråga genom att låta dig överföra medel till ett giltigt bankkort eller bankkonto inom några minuter efter en transaktion. Du kan begära en omedelbar utbetalning när som helst, inklusive på helger och helgdagar, och medlen kommer vanligtvis till det tillhörande bankkontot inom 30 minuter.

Om du vill ha mer information om hur Stripe kan hjälpa dig att skapa en webbaserad kassa kan du läsa vår guide eller kontakta vårt säljteam. Registrera dig för ett konto för att börja ta emot betalningar direkt.