Per garantire che le attività rispettino i loro obblighi in materia di imposta sul valore aggiunto (IVA), l'ufficio delle imposte può condurre un'ispezione IVA. In questo articolo scoprirai cos'è un'ispezione IVA e in quali casi l'ufficio delle imposte può ordinarne una. Spieghiamo inoltre il processo, descriviamo le possibili conseguenze e offriamo suggerimenti su come prepararti al meglio per un'ispezione IVA.

Di cosa tratta questo articolo?

- Che cos'è un'ispezione IVA?

- Quando viene effettuata un'ispezione IVA da parte dell'ufficio delle imposte?

- Come funziona un'ispezione IVA?

- Quali sono le possibili conseguenze di un'ispezione IVA?

- In che modo le attività possono prepararsi per un'ispezione IVA?

Che cos'è un'ispezione IVA?

L'ispezione IVA è uno strumento utilizzato dalle autorità fiscali tedesche per verificare se le attività rispettano i propri obblighi in materia di IVA. Si tratta di un accertamento senza preavviso durante il quale le autorità fiscali autorizzano i funzionari a entrare nelle proprietà e negli edifici delle attività durante l'orario di lavoro e di attività per ispezionare i loro documenti aziendali e i documenti relativi all'IVA. A differenza di un normale accertamento aziendale, un'ispezione IVA non comporta un esame completo di tutte le operazioni, ma piuttosto questioni specifiche relative all'IVA.

L'ispezione dell'IVA è diversa dalla verifica speciale dell'IVA, che le autorità fiscali annunciano in anticipo e conducono senza una giustificazione specifica. Inoltre, un controllo speciale si concentra in genere su singole questioni o periodi specifici. Questo non è necessariamente il caso di un'ispezione: i funzionari del fisco possono esaminare le questioni relative all'IVA per un periodo illimitato. La base giuridica per l'ispezione IVA è l'articolo 27b della legge sull'IVA (UStG).

Quando viene effettuata un'ispezione IVA dall'ufficio delle imposte?

L'ufficio delle imposte conduce un'ispezione IVA se ci sono indicazioni che un'attività non sta adempiendo correttamente ai propri obblighi in materia di IVA. Tuttavia, le autorità fiscali possono condurre preventivamente un'ispezione IVA per rilevare possibili errori o violazioni. Ecco alcuni motivi tipici per farlo:

Verifica dell'esistenza di un'attività

Nel caso di attività di nuova costituzione, l'ufficio delle imposte verifica se esistono effettivamente o se esistono solo "sulla carta", soprattutto se un'attività dichiara regolarmente importi elevati di imposte a monte. L'ispezione verifica se l'impresa si trova al suo indirizzo ufficiale e se ha realmente effettuato i costosi acquisti dichiarati per lo svolgimento dell'attività.

Modifica del settore o dell'oggetto sociale

Se un'attività entra improvvisamente in un nuovo settore o cambia in modo significativo il suo oggetto sociale, ciò può interessare anche le autorità fiscali. Modifiche di questo tipo possono, ad esempio, influire sul tipo di vendita o sulle condizioni per la detrazione dell'imposta precedente. Per garantire che l'attività adempia correttamente ai propri obblighi IVA nonostante le modifiche e che non si verifichino discrepanze, l'ufficio delle imposte può condurre un'ispezione.

Scostamenti significativi delle vendite dalla media del settore

Se le vendite di un'attività si discostano in modo significativo dai valori tipici del rispettivo settore, ciò può far sorgere sospetti di irregolarità o errori nella dichiarazione IVA. Scostamenti significativi potrebbero indicare informazioni errate o una registrazione incompleta delle transazioni commerciali. Per assicurarsi che l'attività abbia calcolato e pagato correttamente l'imposta sulle vendite, l'ufficio delle imposte può condurre un'ispezione per verificare le transazioni sottostanti e i documenti contabili.

Irregolarità nelle dichiarazioni anticipate dell'IVA

L'autorità fiscale spesso conduce un controllo se un'attività non ha presentato tempestivamente le sue dichiarazioni anticipate dell'IVA o non se le ha presentate affatto. Tuttavia, le irregolarità possono includere anche scostamenti significativi negli importi dichiarati delle vendite o dell'imposta a monte rispetto ai periodi precedenti.

Vendite con aliquote fiscali diverse

Le attività che offrono beni o servizi con aliquote fiscali regolari e ridotte sono esposte a un rischio maggiore di errori. L'assegnazione di un'aliquota errata può portare a importi IVA errati. Con un'ispezione, l'ufficio delle imposte può verificare se l'attività ha attribuito le vendite alle rispettive aliquote fiscali e se ha prontamente pagato gli importi delle imposte corrispondenti.

Elevati rimborsi di imposte a monte

Un'ispezione è possibile anche se un'attività dichiara regolarmente degli importi elevati di imposta a monte che sono sproporzionati rispetto alle vendite dichiarate. Tali casi richiedono un esame più dettagliato per garantire che gli importi dell'imposta pagata a monte dichiarati dall'attività siano giustificati e che le autorità fiscali possano convalidarli adeguatamente. Un'ispezione consente all'ufficio delle imposte di controllare le fatture e le ricevute in loco per individuare potenziali usi impropri o errori contabili.

Fatture mancanti o errate

Le attività devono prestare particolare attenzione alla fatturazione. Se le fatture sono mancanti, contengono informazioni errate o sono incomplete, è probabile che si verifichi un'ispezione. Tutte le fatture devono contenere le informazioni obbligatorie elencate nell'articolo 14, paragrafo 4 della legge sull'IVA.

Sospetto di frode sull'IVA

Il sospetto di frode IVA è un motivo serio per un'ispezione IVA da parte dell'ufficio delle imposte. Ciò vale in particolare per l'indicazione di operazioni carosello, in cui un'impresa evade l'IVA con l'inganno sistematico. L'obiettivo di un'ispezione in questo caso è che le autorità fiscali accedano ai documenti dell'attività in loco per trovare possibili modelli di frode.

Rapporti d'affari speciali

Transazioni ripetute con persone vicine agli imprenditori possono far sorgere sospetti di distribuzioni di utili nascoste o altre irregolarità fiscali. Di conseguenza, possono essere un motivo per l'ufficio delle imposte per condurre un'ispezione. Lo stesso vale per le normali transazioni commerciali estere e la collaborazione con i subappaltatori, poiché si applicano norme speciali in materia di IVA.

Avvisi e report di verifiche

L'ufficio delle imposte può ricevere notifiche di verifica da altre autorità fiscali o da terze parti (ad esempio, tribunali o notai). È il caso, ad esempio, se le autorità rilevano anomalie o irregolarità. Le segnalazioni di terze parti possono destare l'attenzione dell'ufficio delle imposte in merito a possibili violazioni, ad esempio se l'ufficio delle imposte sospetta un'evasione dell'IVA. Per dare seguito a tali informazioni e verificare il rispetto degli obblighi in materia di IVA, l'ufficio delle imposte può chiarire i fatti in loco nell'ambito dell'ispezione IVA.

Le attività hanno influenza sulla maggior parte delle potenziali cause di un'ispezione IVA. Un'ispezione senza preavviso da parte dell'ufficio delle imposte diventa meno probabile se l'attività rispetta i principi della corretta contabilità (GoBD) e garantisce che tutte le informazioni e i calcoli siano corretti. I processi automatizzati aiutano a ridurre gli errori. Stripe Tax può essere utile perché calcola automaticamente l'IVA per tutti i prodotti e servizi.

Come funziona un'ispezione IVA?

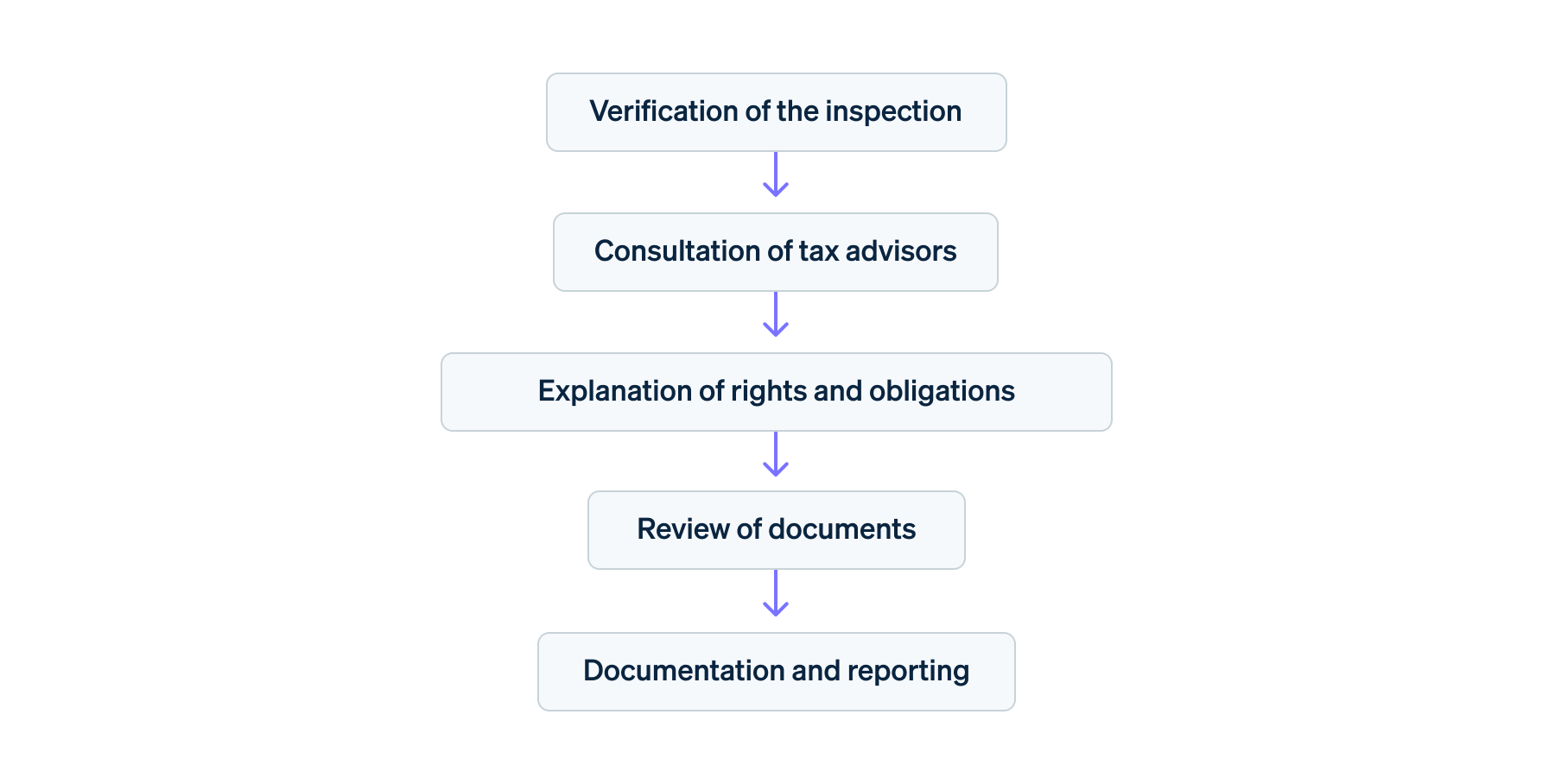

Un'ispezione IVA ha diverse fasi; le attività interessate devono prestare attenzione ad alcuni punti chiave:

- Verifica dell'ispezione: se i funzionari del fisco si presentano presso la tua attività senza preavviso, sono obbligati a presentare un documento identificativo. Per prevenire possibili frodi, è possibile chiamare l'ufficio delle imposte e chiedere se le autorità hanno ordinato l'ispezione.

- Consulenza di commercialisti: nella seconda fase, devi contattare immediatamente il tuo commercialista e chiedergli di partecipare all'ispezione. Importante: i funzionari non sono obbligati ad aspettare l'arrivo dei consulenti fiscali dell'attività per iniziare l'ispezione.

- Spiegazione dei diritti e degli obblighi: prima dell'ispezione, i funzionari del fisco devono informarti sui diritti e sugli obblighi dell'impresa. Ciò include informazioni relative allo scopo e all'ambito dell'ispezione, nonché spiegazioni su quali documenti e informazioni è necessario fornire.

- Revisione dei documenti: ai sensi dell'articolo 27b, paragrafo 2 della legge sull'IVA, l'attività è tenuta a fornire ai funzionari tutti i documenti rilevanti per la verifica ai fini dell'ispezione. Questi includono, tra l'altro, fatture, documenti aziendali, certificati e documenti relativi all'IVA. I funzionari del fisco possono anche controllare i documenti elettronici. Inoltre, i responsabili dell'attività sono tenuti a fornire informazioni complete. I funzionari del fisco hanno anche il diritto di interrogare i dipendenti dell'impresa per ottenere informazioni o chiarire le discrepanze.

- Documentazione e reportistica: i funzionari del fisco registreranno e documenteranno i risultati della revisione in un rapporto finale. I responsabili dell'attività hanno il diritto di prendere visione di questo rapporto.

Procedura di ispezione IVA

Quali sono le possibili conseguenze di un'ispezione IVA?

Le conseguenze di un accertamento IVA possono variare in base ai risultati. Se un'attività fornisce informazioni errate, l'autorità fiscale ordinerà rettifiche alle dichiarazioni IVA per i periodi interessati per correggere gli errori fiscali. Se l'ufficio delle imposte riscontra problemi significativi, può ordinare ulteriori accertamenti o una verifica più completa. Le attività potrebbero anche dover adeguare le procedure contabili e fiscali per evitare errori.

Se i funzionari scoprono irregolarità, l'ufficio delle imposte può richiedere il pagamento di IVA supplementare. Inoltre, l'attività potrebbe dover pagare interessi sui pagamenti aggiuntivi e sanzioni per il ritardato pagamento. Le violazioni gravi o intenzionali delle norme sull'IVA possono comportare multe. In caso di evasione o frode fiscale, possono sorgere indagini e procedimenti penali. Questi possono danneggiare la reputazione dell'attività e minare la fiducia di clienti, investitori e partner commerciali.

In che modo le attività possono prepararsi per un'ispezione IVA?

Poiché un'ispezione IVA avviene senza preavviso, le attività possono prepararsi solo in misura limitata. Tuttavia, per essere preparati in ogni momento, è necessario assicurarsi che i registri contabili siano sempre aggiornati e corretti. È necessario registrare correttamente tutte le transazioni commerciali. È anche consigliabile accertarsi di completare fatture e ricevute, ordinarle correttamente e renderle facilmente accessibili. Stripe Tax offre alle attività un accesso centralizzato a tutti i documenti fiscali pertinenti in qualsiasi momento, semplificando le ispezioni estemporanee.

Oltre a una corretta tenuta della contabilità, è utile formare i dipendenti in preparazione di un'eventuale ispezione IVA. È necessario informare tutte le persone dell'attività incaricate delle procedure amministrative su come i funzionari del fisco conducono un'ispezione. È anche necessario nominare i dipendenti che fungeranno da contatti per i funzionari del fisco durante un'ispezione.

I contenuti di questo articolo hanno uno scopo puramente informativo e formativo e non devono essere intesi come consulenza legale o fiscale. Stripe non garantisce l'accuratezza, la completezza, l'adeguatezza o l'attualità delle informazioni contenute nell'articolo. Per assistenza sulla tua situazione specifica, rivolgiti a un avvocato o a un commercialista competente e abilitato all'esercizio della professione nella tua giurisdizione.