To ensure businesses comply with their value-added tax (VAT) obligations, the tax office can conduct a VAT inspection. In this article, you will learn what a VAT inspection is and in which cases the tax office can order one. We also explain the process, describe possible consequences, and offer tips on how you can best prepare for a VAT inspection.

What’s in this article?

- What is a VAT inspection?

- When does the tax office conduct a VAT inspection?

- How does a VAT inspection work?

- What are the possible consequences of a VAT inspection?

- How can businesses prepare for a VAT inspection?

What is a VAT inspection?

A VAT inspection is a tool used by German tax authorities to check whether businesses are complying with their VAT obligations. It is an unannounced audit during which the tax authorities authorise officials to enter the properties and buildings of businesses during business and working hours to inspect their business documents and documents related to VAT. Unlike a regular business audit, a VAT inspection does not involve a comprehensive review of the full operation but rather specific VAT issues.

The VAT inspection is not the same as the special VAT audit, which the tax authorities announce in advance and conduct without specific justification. In addition, a special audit typically focuses on individual issues or specific periods. This is not necessarily the case for an inspection: tax officials can review VAT matters for an unlimited period. The legal basis for the VAT inspection is Section 27b of the VAT Act (UStG).

When does the tax office conduct a VAT inspection?

The tax office conducts a VAT inspection if there are indications a business is not properly fulfilling its VAT obligations. However, the tax authorities can conduct a VAT inspection pre-emptively to detect possible errors or violations. Here are some typical reasons for doing so:

Verify the existence of a business

In the case of newly founded businesses, the tax office checks whether they actually exist or do so only “on paper” – especially if a business regularly claims high amounts of input tax. The inspection checks whether the business is at the official address and whether it has made its reported costly purchases for business purposes.

Change of industry or business purpose

If a business suddenly enters a new industry or significantly changes its business purpose, this can also interest the tax authorities. Changes such as these can, for example, affect the type of sales or conditions for input tax deduction. To ensure the business properly fulfils its VAT obligations despite the changes and no discrepancies arise, the tax office can conduct an inspection.

Significant sales deviations from the industry average

If a business’s sales deviate significantly from the typical values in the respective industry, this can raise suspicions of irregularities or errors in the VAT return. Significant deviations could indicate incorrect information or incomplete recording of business transactions. To ensure the business has correctly calculated and paid its sales tax, the tax office can conduct an inspection to check the underlying business transactions and accounting documents.

Irregularities in the preliminary VAT returns

The tax authority often conducts an audit if a business has not submitted its preliminary VAT returns promptly or at all. However, irregularities can also include significant deviations in reported sales or input tax amounts compared with previous periods.

Sales with different tax rates

Businesses that offer goods or services at regular and reduced tax rates are at increased risk of errors or incorrect tax applications. Incorrect allocations can lead to incorrect VAT amounts. With an inspection, the tax office can check whether the business has allocated its respective sales to the various tax rates and whether it has promptly paid the corresponding tax amounts.

High input tax refunds

An inspection is also possible if a business regularly claims high amounts of input tax that are disproportionate to the reported sales. Such cases require a more detailed review to ensure the input tax amounts the business claims are justified and the tax authorities can properly substantiate them. An inspection lets the tax office check the invoices and receipts on site to find potential misuse or accounting errors.

Missing or incorrect invoices

Businesses need to pay particular attention to invoicing. If invoices are missing, contain incorrect information, or are incomplete, an inspection is likely. All invoices must contain the mandatory information listed in Section 14, Paragraph 4 of the VAT Act.

Suspicion of VAT fraud

Suspicion of VAT fraud is a serious reason for a VAT inspection by the tax office. This applies in particular to indication of carousel transactions, in which a business evades VAT through systematic deception. The aim of an inspection in this case is for tax authorities to access the business’s documents on site to find possible fraud patterns.

Special business relationships

Repeated transactions with individuals close to the business owners can give rise to suspicions of hidden profit distributions or other tax irregularities. As a result, they can be a reason for the tax office to conduct an inspection. The same applies to regular foreign business transactions and cooperation with subcontractors because special VAT regulations apply.

Audit notices and reports

The tax office can receive audit notifications from other tax authorities or third parties (i.e., courts or notaries). This is the case, for example, if the authorities detect abnormalities or irregularities. Reports from third parties can alert the tax office to possible violations – for example, if the tax office suspects VAT evasion. To follow up on such information and to check compliance with VAT obligations, the tax office can clarify the facts on site as part of the VAT inspection.

Businesses have influence over the majority of the potential causes for a VAT inspection. An unannounced inspection by the tax office becomes less likely if a business observes the principles of proper accounting (GoBD) and ensures all information and calculations are correct. Automated processes help reduce errors. Stripe Tax can help because Tax automatically calculates the VAT for all products and services.

How does a VAT inspection work?

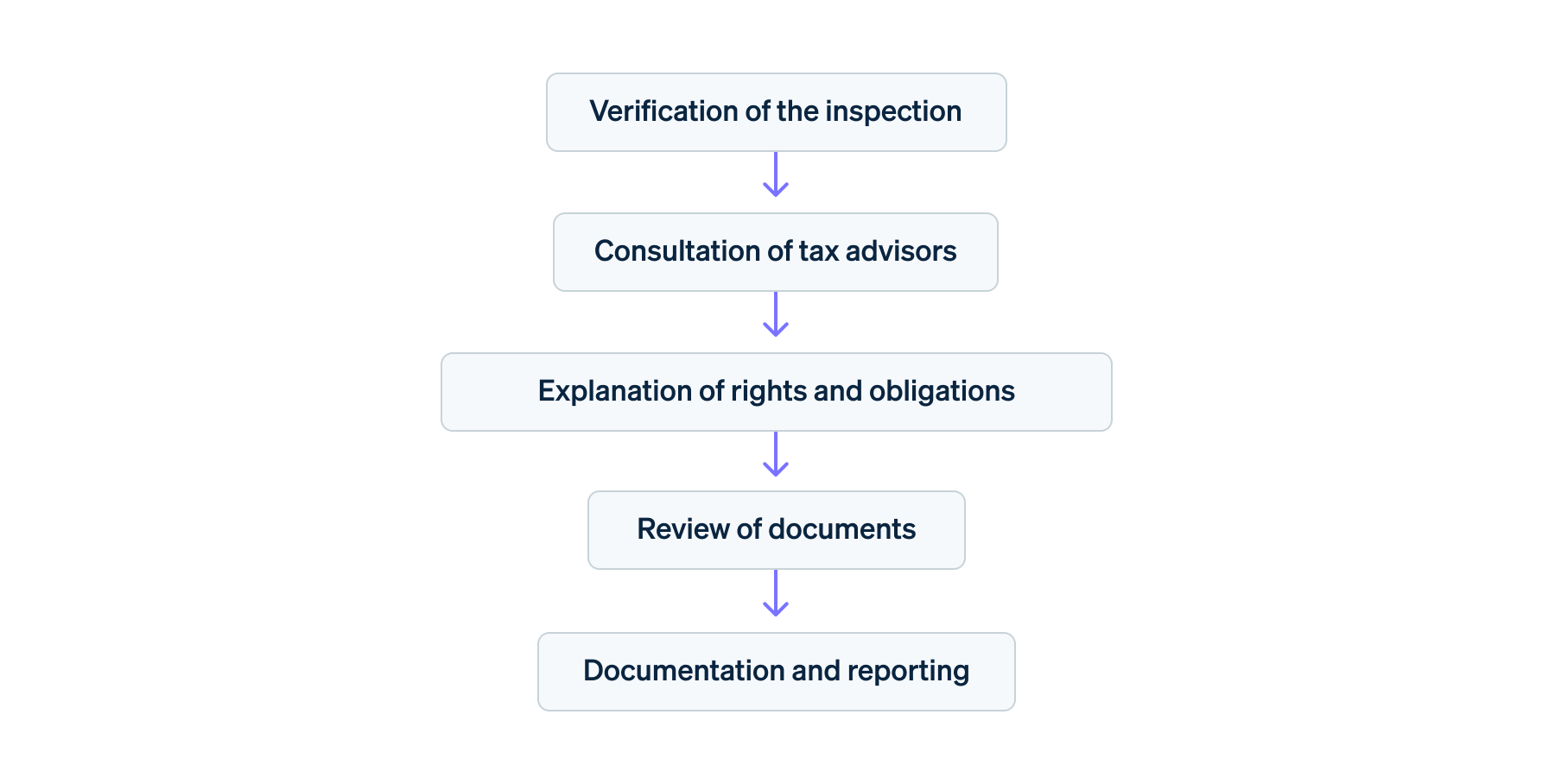

A VAT inspection has several steps; affected businesses need to pay attention to a few key points:

- Verification of the inspection: If tax officials appear at your business unannounced, they are obliged to present their identification. To prevent possible fraud, you can call the tax office and ask whether the authorities have ordered the inspection.

- Consultation of tax advisors: In the second step, you need to contact your tax advisor immediately. Ask them to take part in the inspection. Important: the auditors are not obliged to wait for your tax advisors to arrive to begin the inspection.

- Explanation of rights and obligations: Before the inspection, the tax officials must inform you about your rights and obligations. This includes information regarding the purpose and scope of the inspection as well as explanations of which documents and information you must provide.

- Review of documents: According to Section 27b, Paragraph 2 of the VAT Act, you are obliged to provide the auditors with all documents relevant to the audit for inspection. These include, among others, invoices, business papers, certificates, and records relating to VAT matters. The tax officials can also check electronic documents. In addition, you are obliged to provide comprehensive information. The tax officials are also entitled to question your employees to obtain information or to clarify discrepancies.

- Documentation and reporting: The tax officials will record and document the results of the review in a final report. You have the right to review this report.

VAT inspection process

What are the possible consequences of a VAT inspection?

The consequences of a VAT audit can vary based on the results. If a business provides incorrect information, the tax authority will order adjustments to the VAT returns for the periods concerned to correct the tax errors. If the tax office finds significant problems, it can order additional audits or a more comprehensive audit. Businesses might also need to adjust their accounting and tax processes to avoid errors.

If officials discover irregularities, the tax office can demand additional VAT payments. In addition, the business might have to pay interest on the additional payments and late payment penalties. Serious or intentional violations of VAT regulations can result in fines. In cases of tax evasion or fraud, criminal investigations and proceedings can arise. These can damage the business’s reputation and undermine the trust of customers, investors, and business partners.

How can businesses prepare for a VAT inspection?

Because a VAT inspection is unannounced, businesses can prepare for the audit to only a limited extent. However, to be prepared at all times, you need to ensure your accounting records are up to date and correct at all times. You need to properly record all business transactions. You also need to ensure you complete invoices and receipts, sort them well, and make them easily accessible. Stripe Tax offers businesses centralised access to all relevant tax documents at any time, which makes spontaneous inspections easier.

In addition to proper bookkeeping, train employees in preparation for a possible VAT inspection. You need to inform all people in the business entrusted with administrative procedures about how tax officials conduct an inspection. And you need to name employees who will act as contacts for the finance officials during an inspection.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.