Navigating tax compliance can be challenging for all companies but especially for European businesses. In Europe, the applicable tax rules vary depending on whether you’re located in an EU member country and if you’re selling to a business or individual.

How to register for VAT in Europe

First, you need to determine where you are required to collect value-added tax (VAT). Your next step is to register with the appropriate tax authority. Once registered, you can begin collecting and remitting VAT. Keep in mind that these guidelines pertain to direct sellers. If you sell exclusively on marketplaces, you should consult a tax expert to determine the best path forward, since the rules for marketplace sellers may be different.

This guide will cover when businesses are required to register for VAT in EU countries, the UK, Norway, and Switzerland. Keep in mind that the content of this guide is written for businesses making sales outside their home country. Finally, we’ll share how Stripe can help you manage ongoing tax compliance.

Registering to collect VAT in the EU

When to register

If you perform a transaction that’s taxable in an EU country other than the one where you’re established, you generally must be registered to collect VAT in that country unless the transaction is exempt or subject to reverse charge (which typically applies in business-to-business [B2B] scenarios, such as software-as-a-service [SaaS] offerings). EU business-to-consumer (B2C) sellers may benefit from a simplified registration process called VAT One Stop Shop (VAT OSS) Union scheme, which allows them to report VAT due in other EU countries in their country of establishment.

Similar rules apply to non-EU sellers. They are required to charge VAT beginning with the first taxable transaction performed in the EU unless it is exempt or subject to reverse charge. Non-EU businesses that sell digital services to private individuals in multiple EU countries can register for the VAT One Stop Shop (VAT OSS) non-Union scheme. This scheme does not apply to goods. Non-EU businesses that sell goods located within the EU must register for VAT OSS Union scheme.

Sellers that sell B2C goods (such as retail sales) that are imported from a non-EU country into the EU in consignments valued below €150 can register for VAT Import One Stop Shop (VAT IOSS). All simplified OSS schemes are voluntary.

How to register for a VAT number

While businesses can register in individual countries to collect VAT, it’s more efficient for EU businesses that sell to individuals in multiple EU countries to register for VAT OSS Union scheme. This scheme was created to simplify the process of collecting and paying VAT across countries exclusively within the EU. With the VAT OSS Union scheme, you don’t have to register with each EU country where you sell goods or services remotely; EU businesses must register for VAT OSS in the EU country where they are established.

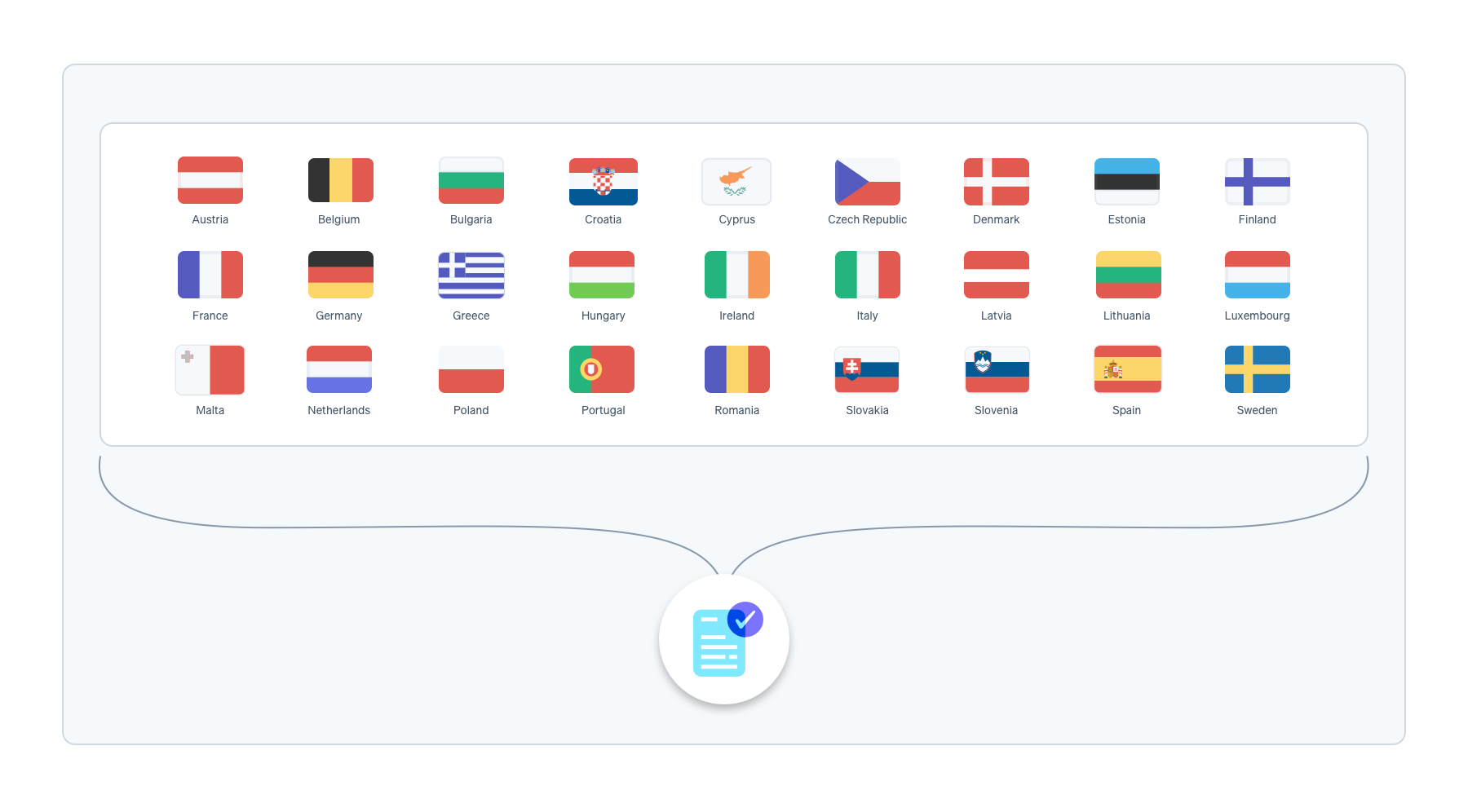

Image displaying EU countries that participate in VAT OSS

There is an exception for EU businesses that are established in one EU country and sell physical goods and digital products to individuals in other EU countries. In these B2C sales, businesses may collect VAT at the rate of their country of residence rather than the customer’s country of residence. Once the B2C sales exceed €10,000, the seller needs to collect at the rate of the customer’s country of residence. If your sales are below the threshold, a domestic VAT registration is sufficient.

For example, if you’re based in Austria and sell digital services to private individuals in Italy, and your total revenue from B2C sales of goods and services to consumers is under €10,000, you will collect Austrian VAT, not Italian VAT. In this scenario, a domestic VAT registration is all that is required. Once your B2C sales exceed €10,000, then you will collect Italian VAT.

Non-EU businesses that sell services to private individuals in multiple EU countries and opt for the VAT OSS non-Union scheme can choose which EU country they want to register in. Non-EU businesses that sell goods located within the EU must register for the VAT OSS Union scheme in the EU country where the transport of the goods begins. If goods are transported from more than one country, the seller can choose the country of registration.

EU sellers must register for IOSS in their country of establishment. Non-EU sellers that are not located in countries with which the EU has concluded an agreement on mutual assistance for the recovery of VAT must appoint an intermediary to use IOSS. If a seller is established outside the EU, but in a country with which the EU has concluded an agreement on mutual assistance for the recovery of VAT and makes sales of imported goods from that country, the seller is free to choose any EU member state as the state of registration. In this case, there is no need to appoint an intermediary to be able to use IOSS. However, if the seller makes sales of imported goods from other countries, an intermediary is required in order to use IOSS.

If you’ve exceeded a tax threshold in the EU and are concerned you owe penalties and back taxes, we recommend you contact a tax expert for guidance. Once you register, you can begin collecting VAT. Do not begin collecting VAT until you have properly registered.

Registering to collect VAT in the UK

When to register

Any business that wants to sell into the UK must register within 30 days of performing the first taxable transaction in the UK. You’re also liable to register if you have reasonable grounds to believe that you’ll have a taxable transaction within the next 30 days.

A taxable transaction is any sale made in the UK that’s neither exempt from VAT nor subject to reverse charge (meaning the customer is responsible for accounting for VAT). Taxable transactions include those that are zero-rated for VAT purposes.

For example, if you’re based in the US and sell digital services to UK customers, you must register in the UK as soon as you have reasonable grounds to believe that a UK consumer will purchase your services. If a UK consumer has actually bought your digital services, you must register within 30 days of performing the sale. However, if you only sell to UK businesses, you don’t need to register, because such sales are subject to reverse charge and don’t constitute taxable transactions for UK VAT purposes.

Businesses that sell B2C goods (such as retail sales) that are imported from abroad into the UK in consignments valued below £135 are responsible for charging UK VAT and should register to collect VAT.

If the low-value sale of imported goods is B2B, the seller does not need to charge VAT as long as the buyer is a UK business and has provided its UK VAT registration number.

How to register for a VAT number

Since Brexit, the UK now has a VAT registration process that’s separate from the EU VAT OSS. Businesses can register to collect VAT in the UK using this online portal. The UK does not provide any simplified registration procedures for non-resident sellers.

If you’ve exceeded a tax threshold in the UK and are concerned you owe penalties and back taxes, we recommend you contact a tax expert for guidance. Once you register, you can begin collecting VAT. Do not begin collecting VAT until you have properly registered.

Registering to collect VAT in Norway

When to register

If you’re based outside Norway and sell to customers based in Norway, you must register as soon as your taxable sales in Norway reach 50,000 NOK during a period of 12 months. This amount does not include sales with reverse charge (which generally applies to B2B sales). In these scenarios, the customer is responsible for accounting for VAT on their VAT returns.

How to register for a VAT number

Businesses located in the European Economic Area (EEA) can register directly with the Norwegian tax authority. Businesses located outside the EEA must appoint a Norwegian VAT representative unless they use the simplified registration procedure (VAT on E-Commerce, or VOEC), which is available for B2C sales of digital services and low-value goods (less than 3,000 NOK). Foreign businesses can register for VOEC using this online portal.

For example, if you’re based in the US, sell digital services to Norwegian consumers, and exceed the threshold during a period of 12 months (from February of the past year to January of the current year), you must register in Norway. However, if you sell digital services only to Norwegian businesses, you don’t need to register, because these services are subject to reverse charge.

If you’ve exceeded a tax threshold in Norway and are concerned you owe penalties and back taxes, we recommend you contact a tax expert for guidance. Once you register, you can begin collecting VAT. Do not begin collecting VAT until you have properly registered.

Registering to collect VAT in Switzerland

When to register

If you’re based outside Switzerland and your global revenue exceeds 100,000 CHF or will exceed this amount in the next 12 months, you must register for VAT in Switzerland within 30 days of performing the first taxable transaction. The obligation to register doesn’t apply if:

- You only sell to Swiss businesses (B2B sales) and the sales are subject to reverse charge in Switzerland

- You only provide tax-exempt services to customers in Switzerland

Switzerland applies special rules to imports of low-value consignments. Low-value consignments refer to goods with a value (including shipping costs) of less than 62 CHF that are subject to the standard rate of 8.1% and to goods with a value of less than 193 CHF that are subject to the reduced rate of 2.6%. If a seller established outside of Switzerland generates revenue in excess of 100,000 CHF from low-value consignments, the place of supply of their sales is shifted to Switzerland, and the seller will have to register for VAT and collect and pay VAT on all sales.

How to register for a VAT number

There is no simplified VAT registration process for non-residents. Non-resident sellers must appoint a tax representative and sometimes provide a bank guarantee. It is possible to register online via this link. When you register online, you must provide information about your tax representative.

If you’ve exceeded a tax threshold in Switzerland and are concerned you owe penalties and back taxes, we recommend you contact a tax expert for guidance. Once you register, you can begin collecting VAT. Do not begin collecting VAT until you have properly registered.

How Stripe Tax can help

Stripe enables marketplaces to build and scale powerful global payments and financial services businesses with less overhead and more opportunities for growth. Stripe Tax reduces the complexity of global tax compliance so you can focus on growing your business. It automatically calculates and collects sales tax, VAT and GST on both physical and digital goods and services in all US states and more than 100 countries. Stripe Tax is natively built into Stripe, so you can get started faster – no third-party integration or plug-ins are required.

Stripe Tax can help you:

Understand where to register and collect taxes: See where you need to collect taxes based on your Stripe transactions and, after you register, switch on tax collection in a new state or country in seconds. You can start collecting taxes by adding one line of code to your existing Stripe integration or add tax collection to Stripe no-code products, such as Invoicing, with the click of a button.

Register to pay tax: If your business is in the US, let Stripe manage your tax registrations and benefit from a simplified process that prefills application details – saving you time and simplifying compliance with local regulations. If you're located outside the US, Stripe partners with Taxually to help you register with local tax authorities.

Automatically collect sales tax: Stripe Tax calculates and collects the amount of tax owed, no matter what or where you sell. It supports hundreds of products and services, and is up-to-date on tax rule and rate changes.

Simplify filing and remittance: With our trusted global partners, users benefit from a seamless experience that connects to your Stripe transaction data – letting our partners manage your filings so you can focus on growing your business.

Learn more about Stripe Tax.