驾驭税务合规对所有公司来说都具有挑战性,但对于欧洲企业尤其如此。在欧洲,适用的税务规则根据您所在是否是欧盟成员国以及您是向企业还是个人销售而有所不同。

如何在欧洲注册增值税

首先,您需要确定在哪里需要征收增值税 (VAT)。接下来的步骤是向相关税务机关注册。注册后,您就可以开始收取和汇缴增值税了。请记住,这些指南适用于直接销售商。如果您仅在交易市场上销售,您应咨询税务专家以确定最佳的前进路径,因为交易市场销售商的规则可能不同。

本指南将涵盖何时企业需要在欧盟国家、英国、挪威和瑞士注册增值税。请记住,本指南的内容是针对在国外进行销售的企业编写的。最后,我们将介绍 Stripe 如何帮助您管理持续的税务合规。

注册收取增值税

何时注册

如果您在非设立国的欧盟国家/地区进行应税交易,通常必须在该国注册征收增值税,除非交易免税或适用反向征税(通常适用于 [B2B] 交易,例如 [SaaS] 服务)。欧盟 B2C 卖家可能会受益于一个简化的注册流程,即增值税一站式申报服务 (VAT OSS) 联盟计划,该计划允许他们在其设立国报告在其他欧盟国家应缴纳的增值税。

类似的规则适用于非欧盟卖家。他们被要求从在欧盟内进行的第一笔应税交易开始征收增值税,除非该交易是免税的或适用反向征税。在多个欧盟国家/地区向个人消费者出售数字服务的非欧盟企业可以注册增值税一站式申报服务 (VAT OSS) 非联盟计划。此计划不适用于商品。非欧盟企业在欧盟内部销售商品必须注册 VAT OSS 联盟计划。

销售从非欧盟国家进口到欧盟,并且单次货物价值低于 150 欧元的 B2C 商品(例如零售销售)的卖家可以注册增值税进口一站式服务 (VAT IOSS)。所有简化 OSS 计划都是自愿的。

如何注册增值税税号

虽然企业可以在各个国家注册以征收增值税,但对于向多个欧盟国家的个人销售商品的欧盟企业来说,注册 VAT OSS 计划更有效率。该计划旨在简化欧盟范围内所有国家征收和缴纳增值税的流程。使用 VAT OSS 欧盟方案,您不必在每个销售商品或服务的欧盟国家注册;欧盟企业必须在其成立所在的欧盟国家注册 VAT OSS。

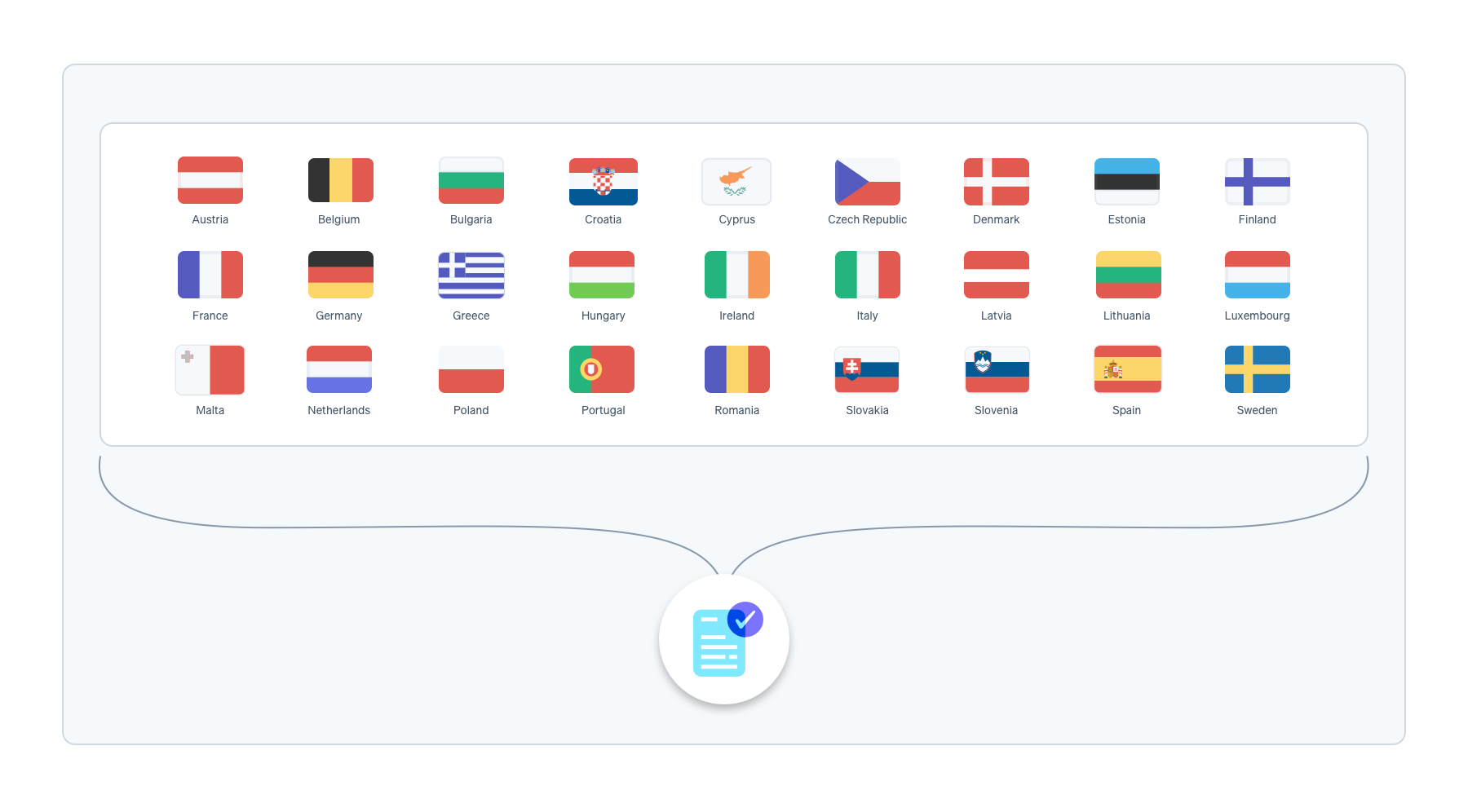

图片显示参加增值税 OSS 的欧盟国家

在一个欧盟国家设立的欧盟企业向其他欧盟国家的个人销售实物商品和数字产品的情况除外。在这些 B2C 销售中,企业可按其居住国而非客户居住国的税率征收增值税。一旦 B2C 销售额超过 10,000 欧元,卖方就需要按照客户居住国的税率征收增值税。如果您的销售额低于门槛,在国内注册增值税即可。

例如,如果您的总部设在奥地利,但向意大利的个人销售数字服务,而且您向消费者销售商品和服务的 B2C 总收入低于 10,000 欧元,那么您将征收奥地利增值税,而不是意大利增值税。在这种情况下,只需进行国内增值税注册即可。一旦您的 B2C 销售额超过 10,000 欧元,您将征收意大利增值税。

在多个欧盟国家向个人销售服务并选择增值税 OSS 非联盟计划的非欧盟企业可以选择在哪个欧盟国家注册。在欧盟境内销售货物的非欧盟企业必须在货物运输开始的欧盟国家注册增值税 OSS 联盟计划。如果货物从一个以上的国家运输,卖方可以选择注册国。

欧盟卖家必须在其所在国注册 IOSS。非欧盟卖家如果不在与欧盟签订了增值税追缴互助协议的国家,则必须指定一个中间人来使用 IOSS。如果卖方位于欧盟以外但与欧盟签订了增值税追缴互助协议的国家,并从该国销售进口货物,则卖方可自由选择任何欧盟成员国作为注册国。在这种情况下,无需指定中间商即可使用 IOSS。但是,如果卖方销售来自其他国家的进口商品,则需要中间商才能使用 IOSS。

如果您在欧盟超过了纳税额起征点,并且担心欠缴罚金和需要补税,我们建议您联系税务专家寻求指导。一旦注册,您就可以开始征收增值税。在正确注册之前,请勿开始征收增值税。

注册收取英国增值税

何时注册

任何希望向英国销售的企业必须在进行第一次应税交易后的 30 天内注册。如果您有合理理由相信在未来 30 天内会进行应税交易,您也有责任进行登记。

应税交易是在英国进行的任何销售,该销售不免征增值税,也不适用于反向征税(意味着客户有责任计算增值税)。应税交易包括出于增值税目的为零税率的交易。

例如,如果您在美国并向英国客户销售数字服务,您必须在有合理理由相信英国消费者会购买您的服务时,立即在英国注册。如果英国消费者实际购买了您的数字服务,您必须在销售完成后的 30 天内注册。然而,如果您仅向英国企业销售,您不需要注册,因为此类销售适用于反向征税,并且不构成英国增值税目的的应税交易。

销售 B2C 商品(如零售商品)的企业,如果这些商品是以低于 135 英镑的货物从国外进口到英国的,那么他们有责任征收英国增值税并且应该注册以收取增值税。

如果低价值进口商品的销售是 B2B 类型,那么只要买家是英国企业并提供了其英国增值税注册号,卖家就不需要征收增值税。

如何注册增值税税号

脱欧后,英国现在有一个与欧盟 VAT OSS 分开的增值税注册流程。企业可以使用此在线门户网站在英国注册收取增值税。英国不为非居民卖家提供任何简化的注册流程。

如果您在英国超过了税收门槛,并且担心您欠下罚款和追缴税款,我们建议您联系税务专家以获取指导。一旦您注册成功,您就可以开始收取增值税。在您正式注册之前,不要开始收取增值税。

在挪威注册征收增值税

何时注册

如果您的总部不在挪威,但您的销售对象是挪威的客户,那么一旦您在挪威的应税销售额在 12 个月内达到 50,000 挪威克朗,您就必须立即注册。这一数额不包括对方缴税销售额(一般适用于企业对企业 (B2B) 销售)。在这种情况下,客户有责任在其增值税申报表中核算增值税。

如何注册增值税税号

位于欧洲经济区 (EEA) 的企业可直接向挪威税务机关注册。位于 EEA 以外的企业必须指定一名挪威增值税代表,除非他们使用简化注册程序(电子商务增值税,简称 VOEC),该程序适用于数字服务和低价值商品(低于 3,000 挪威克朗)的 B2C 销售。外国企业可使用此在线门户网站 注册 VOEC。

例如,如果您的总部设在美国,向挪威消费者销售数字服务,并且在 12 个月内(从去年 2 月到今年 1 月)超过了门槛,您就必须在挪威注册。但是,如果您只向挪威企业销售数字服务,则无需注册,因为这些服务属于对方缴税。

如果您在挪威超过了纳税额起征点,并担心自己欠缴罚金和需要补税,我们建议您联系税务专家寻求指导。一旦注册,您就可以开始征收增值税。在正式注册之前,请勿开始征收增值税。

注册收取瑞士增值税

何时注册

如果您不在瑞士境内并且您的全球收入超过 100,000 瑞士法郎或将在未来 12 个月内超过此金额,则必须在进行首次应税交易后的 30 天内在瑞士注册增值税。如果出现以下情况,则无需注册:

- 您仅向瑞士企业进行销售(B2B 销售),并且该销售在瑞士适用反向征税。

- 您仅向瑞士的客户提供免税服务

瑞士对低价值货物的进口适用特殊规则。低价值货物是指价值(包括运费)低于 62 瑞士法郎且适用标准税率 8.1% 的货物,以及价值低于 193 瑞士法郎且适用降低税率 2.6% 的货物。如果一家卖方在瑞士境外,其低价交货的收入超过 100,000 瑞士法郎,那么其销售的供应地将转移至瑞士,卖方必须注册增值税并对所有销售征收和支付增值税。

如何注册增值税税号

对于非居民来说,没有简化的增值税注册流程。非本地卖家必须指定一位税务代表,有时需要提供银行担保。可以通过此链接在线注册。当您在线注册时,您必须提供有关您的税务代表的信息。

如果您在瑞士超过了税收门槛,并担心欠下罚款和补税,建议您联系税务专家寻求指导。一旦您注册成功,您就可以开始收取增值税。在您正式注册之前,不要开始收取增值税。

Stripe Tax 如何提供帮助

Stripe 助力交易市场建立和扩展强大的全球支付和金融服务业务,减少开销,创造增长机会。Stripe Tax 降低了全球税务合规的复杂性,让您可以集中精力发展业务。它可以自动计算并征收美国所有州及 100 多个国家/地区的实物和数字商品和服务的销售税、增值税和商品及服务税。Stripe Tax 是内置在 Stripe 中的,因此您可以更快上手——不需要第三方集成或插件。

Stripe Tax 可帮助您:

明确需进行税务登记并代征税款的地区:根据 Stripe 交易数据智能识别征税地区,完成注册后数秒即可在新州或新国开启代征税费。您只需在现有 Stripe 集成中添加一行代码,或通过点击按钮为 Stripe 无代码产品(如 Invoicing)启用税费代收功能。

注册缴纳税款:如果您的企业位于美国,可以让 Stripe 代为管理税务注册事宜,享受预填申请详情的简化流程——为您节省时间,简化当地法规合规流程。如果您位于美国境外,Stripe 将与 Taxually 合作,帮助您在当地税务机关完成登记。

自动收取销售税:Stripe Tax 能精准计算并代征应纳税额,全面覆盖各类销售商品与服务的地域范围。该系统支持数百种产品与服务,且持续同步全球税制与税率的最新变动。

简化申报和上缴流程:通过与我们可信赖的全球合作伙伴的合作,用户可以体验到与您的 Stripe 交易数据无缝链接,我们的合作伙伴会帮助您管理申报事宜,让您能够专注于发展业务。

了解有关 Stripe Tax 的更多信息。