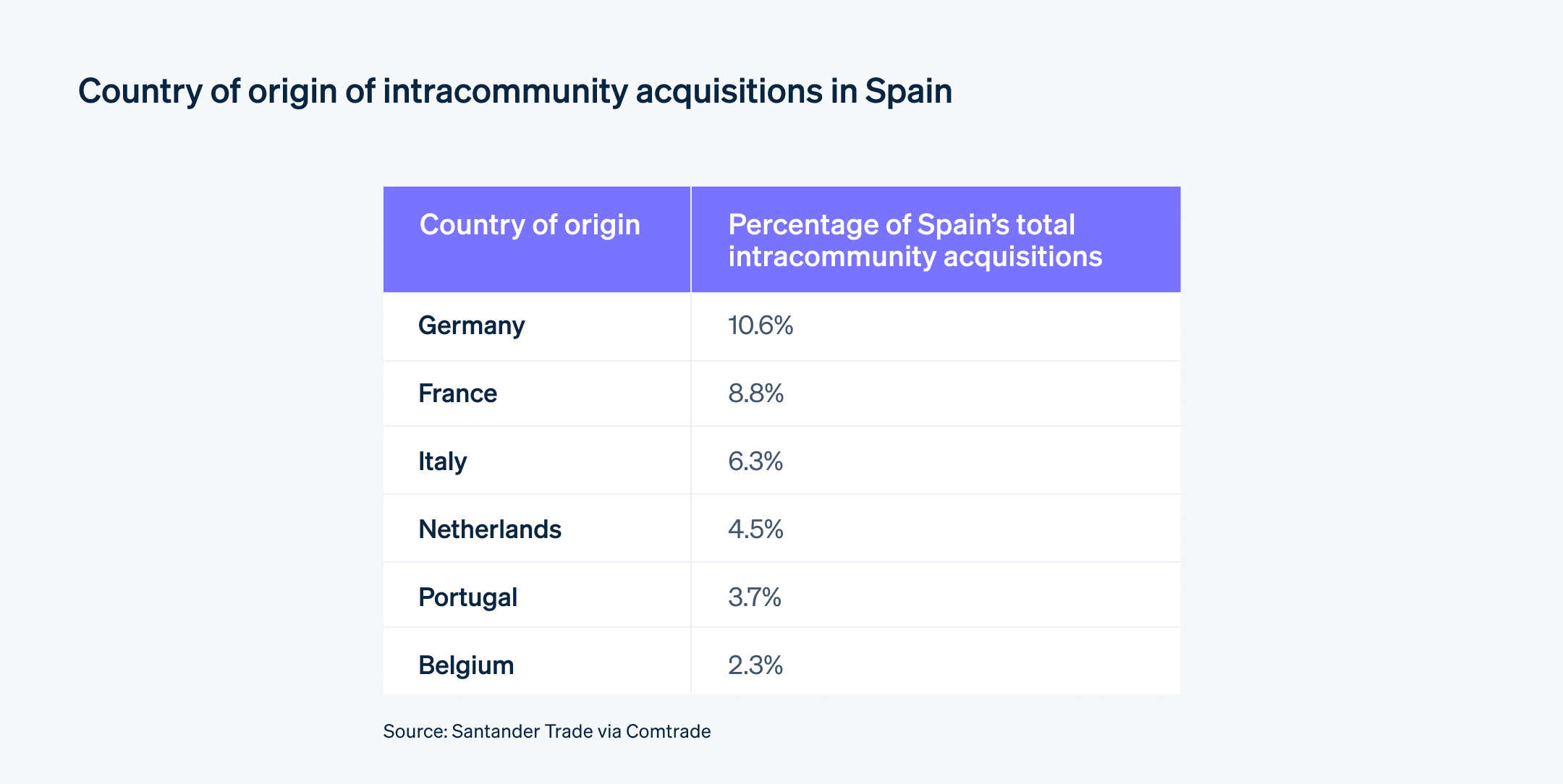

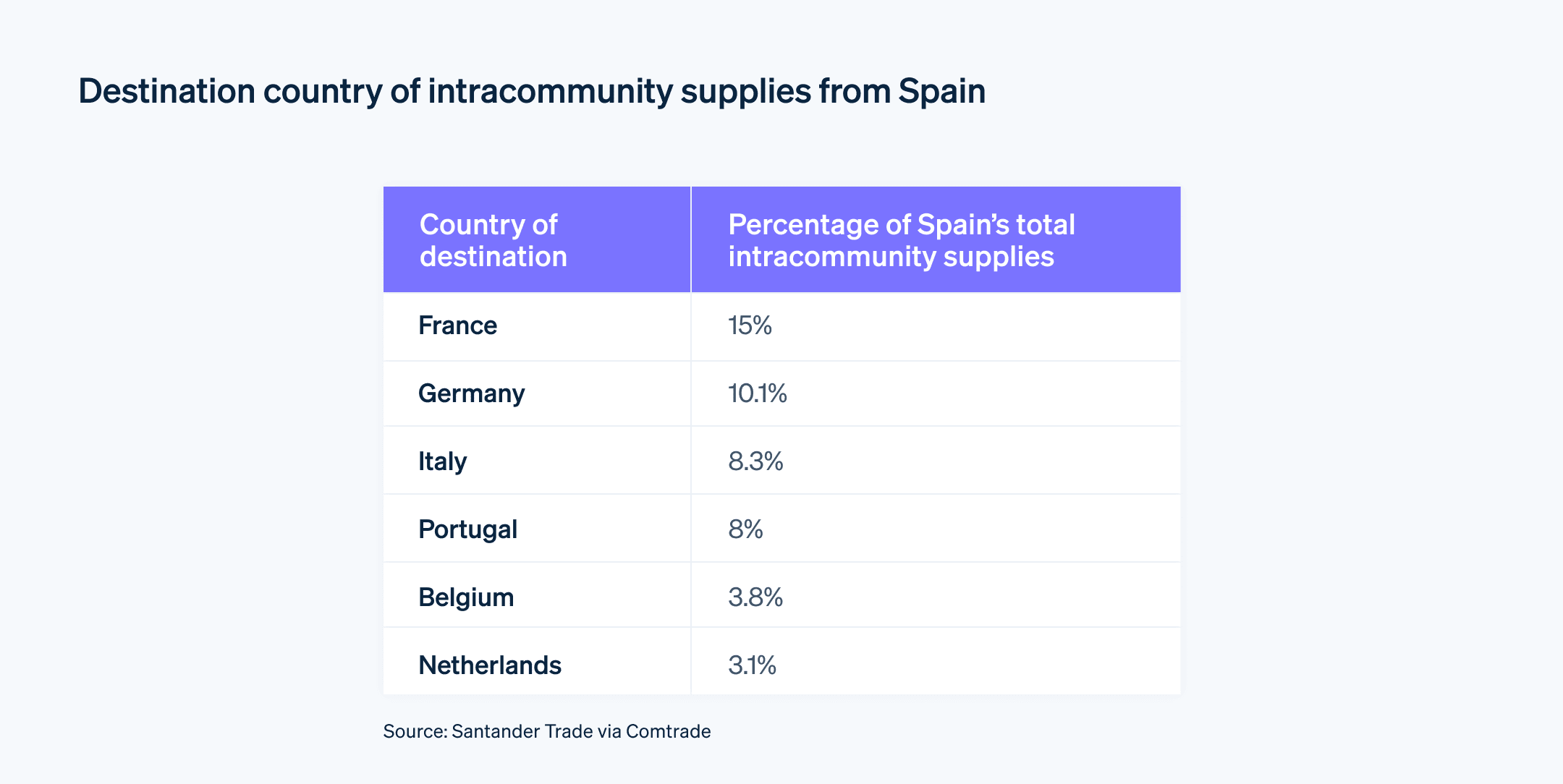

Over the past two years, cross-border transactions within the EU have resumed steady growth after a year and a half of decline. For instance, in the second quarter of 2024, imports and exports – referred to as intracommunity acquisitions and supplies among EU member countries – rose by 3.4% and 0.7%, respectively.

Spain is among the EU countries with the highest volume of intracommunity transactions and currently ranks seventh among all member countries. To help you expand your business internationally to other European countries, this article examines the workings and obligations of intracommunity transactions in Spain.

What’s in this article?

- What are intracommunity transactions?

- Types of intracommunity transactions

- Requirements for intracommunity transactions

- Invoicing intracommunity transactions

- How is VAT handled on intracommunity transactions?

- Frequently asked questions about intracommunity transactions

What are intracommunity transactions?

Intracommunity transactions refer to the purchase and sale of goods or services conducted between two companies or professionals located in different EU member countries. Since these transactions occur within the EU, they are commonly referred to as “intracommunity acquisitions and supplies” rather than “imports and exports.”

Types of intracommunity transactions

There are two types of intracommunity transactions: acquisitions and supplies, which correspond to what are commonly known as imports and exports.

Intracommunity acquisitions

Purchases made by a company or self-employed person in Spain from another EU country, regardless of who handles the transport, are considered intracommunity acquisitions. Here are some other specific cases that are also considered intracommunity acquisitions:

The purchase of new vehicles in Spain – defined as those less than six months old from their first registration or with a mileage of up to 6,000 km – from another EU country, regardless of whether the transaction is between private individuals, professionals, or a private individual and a professional.

Receipt of goods brought into Spain by a company from another EU country, such as the transfer of stock between two offices in different countries.

The purchase of goods from another EU country in Spain, when the seller is a professional and the buyer is a non-business legal entity (such as a nonprofit association, public body, or community estate), provided the transaction exceeds €10,000.

Please note that some transactions are not considered intracommunity acquisitions:

Purchases of products from another member state that are installed or assembled in mainland Spain or the Balearic Islands before the purchaser acquires full ownership.

Purchases of products in Spain from a professional in another EU country operating under their country’s franchise regime.

Distance sales where the purchaser is a physical, legal, or natural person who does not carry out a professional activity. Distance sales are also considered when the buyer is a business engaged exclusively in VAT-exempt activities or operating under the special regime for agriculture, livestock, farming, and fishing.

Purchases of products covered by the special regime for second-hand goods, works of art, antiques, and collector’s items. For these, the sale is taxed in the country of origin.

Intracommunity supplies

Sales of services or goods by a company or self-employed person in Spain to a customer in another EU country – regardless of who manages the transport – are classified as intracommunity supplies. Here are some other specific cases that are also considered as intracommunity supplies:

Sales of new vehicles from Spain to another EU country, regardless of whether the buyer and seller are private individuals or professionals.

Shipments of goods from a company’s head office in Spain to its premises in another EU country.

To grow your business and sell products and services in other EU countries, it is important to use a payment platform designed for international commerce. With Stripe Payments, you can accept online payments using your customers’ preferred payment methods in 195 countries, including all EU member states, and consolidate all of your revenue in one platform. This makes accounting much easier and reduces the risk of manual errors.

Requirements for intra-community transactions

The sole requirement for conducting intra-community supplies and acquisitions in Spain is registration in the Register of Intra-community Operators (ROI). To register, you must file Form 036, paying particular attention to the “Reasons for Filing” section, where you must indicate your request to register in the ROI.

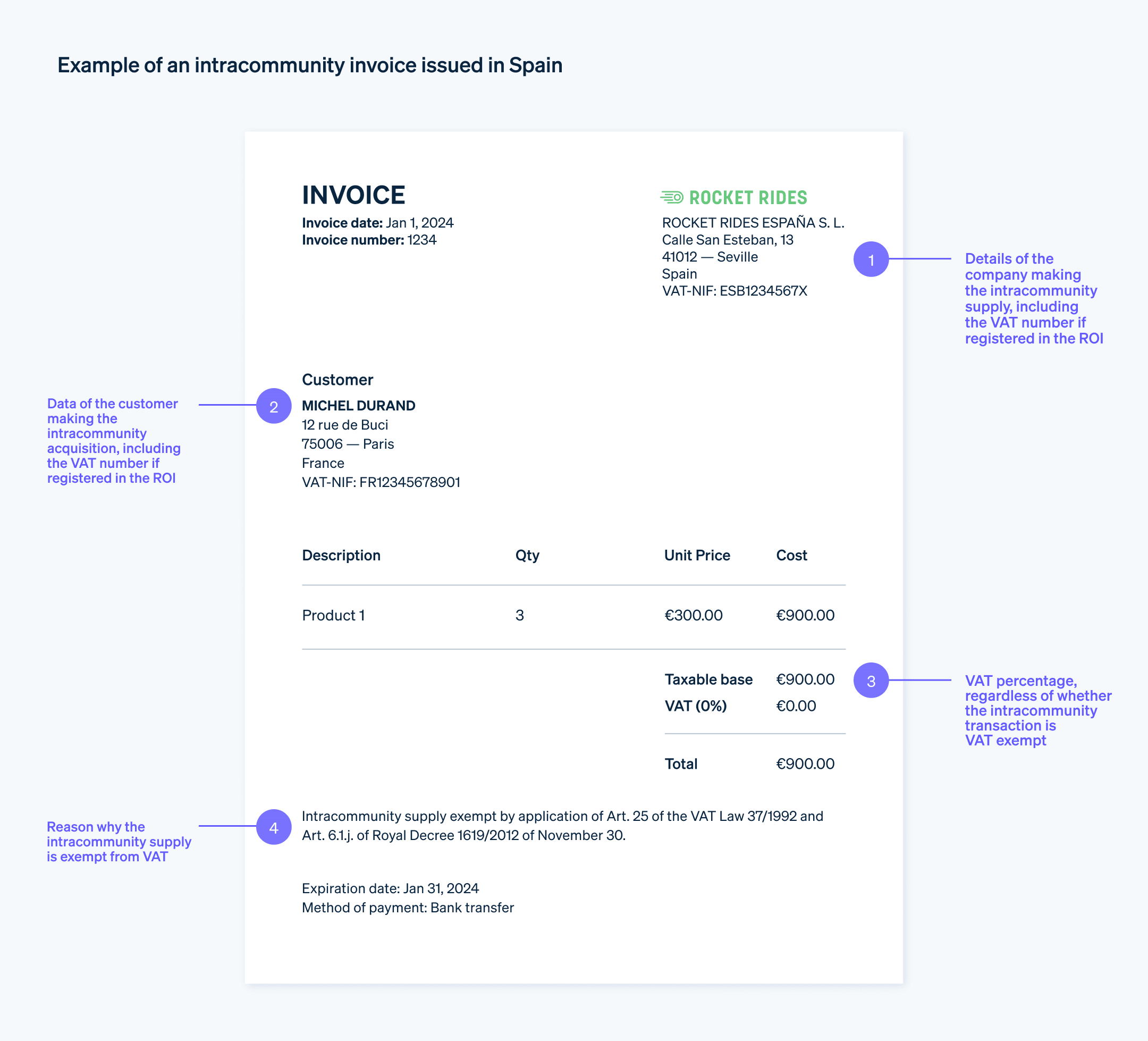

Once your application is approved – no later than three months after filing Form 036 – the Spanish Tax Agency (Agencia Tributaria, or AEAT) will issue you an intra-community VAT number (also known as a “European VAT number”, “VAT identification number [NIF-IVA]”, or “EU VAT number”). To qualify for the corresponding VAT exemption, both the buyer and the seller must have valid intra-community VAT numbers, and both numbers must be included on the invoice.

Once the intra-community VAT number is obtained, the business or professional will automatically be included in the VAT Information Exchange System (VIES). This will allow both you and the other party in the transaction to verify the validity of the intra-community VAT numbers through the AEAT or European Commission websites. It’s important to validate your customers’ intra-community VAT numbers before issuing an invoice without VAT. If the number provided is invalid, the AEAT will demand the VAT for that transaction, as it will not be considered an intra-community operation and, therefore, is subject to tax.

Note that if you do not carry out any intra-community transactions within a year, the AEAT will automatically cancel your registration in the ROI. In such cases, you will receive a notification before the cancellation takes effect, allowing you to submit Form 036 to request re-registration in the ROI. The AEAT usually reacts quickly in such cases.

When intra-community acquisitions and supplies involve physical goods, they must also be accompanied by proof of transport. The most commonly used document is the “CMR consignment note” (referred to as “CMR” after the French acronym for the Convention on the Contract for the International Carriage of Goods by Road). It must contain details of the goods being transported, their quantities, the dates and countries of collection and delivery, and the details of the seller, buyer, and carrier.

Invoicing intracommunity transactions

Invoices for intracommunity transactions between professionals registered in the ROI do not include VAT. However, they must explicitly state that a 0% rate has been applied or that the transaction is exempt from VAT.

In addition to the standard information required on any invoice, intracommunity transactions require a more comprehensive set of mandatory details. Here is a sample invoice:

How is VAT handled on intracommunity transactions?

VAT is managed differently depending on the type of intracommunity transaction: acquisitions or supplies.

For example, intracommunity acquisitions are the only intracommunity transactions that are taxed in Spain. In these cases, the tax system requires the company to both assume (i.e., declare the deduction of the tax) and self-assess (i.e., declare the obligation to pay) the VAT for the transaction.

Although in most cases the tax return will be neutral (i.e., input and output VAT amounts will cancel each other out, resulting in no payment), there are exceptions where a payment can be required. For example, if a self-employed person in Spain buys a car from a company in another EU country, they would declare 100% of the VAT on the transaction but could only deduct 50% of it due to the third exception in Article 95 of the VAT Law. This article assumes 50% of the cars, trailers, mopeds, and motorcycles are used for business purposes. As a result, the individual would have to pay the remaining 50% of the VAT to the AEAT.

Intracommunity supplies, however, are taxed in the country of destination. If a customer from another member state who is not registered in the ROI buys products from a Spanish company, they will have to pay Spanish VAT. However, if it is a distance sale, the special rules for such transactions apply. These rules require the payment of VAT in the country of destination if the company has exceeded €10,000 in intracommunity sales during the current or previous year.

Although output VAT is not charged on intracommunity supplies between professionals (as these are VAT-exempt transactions), it is still possible to deduct input VAT on related transactions. For instance, if a Spanish company purchases materials in Spain to manufacture products for sale in Europe, it can deduct the VAT on those purchases, even if its sales to business customers in other member countries are VAT-exempt. This process is known as full exemption. These transactions must be reported by filling out Form 349 monthly or quarterly.

It is important to note that the VAT management of intracommunity transactions – both in Spain and across the EU – has been updated with the implementation of new European regulations, such as Directive 2006/112/CE. To ensure the correct VAT rate is always applied to your sales, Stripe Tax enables you to automatically calculate and collect tax on all your Stripe transactions. In addition, Tax is regularly updated to reflect legislative changes in the EU and in the more than 50 countries where it is available (exceptions can be found here).

Frequently asked questions about intracommunity transactions

When do intracommunity invoices carry Spanish VAT?

Intracommunity invoices carry Spanish VAT when one of the parties does not have a European VAT number and the goods are delivered in the taxable area for indirect tax (i.e., mainland Spain and the Balearic Islands).

Are intracommunity acquisitions subject to VAT?

It depends. If they are conducted between two companies from different EU member countries registered in the ROI, they are exempt from VAT and do not include it. However, if one of the parties is an individual or a company not registered in the ROI, intracommunity acquisitions are subject to VAT in the country of destination.

When does an intracommunity invoice without VAT have to be issued?

An intracommunity invoice without VAT should be issued when a supplier who is registered in the ROI sells a product or service to a company in another EU country that also has its own intracommunity VAT number.

In what language should a company in Spain issue invoices?

If you issue invoices from Spain, you can choose your preferred language in the text. Royal Decree 1496/2003 states that “invoices or substitute documents may be issued in any language,” but it also allows the AEAT to require a translation into Spanish (or another official language of Spain) if necessary for verification purposes.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.