Text to Pay is a payment method in which a business sends a bill through a text message, and the customer pays with their mobile device. This technique simplifies the payment process by allowing customers to make payments through their phone without needing to log in to a separate payment system. Its convenience and speed make it a popular method for businesses and consumers: a 2023 study from SimpleTexting found that 71% of US consumers are signed up to receive texts from businesses, indicating a potentially high level of acceptance for Text to Pay services among customers. This method often uses a secure link within the text message that directs the customer to a payment interface where they can enter payment details, such as credit card information, to complete the transaction. The system benefits both businesses and customers by reducing the time spent on billing and payments.

Below, we'll cover how Text to Pay works, including which businesses can benefit the most from it, and the details of creating a Text to Pay strategy for your business. Here's what you should know.

What's in this article?

- How does Text to Pay work?

- What types of businesses use Text to Pay?

- Pros and cons of accepting Text to Pay for businesses

- How to create a Text to Pay strategy that fits your business needs

- What does Text to Pay cost to implement and use?

How does Text to Pay work?

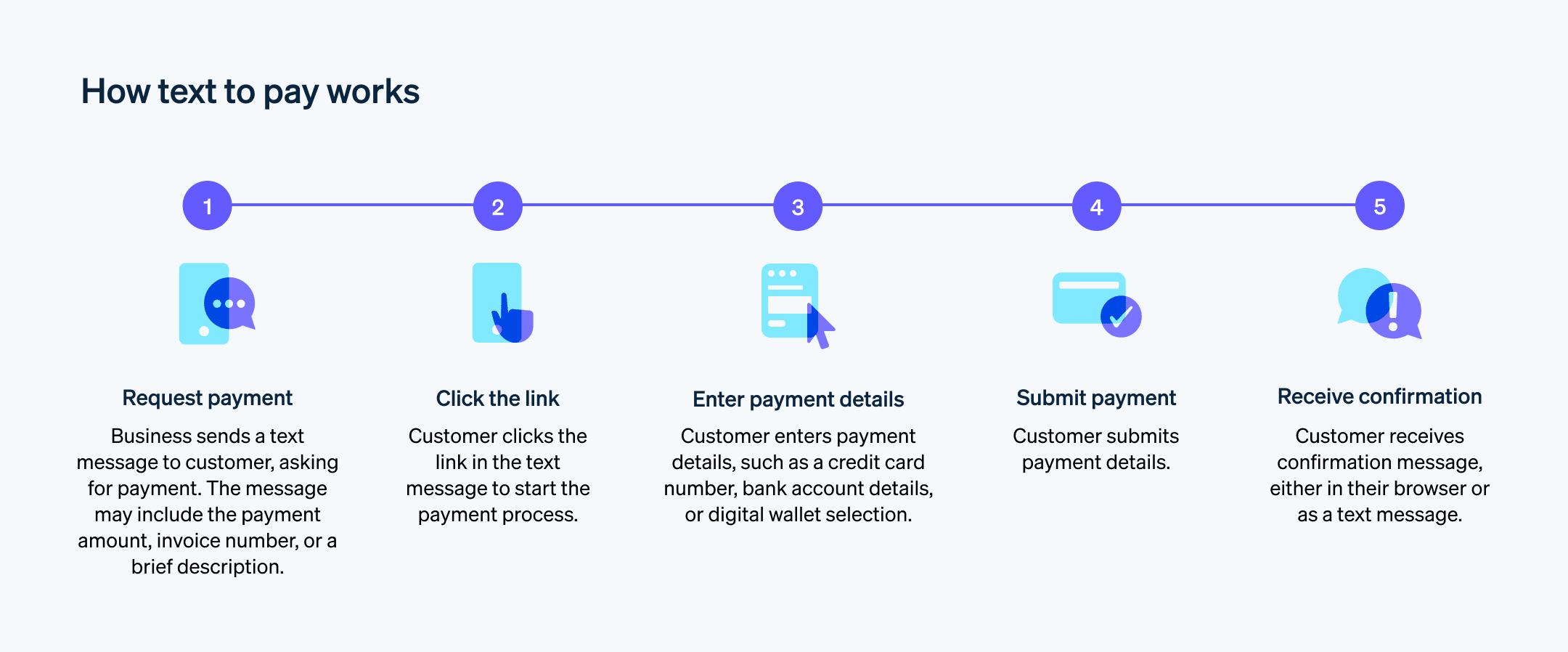

Text to Pay simplifies transactions by integrating the billing and payment process into a single, mobile-friendly platform. Here's how Text to Pay works:

Payment request via text

A business initiates the process by sending a text message to a customer's mobile phone, which informs the customer that a payment is due. This concise message usually includes the payment amount and may also provide a brief description or invoice number for reference. The goal of the message is to provide enough detail about the purchase without overwhelming the customer with information.Secure payment link

The text message contains a link that the customer can click to start the payment process. This link directs the customer to a secure payment portal, which is often mobile-optimised for convenience. The link uses encryption and other security measures to protect the customer's personal and financial information.Entering payment information

The payment page prompts the customer to enter their payment details, such as credit card information, bank account details or a digital wallet selection. The interface where the customer enters this information is designed to be simple and intuitive. Security protocols encrypt the data and safeguard against unauthorised access.Confirmation and receipt

After the customer submits payment details, the transaction is processed immediately. The customer receives a confirmation message, both on the same payment page and also as a follow-up text message. This second text serves as a digital receipt, confirming the amount paid and to whom. The business gets a notification that the customer made a payment, which allows the business to update its records.

This process represents a shift towards more direct and instantaneous billing methods, and it also reflects the mobile-centric habits of customers. Text to Pay makes it easier for customers to settle bills promptly, helping businesses improve their receivables and overall service.

What types of businesses use Text to Pay?

A range of businesses use Text to Pay. These include:

Utilities and service providers

Businesses that provide essential services such as water, electricity and telecommunications often use Text to Pay for monthly billing. This method ensures the timely collection of payments and reduces the need for paper billing.Healthcare facilities

Medical practices, clinics and hospitals use Text to Pay to collect payments for services rendered. It's a convenient way for patients to pay their bills without needing to call a provider or use the postal service.Retail businesses

Retailers, especially those with online storefronts, sometimes use Text to Pay as an option for their customers to make quick and easy payments. These purchases are often linked with order confirmation texts.Restaurants and food services

Some restaurants and food delivery services use Text to Pay to enable convenient contactless payment.Transport services

Taxi businesses and liftsharing services use Text to Pay to allow customers to pay for their rides with their mobile phones. Often, these businesses integrate this feature within their mobile application systems.Insurance businesses

Insurers use Text to Pay to collect premiums, allowing customers to maintain their policies without the traditional methods of making payments by phone or post.Property management firms

Residents can pay rent and other property-related fees through text, simplifying the process for both landlords and tenants and providing a digital trail of payments.Government entities

Some government agencies have adopted Text to Pay for collecting fees and fines, providing a more modern payment solution.

These businesses and organisations benefit from Text to Pay through reduced administrative costs, faster payment cycles and a decrease in late or missed payments. The convenience of Text to Pay can also lead to higher customer satisfaction for customers with a mobile-focused lifestyle.

Pros and cons of accepting Text to Pay for businesses

When a business adopts Text to Pay, it places an emphasis on fast and simple transactions. SimpleTexting's 2023 survey revealed that almost 81% of US consumers check their text notifications within five minutes of receiving a text. Offering customers Text to Pay acknowledges the importance customers place on instant, mobile-based transactions.

Using Text to Pay comes with many advantages – as well as some challenges. Here's a rundown of both:

Advantages for businesses

Transaction speed: The immediacy of Text to Pay can shrink the gap between billing and payment to mere moments, keeping pace with modern commerce.

Customer experience: This method provides customers with a one-tap solution that fits neatly into their daily digital routine.

Promptness in payments: The direct nudge of a text message can cut through the clutter, prompting timely payments and smoothing out the revenue cycle.

Operational savings: Transitioning to a digitised payment collection can prove much more efficient than traditional billing methods and reduce the need for paper and postage.

Auditing efficiency: A digital trail of transactions simplifies the auditing process, consolidating records into a ledger that is easy to navigate.

Accessibility: Text to Pay allows businesses to cast a wider net for potential customer engagement.

Disadvantages for businesses

Technological reliance: Text to Pay hinges on the assumption that customers are equipped and willing to engage with mobile technology for financial transactions, which may not be the case for all customers.

Security imperatives: A Text to Pay transaction requires a fortified cybersecurity strategy that guards against the vulnerabilities inherent in digital data exchange.

Infrastructure investment: Text to Pay demands an up-front investment in creating a strong and user-friendly payment platform, as well as ongoing upkeep to maintain effective operations.

Accuracy in billing: Billing automation must be meticulously programmed to avoid the fallout from billing inaccuracies, which can erode trust and customer loyalty.

Regulatory navigation: Businesses must remain nimble to stay compliant with the financial sector's regulations.

Adaptation hurdles: Some segments of the market may cling to traditional payment methods, viewing the new digital environment with scepticism or refusing to participate.

Incorporating Text to Pay is not just a functional upgrade – it's a strategic choice that a business makes to engage with customers in an elevated way. However, businesses must implement this new payment method thoughtfully and take into account the security and sophistication such a system demands.

How to create a Text to Pay strategy that fits your business needs

Creating a Text to Pay strategy that fits your business objectives involves a series of steps tailored to your operations and customer interactions. Here's a step-by-step guide:

Assess customer habits: To determine how appropriate Text to Pay is for your business, examine the ways your customers currently pay and how open they are to new technology.

Define objectives: Clearly state what you want to achieve with Text to Pay. This could include faster payments, improved customer experience, reduced administrative work, etc.

Choose the right provider: Select a payment platform that provides Text to Pay and is a good fit for your business – both in size and volume of transactions. Scrutinise the payment provider's security measures, reliability and support services.

Integrate with existing systems: Your Text to Pay solution should work with your current billing software, helping you manage payments and maintain records without the need for manual entry.

Set up infrastructure: Invest in the technology infrastructure that supports Text to Pay, such as secure internet connections and compliance with payment card industry standards.

Develop clear messaging: Craft messages that are direct and concise for your payment requests. They should include the amount due and simple instructions on how to pay.

Train your team: Make sure your staff understands how Text to Pay works and that they can assist customers with enquiries.

Test the system: Before rolling out Text to Pay widely, conduct a pilot test to work out any issues.

Launch and educate: Introduce Text to Pay to your customers, highlighting the ease and safety of the service. Provide guides or FAQs to educate customers on how to use the new payment method.

Gather feedback: After implementation, collect customer feedback to see how the service is being received and make any necessary adjustments.

Monitor and adapt: Monitor transaction volumes and customer feedback. Be prepared to tweak your strategy as you learn more about what works for your customers and what doesn't.

A well-thought-out Text to Pay strategy requires careful planning and a willingness to adjust when necessary. Successful implementation can lead to more timely payments and a better payment experience for customers.

What does Text to Pay cost to implement and use?

The costs to implement and operate a Text to Pay system can vary widely depending on several factors, including the size of your business, the volume of transactions and the specific service provider you choose.

Implementation costs

- Setup fees: Some providers charge an initial fee to set up the Text to Pay service, which can include integrating it with your existing billing systems.

- Technology investments: If your current systems aren't capable of supporting Text to Pay, you may need to invest in upgrading your hardware or software.

- Compliance costs: To safely handle payment information, you might incur costs related to adhering to payment industry security standards.

Operational costs

- Transaction fees: Providers typically charge a fee per transaction. This can be a percentage of the transaction amount, a flat fee or a combination of both.

- Monthly fees: There may be a recurring monthly fee for access to the Text to Pay platform, which can vary based on the level of service and features you choose.

- Maintenance fees: Ongoing maintenance and technical support to make the system run effectively can also add to the operating costs.

Additional costs

- Payment processing fees: These are fees charged by banks or credit card businesses for processing the payments, which are separate from the transaction fees that your Text to Pay provider charges.

- Marketing costs: You may need to spend money on marketing campaigns to inform your customers about the new payment option.

Businesses that are deciding whether to implement Text to Pay need to consider these costs against expected benefits, such as faster payments and improved customer satisfaction. It's a good idea to compare prices and services from different providers to find a solution that offers the best value for your specific needs.

With Stripe, for example, Payment Links are part of the standard pricing model, so there are no additional fees for creating and using Payment Links to accept payments. When you use Payment Links along with other Stripe services such as Billing for recurring payments or Stripe Tax, the usual fees for those services apply – as they would with any other transaction types. There are no extra charges for using Payment Links on top of what you would already pay for using Stripe's services.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.