Since 2014, following the approval of Directive 2014/55/EU, the EU has implemented e-invoicing regulations requiring member countries to set up systems that allow businesses to digitally submit economic data to their respective tax authorities.

Although this is a Europe-wide regulation, each member country has some flexibility with implementation. In Germany, for example, mandatory invoicing will be introduced in 2025 through the Growth Opportunities Act, which is distinctly different from the Crea y Crece Law approved by Spain to promote digital transformation. Within some countries, there are also regional regulations.

In this article, we examine TicketBAI, the specific e-invoicing regulation introduced in the Basque Country.

What’s in this article?

- What is the TicketBAI system?

- Why is TicketBAI being implemented?

- Who must implement TicketBAI?

- What are the penalties for noncompliance with TicketBAI?

- How do I comply with TicketBAI regulations?

- What technical solutions can I use for TicketBAI?

- What funding is available for implementing TicketBAI invoicing?

- When will TicketBAI be implemented?

What is the TicketBAI system?

TicketBAI refers to both the mandatory e-invoicing regulations in the three provinces of the Basque Country (Álava, Guipúzcoa, and Vizcaya) and the specific online e-invoicing system developed to implement these regulations. In Vizcaya, TicketBAI is part of a broader strategy called Batuz, a provincial initiative to combat tax fraud.

TicketBAI works in a similar way to the VeriFactu system and the Immediate Supply of Information (SII) system. TicketBAI imposes several technical and legal requirements that companies in the Basque Country must meet to issue invoices. Although the system is designed for all types of transactions, it also allows for better control of cash transactions.

Why is TicketBAI being implemented?

The Provincial Treasury of Guipúzcoa, Álava, and Vizcaya, along with the Basque Government, decided to initiate this project with the primary goal of combating tax fraud, similar to the anti-fraud law. Here is the full list of goals:

- Ensure all taxpayers pay taxes in accordance with their economic performance.

- Verify all transactions are properly reported.

- Confirm all cash payments are accurately recorded in the cash register and the corresponding invoice is issued to avoid “off-the-books accounting.”

- Simplify the process of complying with tax obligations for businesses in the Basque Country.

- Guarantee the traceability of both invoices and purchase receipts.

- Promote the digitisation of businesses in the Basque Country.

- Reduce the time it takes to create, order, and record invoices. To complement the tools provided by the system, it’s very useful to have a modern payment platform like Stripe Payments that allows you to accept both online and in-person payments using your customers’ preferred payment methods. Additionally, Payments allows you to consolidate all of your revenue in one place, streamlining accounting and invoicing while reducing manual errors.

- Simplify procedures with the Spanish Tax Agency (AEAT) by using the information received to prepare drafts of tax forms, such as Form 303 for the quarterly value-added tax (VAT) return.

Who must implement TicketBAI?

Implementing TicketBAI is required for any self-employed individual or company. It’s also mandatory for any entity that does not have legal status provided it:

- Transacts business in the Basque Country: This includes selling products or providing services subject to Law 37/1992, commonly known as the VAT Law.

- Issues invoices or receipts to clients: Even though certain transactions do not require the issuance of an invoice (such as the issuance of a receipt to a private customer), they are still subject to TicketBAI’s regulations.

What are the penalties for non-compliance with TicketBAI?

If a company or an individual fails to comply with the TicketBAI regulations, they will be subject to the penalties outlined in the penalty regime.

There are two types of violations:

- Violation #1: Failure to make use of certified billing software

- Violation #2: Modifying the software or the information included in it

Here are some examples of punishable actions under Violation #2:

- Deleting or modifying content

- Instructing another individual to carry out such actions

- Possessing the means necessary to modify the software or data or providing such means to others

- Modifying the software or documentation

- Performing any action that does not qualify as modification but results in a change to the data

Penalties vary considerably depending on the type of violation. For the first violation – failure to invoice using approved software – penalties differ according to the frequency of occurrence:

- Isolated case: Fixed fine of €2,000 for each transaction. For a repeat offence, the fine is 20% of the ordinary income, with a minimum of €20,000.

- General case: Proportional fine of 20% of the ordinary income with a minimum of €20,000. For a repeat offence, the percentage increases to 30%, and the minimum fine is €30,000.

For the second violation – modifying the software or data – the penalties differ according to who carries out the violation:

- Modification by the taxpayer: Proportional penalty of 20% of the ordinary income. The minimum fine is €40,000. In the case of a repeat offence, the percentage increases to 30%, and the minimum fine is €60,000.

- Modification by the developer or someone other than the taxpayer: All parties involved are subject to a fixed fine of €40,000. For a repeat offence, the penalty is up to €60,000.

- Modification by the taxpayer who is also the software developer: Proportional fine of 20% of the ordinary income. The minimum is €40,000.

Note that when we refer to “ordinary income,” we mean the turnover from the previous fiscal year, which is the income generated by the company or self-employed individual through their professional activities.

Failing to comply with TicketBAI regulations can lead to significant financial consequences for a company, similar to the VAT penalties in Spain. Since the introduction of the TicketBAI electronic invoicing system, the three regional tax authorities have initiated several proceedings, including actions taken by the Álava Treasury against the “txosnas” (pop-up bars) for not using the mandatory TicketBAI system.

How do I comply with TicketBAI regulations?

The process for complying with TicketBAI regulations varies depending on the territory: Guipúzcoa, Álava, or Vizcaya. You can visit the link for the territory in which you sell your goods or services to understand the specific details relevant to your case. For example, the web application used to issue TicketBAI invoices varies in each territory:

- Guipúzcoa: FakturaBAI

- Álava: FakturAraba

- Vizcaya: Haz tu factura

Despite the differences between these three areas in the Basque Country, TicketBAI compliance does have some commonalities:

- E-invoices: Any Basque business must use an electronic device to issue invoices, such as a tablet, computer, smartphone, or point-of-sale (POS) system.

- Software: If you don’t use any of the three previously mentioned web applications, you must use software listed in the TicketBAI Approved Software Register. The invoicing software used by the company or individual must comply with all TicketBAI requirements. In this regard, the developer company must follow the instructions and recommendations provided in the note to developers to create a software solution that complies with this regulation.

- Extensible markup language (XML) file: The TicketBAI file must be an XML file that adheres to the specified content and structural format. For example, if the invoice number and series are included (although not always required), they must be shown separately.

- Signature: The TicketBAI file must be electronically signed.

- Images: The invoice image must be either physical or digital. In both cases, it must include a quick response (QR) code measuring between 30 × 30 mm and 40 × 40 mm, along with a 39-character TicketBAI identification code. Both codes are generated using the TicketBAI file signature.

The TicketBAI file must contain information about the parties involved in the transaction as well as an invoice and signatures.

First, it must contain the following entities:

- Company: The party issuing the invoice

- Customer: The party receiving the invoice

Next, it must include the following information about the invoice:

- Header: Invoice number, date and time of issue, etc.

- Data: Details of the invoiced transactions, total amount, and VAT taxation regimes, including the special cash basis regime (RECC) and others

- Breakdown: Whether the transaction is not subject to VAT, fully exempt from the tax, partially exempt in terms of the taxable base, or similar details

Lastly, it should include this information:

- Audit trail: Invoice number, series, and issue date

- Signature: Signature of TicketBAI file

- License: Data confirming the developer has the legal right to create the billing software

- Developer: Company that has developed the software

- Software: Name of the tool used to create the TicketBAI file

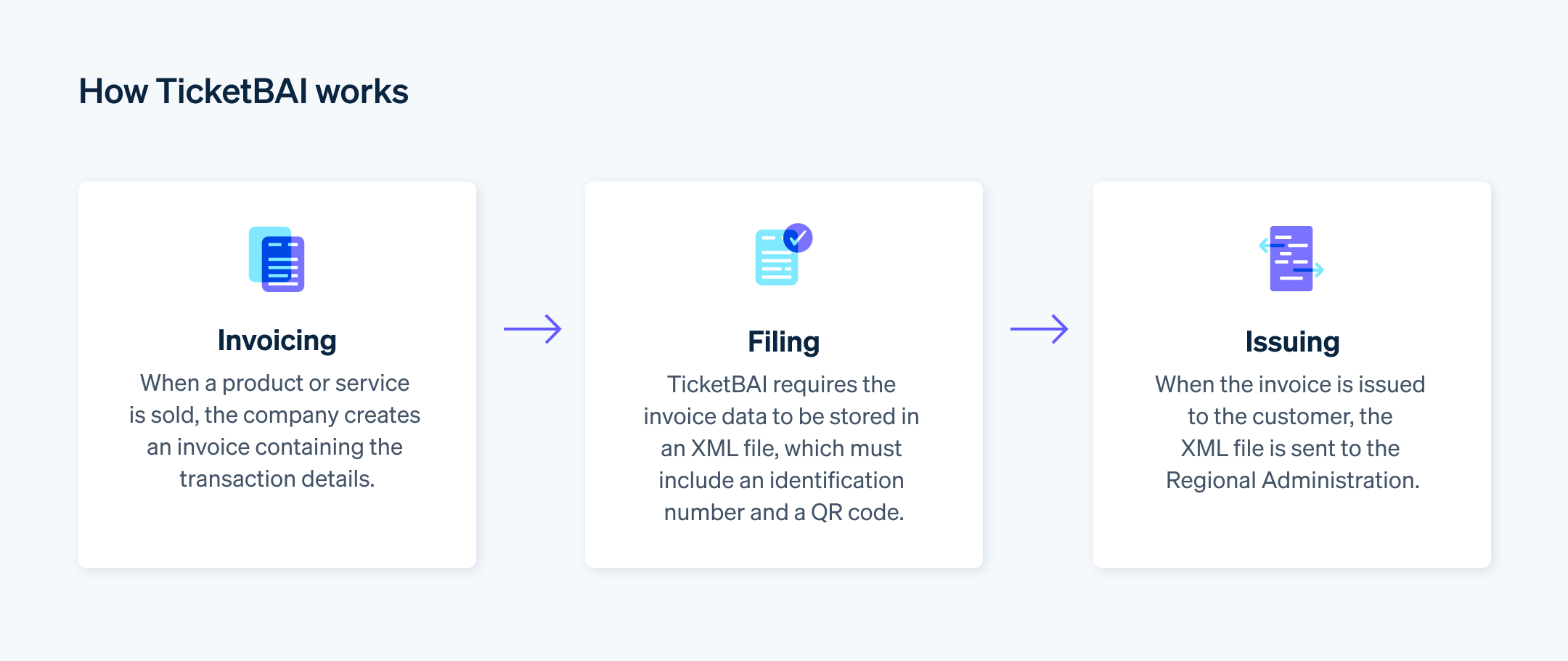

Once the invoice is issued to the customer, the XML file is automatically transmitted to the relevant tax authorities. Typically, three steps must be followed:

What technical solutions can I use for TicketBAI?

You can confirm a technological solution is valid for TicketBAI if it:

- Is registered in the TicketBAI approved software registry

- Provides unique transaction codes for each transaction

- Can generate files with an electronic signature compatible with digital certificates

- Automatically adds the TicketBAI identification code and QR code to invoices

- Sends TicketBAI files instantly

To ensure the technological solution you choose complies with the regulations, you can consult the list of TicketBAI software, which includes all registered programmes. Keep in mind that if a solution is valid for one province, it is also valid for the other two.

Important note: To comply with TicketBAI regulations using Stripe, you must use a third-party connector from the list of officially approved software. The Guipúzcoan company Itcons has developed a connector between Stripe and TicketBAI, approved by the Regional Tax Authorities as TicketBAI software.

What funding is available for implementing TicketBAI invoicing?

To ease the economic burden of Basque companies in adopting these technological solutions, the three regional tax administrations initially provided financial support in the form of deductions in the payment of corporate income tax (IS) or personal income tax (IRPF). For example, in Guipúzcoa, where the TicketBAI regulation is already mandatory for all companies, their Tax Agency offered a 60% reduction on all IS and IRPF payments for businesses who implemented TicketBAI during the voluntary period.

In 2023, previous subsidies were discontinued, and currently, the only available support for implementing TicketBAI is the Kit Digital programme, which companies can apply for until 31 October 2025. If approved, they will only need to cover the VAT for the IT solution they choose to digitise their invoicing.

In addition, the three regional administrations offer a completely free web application, ideal for companies with medium or low invoicing volumes. However, this free software is not available to companies under the special regime for groups of companies or for certain types of transactions.

When will TicketBAI be implemented?

Although TicketBAI was proposed in 2019 and officially approved in 2020, its progressive implementation did not begin until 2022:

- 2019: In response to alarming data regarding the underground economy in the Basque Country, a proposal was introduced to make electronic invoicing mandatory. The group of regulations is called TicketBAI.

- 2020: The Provincial Tax Authorities of the Basque Country establish the obligation to implement the TicketBAI system through provincial regulations, such as Regulation 3/2020.

- 2022: Although the plan was to require companies in the Basque Country to implement TicketBAI in 2021, the COVID-19 pandemic caused delays in its rollout. Finally, in 2022, Guipúzcoa became the first of the three territories to make its implementation mandatory.

Guipúzcoa was the first province to require the implementation of TicketBAI, while the rollout across all three provinces of the Basque Country will gradually continue until 2026.

In Guipúzcoa:

- 2021: Start of voluntary period

- 2022: Mandatory for professionals in certain sectors (such as hospitality and tax management)

- 1 June 2023: Mandatory for all professionals

In Álava:

- 2022: Start of voluntary period

- 1 December 2022: Mandatory for all professionals

In Vizcaya:

- 2024: Mandatory for IS taxpayers and professionals in certain sectors (such as industrial and healthcare)

- 2025: Mandatory for wholesale and retail businesses, among others

- 1 January 2026: Mandatory for all professionals

Although Navarra is part of the autonomous regime, it has not yet implemented an electronic invoicing system. The Administration of the Autonomous Community of Navarra plans to automate invoice receipt by 2026 through the VeriFactu-TicketBAI Navarra project.

By 2023, 300,000 invoices were already being issued per day in Álava using the TicketBAI system, so it is expected that the successful implementation of this regulation in the Basque Country will serve as a model for other state and regional initiatives.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.