As of 2022, there were 33.2 million small businesses in the United States, according to the Small Business Administration. Each of these businesses needs to select a business structure, building a foundation for how they operate, grow and address challenges. This decision affects every facet of business operations, including liability, taxation and the ability to raise capital. Two types of business structure that companies consider are a limited liability company (LLC) and a C corporation (C corp).

The decision between forming an LLC or a C corp is a strategic choice that can influence a business's operational efficiency, fiscal health and growth potential significantly. Here's what businesses need to know about these two business entities.

What's in this article?

- What is a C corp?

- What is an LLC in America?

- What are the benefits of a C corp?

- What are the benefits of an LLC?

- C corp vs LLC: Differences and similarities

- How to choose between an LLC and a C corp

What is a C corp?

A C corporation, often referred to as a C corp, is a type of business entity that is legally separate from its owners. This means that the corporation itself, not the shareholders who own the company, is held legally liable for the actions and debts that the business incurs. C corporations are one of several types of business entities, which also include S corporations, LLCs and partnerships.

What is an LLC in America?

A limited liability company (LLC) is a type of business structure in the United States where owners have limited personal liability for the debts and actions of the company. The "limited liability" structure is designed to protect the personal assets of the owners (also known as members) in the event of legal or financial debts incurred by the business.

What are the benefits of a C corp?

Recognised for its robust structure, investment potential and perpetuity, a C corp may align well with your business's growth trajectory and future aspirations. Here's an overview of the key advantages of C corps:

Limited liability

One of the most significant advantages of a C corporation is that it provides its owners (shareholders) with limited liability protection. This means that if the corporation incurs debts or is sued, the shareholders' personal assets, such as houses, cars and savings accounts, typically can't be touched by creditors or litigants. This is an important consideration for anyone starting a business, as it provides additional financial and legal protection.Perpetual existence

A C corporation has a legal identity that is separate and distinct from its owners. This means that it can have a "perpetual existence", living on regardless of what happens to its shareholders, directors or officers. This feature allows the business to maintain operational continuity through ownership changes and management transitions, which is valuable for long-term strategic planning and legacy building.Increased credibility

Incorporating a business can increase its credibility with potential customers, suppliers and investors. This credibility comes from the perception that corporations have stability and longevity. The formal corporate structure sends a message that the business is professional and committed in the long term.Easier access to capital

C corporations have a unique ability to raise funds through the sale of stock, whether through private placements or public offerings. This can give them easier access to capital than other business structures, such as sole proprietorships or partnerships. Access to more capital can mean more opportunities for growth and expansion. Additionally, corporations can take advantage of various other funding options, such as bonds and convertible notes.No limit on the number of shareholders

Unlike some other types of corporations, a C corporation can have an unlimited number of shareholders. This feature is beneficial for businesses that plan to grow, especially if they intend to go public. This unlimited shareholder policy enables a C corporation to sell shares to a broader range of investors, both domestically and internationally.Ownership and management separation

In a C corporation, owners (shareholders) and management can be separate. The shareholders own the company, but the board of directors – elected by the shareholders – make the significant business decisions and oversee the corporation's general affairs. The board of directors then appoints the officers who manage the day-to-day business operations.Tax deductions

C corporations can deduct employee benefits, such as health insurance and retirement plan contributions.

What are the benefits of an LLC?

An LLC is a flexible business structure that offers a strong blend of protection and simplicity. Here's an overview of the benefits of LLCs:

Limited liability

Just like a corporation, an LLC provides its owners (members) with limited liability protection. This means that the members are not personally responsible for the company's debts and liabilities. If the LLC incurs debt or is sued, it is typically only the business assets that are at risk. The members' personal assets, such as homes, cars and personal bank accounts, are protected. This characteristic provides significant protection for members.Pass-through taxation

One of the most appealing characteristics of an LLC is the benefit of pass-through taxation. Generally, LLCs do not pay taxes at the business level. Income or loss is reported on the owners' personal income tax returns and any tax due is paid at the individual level.Flexibility in management and ownership structure

LLCs have considerable flexibility in terms of management and ownership structure. They can either be member-managed, where all members participate in the decision-making process of the business, or manager-managed, where designated members (or even outsiders) are appointed to manage the LLC.Less paperwork and formal requirements

Compared with corporations, LLCs have fewer annual requirements and ongoing formalities. This can make LLCs easier and less expensive to operate from a legal perspective.Flexible profit distribution

An LLC has flexibility in how it distributes its profits to its members. An LLC can choose to distribute its profits however it wants to. This allows an LLC to balance out any income disparities among different members, if necessary.Perpetual existence

In many states, if a member leaves an LLC or dies, the LLC does not dissolve automatically. Many states allow an LLC to design its operating agreement to ensure that the business can continue if a member leaves the business.

C corp vs LLC: Differences and similarities

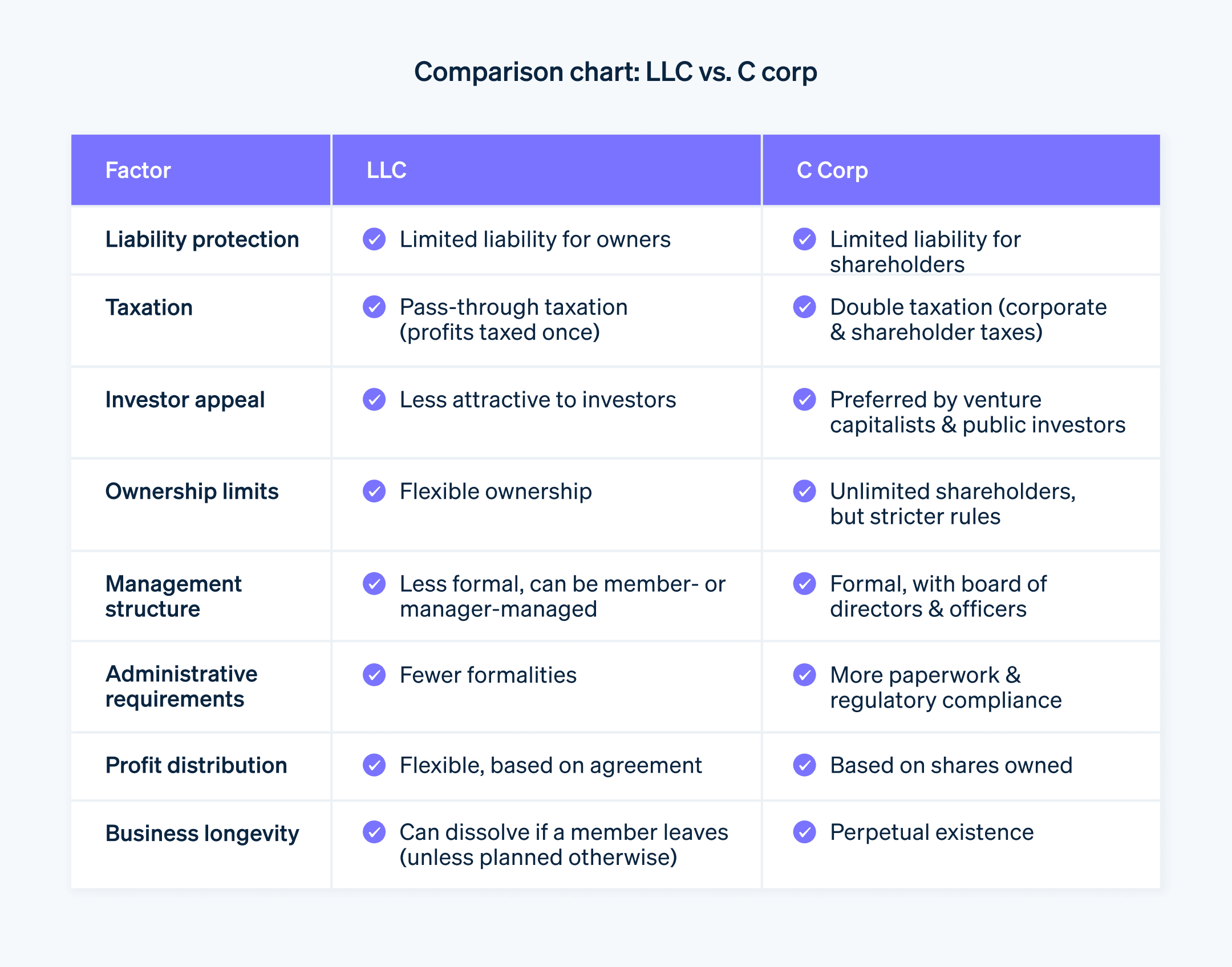

When choosing a business structure, the decision between a C corp and an LLC can be challenging. Both structures have benefits and drawbacks. Here's a more detailed comparison to help you understand which may be the right choice for your business:

Taxation

One of the main differences between an LLC and a C corp is how they are taxed. An LLC is a pass-through tax entity, meaning that the company itself does not pay any income taxes. Instead, income is passed through to the owners who report it on their personal tax returns. On the other hand, a C corp is subject to "double taxation". The corporation pays taxes on its earnings at the corporate level and then shareholders pay taxes again on the dividends that they receive. However, C corps have the advantage of being able to deduct the cost of employee benefits.Investment opportunities

If you plan to seek investment from venture capitalists or if you aim to go public in the future, a C corp is usually the preferred choice. This is because C corps can have an unlimited number of shareholders and are more familiar to investors. An LLC is often less appealing to investors because it is a less standardised business structure.Management structure

In a C corp, the management structure is divided into shareholders, directors and officers, which can provide clarity of roles, but may also introduce administrative issues. In contrast, LLCs have a more flexible structure. They can be managed by members (owners) or by managers, which could be members or outsiders.Administrative requirements

C corps often have more administrative requirements, such as holding annual meetings, recording meeting minutes and creating bylaws. These requirements can create more structure in business operations, but they can also result in more paperwork. LLCs generally have fewer administrative tasks, which can mean less paperwork and lower legal and accounting fees.Profit distribution

C corps distribute profits to shareholders based on the number of shares that they own. LLCs have more flexibility in profit distribution: they can distribute profits however they see fit, as long as it's outlined in the LLC operating agreement.Perpetual existence

C corps have perpetual existence, meaning that the corporation can continue indefinitely, regardless of what happens to its individual owners or managers. An LLC's life span can be more complex and varies by state. In some states, if a member exits the LLC or passes away, the LLC is dissolved unless there is a different provision in the operating agreement.

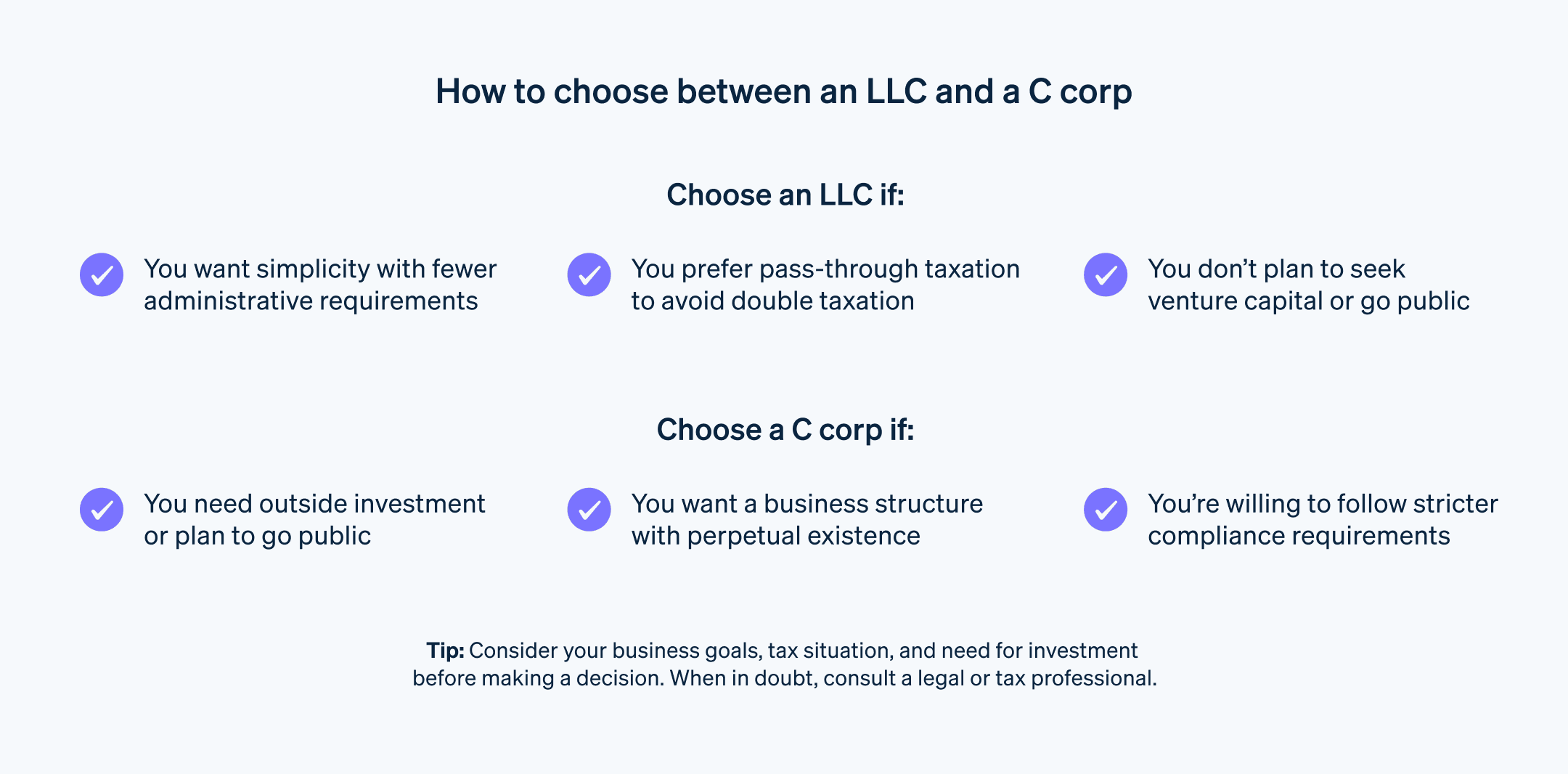

How to choose between an LLC and a C corp

The decision to form an LLC or a C corp depends on a variety of factors. Here is a closer look at how to assess your options for structuring your business:

Understand your business goals

Understand your business's long-term goals. For example, if your business plan includes going public or seeking investment from venture capitalists, then a C corp is generally a better choice. This is because C corps allow for the easy transfer of ownership through the sale of shares, and are a familiar and trusted structure for many investors. On the other hand, if your primary goal is to keep things simple while protecting yourself against personal liability, an LLC might be a more suitable choice.Assess the nature of your business

Different businesses come with different levels of risk and liability, which can inform your choice. If your business carries a high risk of liability, having the added protection of a C corp structure may be more beneficial. Furthermore, consider the size of your business. Larger businesses with many employees and shareholders may benefit from the structured hierarchy of a C corp.Examine your tax situation

One of the primary differences between an LLC and a C corp is how they are taxed. C corps are subject to double taxation – once at the corporate level and again at the individual level when dividends are distributed to shareholders. An LLC, however, is a pass-through entity, so taxes on profits are only paid once on the owner's individual tax return. Therefore, if keeping your tax situation straightforward is a priority, you might lean towards an LLC. However, if you're planning to reinvest profits back into the business rather than distributing them, the C corp's double taxation may not be a significant drawback.Consider your need for investment

If attracting investors is a key part of your business strategy, forming a C corp might make more sense. C corps allow for an unlimited number of shareholders and are generally the preferred, and sometimes the required, structure for venture capitalists and other institutional investors. An LLC structure can make it more complicated to bring investors on board.Think about management structure

An LLC offers more flexibility in management structure, as it can be member-managed or manager-managed. C corps have a defined structure with a board of directors and officers. Depending on your management style and preferences, one structure might appeal to you more than the other.Factor in administrative requirements

C corps often require more administrative tasks, such as holding annual meetings and filing reports, which can be burdensome for a small business. On the other hand, the formal requirements of a C corp can help to ensure that good business practices are followed.Seek outside counsel

Once you've evaluated all of the factors above, consult with a business advisor or legal expert to guide your decision. They can provide advice that is tailored to your specific situation and goals – and they can help you understand the state-specific requirements and processes for forming an LLC or a C corp.

How Stripe Atlas can help

Stripe Atlas sets up your company's legal foundations so you can fundraise, open a bank account and accept payments within two business days from anywhere in the world.

Join 75K+ companies incorporated using Atlas, including startups backed by top investors like Y Combinator, a16z and General Catalyst.

Applying to Atlas

Applying to form a company with Atlas takes less than 10 minutes. You'll choose your company structure, instantly confirm whether your company name is available and add up to four co-founders. You'll also decide how to split equity, reserve a pool of equity for future investors and employees, appoint officers and then e-sign all your documents. Any co-founders will receive emails inviting them to e-sign their documents, too.

Accepting payments and banking before your EIN arrives

After forming your company, Atlas files for your EIN. Founders with a US Social Security number, address and mobile phone number are eligible for IRS expedited processing, while others will receive standard processing, which can take a little longer. Additionally, Atlas enables pre-EIN payments and banking, so you can start accepting payments and making transactions before your EIN arrives.

Cashless founder stock purchase

Founders can purchase initial shares using their intellectual property (e.g. copyrights or patents) instead of cash, with proof of purchase stored in your Atlas Dashboard. Your IP must be valued at US$100 or less to use this feature; if you own IP above that value, consult a lawyer before proceeding.

Automatic 83(b) tax election filing

Founders can file an 83(b) tax election to reduce personal Income taxes. Atlas will file it for you – whether you are a US or non-US founder – with USPS Certified Mail and tracking. You'll receive a signed 83(b) election and proof of filing directly in your Stripe Dashboard.

World-class company legal documents

Atlas provides all the legal documents you need to start running your company. Atlas C corp documents are built in collaboration with Cooley, one of the world's leading venture capital law firms. These documents are designed to help you fundraise immediately and ensure your company is legally protected, covering aspects like ownership structure, equity distribution and tax compliance.

A free year of Stripe Payments, plus $50K in partner credits and discounts

Atlas collaborates with top-tier partners to give founders exclusive discounts and credits. These include discounts on essential tools for engineering, tax, finance, compliance and operations from industry leaders like AWS, Carta and Perplexity. We also provide you with your required Delaware registered agent for free in your first year. Plus, as an Atlas user, you'll access additional Stripe benefits, including up to a year of free payment processing for up to $100K in payments volume.

Learn more about how Atlas can help you set up your new business quickly and easily and get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.