Seventy-four percent of freelancers report not being paid on time. That’s why it’s so important for freelancers to not only choose the right payment method, but also have clear payment terms and conditions.

By understanding and carefully selecting your payment options, you’re putting key structures in place to ensure you are compensated promptly and fully for your work. There are countless ways for freelancers to get paid. These myriad options can open up new opportunities, but they can also create decision-paralysis. Here’s what you need to know about the common methods freelancers use to get paid and how to choose the best one for you.

What’s in this article?

- What is a freelancer?

- How do freelancers get paid?

- How to get paid as a freelancer: Payment methods

- Choosing how to get paid as a freelancer

- How to use Stripe to get paid as a freelancer

What is a freelancer?

A freelancer is a self-employed person who offers services to clients on a per-project basis. These services often fall within a particular skill set or expertise. For example, a freelance writer may offer content creation, editing, and proofreading services, while a freelance graphic designer may offer logo design, illustration, and website design services.

Freelancers have the flexibility to choose the type of work they do, clients they work with, and rates they charge. Freelancers can work with multiple clients at the same time and are not considered employees of the companies they work for, but rather independent contractors.

Freelancers are responsible for their own business costs such as marketing, taxes, and health insurance. They often work remotely and use digital platforms to connect with potential clients, collaborate on projects, and receive payment. The rise of the gig economy and remote work has led to a significant increase in freelancing. Statista projects that in 2027, there will be 86.5 million freelancers in the United States, a figure that would constitute more than 50% of the total US workforce.

How do freelancers get paid?

Freelancers can get paid in a variety of ways, depending on the agreements they make with their clients:

Hourly rate

The freelancer charges the client for each hour of work completed. Typically, this is used for ongoing or long-term projects for which the scope of work is not clearly defined up front.Project-based fee

The freelancer charges the client a fixed amount for a specific project. This is usually agreed upon before the work begins and is based on an estimate of the time and effort required to complete the project.Retainer fee

The freelancer and client agree on a monthly fee for a certain amount of work. A retainer fee model provides a consistent income for the freelancer and ongoing, on-demand services for the client.Per-word or per-page rate

Some freelancers, like writers and editors, charge clients per word or per page.Commission

In a commission model, the client pays the freelancer a percentage of the revenue generated by their work. This is common in sales-related freelancing.Value-based pricing

In this model, pricing is based on the value the work will bring to the client rather than the time it takes to complete. For example, a freelance software developer who specializes in particularly complex work might charge more than other similarly experienced developers who spend a comparable number of hours doing easier or less important work. This requires a clear understanding of the client’s business and potential impact of the freelancer’s work.

How to get paid as a freelancer: Payment methods

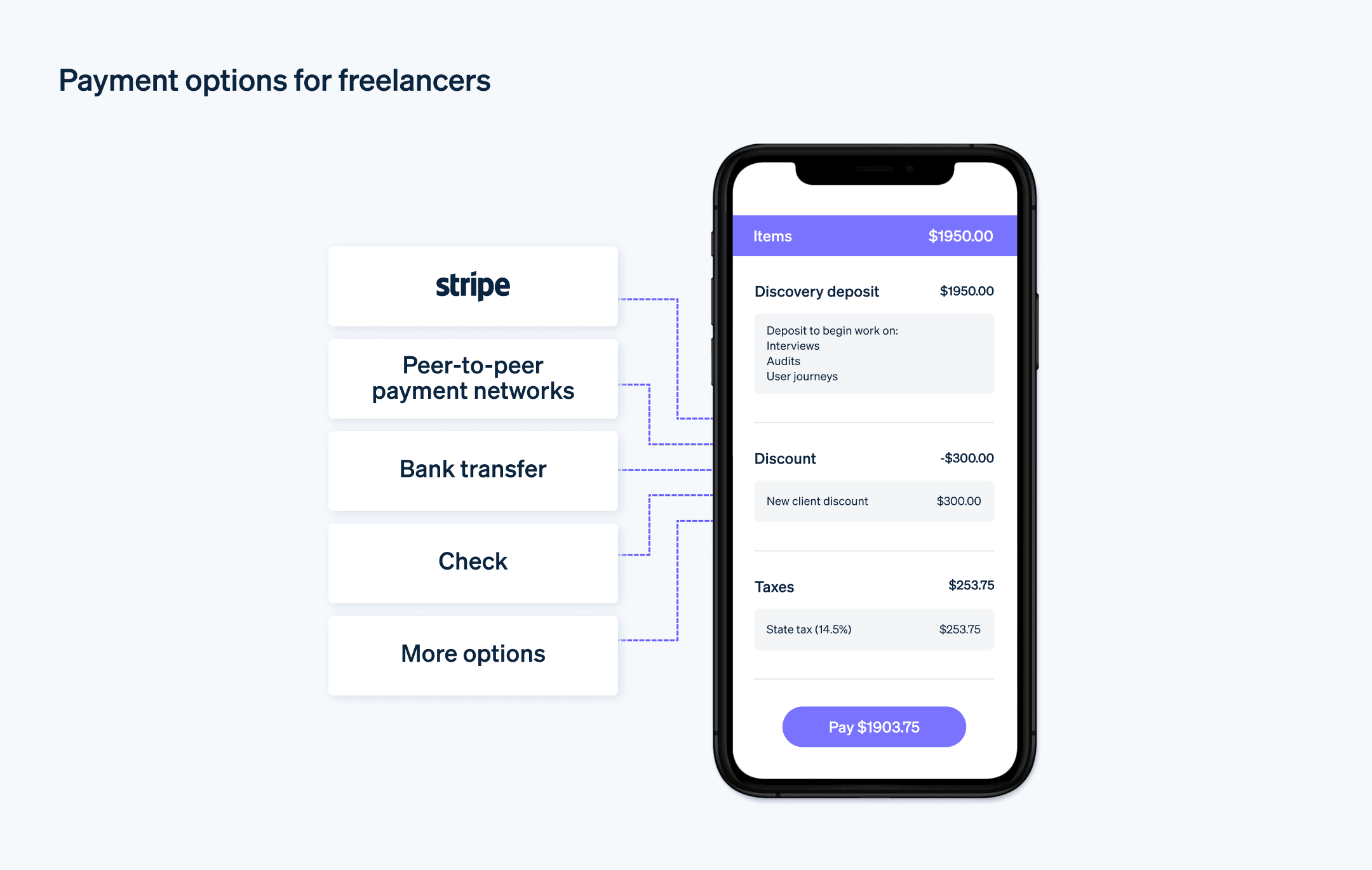

As a freelancer, it’s important to understand the different payment methods that you can use to receive payments from clients. Each method has its own advantages and potential drawbacks, and some may be better suited to your needs depending on your location, nature of your work, and preferences of your clients:

Bank transfers

Bank transfers, including direct deposits, are a convenient and common choice for freelancers. For example, a freelance event planner working with a local client may agree on bank transfers as their method of payment. Once the event is planned and executed, the client would initiate a transfer from their bank account to the event planner’s bank account.Peer-to-peer payment networks

Digital platforms like PayPal, Venmo, and Zelle facilitate quick money transfers. For instance, imagine you’re a freelance illustrator creating artwork for an indie game developer in another country. Because PayPal supports international transactions, the developer could send your payment swiftly and securely through PayPal once your artwork is approved. Alternatively, a freelance dog walker working with several local clients might prefer Venmo or Zelle for quick, easy payments that clients can initiate from their smartphones.Freelance marketplaces

Websites such as Upwork, Fiverr, and Freelancer have built-in payment systems. For example, a freelance web developer could use Upwork to connect with a client who needs a website overhaul. After the freelancer completes the project and the work is approved, the client pays the freelancer through Upwork’s system. The funds are held in an escrow account during the project, which adds a layer of financial security for the freelancer.Stripe

Stripe allows freelancers to accept debit and credit card payments directly, as well as bank transfers, typically through the freelancer’s personal website. For example, a freelance business consultant with her own website might use Stripe to accept payments for her online courses. Clients can pay directly on the website, and Stripe processes the payment and deposits the funds into the consultant’s bank account.Paper checks

While not a common payment method in the digital age, some clients still prefer to pay for services with checks. For instance, a freelance writer hired for a project by a major publisher may receive a check as payment and deposit that check at their bank. The publisher’s finance department might prefer this method because it aligns with their established accounting procedures.

Each of these methods caters to different needs and circumstances. When choosing the most appropriate payment methods, freelancers should consider their own situation, clients’ preferences, and the nature of their work. No matter the method, it’s important that freelancers ensure the client agrees to all payment terms before starting work.

Choosing how to get paid as a freelancer

Freelancers need to be mindful of several factors when deciding on the best payment methods to accept from clients. These considerations can help ensure smooth transactions and prompt payments while minimizing any potential fees.

Here are some steps a freelancer can take to determine the best way to accept payments:

Evaluate the nature of your services and clients

The type of work you do and the clients you serve can help you find your optimal payment method. For example, if you work with local clients, direct bank transfers or peer-to-peer payment networks may be the best choice. On the other hand, if you work with international clients, using a payment processor like Stripe can simplify your payments setup. Stripe supports transactions in a multitude of currencies and payment methods, so you won’t lose out on international clients due to payment method limitations.Consider your business structure

If you operate as a sole proprietor, simpler methods like direct bank transfers might be sufficient. However, if you run a larger freelance business with multiple employees or subcontractors, you might require a more sophisticated payment system, such as those offered by Stripe or a similar service.Take into account the size and frequency of payments

If you’re working on large projects with substantial but infrequent payments, bank transfers or checks might be suitable, given that these methods can handle larger amounts and the processing time won’t be as much of a concern. If you’re dealing with small, frequent payments, a method with lower transaction fees like a peer-to-peer network might be a better option. With Stripe, the size and frequency of your payments aren’t an issue. Stripe’s processing system can handle both large, infrequent payments and small, frequent ones. Stripe’s flexible system can adapt to your specific billing needs, whether you charge per project, per hour, or on a recurring basis.Consider ease of use and accessibility for your clients

It’s important to choose a payment method that your clients are comfortable with. For example, if your clients are tech-savvy, they might prefer digital payments. However, if they’re more traditional, checks or direct bank transfers might make the most sense for them. If you’re looking for a solution that works for everyone, Stripe offers a smooth and intuitive payment experience in which clients can pay with their preferred method, whether it’s a credit card, debit card, or local payment method.Understand fees

Most payment methods charge some kind of fee. These fees can be flat rates or percentages of the transaction amount. Because these fees add up over time, it’s important to understand the fee structure of your chosen payment method and consider how it will impact your overall earnings.Consider security

Choose a payment method that provides good security measures to protect your earnings and your clients’ information. Reliable services should have strong encryption and fraud prevention features in place. Stripe’s security adheres to and surpasses the toughest industry security benchmarks, employs encryption for every transaction, and includes expansive fraud detection and prevention measures that are built into its payment solutions.Explore integration with other business tools

Some payment methods can integrate with other business tools that you use, like accounting or project management software. This can streamline your administrative tasks and make it easier to manage your business. For instance, Stripe can integrate with a variety of business tools you may already use, from accounting software like QuickBooks to CRM systems like Salesforce.

When choosing a payment method for your freelance work, there’s no obligation to pick only one. It’s perfectly acceptable to offer more than one payment option to accommodate various client preferences, as long as you’re comfortable with managing different methods. And whatever you choose, be sure to clearly communicate your payment options and terms to your clients up front to avoid any confusion or delays in payment.

How to use Stripe to get paid as a freelancer

Stripe handles transactions from a variety of payment methods and currencies. For freelancers, this agility is particularly useful because it allows them to accommodate a variety of payment structures and methods with different clients, while keeping payments within one unified ecosystem.

Here’s how freelancers can use Stripe to get paid:

1. Setting up a Stripe account

First, you’ll need to sign up for a Stripe account. Go to the Stripe website and follow the instructions for creating a new account. You’ll need to provide some basic information about yourself and your business, including your business bank account details where Stripe will deposit your payments.

2. Creating a payment link or checkout

After setting up your account, you can create a payment link or set up a checkout process directly on your website:

Payment links

This is a simple way to accept payments if you don’t have a website or if you’re invoicing your clients directly. You can create a payment link for a specific amount and service in your Stripe Dashboard, then send this link to your clients. They can click the link to make a payment using their credit or debit card.Checkout on your website

If you have a website, you can use Stripe APIs to integrate a checkout system into your site. This involves some mild coding, so it might be a good option if you have technical skills or can hire a developer. Stripe Checkout provides a prebuilt, customizable payment page, which simplifies the process.

3. Processing payments

Once a client makes a payment, Stripe will process the funds and transfer them to your bank account. The standard timing for this transfer is two business days for businesses in the US, although this can vary depending on your country and your specific Stripe account settings.

4. Invoicing

Stripe also has built-in invoicing capabilities. You can create and send invoices directly from your Stripe Dashboard. Clients can then click a link in the invoice to make a payment.

For freelancers, using Stripe means reliability and flexibility. Whether you’re working on your own or running a larger freelance business, Stripe’s scalable solutions are designed to grow and adapt with you. Stripe’s range of tools can manage both simple transactions and complex payment processes, making it a smart choice for businesses of all sizes—even if you’re a team of one.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.