74% 的自由职业者称他们未能按时获得报酬。这就是为什么对于自由职业者来说,不仅要选择正确的支付方式,还要有明确的付款条款和条件。

通过了解并仔细选择付款方式,您就建立了关键的结构,以确保您能及时全额获得工作报酬。自由职业者获得报酬的方式不胜枚举。这些多种多样的选择可以带来新的机会,但也会造成决策瘫痪。以下是您需要了解的自由职业者获得报酬的常用方法,以及如何选择最适合您的方法。

目录

- 什么是自由职业者?

- 自由职业者如何获得报酬?

- 如何作为自由职业者获得报酬:支付方式

- 选择如何作为自由职业者获得报酬

- 如何使用 Stripe 作为自由职业者获得报酬

什么是自由职业者?

自由职业者是按项目为客户提供服务的个体户。这些服务通常属于特定的技能或专业知识。例如,自由撰稿人可能提供内容创作、编辑和校对服务,而自由平面设计师可能提供徽标设计、插图和网站设计服务。

自由职业者可以灵活地选择他们所做的工作类型、与他们合作的客户以及他们收取的费率。自由职业者可以同时与多个客户合作,不被视为所服务公司的员工,而是独立承包商。

自由职业者负责自己的业务成本,例如营销、税收和健康保险。他们经常远程工作并使用数字平台与潜在客户联系、在项目上进行协作并接收付款。零工经济和远程工作的兴起导致自由职业者数量显著增加。Statista 预计,到 2027 年,美国将有 8650 万自由职业者,这一数字将占美国劳动力总数的 50% 以上。

自由职业者如何获得报酬?

自由职业者可以通过多种方式获得报酬,具体取决于他们与客户达成的协议:

小时费率

自由职业者向客户收取每小时完成的工作费用。通常,这用于预先未明确定义工作范围的持续或长期项目。基于项目的费用

自由职业者为特定项目向客户收取固定金额。这通常是在工作开始之前商定的,并且基于对完成项目所需时间和精力的估计。聘请费

自由职业者和客户就一定工作量的月费达成一致。聘请费模式为自由职业者提供了稳定的收入,也为客户提供了持续的按需服务。每字或每页费率

一些自由职业者(如作家和编辑)按字或每页向客户收费。佣金

在佣金模式中,客户向自由职业者支付其工作产生的收入的一定比例。这在与销售相关的自由职业者中很常见。基于价值的定价

在这种模式中,定价是基于工作将给客户带来的价值,而不是完成工作所需的时间。例如,一个专门从事特别复杂工作的自由软件开发员的收费可能会高于其他同样经验的开发员,因为后者花了相当多的时间来做比较简单或不太重要的工作。这需要清楚地了解客户的业务以及自由职业者工作的潜在影响。

如何作为自由职业者获得报酬:支付方式

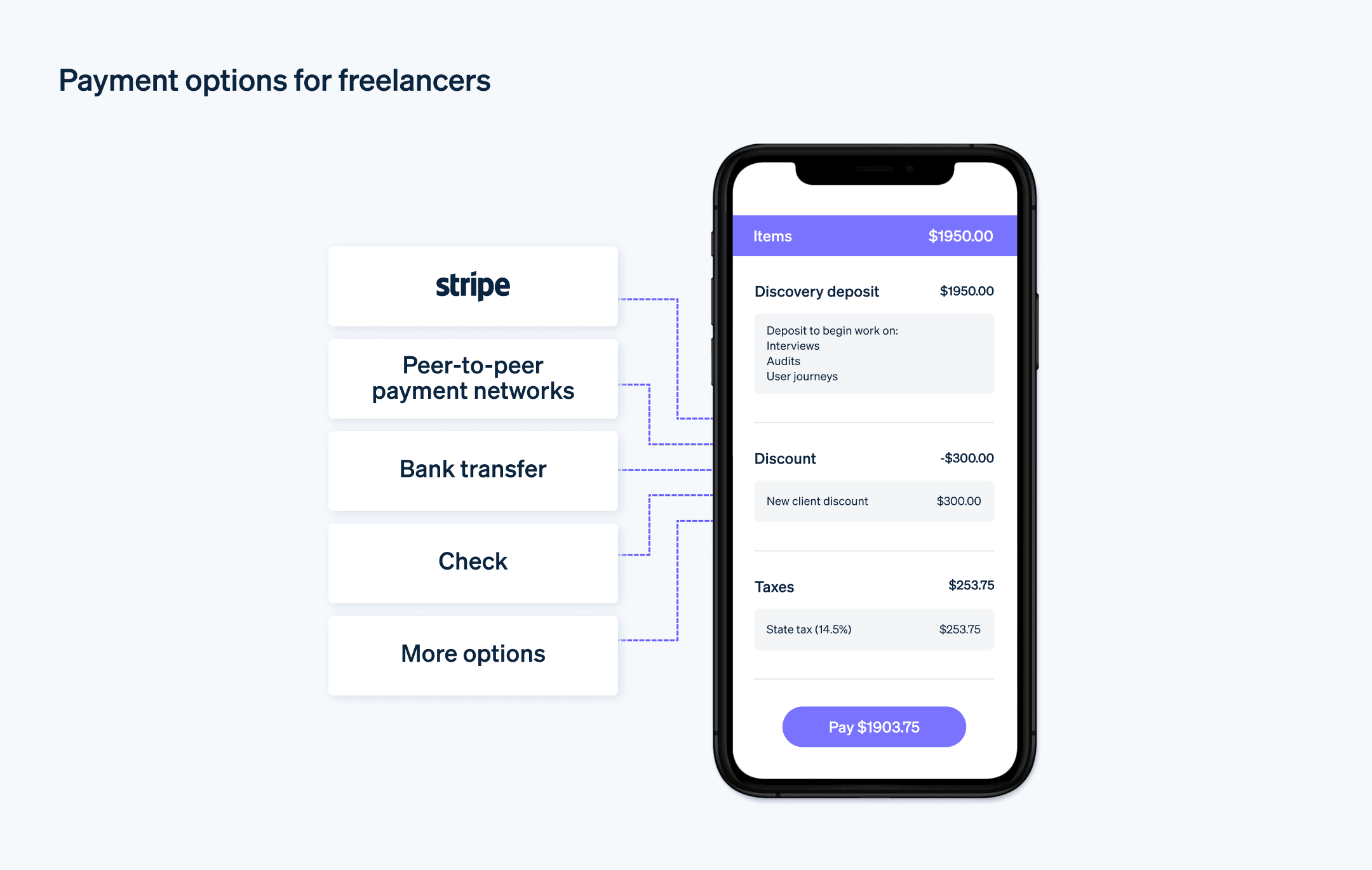

作为自由职业者,了解可用来从客户接收付款的不同支付方式 很重要。每种方式都有其自身的优点和潜在的缺点,根据您的位置、工作性质和客户的偏好,有些方式可能更适合您的需求:

银行转账

银行转账(包括直接存款)是自由职业者方便且常用的选择。例如,一名自由职业活动策划人与当地客户合作时,可能会商定以银行转账作为付款方式。一旦活动策划和执行完毕,客户就会从自己的银行账户向活动策划人的银行账户转账。点对点支付网络

PayPal、Venmo 和 Zelle 等数字平台为快速转账提供了便利。例如,假设您是一名自由插画家,为另一个国家/地区的独立游戏开发者创作艺术作品。由于 PayPal 支持国际交易,因此一旦您的作品获得批准,开发者就可以通过 PayPal 快速安全地向您汇款。另外,如果您是一名自由遛狗员,需要与多个本地客户合作,那么您可能会选择 Venmo 或 Zelle,这样客户可以通过智能手机快速、方便地付款。自由职业市场

Upwork、Fiverr 和 Freelancer 等网站都有内置的支付系统。例如,自由 Web 开发人员可以使用 Upwork 与需要整改网站的客户联系。在自由职业者完成项目并批准工作后,客户通过 Upwork 的系统向自由职业者付款。在项目期间,资金存放在托管账户中,这为自由职业者增加了一层财务保障。Stripe

Stripe 允许自由职业者直接接受借记卡和信用卡付款,以及银行转账,通常通过自由职业者的个人网站完成。例如,拥有自己网站的自由商业顾问可能会使用 Stripe 来接受其在线课程的付款。客户可以直接在网站上付款,然后 Stripe 处理付款并将资金存入顾问的银行账户。纸质支票

虽然在数字时代不是一种常见的支付方式,但一些客户仍然更喜欢用支票支付服务费用。例如,一位自由撰稿人受雇于一家大型出版商的项目,他可能会收到一张支票作为付款,然后将支票存入银行。出版商的财务部门可能更喜欢这种方法,因为这符合他们既定的会计程序。

这些方法中的每一种都迎合了不同的需求和情况。在选择最合适的支付方式时,自由职业者应考虑自己的情况、客户的偏好和工作性质。无论采用哪种方式,自由职业者都必须确保客户在开始工作之前同意所有付款条件。

选择如何作为自由职业者获得报酬

自由职业者在决定接受客户付款的最佳方式时需要注意几个因素。这些考虑因素有助于确保交易顺利进行和及时付款,同时更大限度地减少任何潜在费用。

以下是自由职业者确定最佳付款方式的一些步骤:

评估您的服务和客户的性质

您从事的工作类型和您服务的客户可以帮助您找到最佳支付方式。例如,如果您与本地客户合作,直接银行转账或点对点支付网络可能是最佳选择。另一方面,如果您与国际客户合作,使用像 Stripe 这样的支付处理商可以让您简化支付设置。Stripe 支持多种货币和支付方式的交易,因此您不会因为支付方式的限制而失去国际客户。考虑您的业务结构

如果您是独资经营者,直接银行转账等更简单的方法可能就足够了。但是,如果您经营的个体商户规模较大,有多名员工或分包商,您可能需要一个更复杂的支付系统,如 Stripe 或类似服务提供的支付系统。考虑付款的额度和频率

如果您正在进行大型项目,需要大量但不频繁的付款,那么银行转账或支票可能比较合适,因为这些方法可以处理较大的金额,而且处理时间也不会太长。如果您正在处理小额、频繁的付款,那么像点对点网络这样交易费用较低的方法可能是更好的选择。使用 Stripe,您的付款额度和频率都不是问题。Stripe 的处理系统既可以处理大额、不频繁的付款,也可以处理小额、频繁的付款。Stripe 灵活的系统可以满足您的特定计费需求,无论您是按项目收费、按小时收费还是定期收费。考虑客户的易用性和可访问性

选择一种客户能够接受的支付方式非常重要。例如,如果您的客户精通技术,他们可能更喜欢数字支付。但是,如果他们比较传统,支票或直接银行转账对他们来说可能最有意义。如果您正在寻找适合所有人的解决方案,Stripe 提供了流畅直观的支付体验,客户可以使用自己喜欢的方式进行支付,无论是信用卡、借记卡还是本地支付方式。了解费用

大多数支付方式都会收取某种费用。这些费用可以是统一费率,也可以是交易金额的百分比。由于这些费用会随着时间的推移而累积,因此请务必了解所选支付方式的费用结构,并考虑它将如何影响您的整体收入。考虑安全性

选择一种提供良好安全措施的支付方式,以保护您的收入和客户的信息。可靠的服务应具备强大的加密 和欺诈预防 功能。Stripe 的安全性符合并超越了最严格的行业安全基准,对每笔交易都进行加密,并在其支付解决方案中内置了广泛的欺诈检测和预防措施。探索与其他业务工具的整合

某些支付方式可以与您使用的其他业务工具整合,例如会计或项目管理软件。这可以简化您的管理任务,让您更轻松地管理业务。例如,Stripe 可以与您可能已经使用的各种业务工具(从 QuickBooks 等会计软件到 Salesforce 等 CRM 系统)集成。

在为自由职业选择支付方式时,没有义务只选择一种。只要您能很好地管理不同的支付方式,提供多种付款方式以满足不同客户的偏好是完全可以接受的。无论您选择哪种,请务必提前向客户清楚地传达您的付款方式和条款,以避免付款时出现任何混淆或延迟。

如何使用 Stripe 作为自由职业者获得报酬

Stripe 可以处理各种支付方式 和货币 的交易。对于自由职业者来说,这种灵活性特别有用,因为它允许他们适应不同客户的各种支付结构和方法,同时将支付保持在一个统一的生态系统中。

以下是自由职业者如何使用 Stripe 获得报酬:

1. 设置 Stripe 账户

首先,您需要注册一个 Stripe 账户。转到 Stripe 网站并按照说明创建新账户。您需要提供有关您自己和您的企业的一些基本信息,包括您的 商家银行账户,Stripe 将把您的款项存入该账户。

2. 创建付款链接或结账

设置账户后,您可以直接在网站上创建付款链接或设置结账流程:

付款链接

如果您没有网站 或者直接向客户开具发票,可通过这种简单的方式接受付款。您可以在 Stripe 仪表板 中创建一个特定金额和服务的支付链接,然后将此链接发送给您的客户。他们可以点击该链接使用信用卡或借记卡进行付款。在网站上结账

如果您有网站,可以使用 Stripe API 将 结账系统整合到您的网站中。这涉及到一些轻微的编码工作,所以如果您有技术能力或可以聘请开发人员,这可能是一个不错的选择。Stripe Checkout 提供了一个预构建的、可自定义的支付页面,简化了此流程。

3. 处理付款

客户付款后,Stripe 将处理资金并将其转入您的银行账户。对于美国企业,此转账的标准时间是两个工作日,但这可能因您所在的国家/地区和特定的 Stripe 账户设置而异。

4. 开票

Stripe 还具有内置的 invoicing 功能。您可以直接从 Stripe 仪表板创建和发送发票。然后,客户可以点击发票中的链接进行付款。

对于自由职业者来说,使用 Stripe 意味着可靠性和灵活性。无论您是独自工作还是经营大型个体商户,Stripe 的可扩展解决方案都能与您一起成长和适应。Stripe 的一系列工具既可以管理简单的交易,也可以管理复杂的支付流程,使其成为各种规模的企业的明智选择,即使您是一个团队也是如此。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。