Fifty-eight percent of European checkouts we analysed had at least three basic errors, adding unnecessary friction for customers.

Ecommerce businesses spend time, money, and resources on building brand awareness, driving website traffic, and optimising their product pages—all with the goal of getting their target audience to make a purchase. However, a surprisingly large number of European businesses we analysed are neglecting one crucial step in the conversion journey: the checkout flow.

Analysing checkouts across European ecommerce websites

We conducted a detailed review of the top 450 ecommerce websites across the UK, France, Germany, the Netherlands, Spain, Italy, and Sweden and found that 58% of checkouts had at least three basic errors, adding unnecessary friction for customers and complicating the checkout process. Some of the most common issues include not automatically verifying the card number as it was entered, the absence of a numerical keypad for entering card numbers on mobile devices, and allowing transactions to be submitted with incorrect card numbers or expiry dates. On their own, these issues may seem small. But when combined, they add up to a needlessly difficult checkout experience for customers.

With nine out of ten lost sales in Europe failing on the checkout page, fixing these basic errors and reducing friction in the transaction process can result in significant increases in conversion and revenue.

This report dives into the results of our analysis and details the most common checkout issues related to form design and mobile optimisation. We’ll cover why these checkout issues matter, how to prevent them from happening in your checkout flow, and how Stripe can help. But just avoiding the basic errors isn’t enough. We’ll also share additional opportunities for checkout optimisation throughout the guide, like supporting digital wallets and local payment methods in markets where they are widely used.

Checkout form design

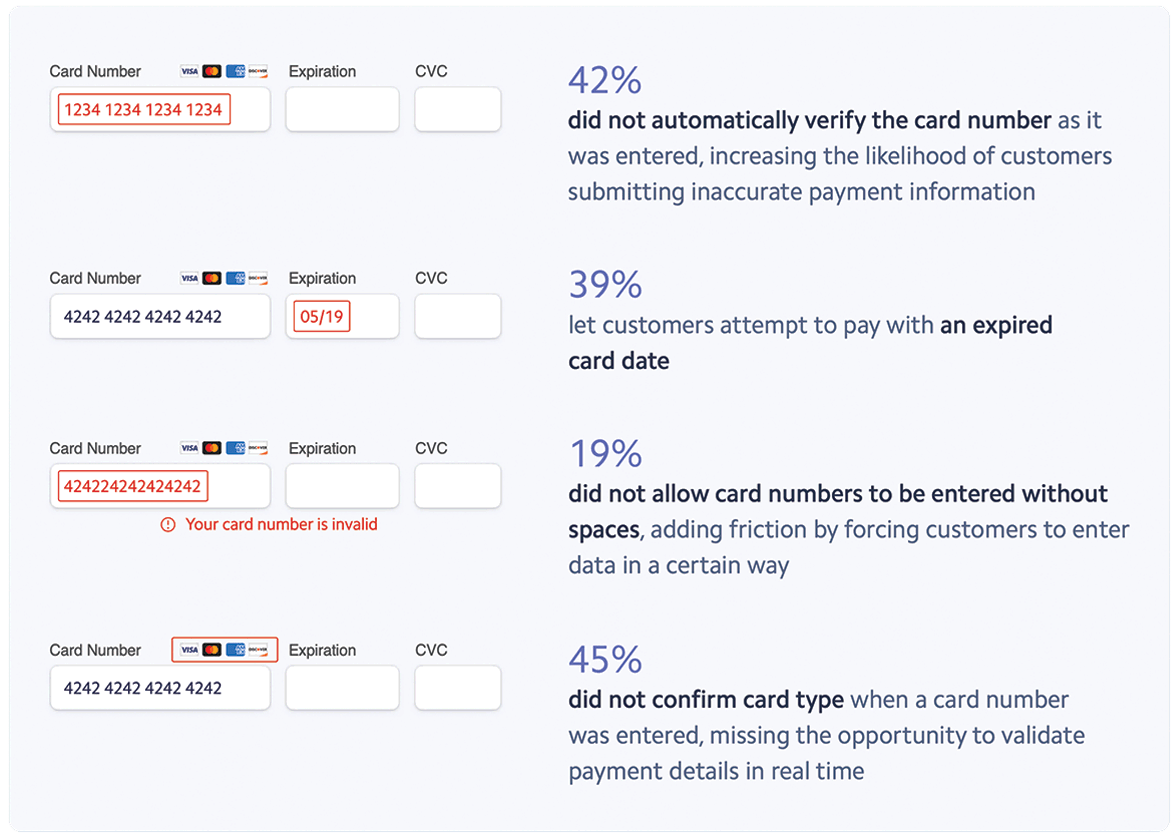

More than one-third of ecommerce companies added unnecessary friction to their checkout flow, preventing customers from checking out.

For many of the factors we assessed, checkouts in Italy and the Netherlands performed the worst. In Italy, 66% did not confirm card type when a card number was entered, and 56% did not automatically verify the card number. In the Netherlands, 50% did not confirm card type, and 56% let customers attempt to pay with an expired card date.

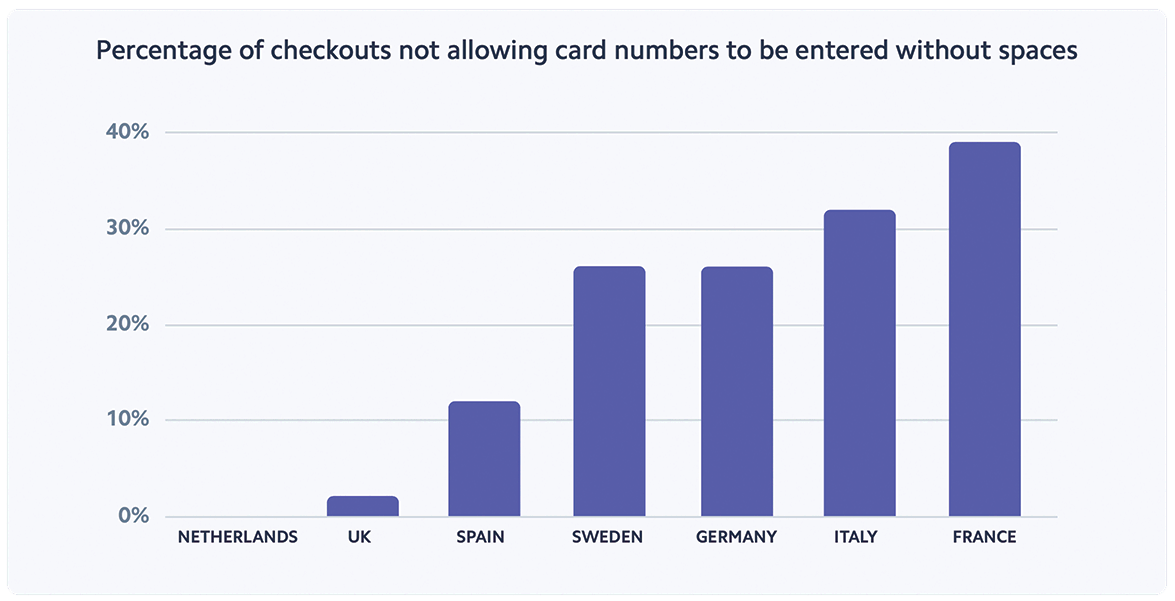

The number of checkouts that did not enable card numbers to be entered without spaces differed the most.

Checkouts in the Netherlands performed the best, with all checkouts we analysed allowing the card number to be entered without spaces. Checkouts in the UK and Spain also performed well, with only 2% of UK checkouts and 12% of Spanish checkouts not accepting card numbers without spaces. Checkouts in France performed the worst, with 39% not accepting card numbers without spaces. Checkout flows in Sweden, Germany, and Italy were somewhere in the middle, at 26%, 26%, and 32%, respectively.

Why it matters

A poorly designed checkout form puts an unnecessary burden on customers. They want clicking “Pay” to be the final step in the purchase journey and don’t want to have to go through the form twice to fix basic errors. They also want checkout forms that adapt to their preferences. For example, customers should be able to enter card numbers how they want (with or without spaces) and not encounter any errors. (It is recommended, however, to allow card numbers to be entered with spaces or visually separated into groupings of four digits for easier data validation.) Not only do examples like this add unnecessary friction, they can also lead to lost sales. A 2020 Baymard Institute survey found that 21% of respondents blamed a long and complicated checkout process as the reason for abandoning an order.

Checklist: How to design the best-performing checkout forms

- Highlight payment information errors in real time, before customers click “Checkout” or “Pay;” UI patterns like a red exclamation point or a green check mark can quickly communicate this at a glance.

- When there is a mistake in the form, use descriptive and specific error messaging. Clearly identify what the error is, whether it’s an invalid card number or an expiration date in the past.

- Make sure your checkout form can accept and autofill information saved in a customer’s browser rather than asking them to reenter their details.

- Automatically display an icon for the card brand (like Visa or Mastercard) after the card number is entered.

Mobile optimisation

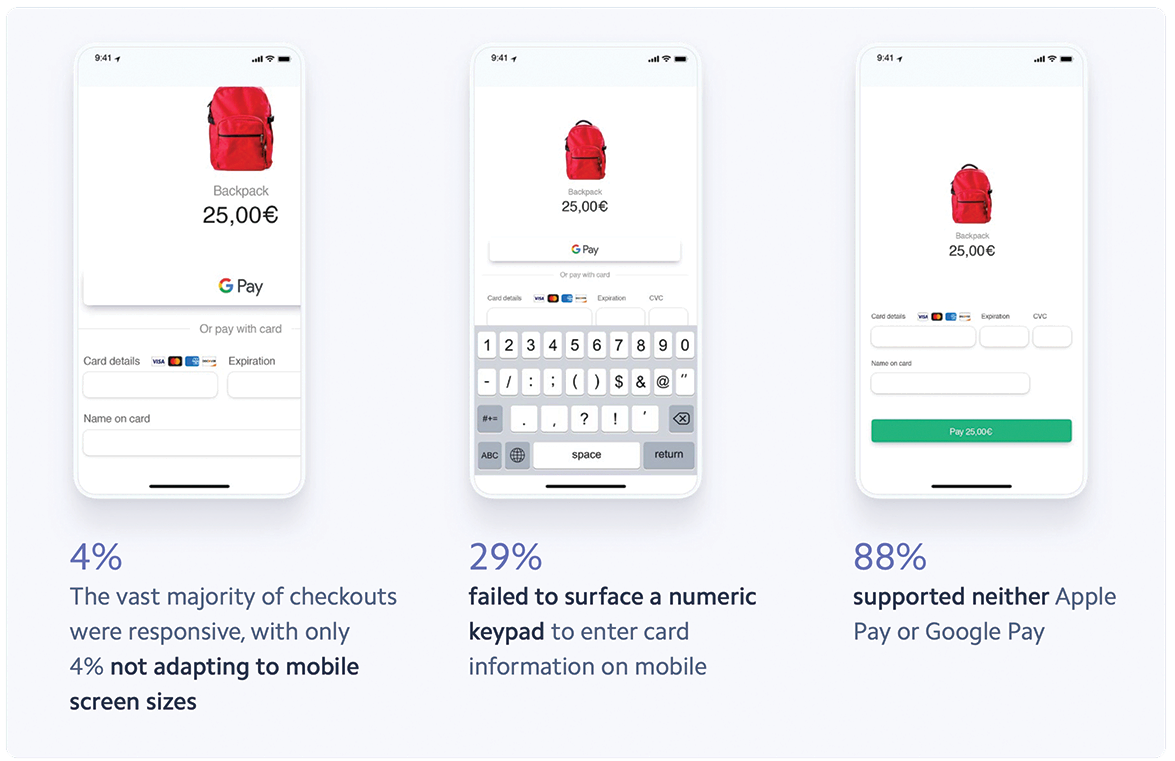

Ninety-six percent of checkouts were designed to adapt to mobile screen sizes, but only 12% supported mobile wallets.

Checkouts in Sweden were the most likely to optimise for mobile, with every single checkout we analysed being both responsive as well as surfacing a numeric keypad to make entering card details easier on mobile.

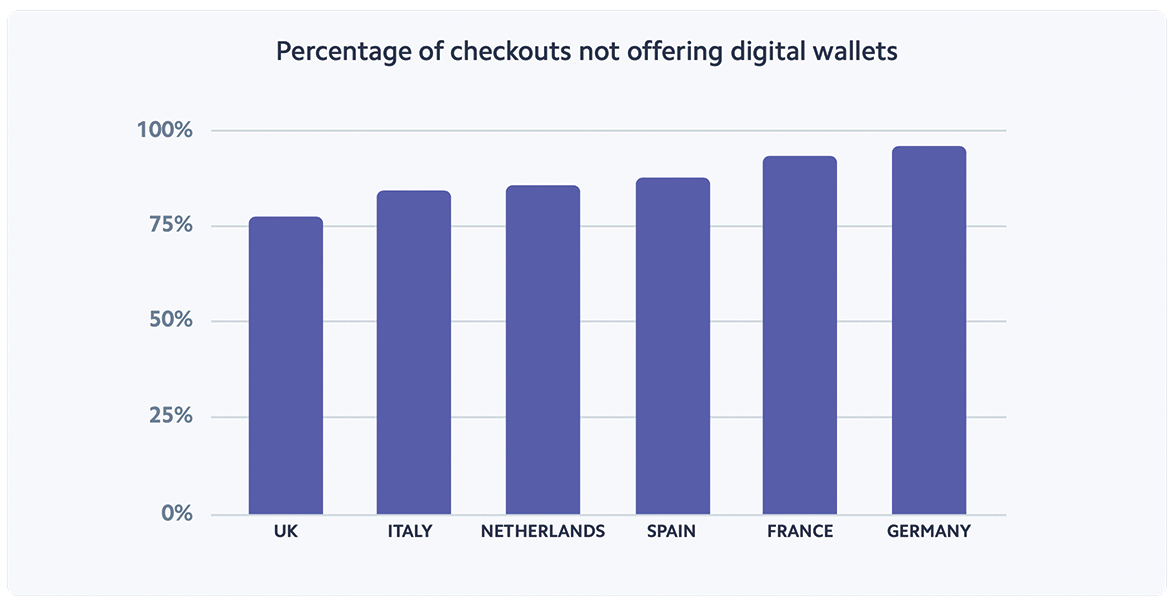

Checkouts in the UK performed the best in terms of digital wallet support, with 22% offering Apple Pay or Google Pay (the highest percentage among all analysed countries). German checkouts performed the worst, with only 4% of checkouts supporting digital wallets (likely because these wallets were introduced more recently in Germany).

Why it matters

Customer expectations are different on mobile than on desktop. For instance, if you present customers with a checkout form that doesn’t automatically adjust to the size of their device, they’ll be more likely to abandon the checkout flow completely. In fact, a separate Stripe analysis found that while more than 50% of ecommerce traffic comes from smartphones, carts are abandoned on mobile at more than twice the rate of desktop.

Digital wallets like Apple Pay or Google Pay allow for a convenient one-click payment experience on mobile, and continue to grow in popularity. Looking at Stripe data, we found that 26% of European customers paying through Stripe Checkout have set up either Apple Pay or Google Pay on their device or browser.

Checklist: How to optimise for mobile

- Ensure your form automatically resizes to the smaller screen.

- Display a numerical keypad when customers are prompted to enter their card information.

- Offer mobile wallet payment methods, like Apple Pay or Google Pay, and ideally only surface them if you know they have been set up by your customer and are usable on their current device.

Localisation

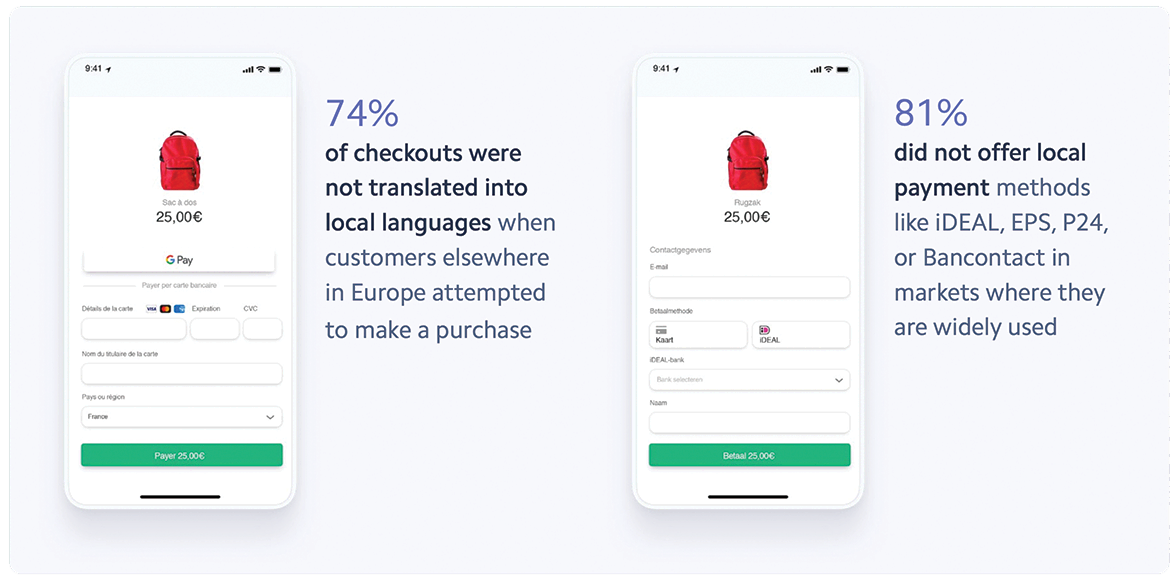

The majority of checkouts were not translated into other languages and did not offer the most relevant payment methods for international customers.

Spanish checkouts were the least likely to be localised for other European markets: None of the checkouts we analysed were translated into local languages when customers elsewhere in Europe attempted to make a purchase or offered local payment methods.

Checkouts in the Netherlands were the most likely to be translated into other languages, but lacked local payment methods. Almost half of checkouts, 55%, supported iDEAL as a payment method, one of the most popular payment methods in the Netherlands. This underscores the importance of iDEAL for Dutch businesses, allowing them to create the most relevant payment experiences for their Dutch customers. However, 86% of checkouts in the Netherlands still failed to surface other local payment methods like Bancontact, EPS, or P24.

Why it matters

Not translating your checkout to the language of your customers or offering popular local payment methods could cut off entire countries from your addressable market, leading to lost sales. For example, only 40% of European online payments are made using debit or credit cards—bank transfers are the most popular payment method in Germany, and almost one-third of Italian customers prefer to pay with a digital wallet.

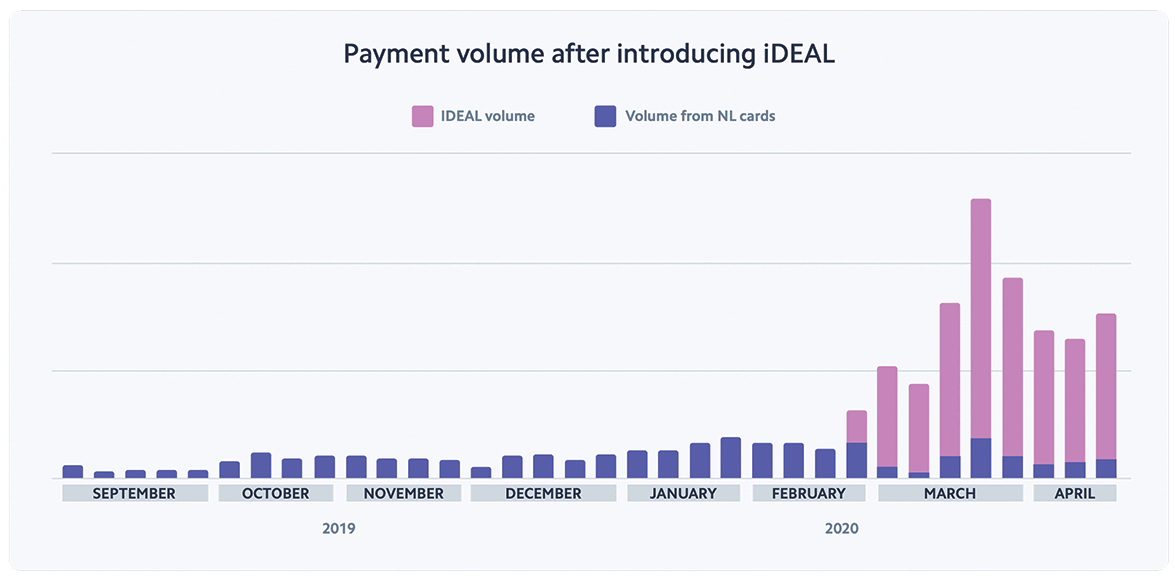

We’ve seen the impact that local payment methods can have on checkout conversion. In a separate Stripe study, we analysed payment volume from three Hong Kong-based businesses that sell into the Netherlands.

Once these companies enabled iDEAL as a payment method, which is the most popular payment method among Dutch customers, payment volume from the Netherlands increased by 79%.

Checklist: How to localise your checkout experience

- Identify the top countries into which you want to sell and make sure you localise the checkout experience by translating the page.

- Change the fields to capture the right information for each country. For example, if your form recognises a UK card, you should dynamically add a field for postcode. On the other hand, if your form recognises an American card, you should change that field to ZIP code.

- Dynamically surface the right payment methods in your checkout depending on where your customers are located.

How Stripe can help

Our analysis shows that basic checkout issues are widespread, even among the top companies across Europe that likely have dedicated teams focused on conversion rates.

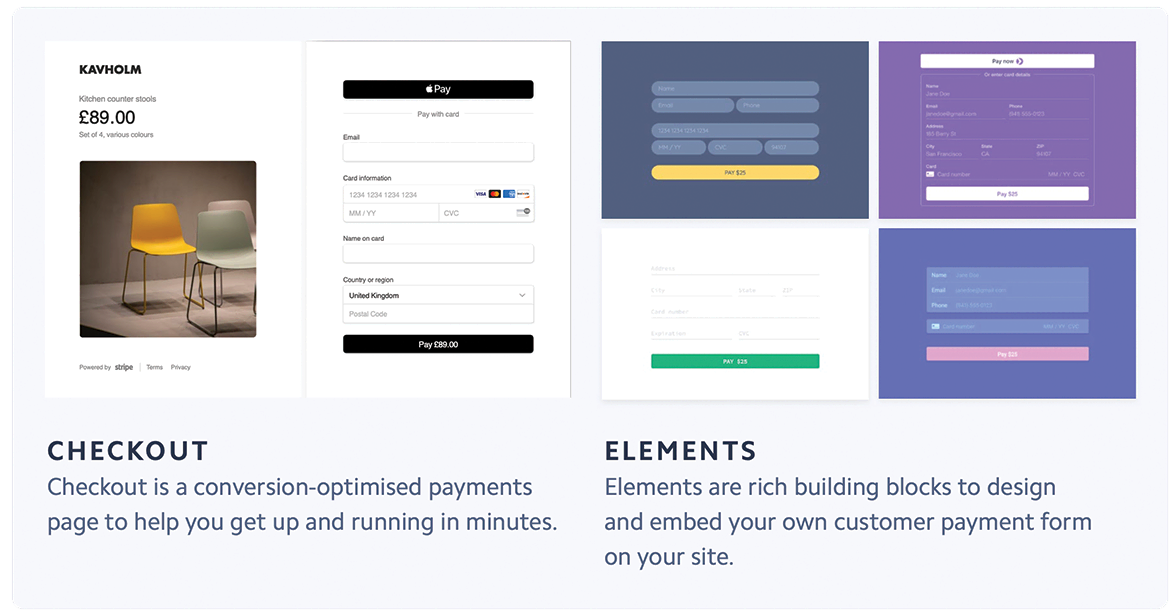

When optimising your own checkout flow, you could try to prevent issues on your own and divert development resources to focus solely on your checkout experience. Or, you could leverage a prebuilt, hosted payments page like Stripe Checkout.

Stripe Checkout was designed with conversion best practices in mind, allowing businesses of all sizes to design seamless checkout flows that are optimised for mobile and cater to an international audience. It combines all of Stripe’s front-end, design, and analytics expertise to offer a seamless payments experience, allowing you to integrate in minutes to securely accept payments.

- Designed to reduce friction: Stripe Checkout uses descriptive error messages to make it clear which information needs to be updated, allows customers to autofill card information they’ve stored in their browser, validates card numbers in real time, and prevents users from accidentally selecting expiration dates in the past.

- Optimised for mobile: The checkout form is designed to be fully responsive and work across any device. It displays a numeric keypad to make it easier for customers to enter their card information and comes with Apple Pay and Google Pay built in, without any additional registration or domain validation required. And, Stripe Checkout will only surface mobile wallets when Stripe knows that they’ve been correctly set up by your customer.

- Built for global: Stripe Checkout supports 30+ languages so your customers around the world can see the checkout form that’s right for them. You can decide which local payment methods to surface or rely on Stripe to dynamically display the right payment methods based on IP, browser locale, cookies, and other signals. The checkout form is also able to trigger 3D Secure and can handle European SCA requirements by dynamically applying card authentication when required by the cardholder’s bank.

If you would like to build your own custom checkout form, you can use Stripe Elements, a set of rich, prebuilt UI components. Like Stripe Checkout, Stripe Elements also offers mobile optimisation, real-time validation, autofill, localisation, and front-end formatting. Learn more about Stripe Elements.

Methodology

In conducting the analysis in this report, Stripe selected the top 50 ecommerce websites in the UK, France, Italy, the Netherlands, and Spain, and the top 100 websites with card options in Sweden and Germany, based on the Alexa ranking for the specific country. Adult entertainment platforms or online gambling websites were not included in the analysis. After determining the relevant websites, each one was tested for predefined errors by placing a product in the shopping cart to simulate an online purchase and in some cases, using a VPN to complete the checkout process as customers based in different countries. Checkouts were tested for a total of 11 errors related to checkout form design and mobile optimisation. Checkouts were also evaluated on additional optimisation opportunities, like whether they supported digital wallets and local payment methods in markets where they are widely used, and whether they were translated into local languages when customers elsewhere in Europe attempted to make a purchase. Checkouts in the UK, France, Italy, Spain, and the Netherlands were tested for all errors and optimisation opportunities. Checkouts in Germany were tested for checkout form design, mobile optimisation, and whether they supported digital wallets. Checkouts in Sweden were tested for checkout form design and mobile optimisation.