Bank debits—such as ACH Direct Debit, Bacs Direct Debit, BECS Direct Debit, pre-authorized debits in Canada, and SEPA Direct Debit—can lower transaction costs, reduce payment failures, and decrease the risk of fraud and chargebacks. Direct debits vary by country, but most are used by businesses collecting recurring payments and by retail and services companies that want a low-cost alternative to cards for large payments, like rent or tuition.

Unlike bank credit transfers or wire payments that require customers to initiate the payment from their bank account, bank debits allow a business to directly pull funds from the customer’s account (with their permission). For example, a B2B software company could automatically collect their monthly $3,000 subscription fee from a customer. The company would get the customer’s permission to debit their account, allowing them to pull funds for future payments without requiring the customer to authorize each subsequent payment.

This guide covers the basics of bank debits. You’ll learn how they work, how to choose a provider, and how Stripe can help.

How bank debits work

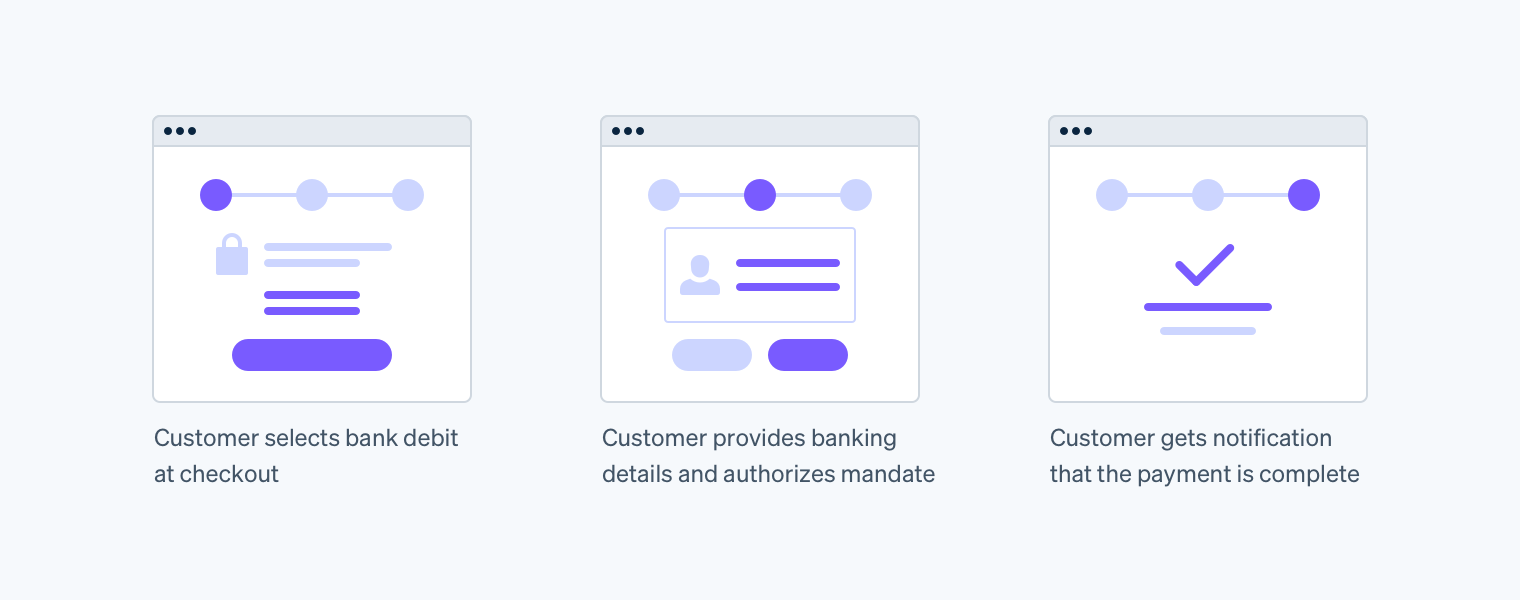

Bank debits are typically presented as one payment option during checkout, alongside credit cards and other payment methods. To initiate a bank debit, customers enter their bank account details, such as their name and address. Most importantly, customers have to give you permission to debit their account, referred to as a “mandate” or “authorization.” This allows you to automatically pull funds from their account. Some bank debit methods also require you to notify customers of future payments in advance.

Payment flow for bank debits

To initiate a direct debit payment, you submit a debit request to your bank or through a payment provider. The request is processed and funds are settled between two and six business days.

Disputes are far less likely to occur with bank debit methods, as customers are required to authorize payments in advance by agreeing to a mandate. However, dispute policies are generally less favorable to businesses compared to cards: Some bank debit schemes honor all customer disputes and take funds back from the business, while others only allow customers to file a dispute for an incorrect or unauthorized payment.

Instant verification vs. micro-deposits

Before debiting a customer’s account, it is recommended, and sometimes required, that you verify the bank account information entered during checkout to prevent fraud and reduce payment failures. In the US and Canada, you can do this instantly, using an instant verification service, or manually via micro-deposits.

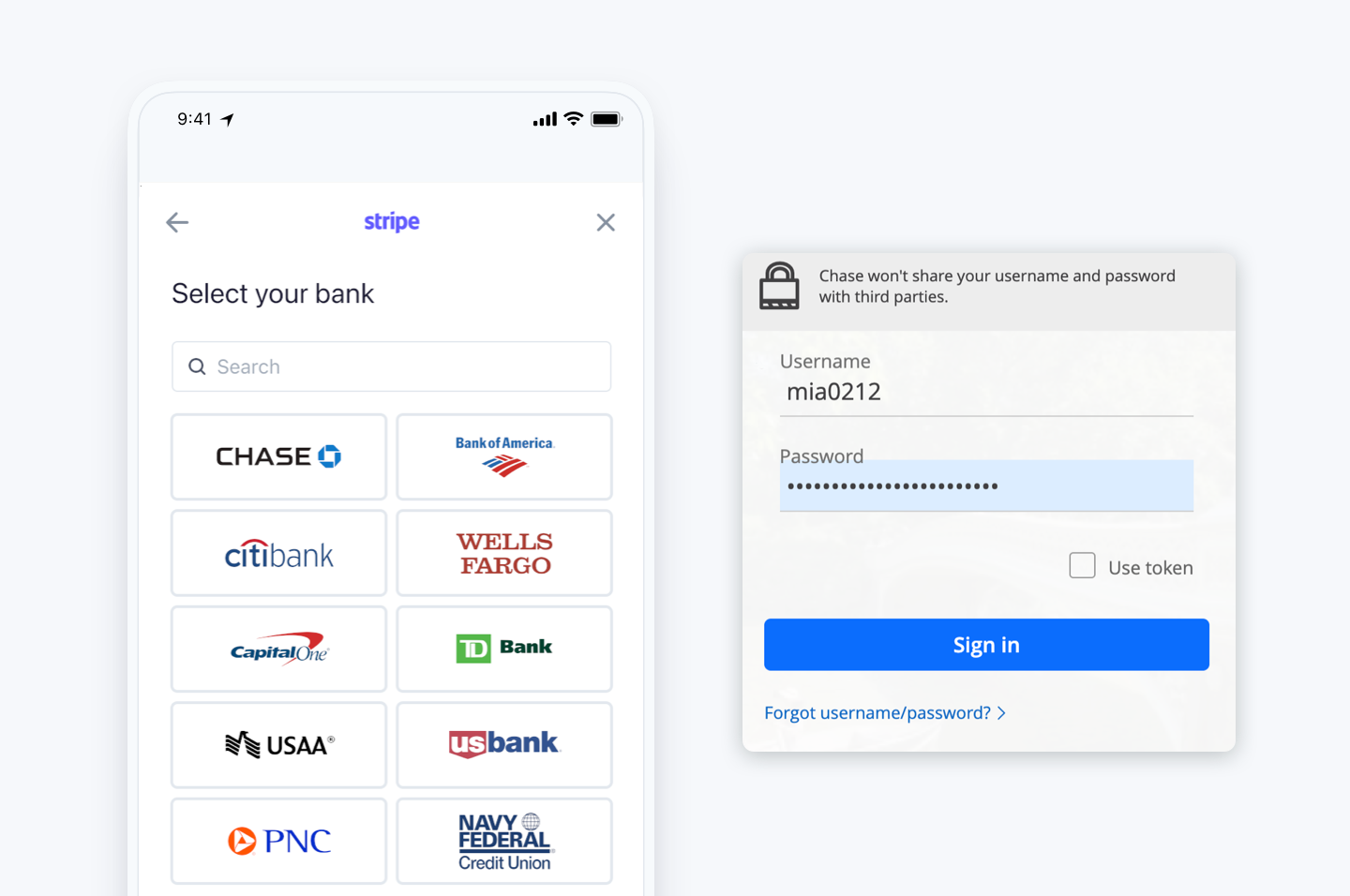

An instant verification service allows you to verify a customer’s bank account in seconds. During the checkout flow, customers are prompted to select their banking institution and enter their account credentials to verify the account. Customers can complete this verification process entirely from within your checkout experience.

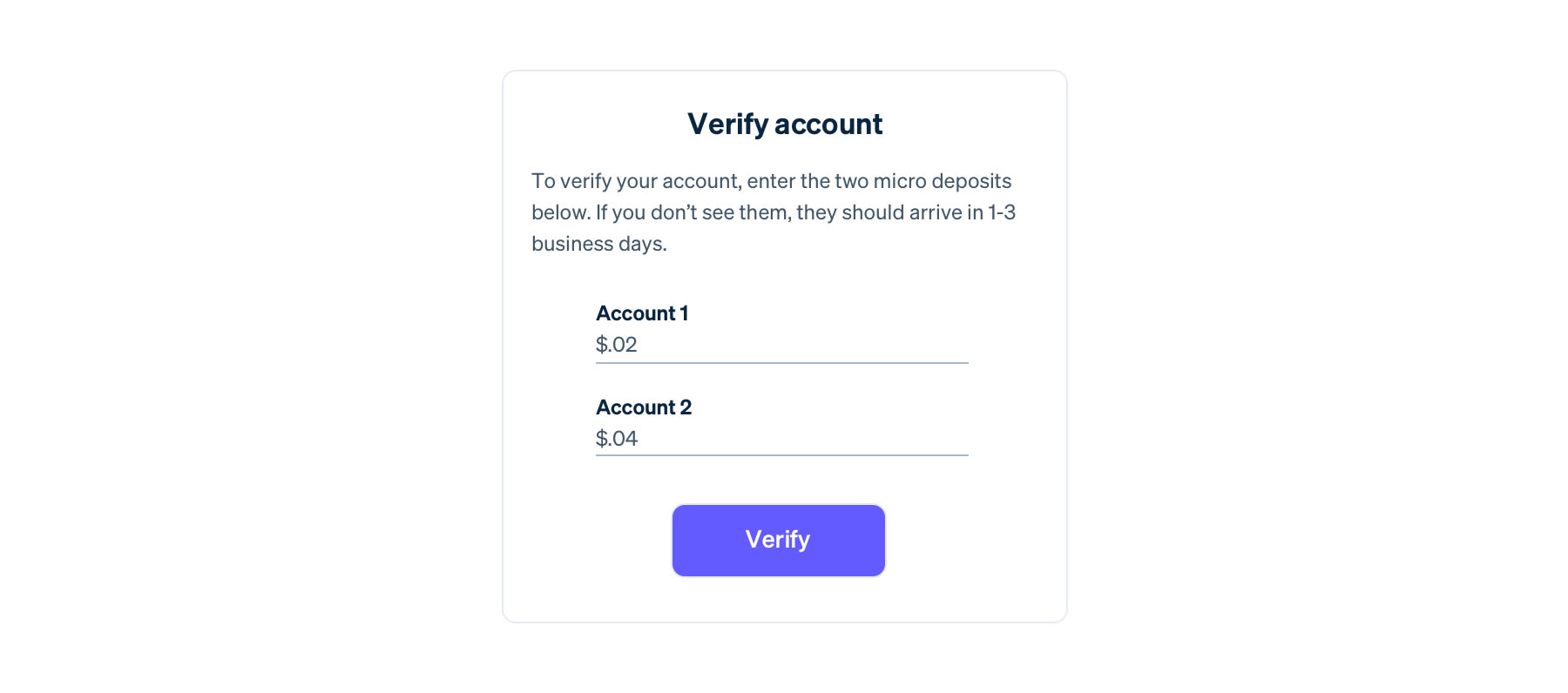

On the other hand, micro-deposits require you to manually send two small deposits to your customer’s bank account. These micro-deposit transfers can take one to two business days to appear. Once they have been received, your customers are sent a link to verify the micro-deposit amounts. This confirms that your customer does in fact have access to that bank account and the associated funds.

Additional ways to improve bank debit security and reliability

While bank account validation is important for confirming that an account is open and legitimate, you may also want to use additional layers of protection against fraud and payment failures.

For example, some verification services let you check a customer’s account balance before initiating debits, to ensure there are sufficient funds for the transaction. You can also retrieve data about the bank account owner, such as their name and address, to confirm it matches the information you have about the customer making a payment. This can help prevent fraud due to stolen login credentials and reduce costly disputes related to unauthorized debits.

Even when your business has verified a bank account and has confirmed the account owner’s information, you might also want to protect against a fraudster who has opened a legitimate bank account for fraudulent purposes. Some instant-verification solutions can also help you understand the risk of accepting debits from an account with suspicious patterns of activity. For example, you might flag a payment from an account that was recently opened, funded with a few large wire transfers, and then immediately used to make expensive purchases at luxury retailers.

Taking these additional steps can help improve the security and reliability of bank debits, and these measures are generally possible when you verify bank accounts instantly rather than via micro-deposits.

Benefits of bank debits

Bank debits give you the ability to reuse a customer’s payment credentials to initiate payments on a custom schedule, without requiring any action by your customers. By offering bank debits, you can:

Reduce payment failure and involuntary churn: Bank debits pull funds from your customer’s bank account, without further action from customers. And, unlike cards, bank accounts don’t expire or get canceled, reducing the rate of payment failure and preventing involuntary churn for recurring revenue businesses.

Decrease the risk of fraud and chargebacks: As a general rule, the better the level of customer authentication, the lower the likelihood of fraudulent and disputed payments. In addition to requiring a customer mandate, bank account verification for bank debits can help minimize fraudulent payments.

Decrease transaction costs: Payment methods have inherently different cost structures, with some incurring higher fees than others to cover credit risk. Bank debits are routed through bank networks, helping to lower transaction fees.

Best practices for managing risk

While bank debits can help capture more payments successfully and lower costs, it may not be a good fit for certain types of businesses. Unlike cards, bank debits can take several days before payments are confirmed, so this could introduce revenue risk for businesses that deliver goods or services within days of the payment being initiated (most payment failures occur within the first five days). To minimize potential losses, it is recommended to wait at least five days after the payment is initiated before delivering goods or services and to clearly communicate payment terms with your customer.

When you refund a debit payment, it is sometimes processed as a credit to your customer's bank account. This means a customer could still see and initiate a dispute on the original debit payment, even once a refund has been issued. It's important to communicate with customers about whether you have initiated a refund and the timeline for the refund.

Comparison of global bank debit methods

Find relevant bank debit methods by reviewing the profiles of Stripe-supported options below. You can also see which payment methods are available for your account by visiting the Dashboard.

|

付款方地域限制

|

支持的货币

|

支付确认与提现

|

争议政策

|

|

|---|---|---|---|---|

|

ACH 直接借记

|

美国 | 美元 (USD) | 4 个工作日 | 自扣款日起,客户有 60 天,企业有 2 天时间申报异常交易 |

|

Bacs 直接借记

|

英国 | 英镑 (GBP) | 3 个工作日 | Bacs 争议处理无限期追溯政策 |

|

BECS 直接借记

|

澳大利亚 | 澳元 (AUD) | 3-4 个工作日 | “无理由争议”最长追溯 7 年 |

|

BECS 直接借记

|

新西兰 | 新西兰元 | 2-3 个工作日 |

如果发起人未能发出书面通知,或者如果扣款金额或日期与通知中规定的不一致则为自提款之日起 120 天。 若未授权扣款,则为 9 个月。 |

|

加拿大预授权借记

|

加拿大 | 加元,美元 | 2-3 个工作日 | 自提款日起,有 90 天时间申报错误或未授权交易 |

|

SEPA 直接借记

|

奥地利、比利时、保加利亚、克罗地亚、塞浦路斯、捷克共和国、丹麦、爱沙尼亚、芬兰、法国、德国、希腊、匈牙利、冰岛、爱尔兰、意大利、拉脱维亚、列支敦士登、立陶宛、卢森堡、马耳他、摩纳哥、荷兰、挪威、波兰、葡萄牙、罗马尼亚、圣马力诺、斯洛伐克、斯洛文尼亚、西班牙、瑞典、瑞士、英国 | 欧元 (EUR) | 5 个工作日 | 客户在交易后 8 周内发起的争议将自动获得支持。8 周后至 11 个月内,客户仍可对未经有效授权的交易提出争议。13 个月后不可再发起争议。 |

Learn about Stripe’s pricing for bank debit payment methods.

ACH Direct Debit

Direct debit payments on the Automated Clearing House (ACH) network, or ACH Direct Debit, allow you to collect funds from your customers’ US bank accounts. The ACH network processed more than 14 billion debit transactions in 2019.

Start accepting ACH Direct Debit

Bacs Direct Debits

Bacs Direct Debits is a bank transfer payment method that accounts for 14% of the market share in the United Kingdom. It is also the most popular method for sending and receiving recurring payments. In fact, 90% of UK customers use Bacs Direct Debit to pay some or all of their regular bills and recurring payments.

Start accepting Bacs Direct Debit

BECS Direct Debit

Bulk Electronic Clearing System (BECS) is an Australia-based payment method administered by the Australian Payments Network for electronic debit and credit payment instructions. It accounted for 19% of non-cash transaction value in Australia in 2018.

Start accepting BECS Direct Debit

Pre-authorized debits

Pre-authorized debits (PADs) are used to collect direct debit payments from customers in Canada. In 2019, more than C$876 billion was processed through bank debits. There are strict requirements about what needs to be mentioned in the PADs agreement to authorize a transaction.

Start accepting pre-authorized payments

SEPA Direct Debit

The Single Euro Payments Area (SEPA) is an initiative of the European Union to simplify payments within and across member countries. They established and enforced banking standards to allow for the direct debiting of every Euro-denominated bank account within the SEPA region, facilitating more than 20 billion transactions every year. In some European countries, such as Germany, SEPA Direct Debit is more popular than cards for online transactions.

Start accepting SEPA Direct Debit

How Stripe can help

Companies around the world use Stripe to accept multiple payment methods—including bank debits—and simplify global operations. Stripe makes it possible to accept direct debit options in minutes with a single integration. Stripe offers:

Fast and seamless integration options

The entire Stripe product suite comes with built-in global payment support so you can create the most relevant payment experiences for your customers.

Stripe’s Payments API makes it easy to support multiple payment methods through a single integration. This leaves you with a unified and elegant integration that involves minimal development time and remains easy to maintain, regardless of which payment methods you choose to implement. Bank debits on Stripe also work with Stripe Billing to automate your recurring billing workflow.

Supporting diverse payments experiences for global customers is even easier with Stripe Checkout, Payment Element, and Invoicing. With any of these UIs, you can add payment methods with one click in your Stripe Dashboard and rely on Stripe to dynamically display the right payment methods and language based on IP, browser locale, cookies, and other signals.

Platforms and marketplaces can use Stripe Connect to accept money and pay out to third parties. Your sellers or service providers benefit from the same streamlined Stripe onboarding and get instant access to select payment methods.

Built-in instant verification

ACH Direct Debit and pre-authorized debits on Stripe come with built-in instant verification, as well as hosted micro-deposit verification as a fallback. This makes it easy to verify bank accounts without having to integrate with a third-party service. Customers simply input their banking credentials, and their accounts are verified in seconds.

In addition to instantly verifying bank accounts for ACH Direct Debit, Stripe Financial Connections also lets your customers securely share their financial data with you. This can help you minimize payment failures and fraud by confirming bank account balances and ownership before initiating debits.

Compliance

In addition to built-in verification options, Stripe handles mandate collection and debit notification emails for you, making it easy to stay compliant with debit scheme rules. Mandates and notifications automatically reflect the payment terms you specify.

No paperwork

Eligible businesses can accept any of these bank debits options with Stripe in minutes—there is no additional application, onboarding, or underwriting process to get started. Find out which bank debits options you are eligible for by visiting the Dashboard.

Unified monitoring and reporting

Payments made with any payment method, including bank debits, appear in the Stripe Dashboard, reducing operational complexity and allowing for lightweight financial reconciliation. This enables you to develop standardized processes for typical operations such as fulfillment, customer support, and refunds.

For more information on supporting bank debits with Stripe, read our docs or contact our sales team. To start accepting payments right away, sign up for an account.