Att förstå internationella skatteregler kan te sig skrämmande för många företag, särskilt de som expanderar sin verksamhet över nationsgränserna. Ändå är internationell beskattning en viktig aspekt som kan bidra till ditt företags ekonomiska hälsa och anseende. En komponent som du kan stöta på när du hanterar källinkomst i USA och internationell beskattning är skatteformuläret W-8. Även om det kan verka som ännu en blankett från IRS är det ett viktigt dokument för företag.

Oavsett om du är ett etablerat multinationellt företag eller ett nystartat företag som ger dig in på nya marknader kan det vara bra att förstå W-8-formulär så att du kan säkerställa att ditt företag följer amerikanska skatteregler. Det kan också hjälpa dig att använda skatteavtalsförmåner, vilket potentiellt kan spara dig betydande summor pengar.

Nedan tar vi en närmare titt på vad W-8-formulär är, de olika typerna av W-8-formulär, vem som behöver deklarerar dem och hur Stripe kan hjälpa företag att förenkla hanteringen av skatteformulär, inklusive W-8-formulär.

Vad innehåller den här artikeln?

- Vad är ett W-8-formulär?

- Typer av W-8-formulär

- Vem behöver lämna in ett W-8-formulär?

- Så här lämnar du in W-8-formulär

- Så kan Stripe hjälpa dig

Vad är ett W-8-formulär?

Ett W-8-formulär är ett dokument som den amerikanska skattemyndigheten Internal Revenue Service (IRS) kräver att utländska enheter – individer och företag – fyller i om de har finansiella transaktioner i USA. Det här formuläret bekräftar att de inte har skattehemvist i USA och är avgörande vid hantering av amerikanska källinkomster för dessa enheter – vilket inkluderar inkomster från källor som amerikansk fastighetsuthyrning eller aktieutdelning från amerikanska företag.

Formuläret gör det också möjligt för dessa enheter att göra anspråk på att vara berättigade till reducerad eller helt befriad från amerikansk källskatt, som dras av från olika inkomsttyper som betalas ut till de som inte har hemvist i USA. Detta är möjligt på grund av de skatteavtal som USA har med många länder, som syftar till att förhindra dubbelbeskattning för skattebetalare utomlands. Genom att fylla i W-8-formuläret korrekt intygar utländska juridiska personer att de inte är i USA och, i förekommande fall, drar nytta av skatteavtalet mellan deras land och USA. Därför är W-8-formuläret en viktig del för att säkerställa efterlevnad a internationella skatteregler och navigera det invecklade amerikanska skattesystemet.

Typer av W-8-formulär

W-8-formuläret är inte ett enda, enhetligt dokument, utan en serie formulär som är utformade för att tillgodose olika situationer, från utländska individer som tjänar pengar i USA till internationella organisationer eller utländska regeringar som har USA-baserade finansiella affärer. Se till att du väljer rätt formulär för att representera din status, eftersom det kan påverka skattebeloppet som innehålls eller till och med resultera i befrielse.

Det finns flera versioner av W-8-formuläret och var och en har olika syften:

W-8 BEN är ett dokument som används av utländska privatpersoner, t.ex. en frilansare i Tyskland som tillhandahåller tjänster till ett företag i USA, för att bekräfta att hen inte har skattehemvist i USA. Detta hjälper dessa personer att dra nytta av skatteavtalsförmåner som kan minska deras amerikanska skatteskuld. Dessutom använder de detta formulär för att bekräfta att de är den rättmätiga mottagaren av den inkomst de får, vilket är särskilt relevant när det kommer till inkomster som aktieutdelning, royalties eller ränta.

Formulär W-8 BEN-E har ett liknande syfte men är avsett för utländska juridiska personer, inte enskilda personer. Till exempel skulle ett nystartat teknikföretag i Indien som tillhandahåller programvarutjänster till ett amerikanskt företag använda det här formuläret för att bekräfta sin utländska status. Om Indien och USA dessutom har ett skatteavtal som ger förmåner till sådana företag, kan företaget göra anspråk på dessa förmåner med hjälp av detta formulär.

Formulär W-8 IMY är avsett för mellanhänder, vilket kan vara enheter eller individer som agerar på uppdrag av någon annan. Om en kanadensisk börsmäklare till exempel förvaltar amerikanska värdepapper för kanadensiska investerare, skulle denna mäklare använda formulär W-8 IMY för att deklarera sin mellanhandsstatus och för att hantera skattskyldigheten för inkomsten från dessa värdepapper.

W-8 EXP används av utländska regeringar, internationella organisationer och liknande enheter. Till exempel skulle en utländsk myndighet som får ränteintäkter från investeringar i USA använda det här formuläret för att bekräfta sin status och för att göra anspråk på eventuella undantag från källskatt i USA som gäller enligt amerikansk skattelagstiftning eller internationella avtal.

Formulär W-8 ECI är avsett för utländska fysiska eller juridiska personer som gör anspråk på att deras inkomst är direkt kopplad till amerikansk handel eller affärsverksamhet. Ett exempel skulle vara en marknadsföringskonsult i Storbritannien som arbetar för ett amerikanskt företag med ett projekt som utgör en betydande del av konsultens inkomst. Med hjälp av detta formulär kan konsulten hävda att deras inkomst är "faktiskt kopplad" till ett amerikanskt företag, vilket gör att de kan beskattas med en skattesats som liknar amerikanska individer eller enheter snarare än att behöva betala den högre automatiska källskattesatsen för utländska enheter.

Varje formulär kräver att den som fyller i det tillhandahåller specifik information och det tjänar ett distinkt syfte i samband med amerikanska skattelagar och förordningar. På IRS webbplats finns mer detaljerade förklaringar av varje formulär och vägledning om när de ska användas.

Vem behöver lämna in ett W-8-formulär?

Vissa utländska individer och företag som tjänar inkomst från amerikanska källor måste lämna in ett W-8-formulär. Dessa formulär hjälper IRS att fastställa ett lämpligt skattebelopp att hålla inne från inkomsten. Vilken typ av W-8-formulär en individ eller ett företag behöver lämna in beror på deras specifika omständigheter.

Olika utländska entiteter – och deras specifika situation – kräver olika W-8-formulär:

Utländska naturliga personer (formulär W-8 BEN)

Icke-amerikanska personer som får vissa typer av inkomster från amerikanska källor – som ränta, aktieutdelning, hyra, royalties och vissa andra typer av inkomst – måste fylla i W-8 BEN. Formuläret används för att göra anspråk på eventuella tillämpliga förmåner enligt skatteavtal och för att verifiera att personen inte har skattehemvist i USA.Utländska företag (formulär W-8 BEN-E)

Det här formuläret är till för utländska juridiska enheter som tjänar inkomst från USA eller tar emot betalningar i egenskap av "verklig huvudman". Med verklig huvudman avses i detta sammanhang någon som har ekonomisk nytta av något men som tekniskt sett inte är ägare. Det är till exempel möjligt att den person som har den slutliga kontrollen över ett bankkonto inte står med på kontot som ägare. Den här personen är verklig huvudman. I ett annat exempel kan den verkliga huvudmannen vara ett utländskt företag som tjänar utdelning från ett amerikanskt företag. Det kan också avse ett utländskt partnerskap som bedriver verksamhet i USA. Till exempel skulle ett australiskt mjukvaruföretag som tjänar utdelning från ett amerikanskt företag eller ett italienskt modedesignpartnerskap som säljer produkter i USA använda det här formuläret, vilket gör det möjligt för dem att bekräfta sin utländska status och, om de är berättigade, göra anspråk på förmåner enligt ett amerikanskt skatteavtal.Utländska mellanhänder eller genomflödesenheter (formulär W-8 IMY)

Detta formulär är för utländska mellanhänder, utländska partnerskap eller utländska enkla truster eller förvaltartruster. Mellanhanden kan vara en mäklare eller ett ombud utanför USA som förvaltar amerikanska investeringar eller tar emot amerikanska inkomster för sina kunders räkning, till exempel en mäklarfirma i Hongkong som förvaltar amerikanska värdepapper för sina kunders räkning eller en schweizisk stiftelse som tar emot amerikanska intäkter för sina förmånstagares räkning. Genom att lämna in detta formulär gör dessa mellanhänder eller truster det möjligt att ta ut lämplig källskatt för sina kunder eller förmånstagare.Utländska regeringar, internationella organisationer eller utländska centralbanker (formulär W-8 EXP)

Dessa juridiska personer skickar in det här formuläret för att begära undantag från Foreign Account Tax Compliance Act (FATCA), om de är befriade, och för att intyga sin status i syfte att undvika vissa skatter enligt amerikansk skattelagstiftning. Ett exempel är en utländsk centralbank som får ränteintäkter från amerikanska statsobligationer. Det här formuläret hjälper sådana juridiska personer att intyga sin status och göra anspråk på eventuell befrielse från källskatt i USA i enlighet med amerikansk skattelagstiftning eller internationella skatteavtal.Utländska personer med "faktiskt kopplad inkomst" (formulär W-8 ECI)

Utländska personer med inkomster som är faktiskt kopplade till en amerikansk handel eller verksamhet måste lämna in det här formuläret. "Faktisk kopplad inkomst" (effectively connected income) kan omfatta viss inkomst från hyra och royalties, eller inkomster från ett handelsbolag som bedriver handel eller verksamhet i USA. Till exempel kan en brittisk skådespelare som medverkar i en film som produceras i USA få inkomster som anses vara faktiskt kopplade till en amerikansk handel eller verksamhet. Detta formulär gör det möjligt för skådespelaren att beskattas med samma graderade skattesatser som en amerikansk medborgare snarare än att behöva betala den fasta källskatt som vanligtvis gäller för utländska medborgare.

Men amerikansk skattelagstiftning är komplicerad och risken finns alltid att lagar ändras, vilket innebär att de scenarier som beskrivs ovan kanske inte omfattar alla situationer där ett W-8-formulär är nödvändigt. IRS tillhandahåller omfattande riktlinjer för varje formulär, men det kan fortfarande finnas omständigheter som inte uttryckligen tas upp. Om du fyller i ett W-8 BEN-formulär och kör fast är det bästa du kan göra att söka råd från en skatterådgivare som är specialiserad på amerikanska skattelagar och förordningar.

Så här lämnar du in W-8-formulär

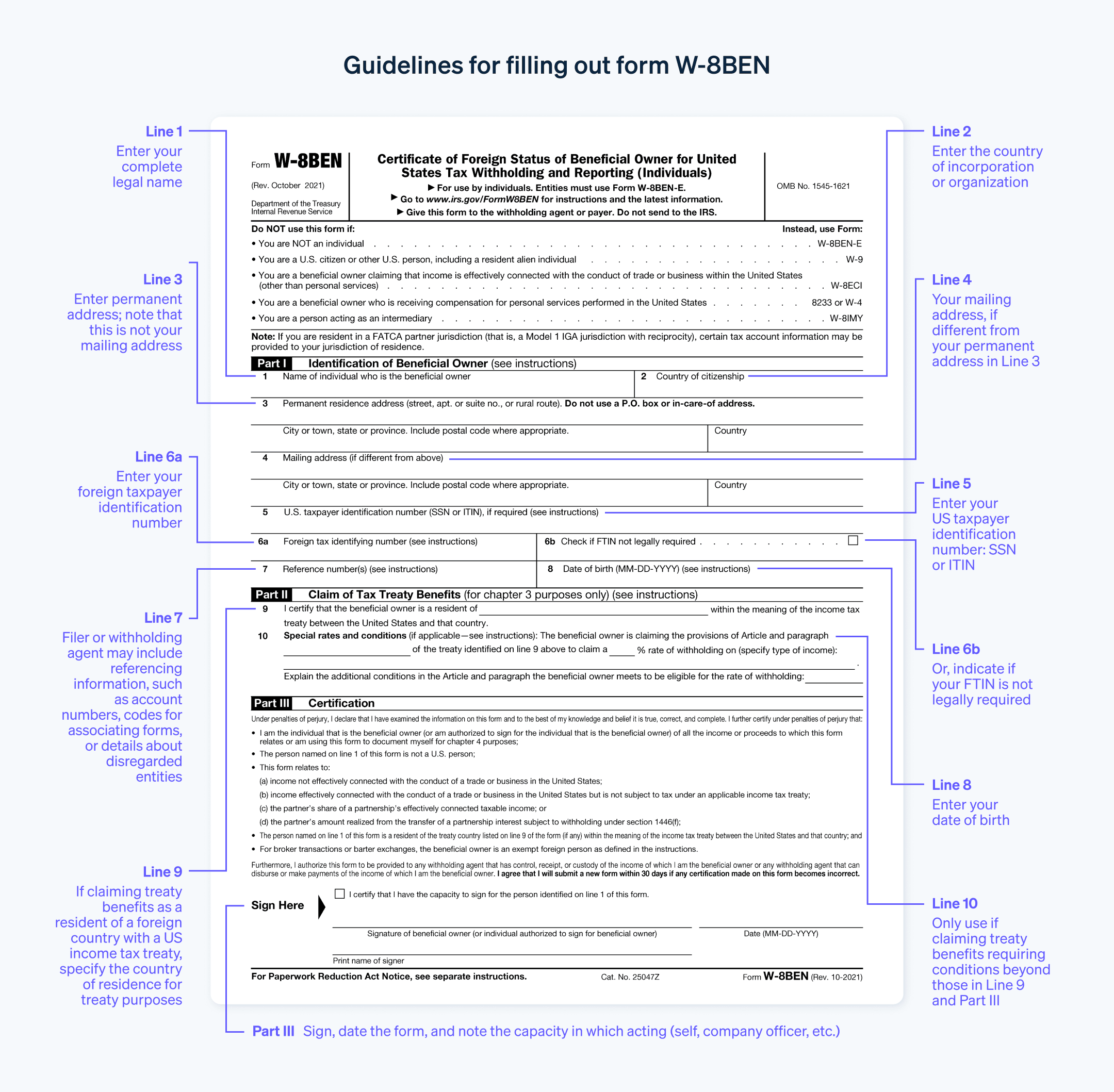

Inlämningen av ett W-8-formulär omfattar flera steg. Eftersom IRS använder dessa formulär för att fastställa det korrekta källskattebeloppet och som ett intyg på avtalsförmåner är det viktigt att fylla i dem korrekt. Här följer en guide om hur du lämnar in W-8-formulär:

Identifiera rätt formulär för dig: Som du ser finns det flera typer av W-8-formulär. Varje typ av formulär har olika syften. Steg 1 är att identifiera det formulär som passar din situation.

Ladda ner formuläret: Du kan ladda ner det W-8-formulär du behöver från IRS officiella webbplats. Det är viktigt att du har den senaste versionen av formuläret, eftersom IRS uppdaterar dessa formulär då och då.

Fyll i formuläret: Fyll i formuläret korrekt och fullständigt. Eventuella fel kan orsaka förseningar eller problem med behandlingen av formuläret. Följ IRS anvisningar för respektive formulär. Om du är osäker på någon aspekt av formuläret är det bäst att söka råd från en skatterådgivare.

Skicka in formuläret: Till skillnad från många andra skatteformulär skickas W-8-formulär vanligtvis inte direkt till IRS. Istället ges de till källskatteombudet eller källskattebetalaren, vilket kan vara banken, investeringsbolaget eller en annan organisation som du får inkomst från. Dessa enheter använder informationen på formuläret för att avgöra hur mycket skatt som ska dras från din inkomst och ansvarar för att vidarebefordra formuläret till IRS vid behov.

Förnya formuläret: W-8-formulär är giltiga i tre år. Efter denna period måste ett nytt formulär skickas in. Om dina förhållanden förändras väsentligt ska du fylla i ett nytt formulär även om treårsperioden ännu inte har gått ut.

Detta är en allmän guide och innehåller eventuellt inte all information som krävs i specifika situationer. När det gäller skatterelaterade frågor är det bäst att rådgöra med en skatterådgivare eller skatteexpert.

Så kan Stripe hjälpa dig

Stripe erbjuder en rad olika verktyg utformade för att effektivisera och förenkla företags ekonomiprocesser. Bland dessa verktyg finns Stripe Tax, en tjänst som är utformad för att automatisera beräkning och uppbörd av omsättningsskatt, moms och skatt på varor och tjänster (GST) för företag.

Stripe kan avsevärt minska den administrativa bördan för företag vad gäller W-8-formulär och internationell skatteefterlevnad. Så här kan Stripe hjälpa dig:

Automatiserad insamling av W-8-formulär

Stripe kan hjälpa till att samla in de nödvändiga W-8-formulären från kunder och leverantörer, vilket minskar mängden manuellt arbete som krävs för att säkerställa skatteefterlevnad. Stripes plattform begär automatiskt de nödvändiga formulären och validerar dem, vilket hjälper företag att uppfylla sina redovisningsskyldigheter och hantera risker förknippade med bristande efterlevnad.Förenklad skattedokumentation

Stripe har ett enkelt och användarvänligt gränssnitt där du kan spara all nödvändig skattedokumentation på ett och samma ställe. Detta inkluderar formulär som W-8 BEN eller W-8 BEN-E som behövs för internationell skatteefterlevnad.Punktliga påminnelser

Stripe erbjuder också påminnelser när W-8-formulär håller på att löpa ut (vanligtvis vart tredje år). Den här funktionen säkerställer att företag har uppdaterade skatteformulär till hands, vilket hjälper dem att undvika straffavgifter relaterade till ogiltiga formulär.Stöd för skatterapportering

Stripe Tax hjälper företag att förbereda sig för deklaration genom att göra det enklare att generera nödvändiga rapporter. Detta kan omfatta rapporter som beskriver inkomster som betalats till utländska enheter, vilket skulle vara nödvändigt för att uppfylla IRS rapporteringskrav relaterade till inkomsten som är källskattepliktig.

Genom att effektivisera processen för efterlevnad av skatteregler och tillhandahålla robust stöd för företag som navigerar internationella skatteförpliktelser kan Stripes verktyg vara en värdefull tillgång för företag som bedriver verksamhet över gränserna.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.