Business-to-business (B2B) sales in Japan require compliant invoices under the Qualified Invoice System (適格請求書等保存方式, also known as インボイス制度) in order for the business to claim a tax credit. You don’t need to issue invoices for business-to-consumer (B2C) sales. Registered businesses (適格請求書等発行事業者) can issue this type of invoice, and we recommend the below best practices to ensure you include the correct fields in both your invoices and receipts. Stripe invoices can be used as qualified invoice documents (適格請求書), and receipts can be used as simplified qualified invoice documents (適格簡易請求書).

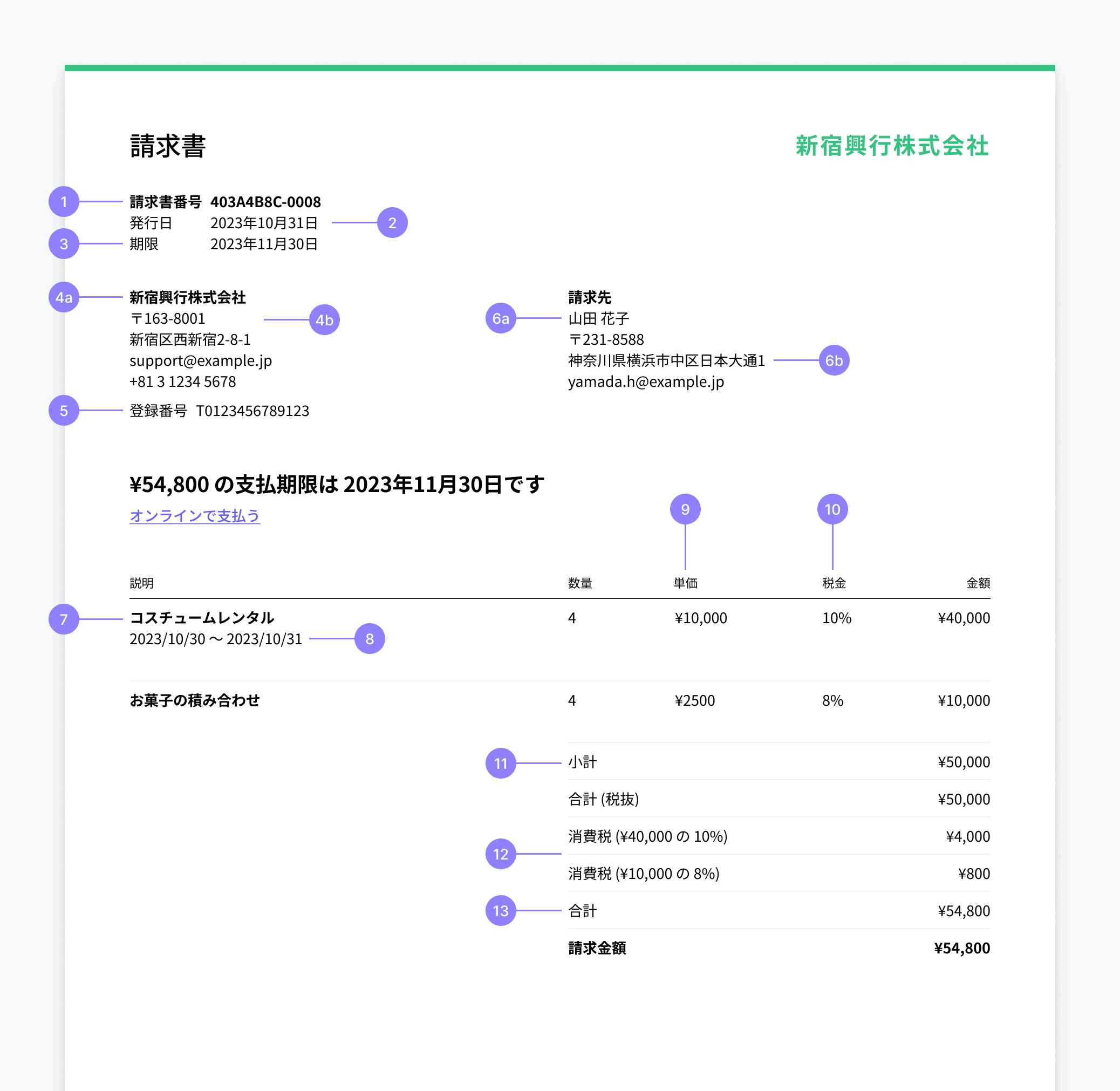

Invoices (適格請求書)

We don’t automatically populate all of the fields in your invoice, so a missed or improperly added field can render an invoice non-compliant. If you intend to use the Qualified Invoice System, make sure that you include the required fields when you prepare your invoices.

You can use tax calculation with Stripe Tax or Tax Rates to help you include tax information in your invoices.

The following table explains the ways that you can populate different invoice fields that align with the Qualified Invoice System. To make sure that your invoices are compliant and adhere to applicable geographic requirements, we recommend that you consult with your tax and legal advisors.

|

Key |

Field |

Requirements |

How to populate |

|---|---|---|---|

|

1 |

Invoice number |

There’s no requirement to show invoice numbers. |

Stripe populates this by default. You can change how invoices are numbered (customer or account level) in the invoice template. |

|

2 |

Date of issue |

You must use this field to list the transaction date (取引年月日), or set line item supply dates. |

Stripe populates this by default. |

|

3 |

Date due |

While there’s no requirement to display the date that a customer must pay an invoice by, it’s a best practice to do so. |

Stripe populates this by default. |

|

4a |

Business company name (適格請求書発行事業者の氏名又は名称) |

This is required. |

Stripe populates this by default from the value in the Public business information section of the Dashboard. |

|

4b |

Business company address |

There’s no requirement to display your address. |

Enter your support address under Public business information. You can also default to your business address as listed in your account settings. |

|

5 |

Business registration number |

Invoices require a business registration number (適格請求書発行事業者の登録番号). |

You must add your business registration number as JP TRN in your invoice settings. Then, each time you create an invoice, you must set it as your Tax ID under “Additional options.” |

|

6a |

Recipient name (書類の交付を受ける事業者の氏名又は名称) |

This is required. |

Stripe populates this by default from the “Customer details.” |

|

6b |

Recipient address |

There’s no requirement to display the recipient address. |

You can add this field by clicking the “Additional details” button when you first create a customer. |

|

7 |

Name of the good or service (取引内容) |

This is required. |

Stripe populates this by default from the invoice items. |

|

8 |

Invoice line item supply date (取引年月日) |

This is required when the supply date of individual line items is different from the invoice send date. |

You can display line item supply dates by clicking the toggle under “Item options.” |

|

9 |

Price of the good or service |

It’s considered a best practice to show the unit price, quantity, and total payable amount for each invoice line item. |

Stripe populates this by default. |

|

10 |

Invoice line item tax rate percentage |

This is required to indicate if an item is subject to the reduced tax rate (軽減税率). It’s sufficient to display the tax percentage amount for an invoice line item. You aren’t required to display the cash amount of the tax per invoice line item. |

Determine the tax to display on an invoice using either of the following methods:

|

|

11 |

Invoice subtotal (excludes tax) |

This is required. |

Stripe populates this by default. |

|

12 |

Total tax amounts and rates (税率ごとに区分して合計した対価の額、適用税率、消費税額) |

This is required and must include the total tax amount per tax rate. |

Stripe populates this by default. |

|

13 |

Invoice total (includes tax) |

This is required. |

Stripe populates this by default. |

Facilitate customer payment

After you set up your invoices to meet Japanese requirements,[1] you can facilitate customer payment by:

- Adding the most popular Japanese payment methods. By accepting a wider range of payment methods, such as bank transfers, you can lower your costs and increase conversions (especially with large customers).

- Using the Hosted invoice page.

- Localising your invoices to the language of your customers.

- Allowing a single invoice to be paid over multiple due dates. By reflecting a payment schedule, you can extend more flexible net terms or collect a deposit.

[1] If you provide a financial product or service, please consult with your legal advisors regarding applicable restrictions and requirements before setting up invoices. Instalment payments; lending; credit; and buy now, pay later services are subject to regulation in Japan, and you may need to register or obtain approvals before engaging in those services.

Refunds (適格返還請求書)

If you need to produce a refund document (適格返還請求書) for your customer, you can issue a credit note. If you’ve completed the steps above to create invoices with the necessary fields, such as your business registration number (適格請求書発行事業者の登録番号), the credit notes will also contain them.

Connect platforms

Make sure your connected account’s invoices contain the necessary information required by the Qualified Invoice System, such as the account’s tax ID and business details. You can configure the information shown on invoices and receipts that Connect creates.

If you use manual taxes on invoices, configure the taxes to round after subtotalling, rather than at the line item level. This setting applies to all invoices generated across your connected accounts and across different geographies.

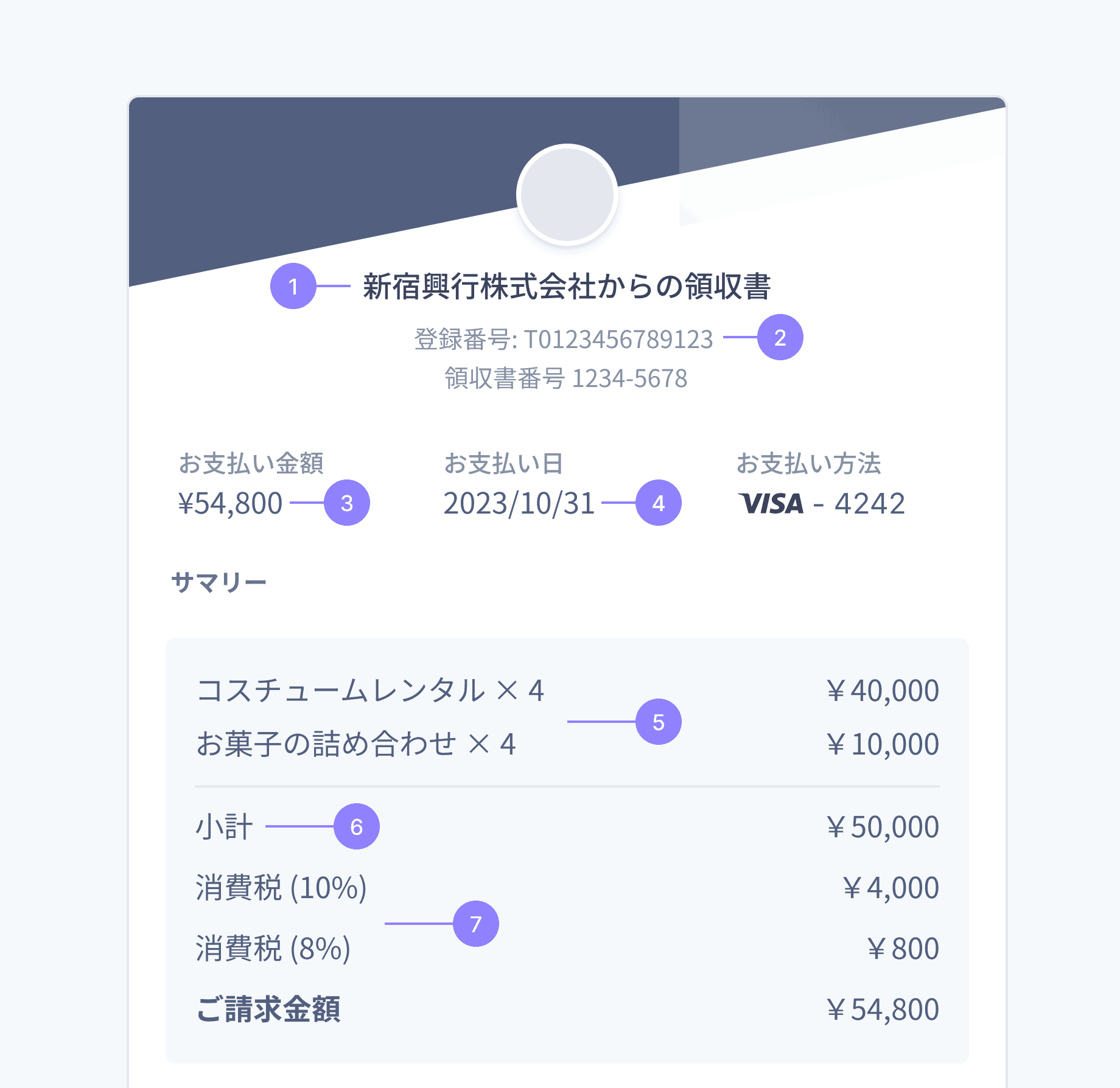

Receipts (適格簡易請求書)

We don’t automatically populate all of the fields on a receipt, so a missed or improperly added field can render a receipt noncompliant. Make sure that you include the noted fields when you prepare your receipts.

How to set receipt fields

The following table explains the ways that you can populate different receipt fields. To make sure that your receipts are compliant and adhere to geographic and business regulations, we recommend that you consult with your tax and legal advisors.

To include tax information in your recipients, you can use Stripe Checkout with Stripe Tax, or set Tax Rates yourself.

|

Key |

Field |

Requirements |

How to populate |

|---|---|---|---|

|

1 |

Business company name (適格請求書発行事業者の氏名又は名称) |

This is always required. |

Stripe populates this from the value in the Public business information section of the Stripe Dashboard. |

|

2 |

Business registration number |

Receipts acceptable as qualified invoices require a business registration number (適格請求書発行事業者の登録番号). |

Enable the option to show tax IDs on receipts in your customer email settings, and set your tax ID. |

|

3 |

Receipt total |

This is always required. |

Stripe populates this by default. |

|

4 |

Date of payment |

You must use this field as transaction date (取引年月日) or set line item supply dates. |

Stripe populates this by default. |

|

5 |

Name of the good or service (取引内容) |

This is always required. |

Stripe populates this by default from the Checkout line items. |

|

6 |

Receipt subtotal (excludes tax) |

This is always required. |

Stripe populates this by default. |

|

7 |

Total tax amounts and rates (税率ごとに区分して合計した対価の額、適用税率、消費税額) |

This is always required. |

You can determine the tax to display on a receipt by:

|

For more information on Stripe Invoicing, read our docs. To start sending invoices and accepting payments right away, reach out to our sales team.

Information is current as of 1 January 2025. The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the guide. You should seek the advice of a competent lawyer or accountant licensed to practice in your jurisdiction for advice on your particular situation.