In 2021, the European Union introduced the so-called “deemed supplier rule.” This regulation makes online marketplaces liable for tax on B2C deliveries. It will be extended to B2B deliveries beginning in 2027.

In this article, we explain the deemed supplier rule, including how it works and what new rules will apply in the future. You will also learn who is liable to pay value-added tax (VAT) in the case of a deemed supplier and what to look out for when invoicing.

What’s in this article?

- What is a deemed supplier?

- How does the deemed supplier rule work?

- What is changing in the deemed supplier rule?

- Who is liable to pay VAT in the deemed supply chain?

- Invoicing in the deemed supply chain

What is a deemed supplier?

The deemed supplier rule is an e-commerce tax rule that includes digital marketplaces in presumed supply chain transactions. The EU’s VAT Digital Package – which went into effect on 1 July 2021 – includes the deemed supplier rule for deliveries to private individuals from third-country online retailers via online marketplaces (i.e., B2C). As part of the implementation of VAT in the Digital Age (ViDA), the EU will extend the rule to B2B deliveries starting in 2027.

The aim of the deemed supplier rule is to better control tax flows in international trade. To this end, online marketplaces will be liable for tax. Prior to the introduction of the deemed supplier rule, online retailers were responsible for paying VAT. However, this resulted in tax losses because some retailers did not fulfil their obligations or did not fulfil them sufficiently. Under the deemed supplier rule, the online marketplace is legally treated as if it sells the goods, thereby assuming responsibility for processing the VAT.

In this way, the deemed supplier rule creates more transparency and legal certainty. It also reduces the burden on the tax authorities. Instead of monitoring hundreds of thousands of taxable online retailers, tax authorities can focus on a few large platforms that act as central tax debtors. This reduces the administrative burden and makes tax evasion less likely. It also allows for fair competition, as domestic retailers are not at a tax disadvantage compared to foreign competitors.

What is ViDA?

ViDA refers to an EU Commission initiative to modernise the existing European VAT system. The package of measures was proposed by the European Commission in 2022 and adopted by the EU Council in November 2024, with some substantial adjustments.

Based on the existing VAT system directive (Directive 2006/112/EC), ViDA aims to regulate three main areas. These are unified VAT registration, e-invoicing and digital reporting, as well as the difficult to define “platform economy.” The digital reporting requirements and the extension of the one-stop-shop system are intended to make tax processes more efficient and close tax loopholes. As a part of this, the deemed supplier rule will also be expanded.

How does the deemed supplier rule work?

In the case of sales via digital platforms, a contract is only concluded between the online retailer and the customer under civil law. Without the deemed supplier rule, the marketplace remains outside of this transaction and is not involved for VAT purposes. However, the deemed supplier rule ensures digital marketplaces are part of the supply chain.

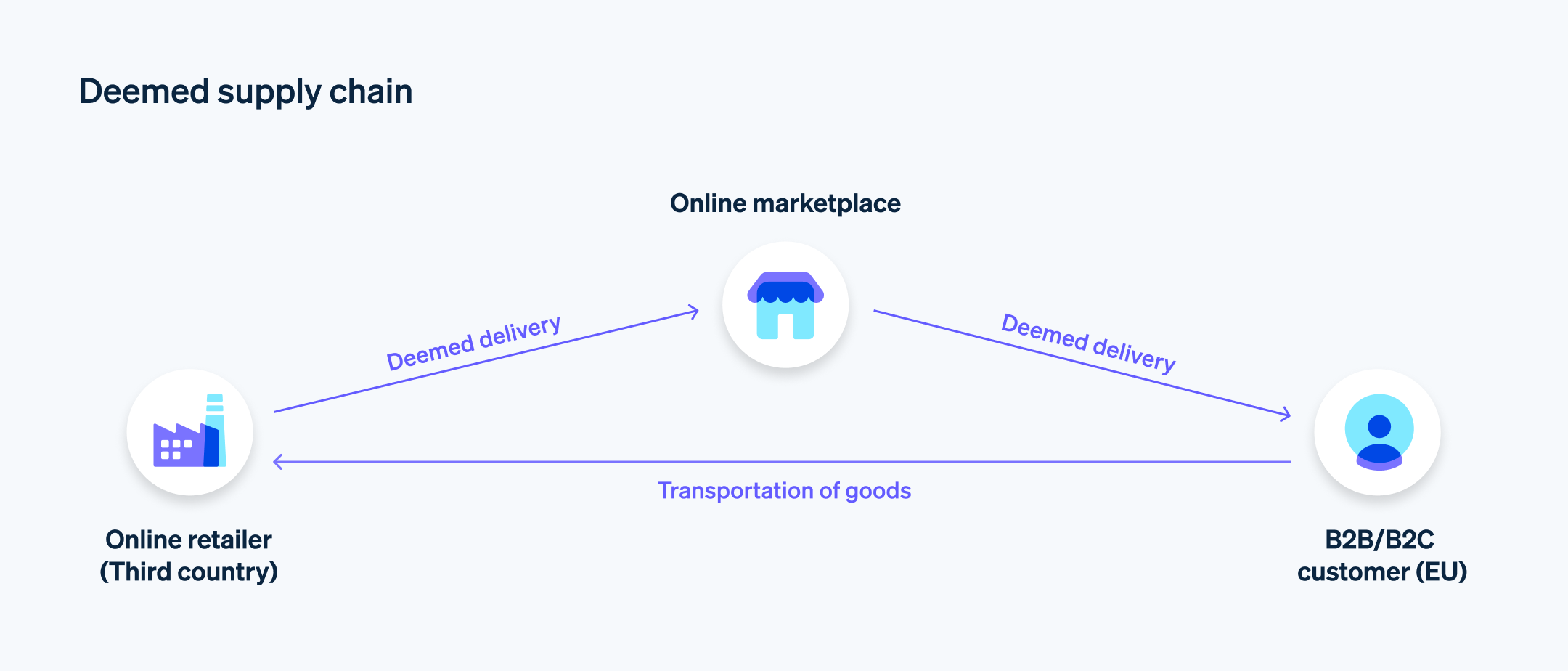

It is assumed that the marketplace first buys the goods from the online retailer and then resells them to the customer. However, the goods are transported only once, and the contract between the online retailer and the customer remains unchanged. This assumption creates an assumed chain of transactions that involves two deliveries for VAT purposes.

Section 3, Paragraph 3a of the German VAT Act (UStG) defines the conditions for a deemed supplier:

- E-commerce platform: Deliveries are ordered via an electronic interface such as an online marketplace, electronic platform, or similar.

- Third country: The online retailer is established in a third country outside the EU.

- Deliveries: Deliveries start and end within the EU (i.e., domestic or intra-European deliveries).

- Customers: Deliveries are ultimately made to private customers.

The restriction on B2C sales will be lifted with the implementation of ViDA.

The deemed supplier rule also applies to another situation for online retailers based in the EU. The rule applies if the goods are still outside the EU at the time of delivery and must first be imported to reach the customer. However, the material value of the goods imported from the third country must not exceed €150 (Section 3, Paragraph 3a of the UStG).

What is changing in the deemed supplier rule?

Beginning on 1 July 2027, the deemed supplier rule will be extended to B2B transactions. This means it will apply to all intra-EU deliveries made by non-EU retailers via online marketplaces.

In addition, starting 1 January 2030, a deemed supply chain will be created for digital platforms that provide passenger transport and short-term accommodation services. For tax purposes, these marketplaces will also be treated as if they provided the services themselves. Beginning 1 July 2028, EU member states will be able to implement the regulation on a voluntary basis.

Who is liable to pay VAT in the deemed supply chain?

During a deemed chain transaction, there is only one sales contract, and the customer pays the purchase price only once. Therefore, VAT is only charged once. The delivery from the online retailer to the marketplace is tax-free, but the delivery from the marketplace to the customer is taxable. This means the online marketplace is liable for the tax.

The same applies to platforms that arrange passenger transport and short-term accommodations. However, there is an exception: Service providers, such as drivers or landlords, can charge VAT on their sales provided they inform the platform and provide their VAT identification number (VAT ID). Member states can also exclude small-scale entrepreneurs from the scheme.

Online marketplaces should be familiar with the VAT rules for real and deemed chain transactions. Stripe Connect can help. With Connect, businesses can offer automated calculation and collection of VAT and more on their platforms. This ensures VAT is correctly calculated on all deliveries to end customers. In addition, Connect allows businesses to offer face-to-face payments, instant payouts, financing, expense cards, and several local payment methods anywhere in the world.

Invoicing in the deemed supply chain

The deemed supplier rule also brings with it new requirements for invoicing. In the deemed supply chain, the online marketplace invoices the customer, not the retailer. Therefore, the online marketplace is responsible for the tax. The relevant invoice must include the VAT due. If a German business is liable for VAT on a supply in a deemed supply chain, the invoice must contain the following mandatory information under Section 14 of the UStG:

- Full name and address of the product or service provider

- Full name and address of the product or service recipient

- Invoice date

- Delivery date

- Provider’s tax number issued by the tax office or VAT ID issued by the Federal Central Tax Office (BZSt)

- Consecutive, unique invoice number

- Quantity and type of products delivered or the scope and type of service provided

- Net or gross amount

- Applicable tax rate and the corresponding tax amount or a reference to the tax exemption

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.