Mastercard, a major force in the global payment sector, provides a broad array of financial services to businesses and individuals across industries. It handles a diverse set of transaction types, supported by its strong data analytics and stringent security protocols.

Mastercard generated US$22.2 billion in revenue in 2022, indicating strong business performance despite a challenging economic environment. However, its reach and capabilities do have limitations, especially in markets where local payment systems dominate.

Below, we'll discuss how Mastercard works, where it operates, whom it serves, and which products and services it offers. Whether you're considering local payment processing, global transactions or any other aspect of payment operations, here's what you need to know.

What's in this article?

- What is Mastercard?

- Where is Mastercard used?

- Who uses Mastercard?

- How Mastercard works

- Business benefits of accepting Mastercard

- Mastercard security measures

- Requirements for businesses that accept Mastercard payments

- Alternatives to Mastercard

What is Mastercard?

Mastercard is an international corporation which operates a global financial network. Through this network, it facilitates electronic funds transfers (EFTs) using branded debit, credit and prepaid cards. As an intermediary between financial institutions and businesses, Mastercard supports payment processing by authorising, clearing and settling transactions.

Built on a foundation of interoperability and scalability, Mastercard's network is a key part of global commerce infrastructure. It can handle a wide range of payment types – from business-to-business (B2B) to person-to-person (P2P) payments – across borders and currencies. Mastercard also offers advanced analytics, payment gateway solutions and anti-fraud systems, catering to the diverse needs of everyone from individual customers to global accounts, enterprises and platforms that handle high transaction volumes.

Mastercard's services, based on application programming interfaces (APIs), integrate with a variety of platforms and offer flexibility to businesses that require customised payment solutions. The network also extends its functionality through strategic partnerships, bringing value-added services such as rewards programmes, supply-chain financing and digital identity verification.

Where is Mastercard used?

Mastercard holds a substantial global footprint, facilitating transactions in over 210 countries and territories. The network's reach also spans a variety of financial environments, including retail, e-commerce, governmental organisations and financial institutions. Businesses across sectors – from hospitality to health care – accept Mastercard-branded payment options. While it initially gained prominence through point-of-sale (POS) terminals, its scope has broadened considerably with the rise of digital payments.

Mastercard's global payment network is used extensively for both personal and commercial transactions. With more than 1.1 billion credit cards actively in circulation, it ranks among the most used payment systems worldwide. Here's an overview of its presence around the world:

North America and Europe: Mastercard is used extensively in the United States, Canada, the United Kingdom and several countries in Europe. The network handles a wide variety of transaction types, ranging from buying groceries to settling multimillion-dollar B2B contracts.

Asia Pacific: Mastercard is a popular choice for payments in Australia, Japan and Singapore. In China and India, both of which have strong domestic payment networks, Mastercard often gets used for international transactions.

Latin America: In countries such as Brazil, Argentina and Mexico, Mastercard is a standard payment method. The company partners with local banks to offer specialised products that are tailored to the financial needs of these countries.

Middle East and Africa: Mastercard is growing in popularity in certain places, such as the United Arab Emirates and South Africa. The network is also expanding into less mature financial markets in sub-Saharan Africa.

Mastercard offers a comprehensive set of services that go beyond transaction processing. These include robust fraud detection, data analytics services and customised financial products for supply-chain management. Its investment in modern technologies enables API-based integrations, supporting a wide range of customised financial solutions for large-scale operations.

Who uses Mastercard?

While exact market shares fluctuate, Mastercard's share is influential in most global markets. Mastercard is especially strong in Europe and North America for payment and receipt purposes. Here are some of the major sectors where Mastercard has a strong presence:

Retail and e-commerce

Mastercard is accepted at a wide range of retail establishments, from local shops to global retail chains. Online platforms also have a preference for using Mastercard, thanks to its speed and security features.Hospitality and travel

International travellers, as well as hotels and airlines, rely heavily on Mastercard. Its global presence makes it a preferred choice for making reservations and completing payment processes.Utilities and services

Telecom operators, water and electric utility companies, and other service providers, all accept Mastercard for one-off and recurring payments.Public sector and institutions

Government agencies and educational institutions use Mastercard for high-volume purchases. These transactions often include Level 3 data, which provides an extensive set of transaction details, including the specific items purchased, tax amounts and other particulars. Providing this level of detail can often reduce transaction costs.B2B transactions

Mastercard is also prominent in the B2B sector and supports various payment options, such as virtual cards that are tailored specifically to bulk payments and vendor settlements.Emerging payment technologies

Digital wallets and mobile-payment apps often use Mastercard as a primary network for tokenised transactions.Cross-border transactions

Mastercard is proficient in handling international transactions, offering multi-currency support and favourable currency-conversion rates.Subscription models

Software-as-a-service (SaaS) platforms and other businesses that rely on subscription revenue streams often use Mastercard for recurring billing.Financial services

Asset managers, hedge funds and other financial organisations use Mastercard for fund transfers, investment activities and liquidity management.

In addition to its popularity in these markets, Mastercard is a mainstay for certain customer segments and businesses, including:

Personal use cardholders

Young adults

Young adults often rely on basic credit or debit cards. Accessibility and ease of use are top concerns, and this age group frequently uses their cards for online shopping, ride-sharing services and food-delivery apps.Middle-income families

With a more established financial standing, middle-income families often opt for cards that offer rewards or cash back. This segment is likely to use their cards for larger expenses, such as holidays or home improvements.High-net-worth individuals

Wealthier customers usually opt for premium or luxury cards. These cards charge higher fees but offer extensive benefits, such as exclusive travel perks and concierge services.

Businesses and organisations

Small and medium-sized businesses (SMBs)

SMBs commonly use specialised business credit cards to manage operating expenses and often look for cards that offer reward points or cash-back incentives.Large enterprises

Enterprise companies require sophisticated payment solutions that allow for bulk transactions and in-depth reporting features. Fraud prevention and data analytics are key considerations for this type of business and Mastercard has a lot to offer in those areas.Non-profits and foundations

Often focused on strict budgeting, non-profits may use prepaid or low-fee cards to manage operational expenses.

Specialised-use cardholders

Travellers

Frequent fliers and international tourists often prioritise cards that are accepted globally, and offer travel rewards but no foreign transaction fees.Online gamers and digital-content customers

These customers are commonly interested in prepaid or digital-wallet solutions that make in-app purchases or subscription payments easier.

Sector-specific cardholders

Health care

Many patients and health care providers turn to specialised health-focused payment options that improve the management of medical expenses.Education

Parents, students and educational institutions may prefer prepaid cards or specialised credit options for tuition payments and other education-related fees.

Mastercard's extended network also includes partnerships with fintech companies, payment facilitators and digital native organisations. These relationships expand its utility through value-added services, from supply-chain financing to rewards programmes and digital identity verification.

API-based integrations extend Mastercard's usability, providing flexibility for customised financial solutions. Various platforms and payment processors integrate these APIs to enable Mastercard transactions, extending the network's reach into specialised software environments.

How Mastercard works

Mastercard as a business financial provider

Mastercard offers a wide range of products to meet the varied needs of businesses, whether they are small operations, large corporations or digital platforms. Mastercard plays a significant role in cross-border transactions, supporting businesses that operate in multiple markets. Multi-currency features allow for transactions across different currency zones, simplifying international trade and e-commerce.

Below are some of Mastercard's offerings for businesses:

- Mastercard business cards: cards that include a standard credit card offering with expense-management features

- Mastercard corporate cards: cards designed for larger organisations, offering centralised billing options

- Mastercard Corporate Fleet Card: a specialised card for companies with vehicle fleets, providing detailed reporting on fuel and maintenance expenses

- Mastercard Send: a service that facilitates fast and secure payment disbursements to various endpoints

- Mastercard B2B Hub: an automated accounts-payable solution that simplifies payments and integrates with existing software

- Mastercard Track: a secure, digital ledger that facilitates the exchange of transaction data and payments between buyers and suppliers

Mastercard also supports a variety of specialised transactions beyond traditional retail settings. These include B2B payments, digital wallets and mobile-payment systems. Global enterprises often use Mastercard's capabilities for disbursement solutions and treasury operations, making it a versatile provider for handling complex financial activities.

Mastercard as a card network

In addition to the services and products it offers to businesses, Mastercard operates a huge network for facilitating payment transactions, bringing together financial institutions, businesses and customers. It acts as an intermediary that authorises, clears and settles transactions. Here's how this actually works:

Authorisation: when a Mastercard is swiped, inserted or entered online, the transaction details are sent to the business's bank and then forwarded to the cardholder's issuing bank for approval. Mastercard's network is the conduit for this data exchange.

Clearing: post-authorisation, the issuing bank transfers the funds to the acquiring bank through the Mastercard network, and the transaction details are recorded and reconciled.

Settlement: finally, funds are deposited from the acquiring bank into the business's bank account. This usually occurs within a couple of working days.

Mastercard primarily makes money through fees charged to financial institutions for the use of its branded cards and network. Additionally, it charges for other services, such as data processing and cross-border transactions, and these fees can vary depending on the jurisdiction and specific services used.

Mastercard's role in transaction processing demonstrates its broad influence within the global financial system. And with ongoing advancements in payment technology, Mastercard continues to adapt.

Business benefits of accepting Mastercard

Accepting Mastercard offers customer-facing businesses multiple advantages that can have a direct effect on the customer experience and the efficiency of financial operations. As one of the most recognised payment networks, Mastercard allows businesses to access a widespread customer base that trusts this form of payment. And B2B businesses in most industries are also highly likely to benefit from accepting this leading international card network.

Here are a few highlights that illustrate how businesses benefit from accepting Mastercard:

Global reach

Mastercard is accepted in over 210 countries and territories, which means that accepting Mastercard gives businesses instant international relevance and market access.Speed and convenience

Transactions are quick, usually only requiring a tap or a swipe, which makes this card network an easy choice for businesses that want to provide a low-friction payment experience for customers and increase the efficiency of their checkout operations.Security features

Mastercard uses sophisticated security measures – such as tokenisation and biometric authentication – to safeguard transactions, thus reducing the risk of fraud.Data analytics

Mastercard offers businesses access to valuable insights through data analytics, enabling them to make informed decisions on inventory management, pricing strategies and more.Flexible payment options

With Mastercard, businesses can offer various payment solutions – including contactless payments, mobile transactions and e-commerce capabilities – to accommodate a diverse range of customer preferences.

These advantages make it easier for businesses to adapt to market changes, meet evolving customer expectations, and preserve trust with customers, partners and vendors.

Mastercard security measures

Mastercard takes a multi-faceted approach to maintaining transaction safety across its global network. As with other global payment networks, it continually adapts and improves its security mechanisms. The company commits significant resources to maintaining a reputable, resilient security strategy amid the complexities of global payment processing.

By investing in protecting its own brand reputation, Mastercard passes along the benefit of strong security standards to the businesses and customers using its products. Here's a quick overview of Mastercard's approach to security:

Advanced encryption

Mastercard uses state-of-the-art encryption technologies that go beyond standard Secure Sockets Layer (SSL)/Transport Layer Security (TLS) protocols. It applies specific encryption methods to data at rest and data in transit, minimising exposure and risks at various touchpoints.Tokenisation

Tokenisation in Mastercard's ecosystem doesn't just substitute card data – it often combines it with transactional history and behavioural data to create a multi-faceted token, making unauthorised access more challenging.Authentication

Multi-factor authentication is commonly employed in financial transactions – especially for those with higher value. But Mastercard doesn't limit its multi-factor authentication to SMS-based codes. It also uses application-based and hardware-based authenticators, such as security tokens, which offer more protection against phishing attempts.Biometric support

Beyond facial and fingerprint recognition, Mastercard is investigating other biometric measures – such as voice recognition and behavioural patterns – to authenticate customers.Regulatory adaptability

Mastercard complies with international regulations, including the EU's Second Payments Services Directive (PSD2) and the Payment Card Industry Data Security Standard (PCI DSS) in the US. It also adapts to local laws and standards in other countries, such as Singapore and Australia. These regulations often dictate the level of encryption and data storage methodologies that card networks and businesses need to use.Sector-specific scrutiny

Businesses in high-risk categories, such as those handling controlled substances, may be subject to additional security protocols. This could involve heightened transaction scrutiny or the compulsory use of more complex security measures.Customised security

Mastercard offers a range of cards and payment solutions that come with security features tailored to specific needs. Corporate cards, for instance, may include more elaborate spending controls and real-time alert systems.EMV chips

For physical cards, EMV chips are more secure than traditional magnetic stripes. The chip generates a unique code for each transaction, making it difficult to replicate or skim information.Artificial intelligence

Machine-learning algorithms scan transactions in real time to assess their risk level and find suspicious activities. Mastercard bases its algorithms on large, diverse data sets that adapt over time and continuously improve the detection of suspicious activities.Mastercard identity check

Also known as Mastercard SecureCode, this is a private code that provides an added layer of security for online shopping. It's similar to a PIN but is used for online purchases.Geographic and sectoral variations

The level of security might differ based on location or business sector. For instance, in regions with higher rates of fraud, additional security measures, such as dynamic authentication, may be mandatory. Similarly, high-risk business sectors may be required to undergo additional identity checks.Zero liability

Mastercard offers zero liability protection, meaning that cardholders won't be held responsible for unauthorised transactions, provided that they have taken reasonable care to protect their card details.

Requirements for businesses that accept Mastercard payments

If your business is already set up to accept credit and debit card payments, it can probably accept Mastercard payments. Mastercard is one of the major card networks both in the US and around the world, so most payment-processing providers have software and hardware equipped to accept it.

The exact process of getting set up to accept Mastercard payments will vary depending on how you plan to process transactions (in person, online etc.), where you're located and who your payment processing provider is. But the process more or less looks like this, in most cases:

Merchant account

A merchant account is a specialised bank account that businesses need to accept credit and debit card payments. However, if you accept payments using Stripe, you don't need to open a merchant account as Stripe provides that functionality.Payment processor

Choose a payment processor that's compatible with Mastercard. This processor will handle the technical aspects of the transaction. Again, most payment processors are compatible with Mastercard and other leading card networks.Terminal and software

Businesses need hardware for card swiping or insertion, as well as software for online transactions. Payment processors often provide both, but businesses can also purchase their own as long as they comply with Mastercard's specifications.Compliance checks

Mastercard requires businesses to adhere to PCI DSS, which is a set of compliance requirements for businesses accepting card payments. Regular audits might be required based on the volume of transactions.Legal documentation

Contracts and agreements outlining terms and conditions, fee structures and other liabilities should be completed with the payment processor or acquiring bank.Account setup

After fulfilling all of the technical and regulatory requirements, the business can set up its merchant account to start accepting payments. This involves verifying bank details and testing the payment system to ensure that it operates correctly.Mastercard branding

Displaying Mastercard decals and signage at physical locations and digital touchpoints indicates to customers that Mastercard payments are accepted. This is not usually a requirement, but it is an option.

Alternatives to Mastercard

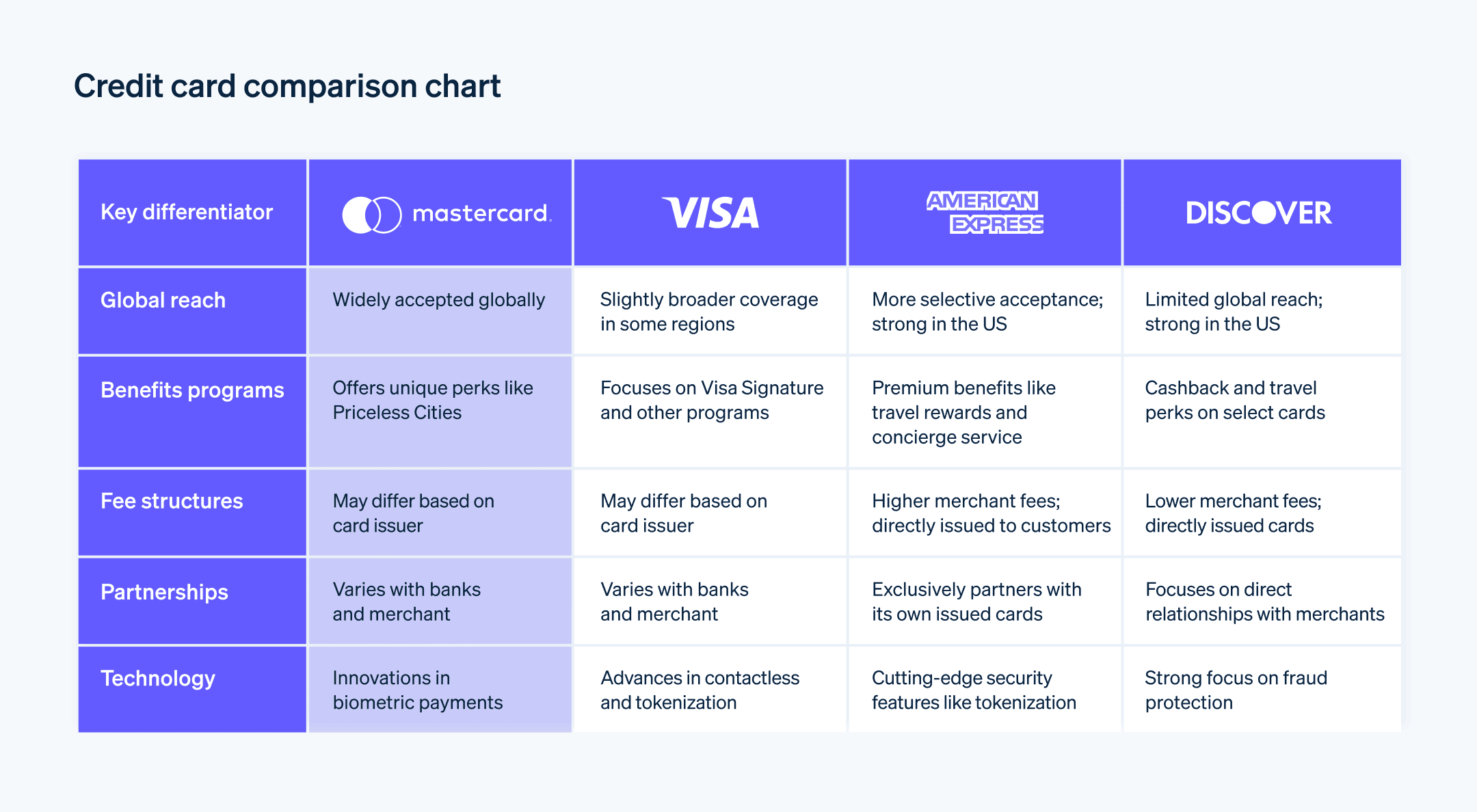

Mastercard is just one option among a variety of global payment solutions that are available to both businesses and customers. The choice of payment network can depend on location, transaction types and associated fees, among other factors. For those operating or residing in the US, several other major card networks offer distinct advantages:

Visa: as a chief competitor to Mastercard, Visa has a comparable global reach and offers a range of benefits. It also provides specialised services for businesses, including data analytics.

American Express: this network is not as widely accepted as Mastercard or Visa, but it compensates with a range of perks, such as strong rewards programmes and purchase protection.

Discover: primarily used in the US, Discover distinguishes itself with strong customer service and often has lower fees compared with other networks.

Many other payment methods are available globally – such as local bank networks, digital wallets and even cryptocurrency options – and offer alternatives to Mastercard.

To explore alternatives to Mastercard, learn more about US card networks and read more about other types of payment networks.

There are many other payment methods globally – such as local bank networks, digital wallets, and even cryptocurrency options – that are alternatives to Mastercard.

To explore alternatives to Mastercard, learn more about US card networks, and read more about other types of payment networks.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.