Under Japan’s invoice system, which began on 1 October 2023, businesses must deliver and retain a qualified invoice to receive a credit for consumption tax purchases.

Qualified invoices can only be issued by taxable businesses registered as qualified invoicing business operators and must meet the detailed requirements set forth in the invoice system. In addition to this, the invoice system contains a qualified refund claim form issued when goods are returned or discounted. Like the qualified invoice, the qualified refund claim form is an important document related to the purchase tax credit.

This article explains how the qualified refund claim form works, based on when it needs to be delivered and when exactly it is required.

What’s in this article?

- What is a qualified refund claim form?

- When is a qualified refund claim form required?

- Timing of provision of a qualified refund claim form

- Requirements and examples of qualified refund claim forms

- Transactions exempt from the provision of a qualified refund claim form

What is a qualified refund claim form?

As mentioned above, a qualified refund claim form is a document that must be issued when goods are returned or when a discount is given on the price of goods.

This form is sometimes called a “return invoice” and must be provided and kept by taxable businesses subject to consumption tax to apply for purchase credit. All B2B businesses need to be fully aware of the information required for the qualified refund claim form and when it must be issued.

This form is required for transactions with taxable enterprises but not for those involving tax-exempt enterprises or general customers.

What happens if you don’t have a qualified refund claim form?

The qualified refund claim form is required to calculate the sales tax credit correctly.

For example, if the buyer returns the goods, they can only deduct the sales tax on the returned goods if the seller submits a qualified refund claim form showing that the goods were returned. As a result, the calculation of the sales tax credit will be incorrect, and sales tax will be underpaid.

To avoid this, the qualified invoice issuer must issue a qualified refund claim form. Issuing and retaining the qualified invoice before the return and the qualified refund claim form after it provides clear proof of the transaction flow and allows the correct amount of tax due to be calculated.

Note that if the seller fails to issue a qualified refund claim form, the same penalties apply to a qualified invoice, and the seller could be subject to imprisonment for up to one year or a fine of up to ¥500,000. For more information, please refer to Japan’s National Tax Agency’s (NTA) prohibitions and penalties for delivery of qualified invoices like documents, etc.

Retention of qualified refund claim forms

Under the current invoice system, both buyer and seller must retain qualified invoices for a certain period (the seller maintains a copy) for the buyer’s business to claim the credit for purchases. This is also true for qualified refund claim forms, so it is important for companies to store both this form and qualified invoices properly.

The retention period for a qualified refund claim form, as defined by the NTA, is seven years, beginning on the day two months after the last day of the taxable period.

Moreover, qualified invoices and qualified refund claim forms must be stored in both paper and electronic formats. Under the Electronic Books Preservation Act, any such documents issued and delivered electronically must be stored as such, making electronic data storage obligatory.

When is a qualified refund claim form required?

A qualified refund claim form must be issued when a reimbursement or refund-like action is made to the buyer for any reason after the seller’s taxable entity has issued a qualified invoice. Under the Japanese Consumption Tax (JCT), this is called “Refund of consideration for sales, etc.” and the following are the main cases eligible for a qualified refund claim form.

Product returns

A qualified claim is issued when the seller reimburses the price of the goods due to the buyer’s return of the goods.

Discounts on merchandise (when a discount on the price of the goods is given after the time of sale)

For example, if the buyer purchases goods for ¥500,000 and then the seller decides to discount the goods by ¥30,000, a qualified claim form will be issued.

Sales incentives

A sales incentive is money paid to distributors and other vendors to encourage them to sell the company’s products. A sales incentive also falls into the category of reimbursement for sales.

For example, under a pre-arranged contract, Company A pays Company B a certain sales incentive for each product that Company B purchases and sells from Company A.

In this instance, the transaction between them is established when Company B, the buyer, pays Company A, the seller, at the time of purchase. Subsequently, Company A pays Company B the sales incentives due upon selling of the purchased goods. Company A, in turn, issues a qualified refund claim form to Company B (however, if the incentive claim form that Company B completes to claim sales incentives from Company A meets the requirements for a qualified refund claim form, then Company A, the seller, does not need to issue another one).

Dividends on business volume

Business volume dividends are surplus distributions paid to members of co-operatives – such as commercial and industrial co-operatives – in proportion to the amount of business each member conducted. For example, if the employer is a member of a partnership, they might receive a qualified refund claim form when it receives distributions from the partnership.

Timing of provision of a qualified refund claim form

A qualified refund claim form must be issued when the “return of consideration for sales” described in the previous section is actually made. It is not issued by the seller when the return is confirmed but instead when the reimbursement for it is processed.

However, in cases such as the sales incentive described earlier, if the buyer issues a payment notice to the seller and retains a copy to apply for the purchase tax credit, the seller is not required to issue a qualified refund claim form if this payment notice meets the requirements.

One note of caution: remember that, unlike a qualified refund claim form, a qualified invoice is usually issued when the claim is finalised.

Requirements and examples of qualified refund claim forms

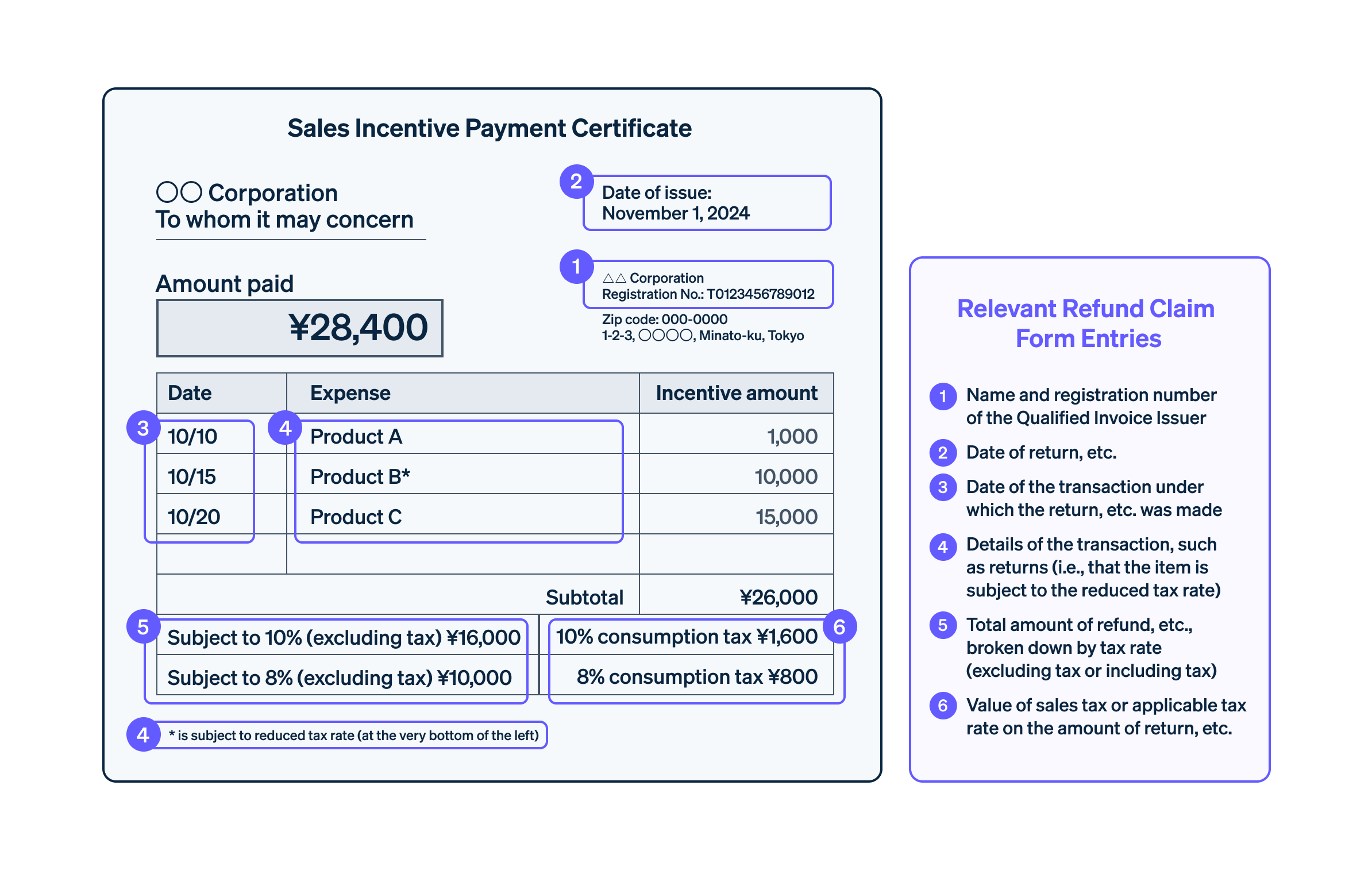

There are no specific rules regarding the format or writing style of the qualified refund claim form, but this information must be accurate and straightforward to understand.

Name and registration number of the qualified invoicing entity

Name of the entity issuing the qualified refund claim form (name for sole proprietors) and registration number.Date of return, etc.

As a qualified refund claim form is issued at the time of the return, the date it was made needs to be listed as the document’s issue date. This will clarify when it needs to be applied to the consumption tax calculation.Date of the transaction on which the return, etc. was made

Include the date of the original transaction that corresponds to the return so it is clear which past sales were discounted or returned.Details of the transaction, such as returns, etc. (indicating that the item is subject to the reduced tax rate)

Include a description of the applicable goods or services, so it is clear which are being discounted or returned. If any of these items are subject to the reduced tax rate, use “*” for the subject item and state that it is also subject to the reduced tax rate (8%) in a separate box.Total amount of returns, etc., broken down by tax rate (excluding or including tax)

Total amount of returns, etc., broken down by standard tax rate of 10% and reduced tax rate of 8%. Either excluding or including tax is fine, but be sure to clearly indicate this.Consumption tax on the amount of the refund, etc., or the applicable tax rate

Total consumption tax on the reimbursement amount, broken down by tax rate. Alternatively, the applicable tax rate can be listed, and it is acceptable to list both.

Qualified refund claim form example

See below for an example of a qualified refund claim form that contains the details listed above.

Qualified refund claim forms are issued together with qualified invoices

The qualified refund claim form could be issued with the qualified invoice in a single document, provided the required information for each document is included.

For example, suppose the previous month’s rebate amount is included in the current month’s invoice. In that case, the rebate amount can be offset against the invoice amount so that the payment information in the transaction is consistent between entities and can be included in a single document. As a result, the timing of the reimbursement does not coincide with that of the timing of the original issuance of the qualified refund claim form. This is because the refund and the receipt of the claim amount are concurrent, whereas the qualified refund claim form was actually issued prior to the reimbursement.

Furthermore, as documents are converted to data to comply with the Electronic Books Preservation Act, and the need for more efficient and DX-oriented operations is increasing, many companies are reviewing their accounting software and introducing systems compatible with the invoice system and the Electronic Books Preservation Act. When digitising documents that qualify as a qualified invoice, using a single system that can handle issuing, storing, and managing documents could be helpful.

Stripe can create compliant invoices and handle various invoice-related needs; Stripe Invoicing will help you optimise your back-office operations. In the event of a refund, one of the features of Stripe Invoicing is that it enables you to issue a credit note that meets the requirements for a qualified refund request form.

Additionally, the automatic consumption tax calculation included with Stripe Tax, which can be customised to your needs, automates tax processing for all electronic transactions, making your business smoother and more efficient.

Transactions exempt from the provision of a qualified refund claim form

In some cases, there is no need to deliver a qualified refund request form. Normally, the seller must issue one to the buyer when reimbursing the consideration for a sale, but it is not required in the instances below:

Transactions where the amount returned is less than ¥10,000, including tax

According to the “summary of exemptions from the obligation to deliver small return invoices”of the NTA, the obligation to deliver a qualified refund request form for returns or discounts is exempted if the relevant taxable amount is less than ¥10,000. This applies even if the reimbursement relates to a transaction for which a qualified invoice must be issued.Where a transaction does not require a qualified invoice

If the original transaction did not require a qualified invoice, it is also exempt from the requirement to submit a qualified refund claim form. For example, in the case of transactions where it is difficult to issue a qualified invoice, such as public transportation fares under ¥30,000 or purchases of goods from vending or automatic service machines, there is an exemption under the invoice system, which means that neither form need be issued. For details, please refer to the NTA’s “Guidance on the Qualified Invoice System (Invoice System) (P18).”

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.