On 1 October 2023, the Qualified Invoice System was introduced in Japan.

It is largely related to taxable purchases. Businesses must deliver and retain a qualified invoice (commonly just called an invoice) that meets the system’s requirements to correctly apply tax credits for purchases and accurately pay consumption tax.

This article provides a straightforward explanation of the basics of the Invoice System using illustrations.

What’s in this article?

- What is the Invoice System?

- Impact of the Invoice System on tax-exempt businesses

- Qualified and simplified invoices

- Understanding and responding to the Invoice System correctly

What is the Invoice System?

The Invoice System was introduced as a way for deducting taxes on purchases corresponding to multiple consumption tax rates, replacing the previous Invoice with Classification Retention Method. The official name of this process is the “Qualified Invoice Retention Method,” which requires more detailed information than the former.

After implementing the Invoice System, you must first apply for registration as a qualified invoice issuer in order to send them out. Upon completion with the billing structure, the company will be assigned a registration number. This registration number must be included on the qualified invoice, as it certifies that the issuer is registered.

For the buyer’s business to claim the tax credit for taxable purchases, the source business (seller) must register with the invoicing system, deliver a qualified invoice to the buyer, and keep a copy for a certain period. Similarly, the buyer must retain the invoices it receives for a specified period. For more information on the retention period, please refer to the National Tax Agency’s “Outline of Qualified Invoice Retention Method (P11, 13).”

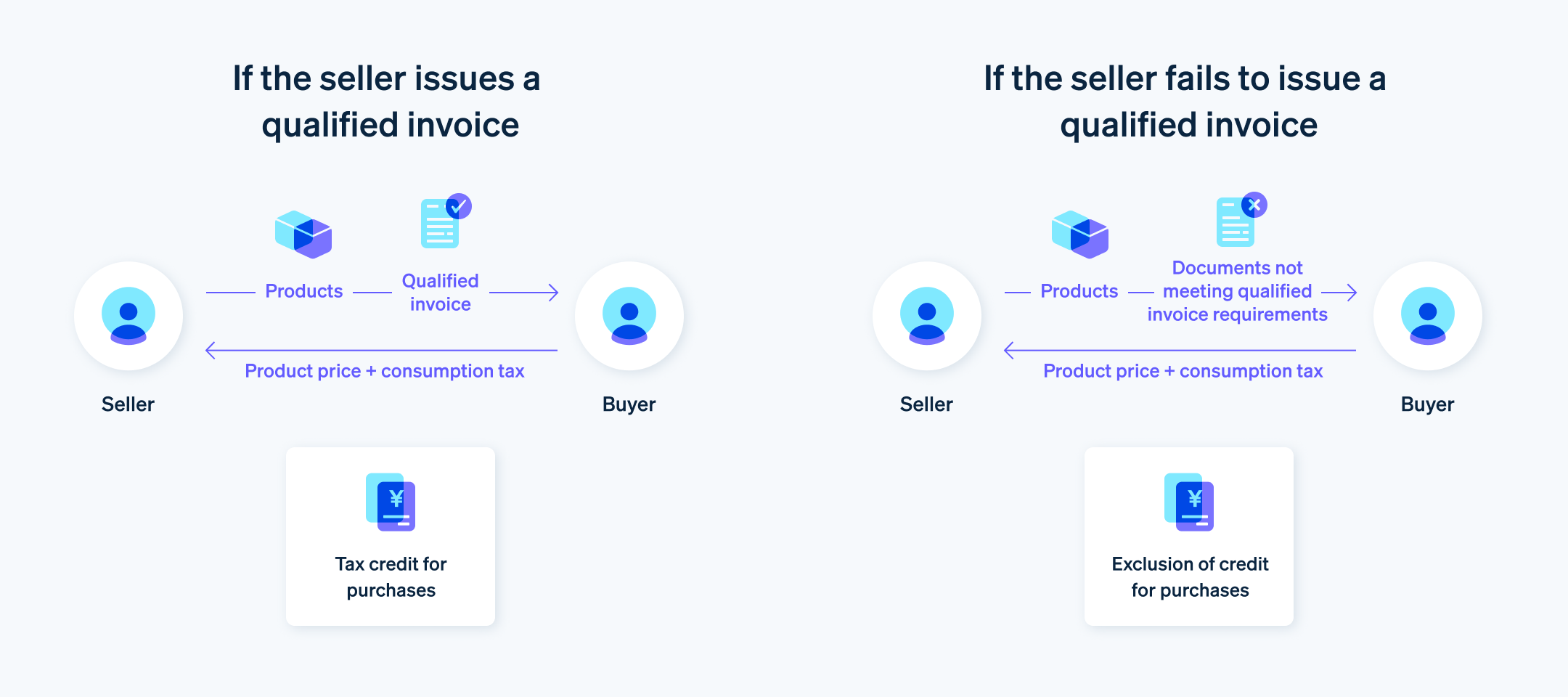

Illustration of the Invoice System

As illustrated above, whether or not the seller issues a qualified invoice determines the applicability of the tax credit for purchases.

Impact of the Invoice System on tax-exempt businesses

In principle, the Invoice System applies to entities obliged to pay consumption tax. So for a tax-exempt business to issue a qualified invoice, it must register with the system as a qualified issuer and become a taxable business.

Registration with the Invoice System is not mandatory, and not all businesses must do this. Therefore, each can choose whether or not to do so with the invoicing scheme.

However, most taxable businesses require a qualified invoice to apply for the order. In other words, if a purchase is made from a tax-exempt business, the buyer’s taxable business will not receive a qualified invoice, and the amount of consumption tax levied will increase. As a result, the tax-exempt business providing the product might lose opportunities, as the buyer could request to terminate the transaction or review the sale price. It might also become difficult to develop new customers.

To avoid such risks, there is an increasing need for tax-exempt businesses with many taxable businesses as customers to consider compliance with the Invoice System.

Transitional measures are provided for purchases from these entities, and a certain percentage of the consumption tax amount could be applied as a credit against purchase tax.

Qualified and simplified invoices

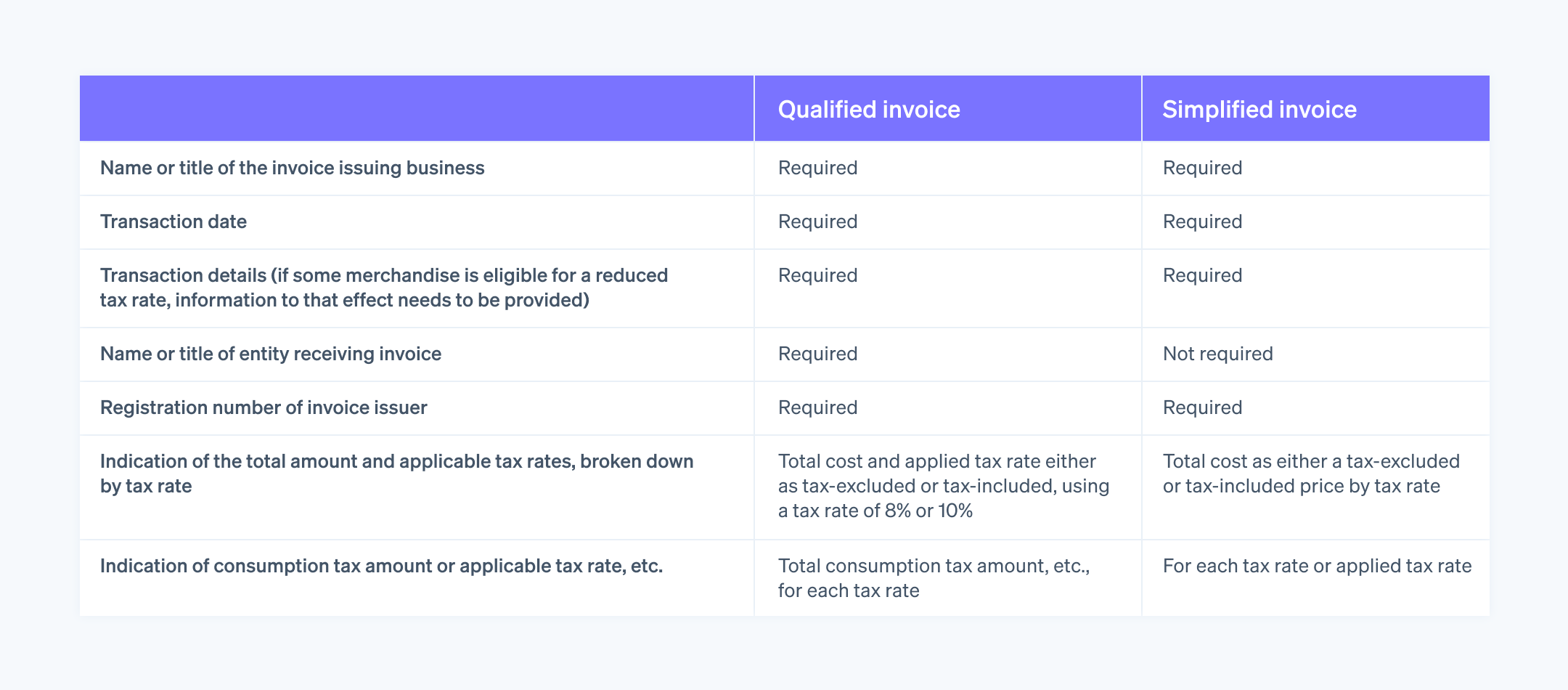

In addition to qualified invoices, the Invoice System also supports simplified invoices depending on the business type.

The following is a list of required items to be included on the qualified and simplified invoice.

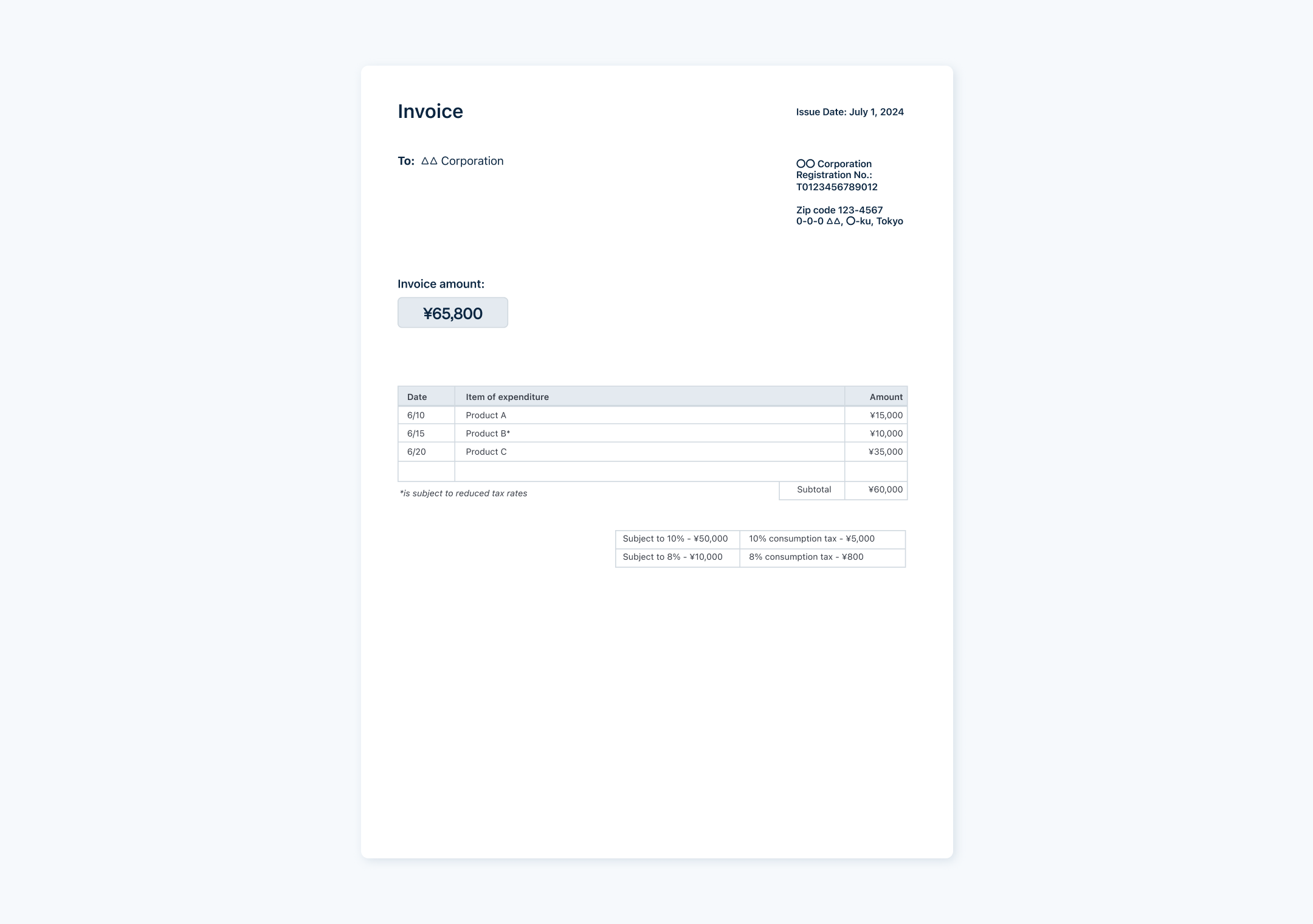

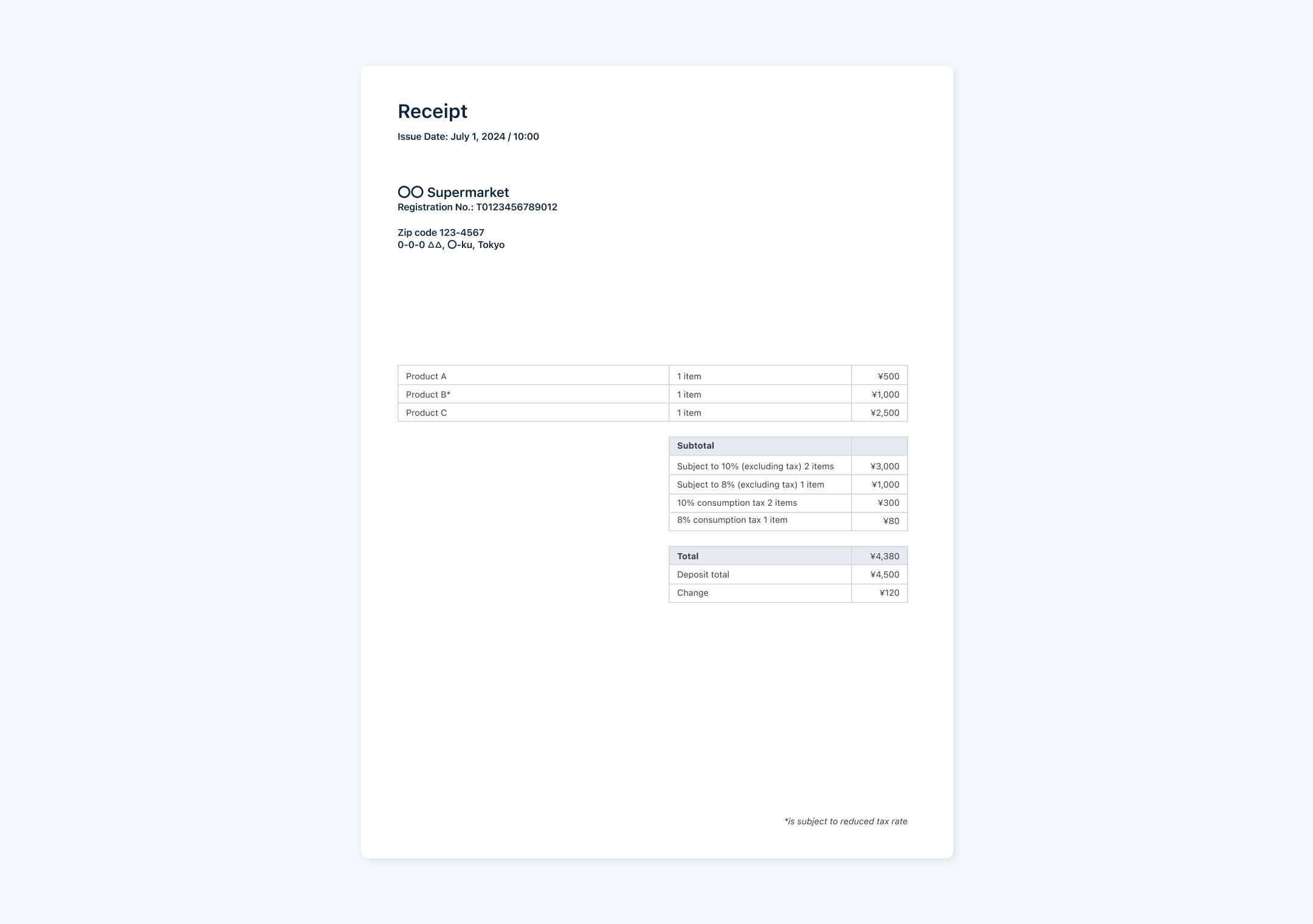

Please refer to the following illustration for how to write a qualified invoice and a simplified invoice, respectively.

Qualified invoice example

Simplified invoice example

Understanding and responding to the Invoice System correctly

The seller and buyer must take appropriate measures so businesses can easily receive the tax credit for purchases under the current invoicing system. In particular, it is important for sellers preparing qualified or simplified invoices to have a compatible environment so that document delivery and storage can proceed smoothly.

Additionally, with the growing digitisation in documents due to regulatory changes and the increasing need for more efficient and DX-oriented operations, many companies are reviewing their accounting software and introducing processes compatible with the invoicing system and the Electronic Books Preservation Act.

One way to address this issue is to take advantage of the Invoice System and consider a solution that unifies document issuance, storage, and management. Stripe Invoicing, which can be used to create invoices compliant with these systems and for various operations, will boost back-office efficiency.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.