Credit cards are the most popular payment method worldwide, with one billion global credit card transactions occurring daily. Small business owners constantly deal with credit cards and the networks that power them, but many don't know how credit card networks work and default to accepting any credit card their customers want to use.

Accepting a variety of payment methods is good business, but knowing how credit card networks work can give business owners insight into how to maximise their usage and minimise risks. Here's what businesses should know.

What's in this article?

- What are credit card networks?

- Credit card issuer vs credit card network

- Types of credit card networks

- Open network

- Closed network

- Open network

- How do credit card networks work?

- Credit card network fees

- What types of fees are there on credit card transactions?

- Why do American Express and Discover charge higher fees for businesses?

- What types of fees are there on credit card transactions?

- Why credit card networks matter for businesses

What are credit card networks?

Credit card networks provide the communication system that issuing banks and businesses use to process credit card transactions. The networks and issuers authorise and process credit card transactions, set the transaction terms and move payments between customers, businesses and their banks. Major credit card networks include Visa, Mastercard, American Express and Discover, but there are others.

Credit card issuer vs credit card network

A credit card issuer, or issuing bank, is the financial institution that gives people credit cards. For example, if you have a credit card through your primary banking institution with their logo and the Visa logo on it, the bank is the credit card issuer and Visa is the credit card network.

When you use a credit card to make a purchase, the transaction request goes to the credit card issuer, who then decides whether or not to authorise it. The issuer is the institution that extends credit to the cardholder, and the cardholder pays the issuer back for purchases made with the credit card.

Credit card networks can also be credit card issuers, meaning they extend credit to cardholders without requiring a third-party financial institution to act as the issuer.

Types of credit card networks

There are two types of credit card networks – open and closed – and they treat card issuing differently.

Open network

Open credit card networks allow other financial institutions to issue their credit cards to customers.

The two largest open credit card networks are:

- Visa

- Mastercard

Closed network

In closed credit card networks, the credit card company exclusively issues the cards. The credit card network also plays the role of acquirer and disburses funds directly to businesses' banks, minus transaction fees.

Closed credit card networks include:

- American Express

- Discover

- Some store-issued credit cards

How do credit card networks work?

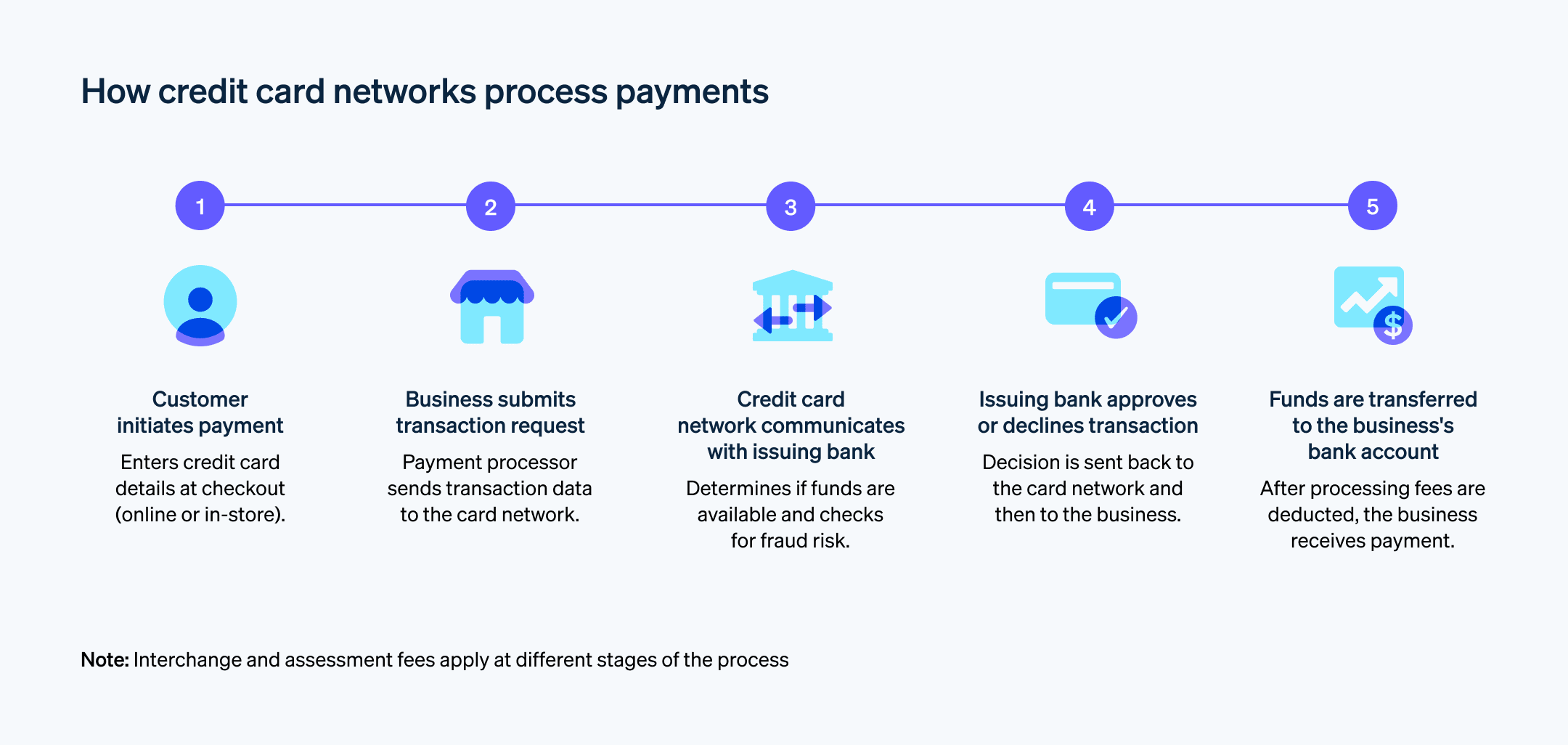

Credit card networks work by connecting the two parties involved in credit card purchases: the card issuer and the business.

1. The customer initiates payment

First, the customer initiates a transaction by submitting their credit card to the business's point of sale (POS) terminal, card reader or online checkout. They can enter their credit card number manually, swipe the card, insert the card's EMV chip, or tap to engage their card or mobile device's contactless payment mechanism.

Not every business accepts payments from every credit card network. Stripe supports all the major global credit card networks in addition to smaller, regional networks.

2. The business's payment terminal connects with the credit card network

Once the card information has been transmitted to the business's payment terminal, the payment processor contacts the credit card network to request approval for the transaction.

If the card network is also the issuer

If the customer's credit card network also issued the card, then the network determines whether or not to approve the transaction.If the card network did not issue the card

If there's a separate issuing bank for the card, the card network talks to the issuing bank to determine whether the transaction should be approved.

3. The card network notifies the business about whether the transaction is approved or denied

The credit card network returns the decision very quickly to the business – it usually just takes a few seconds.

Credit card network fees

Credit card networks charge different processing fees for each transaction. Fees are usually the most important factor that businesses consider when deciding which credit card networks to accept.

What types of fees are there on credit card transactions?

There are two main types of fees that businesses pay on every credit card transaction: interchange fees and assessment fees.

Interchange fee

The financial institution that issued the credit card charges the interchange fee. For example, if Wells Fargo issued a customer's Mastercard, the business pays an interchange fee to Wells Fargo whenever the customer uses that card to make a purchase.Assessment fee

Businesses also pay an assessment fee to the credit card network. On that same Wells Fargo-issued Mastercard, the assessment fee on every purchase goes to Mastercard.

Debit cards, which are usually cheaper for businesses, are priced in a completely different way.

Why do American Express and Discover charge higher fees for businesses?

American Express and Discover act as both the network and the issuer for their credit cards, which results in higher fees – they handle more of the workload for each transaction. These two networks benefit by keeping both the interchange and assessment fees on each transaction, but their higher fees mean that some retailers do not accept their credit cards.

Why credit card networks matter for businesses

Credit card networks – and how they work – have huge implications for businesses and choosing which types of credit cards to accept is an important decision. Your customers might prefer some credit cards over others, depending on where you're doing business, who your customers are and what kind of purchases they make. And how the major credit card networks view your particular business will be reflected in their fee structures.

Here are a few points to consider when deciding which credit card networks to accept as payment options:

Geography

Many credit card networks operate globally, while others are limited to certain countries. When setting up your payments systems, make sure to accept credit card networks that are popular in your location and any international locations where you have customers.

For example, US-based businesses might have never heard of UnionPay, but that credit card network accounts for 93% of card payments in China and 45% of card payments worldwide. UnionPay is second only to Visa and manages more transactions than Mastercard. Neglecting to accept UnionPay could be a huge oversight, depending on where your customers are.

Interchange fees

The major networks' average transaction fees represent the majority of rates, but there are outliers among other credit card networks. Each network examines multiple factors when determining the rate it will charge any given business and rates are subject to change. Here are the main factors that credit card networks look at when deciding what fee to charge:

Type of card

As a consumer and a business, you've probably encountered a vast selection of credit cards on the market. Even within each credit card network, there can be dozens of different cards available, each offering a different perk or targeting a specific customer segment. Different types of cards within the same network can incur different interchange fees.

Payment processing method

Interchange fees also vary depending on how a credit card payment is processed at the point of sale. These processing methods include:

- Contactless payments using near-field technology (NFC)

- Inserted EMV (Europay, Mastercard and Visa) chip cards

- Swiped transactions using a credit card's magnetic stripe (magstripe)

- Card-not-present (CNP) transactions

Interchange fees vary because of the unequal risk of fraud and chargebacks associated with each payment processing method. For instance, CNP transactions are the least secure and tend to have higher interchange fees.

Merchant category

Each business that accepts credit card payments is assigned a merchant category code (MCC). Different categories of businesses have different interchange fees.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.