Credit and debit cards are two of the most commonly used payment methods around the world today. Facilitating card payments is key to business growth.

In this article, we discuss various types of card payments, how they work, and the benefits they offer customers and businesses in France.

What's in this article?

- What are card payments?

- Who are the parties involved in card payments?

- The different types of card payments

- How to pay by card

- The benefits of card payments for businesses

- The costs of card payments for businesses

- Is it possible to set a minimum amount for card payments?

- Can businesses refuse card payments?

- When are card payments charged?

- What happens when the balance on a bank account is insufficient to cover a payment by card?

What are card payments?

Card payments require the use of a debit or credit card to pay in person or online. Once the transaction is finalised, the amount is charged to the customer's bank account or, in the case of credit cards, billed at a later date.

This is an easy, quick, and safe payment method that is popular with both businesses and customers because it simplifies and speeds up the buying process. In France, card payments overtook cash for the first time in 2024. Card payments accounted for 48% of transactions, with cash accounting for 43%.

Who are the parties involved in card payments?

Three parties are involved and communicate with each other in any payment by card:

- The business

- The customer (i.e. cardholder)

- The banks, specifically the customer's issuing bank and business's acquiring bank

https://stripe.com/resources/more/what-is-an-acquirerThe business

The business provides goods or services to the customer and receives the payment. To accept card payments, the business uses:

- A payment terminal – such as Stripe Terminal – for in-person, point-of-sale (POS) transactions

- A checkout page for online transactions

https://stripe.com/resources/more/what-is-an-acquirerThe customer:https://stripe.com/resources/more/how-to-accept-credit-card-payments

The customer (i.e. cardholder) purchases goods or services and initiates the payment using a debit or credit card. Typically, the customer is the holder of the account to which the payment is charged. When using a debit card, the cardholder needs to ensure that the balance available on the account is sufficient to cover the payment. If paying with a credit card, they need to ensure their line of credit is adequate.

The banks

The banks are the final party involved in a card payment. Two banks are involved:

- The customer's bank: This bank issues the card and authorises or declines the payment. During the transaction, it checks whether the cardholder's balance is sufficient and communicates with the business to approve or decline the payment.

- The business's acquiring bank: This bank handles the acceptance and the secure processing of card payments.

The different types of card payments

Businesses can support various types of card payments:

Debit card payments: These are the most common types. The transaction amount is charged directly to the cardholder's account, typically within 48 hours.

Credit cards: The transactions are periodically charged to the customer's account. This generally occurs at the end of the month or at the start of the following month, depending on the issuing bank.

Contactless payments: Enabled by near-field communication (NFC) technology, these payments allow a customer to pay by tapping their card on a terminal, without inserting the card or entering a personal identification number (PIN).

Mobile payments: These are becoming increasingly popular. They allow customers to pay using a smartphone or smartwatch. Find out more about payment methods and revenue optimisation with Stripe.

How to pay by card

There are two main ways to pay by card:

- In-person payments at a POS

- Online payments on an ecommerce website

How do in-person card payments work?

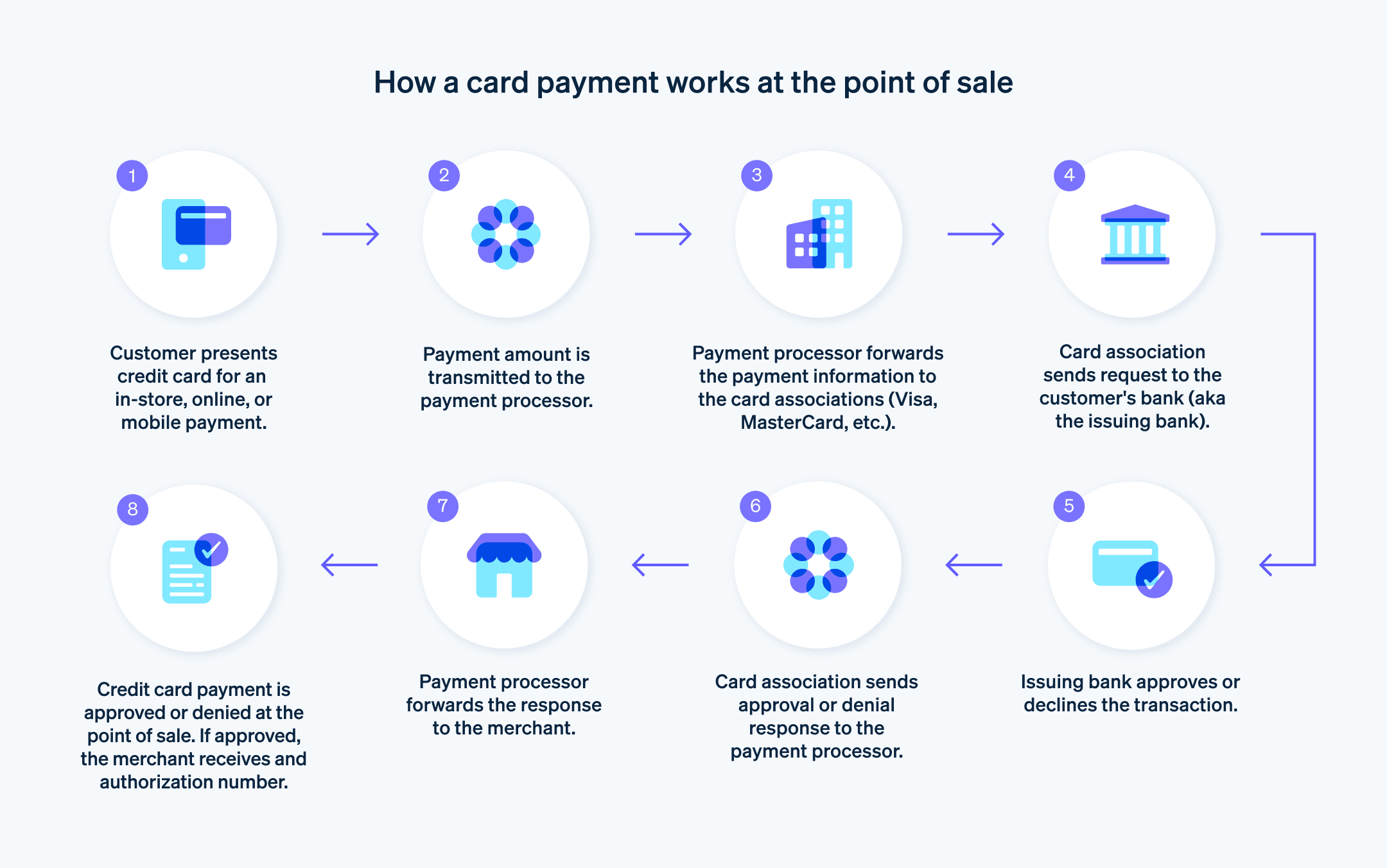

To pay by card in person at a POS, the customer inserts their card into the business's reader, enters their PIN, and waits for the transaction to be authorised or declined. This process usually takes only a few seconds. Here is a more detailed breakdown of the process:

- The purchaser either inserts the card into the electronic payment terminal or, for contactless payment, taps it on the terminal.

- The terminal reads the card details – including the card number and its expiry date – and sends them to the issuing bank or a payment service provider (PSP), such as Stripe.

- To process the card payment, the bank or PSP validates the card and payment request and checks that the customer's balance is sufficient to cover the payment. Then, it approves or declines the transaction.

- If the transaction is approved, the funds are transferred from the customer's account to the business's account.

- The maximum amount for contactless payments is usually €50.

How do online card payments work?

To pay by card online, the customer enters their card information on the checkout page, including the card number, expiry date and three-digit security code. The customer then approves the payment, typically through a banking app that confirms their identity. Here is a breakdown of the process:

- A payment gateway integrated into the business's website sends the transaction information to the bank.

- On the secure payment page, the customer selects the card payment option and enters their card details.

- The customer then confirms the payment through two-factor authentication, in compliance with the 2021 implementation of the 3D Secure (3DS) standard that secures online card payments. The customer can use a transaction number, password, one-time code, banking app or fingerprint.

- The payment gateway approves or declines the payment, completing the transaction.

Remote card payment is another option. It is a phone-based payment method in which the customer shares their card details. The business then saves the bank information on a virtual terminal or with dedicated payment management software. To prevent fraudulent use of their data, the customer should verify that the business follows security procedures.

The benefits of card payments for businesses

Card payments offer many benefits for customers and businesses. As a secure, quick, and efficient payment method, card payments simplify transactions and help businesses support more customers, potentially boosting their revenue.

- More secure transactions: Payments by card remove the risks related to counterfeit bills and cash theft. All transactions are encrypted and processed electronically, so third parties can't intercept card details. Card payment systems also support fraud detection tools – such as Stripe Radar – to help protect businesses from fraudulent transactions.

- Boosted sales: Customers tend to spend more when paying by card. Because there is no physical exchange of cash, customers don't tend to realise exactly how much they've spent. Therefore, they might spend more, which could boost sales for businesses.

- Faster payments: Card payments – especially contactless payments – speed up the payment process, which can allow for the handling of more transactions and enhance the customer experience.

- Instant cash flow: Payments are charged immediately, giving businesses faster access to the funds.

- Insights into customer behaviour: Card payment systems can provide businesses with information about their customers' buying patterns (e.g. top-selling products, purchase frequency, most popular POS, etc.). Businesses can use this data to finetune their marketing strategies or develop new products to better meet customer needs.

The costs of card payments for businesses

The cost of payments by card depends on factors such as the PSP, payment terminal fees, and bank's transaction fees. Check with your provider to find out the exact fixed and variable costs. Here are some costs you may encounter:

- PSP fees: The provider might charge the business a monthly or yearly fee. These fees vary from one provider to the next, so make sure to compare offers before committing to a PSP.

- Payment terminal costs: To accept in-person card payments, the business might need to buy one or more terminals, costing €50–€500. It's also possible to rent a terminal for a monthly fee.

- Transaction fees: Some fees are charged every time a customer payment is processed. There are three main types of fees: the interbank payment commission, network fee, and variable commission. The acquiring bank pays the interbank payment commission to the issuing bank. The network fee is charged by the card network (e.g. CB, Visa, Mastercard) to ensure payment to the business once the transaction is approved. The acquiring bank charges the variable commission based on factors such as the number of transactions, source of the payments, and fraud risk level, among others.

Is it possible to set a minimum amount for card payments?

Businesses can set a minimum amount for card payments. Businesses who choose to set a minimum amount for card payments are required to communicate it clearly to customers, typically by displaying it at the register.

Can businesses refuse card payments?

Businesses can choose not to accept card payments or to accept only specific debit or credit cards. This must be communicated clearly at the POS, typically at the register.

When are card payments charged?

Debit card payments are typically charged within 24–48 hours, while credit card payments are usually charged within one day or more. The time it takes for a payment to be charged depends on the card type and the business's payment system.

Other factors can impact how long it takes for a payment by card to be charged. For example, in the case of large amounts or international transactions, it can take longer for the funds to reach the payee's account. Payments made over the weekend, on public holidays, or in the days immediately before or after those days can take longer as well.

What happens when the balance on a bank account is insufficient to cover a payment by card?

When a customer pays with a card, the electronic system connects with their bank within seconds to check if the balance on the account is sufficient to cover the purchase. If the funds are insufficient, the payment will be declined automatically. The same goes for online orders. If the funds are insufficient, the PSP will automatically decline the transaction. This helps protect businesses from nonpayments.

In the case of insufficient funds, the customer will need to use a different payment method (e.g. cash).

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.