Nowadays, card payments are one of the most popular payment methods. Read this article to learn about the different types of card payments, how card payments work and the benefits that they offer for customers and businesses of all sizes.

What's in this article?

- What is a card payment?

- What types of card payments are there?

- How does a card payment work on a POS?

- How does an online card payment work?

- Benefits of card payments for businesses

- How much do card payments cost a business?

- When are card payments debited?

- What happens if a bank account doesn't have enough funds available for a card payment?

What is a card payment?

Card payments are a cashless payment method where customers pay for their purchases with their debit or credit card, either via a point of sale (POS) or online. The amount is debited directly from their bank account, or if they pay by credit card, they'll be charged at a later date. Most businesses accept card payments because they are quick and easy, expediting the purchase process.

What types of card payments are there?

Businesses can offer customers many different types of card payments via a POS and online. One of the most popular options is a debit card. Another option is credit cards, which charge the customer's account at a later date, usually at the end of the month. In general, credit cards also offer additional benefits, such as a reward programme.

Contactless payments that use NFC technology are also becoming an increasingly popular option. Customers simply need to tap the card on the reader and the amount is debited automatically. Mobile payments using a smartphone or smartwatch are also becoming more common. You can find more information about payment methods and optimising revenue with Stripe here.

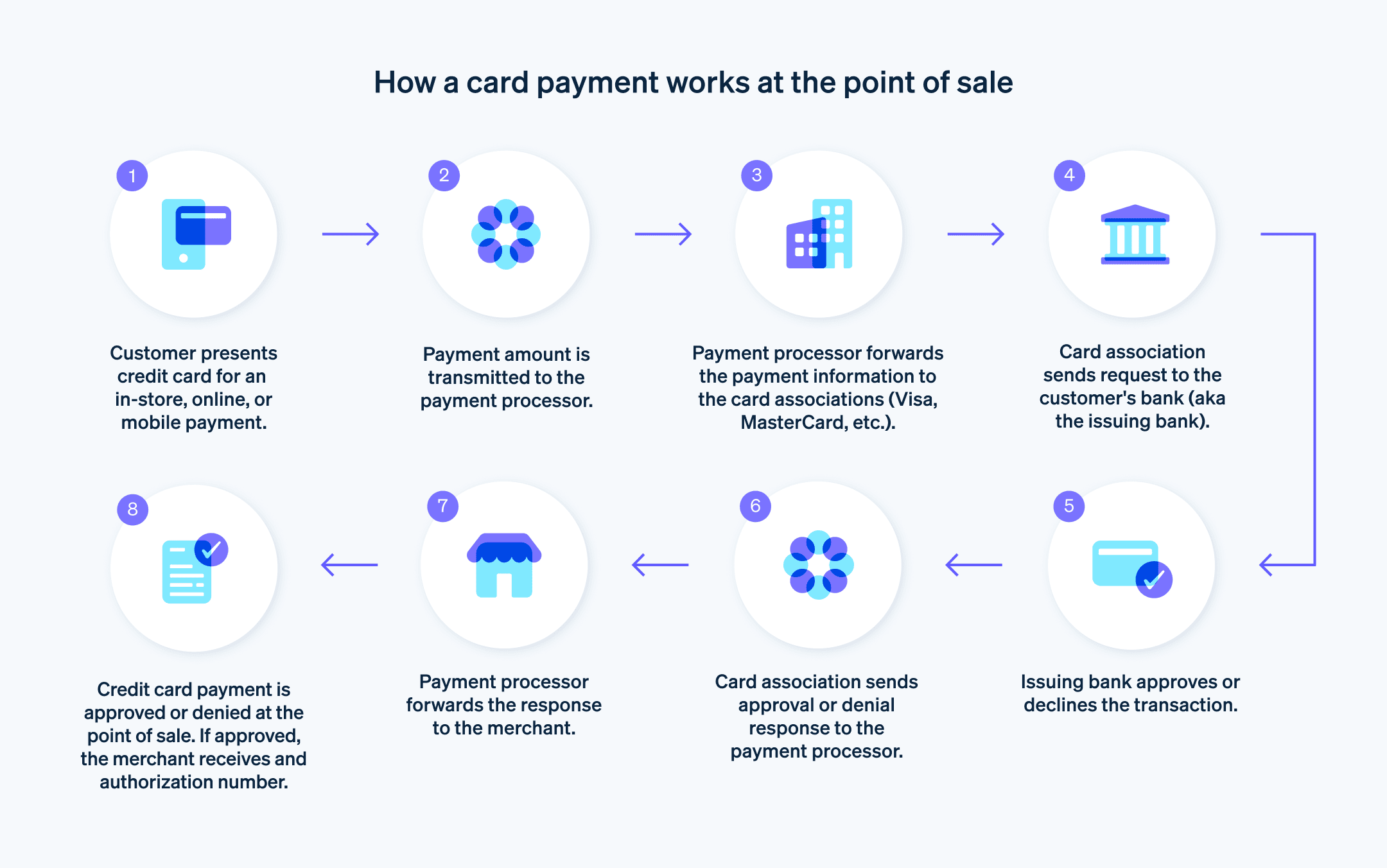

How does a card payment work on a POS?

To pay by card using a POS, the customer inserts their card into the reader or taps the card on the reader. The reader then reads all the information on the card and sends this onto the payment processor. The payment processor processes the request from the gateway, authorises the transaction and checks whether the customer has enough money in their bank account. If the transaction is approved, the money is transferred from the customer's account to the business's account. This process typically takes just a few seconds.

How does an online card payment work?

Customers can also pay online, using a credit or debit card. Debit cards need to have a co-badge from a provider, such as Maestro or Visa. Businesses need to have integrated with a payment gateway that processes the credit card payment online and shares the transaction information with the bank.

Customers need to select the option to pay by credit card, then enter their credit card number, expiry date and card verification number, before confirming the payment. Since the introduction of the 3D Secure (3DS) process in 2021 – a security standard for card payments made online – customers need to verify the payment as a last step. This is done by entering a transaction number (TAN) or a password, or it can be completed via an app or a fingerprint, depending on the bank. After a quick check by the gateway, the payment is completed. This step has made it even safer to pay for things online using a credit card.

Benefits of card payments for businesses

Card payments are not only more convenient for customers, but they also make it easier for businesses to process payments. Card payments are fast, efficient and reliable, enabling businesses to serve more customers.

Card payments are also more secure. Because all transactions are processed electronically and all card transactions are encrypted, they remove the risk of fake bank notes and cash theft, which means that they can't be manipulated by third parties. Card payment systems are equipped with fraud-detection software, protecting businesses against fraudulent transactions. Businesses can also increase revenue because customers tend to buy more when they pay via card.

One of the biggest benefits is that the amount is debited from the card immediately, so businesses receive the money very quickly. Card payment systems can also provide information about customer habits. Businesses can better understand and analyse customers' purchasing habits to determine which products are purchased most frequently or which location is most popular among their customers. This allows them to adjust their marketing strategies or develop new products to meet their customers' needs.

How much do card payments cost a business?

The exact costs of card payments for businesses depend on various factors, such as the payment provider and sales volume.

There may be initial one-off costs for setting up the card reader to accept payments via the POS. These can vary depending on the model and manufacturer, but usually range from €50 to €500. The payment provider may also charge monthly or annual fees. Fees can vary between providers, so it's important to compare them.

Transaction fees – the charges that a business has to pay when it processes a customer's payment – are another important factor. There are also fees for using providers' cards, which range from one to three per cent of the transaction value. Tariffs and breakdowns vary depending on the provider. To know which fixed and variable costs businesses will have to pay, you should ask your provider in advance.

When are card payments debited?

How long it takes to debit a payment depends on the type of card (e.g. credit or debit card) as well as the business's payment system. Generally speaking, this varies from a few minutes to the next working day at the latest for debit cards, and anywhere between one and a few working days for payments made via credit card.

A few other factors can also affect the amount of time needed to debit a card payment. For example, large amounts or international transactions may require more time for the money to reach the business's account. If the payment is made on or around a weekend or bank holiday, this can also delay the debiting process.

What happens if a bank account doesn't have enough funds available for a card payment?

If a customer wants to pay on a POS with a card but they don't have sufficient funds in their account, the payment is rejected automatically. The electronic cash process builds an electronic connection to the customer's bank and checks whether they have sufficient funds, all within a few seconds. If their balance doesn't cover the payment, the payment will be rejected automatically. For businesses, this offers protection against payment defaults. The customer will then need to pay using an alternative method, such as cash. This also applies to online orders, where the payment provider will reject a transaction automatically if funds aren't available.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.