On 1 October 2023, the qualified invoice storage method (also referred to simply as the “Invoice System”) was introduced in Japan as a means for tax credits for purchases corresponding to multiple tax rates. A qualified invoice is necessary for the seller to inform the buyer of the exact applicable tax rate and sales tax amount.

Although any type of document can serve as a qualified invoice, the National Tax Agency has some regulations on what items must be included. This article will explain in detail, using samples to format a qualified invoice for the Invoice System.

What’s in this article?

- Formatting qualified invoices for the Invoice System

- Can a qualified invoice be handwritten?

- What information must be included on a qualified invoice?

- How to differentiate the tax rate format for a qualified invoice

Formatting qualified invoices for the Invoice System

According to the National Tax Agency, creating a new document called a qualified invoice is unnecessary. As long as it meets the requirements for a qualified invoice, it can be used as a format for the Invoice System by adding items missing from the current invoice and receipts.

A qualified invoice can be a combination of multiple documents that satisfy the description; for example, an invoice and a statement of delivery can be a qualified invoice.

Freelancers sometimes do not make invoices for various reasons, including clients telling them they are not needed. If you receive a “purchase statement” or other document containing the amount of payment from your business partner, a registration number and other conditions might be required but this could be handled with a purchase statement. Be flexible on what a qualified invoice should be.

Can a qualified invoice be handwritten?

A qualified invoice can be handwritten as long as the required information is contained. A document with a name (e.g. invoices, delivery, receipts, etc.) can also be a qualified invoice.

What information must be included on a qualified invoice?

The following pieces of information must be included for a statement to be considered a qualified invoice:

- Name of issuing entity or name and registration number

- Transaction date

- Details of the transaction (i.e. that the item is subject to the reduced tax rate)

- Total amount applicable (excluding tax or including tax) and tax rate

- Consumption tax arranged by tax rate

- Name or name of the entity to whom the documents are to be issued

The classified invoice method was being used until 30 September 2023. However, since the launch of the Invoice System on 1 October 2023, it has become the primary method for invoice processing. Remember that the qualified invoice must contain a registration number, applicable tax rate, and consumption tax amount in addition to the necessary information for the classified invoice method.

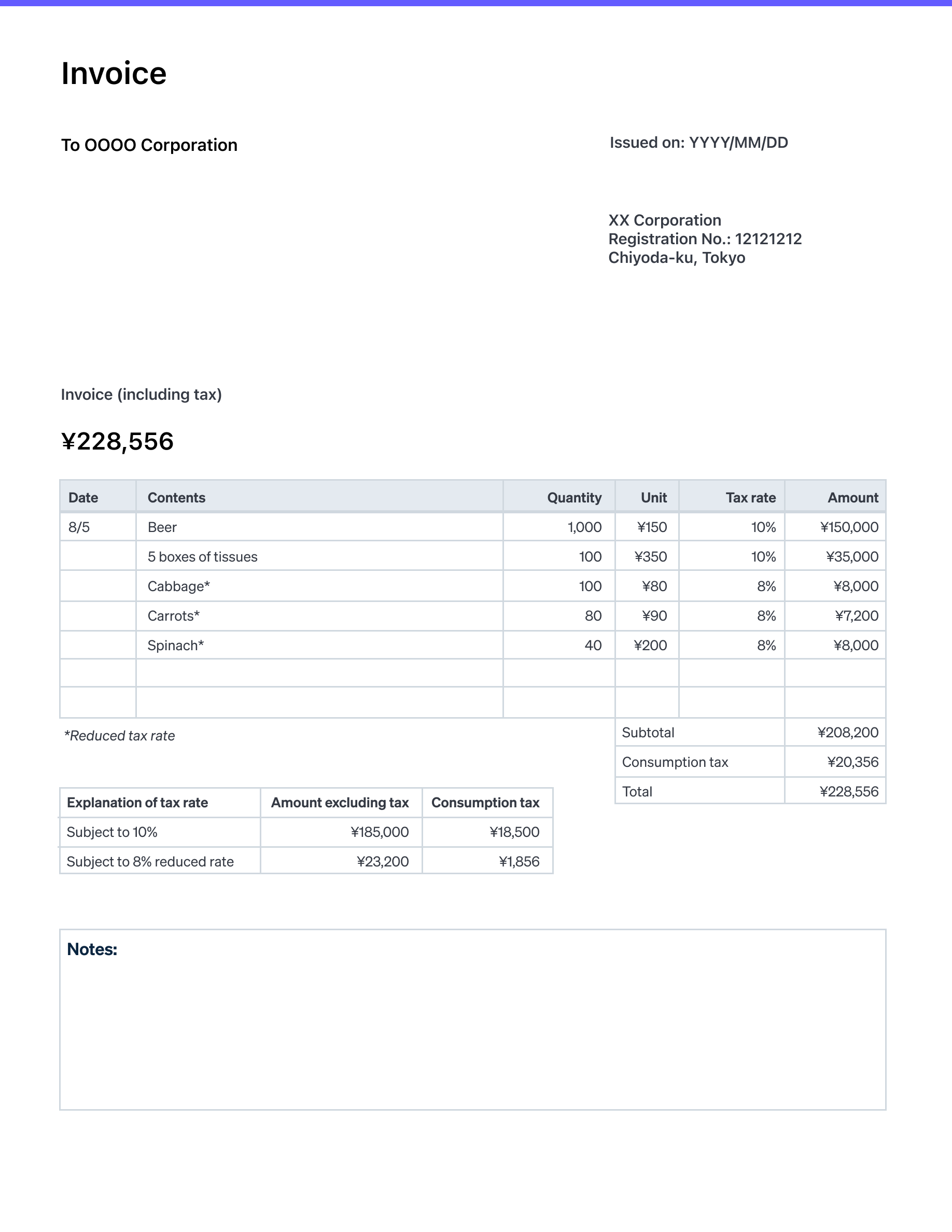

The National Tax Agency states that you can flexibly prepare a qualified invoice if the documents contain the required information. Still, it is easier to visualise if there is a template to be used as a guide. There are also several points to note regarding the inclusion of sales tax. With the above in mind, let’s look at an example.

Example of a typical qualified invoice

The method of saving classified invoices – which was necessary under the tax credit system until 30 September 2023 – also requires the name of the issuing business and the transaction date, transaction details (the item subject to the reduced tax rate total amount), tax rate (excluding tax or including tax), and the name or title of the business entity receiving the document. If you add a registration number, applicable tax rate, and consumption tax rate for each tax rate to that document, this satisfies the requirements for a qualified invoice. Many businesses can handle this by adding the necessary information to their existing documents without having to recreate them, so those registering for the Invoice System need to review them to see if they can be used.

Handling multiple documents

Multiple documents could be used together to meet the requirements of a qualified invoice. However, it must be clearly identifiable that multiple documents submitted as invoices are related.

In the following cases, the invoice and the statement of delivery satisfy the description of a qualified invoice. Also, since the statement of delivery number (highlighted in blue) appears on both documents, they are clearly related.

In the following cases, the invoice and the statement of delivery satisfy the description of a qualified invoice.

How to differentiate the tax rate format for a qualified invoice

When preparing a qualified invoice, it is important to specify the tax rate applicable to the transaction. If only the standard tax rate (10%) or the reduced tax rate (8%) is applied, it is necessary to confirm the appropriate layout for each case. Below are the specifics of which format needs to be used for each sales tax rate.

What are the formats of a qualified invoice for the 10% and 8% sales tax?

If no items are conditional to the reduced tax rate (8%) and items are only subject to the standard tax rate of 10%, the total amount subject to the reduced rate (8%, ¥0) need not be noted. On the other hand, if your template has an item such as “Reduced tax rate 8%,” there is no need to delete it, and you can enter「¥0」or something similar to indicate that the tax rate does not apply.

If there are no items conditional to the standard tax rate (10%) and only items subject to the reduced tax rate (8%), you can enter only the reduced tax rate (8%). However, make sure you indicate on the invoice that the items are “subject to the reduced tax rate” by using asterisks or other symbols.

The format for a qualified invoice that meets the requirements of the National Tax Agency is quite flexible as long as you keep in mind the items that must be included. It can be handwritten, contain multiple documents, and use any appropriate name. If you are a business preparing a qualified invoice, review your current documentation to see if you can use it and create your own original template that meets the National Tax Agency’s requirements.

Stripe is registered as a qualified invoice issuer and can generate qualified invoices that meet the transaction requirements. In addition, Stripe Invoicing enables the creation and processing of invoices in just minutes, facilitating business expansion and efficiency.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.