Recently, interest has grown in whether businesses should focus on becoming a “stock business” or a “flow business.” With a stock business model, you can expect to generate recurring revenue. An increasing number of businesses are moving away from flow-based businesses in search of stability and continuity.

Below, we’ll explain the difference between a stock-type business and a flow-type business, advantages and disadvantages of stock businesses, and successful examples of stock businesses.

What’s in this article?

- What is a stock business?

- Advantages of a stock business

- Disadvantages of a stock business

- Types of stock businesses

- Stock business success stories

- How to run a successful stock business

What is a stock business?

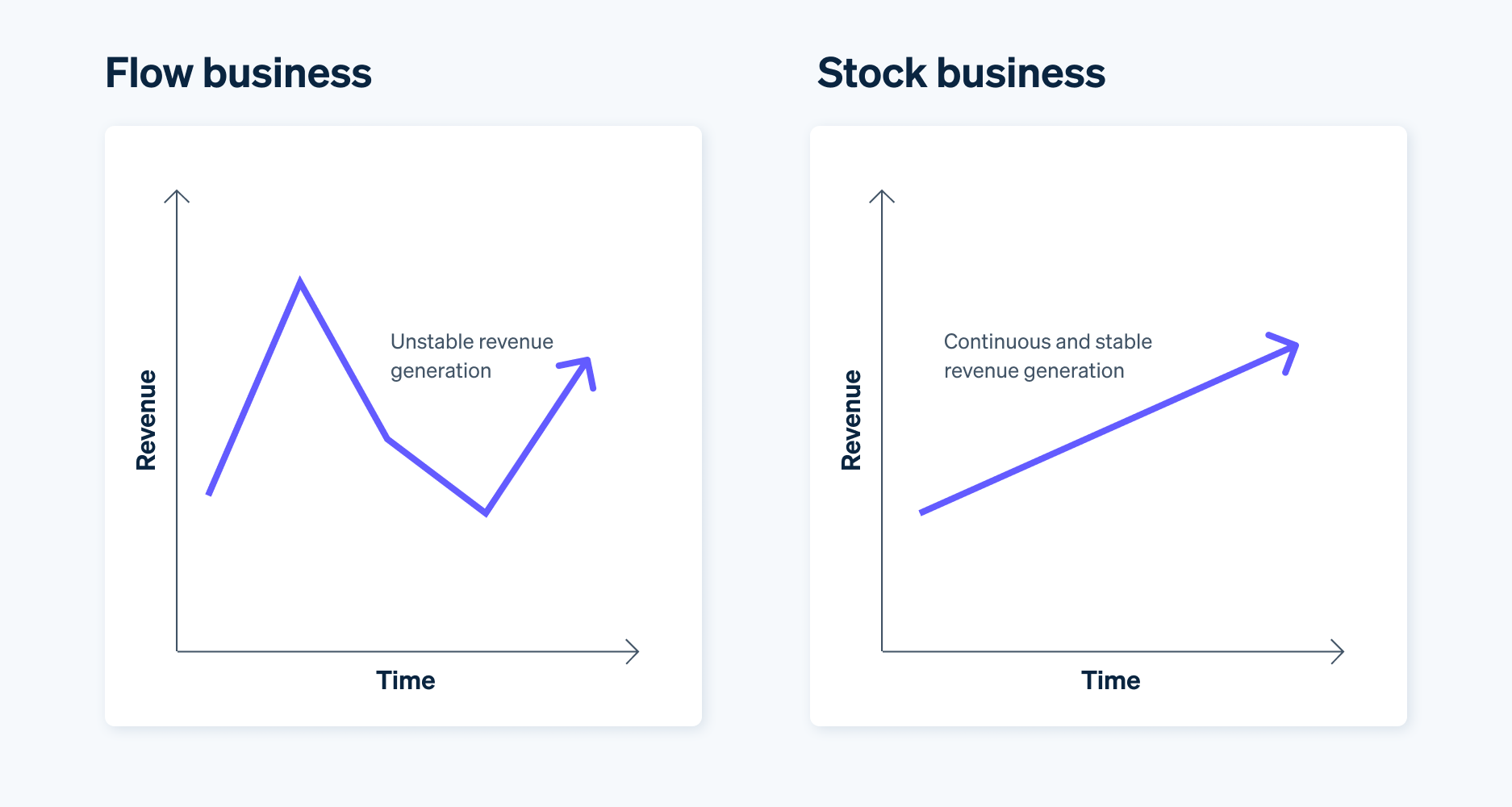

In the stock-type business model, sales continuously accumulate for each customer, meaning earnings continue even if sales activities cease, resulting in a stable and predictable cash flow.

Once a stock-based business has developed long-term relationships with customers, it can focus more on increasing revenue from existing clients instead of focusing on acquiring new ones.

For example, video distribution services, cloud services, real estate rentals, tutoring schools, and utility businesses are stock based because they generate recurring profits and can rely on a steady number of established clientele for much of their revenue.

Differences from flow-type businesses

Flow business is an antonym for stock business. It is a Japanese term derived from the English word “flow” and refers to a “highly fluid” business model. Restaurants, retail stores, and other businesses that generate one-off sales are categorised as flow businesses.

Stock and flow businesses have advantages and disadvantages.

Stock businesses have many advantages and potential for success. On the other hand, flow businesses have the advantage of being profitable in a short period but the disadvantage that sales tend to be affected by external factors, making them one-off and difficult to stabilise.

Depending on the nature of the business, it might be difficult to move everything to a stock-type business, but it might be a good idea to consider whether part of the business can be stock to aim for stability. For example, a restaurant could contract with a company to deliver packed lunches or drinks. This would provide a steady stream of income and more freedom to run the business.

For a stock business, sales will increase as the number of customers increases and the business will continue to generate revenue, whereas a flow business will stop generating revenue if it ceases to operate as a single business.

How subscription-type businesses are related

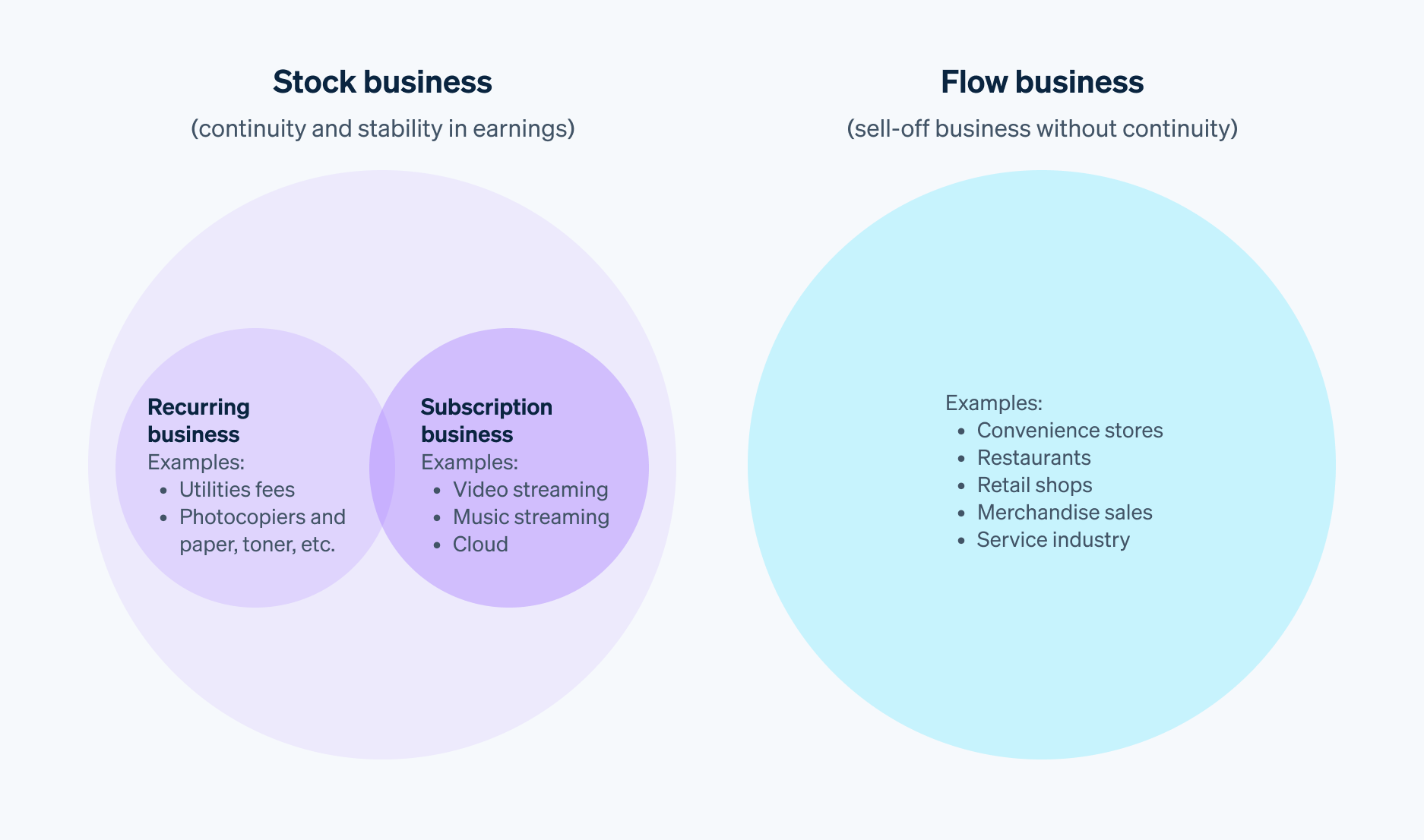

Subscriptions are a type of stock-based business because customers pay a regular fee to receive services. Subscription video distribution services, music distribution services, and cloud services are examples of subscriptions.

How recurring businesses are related

Recurring business refers to all business models that generate recurring revenue.

Recurring and subscriptions are similar business models in that both generate recurring revenue. Typically, recurring is different from the pay-as-you-go business, in which customers pay based on the amount used. Recurring businesses are also different from subscriptions, in which customers pay a fixed amount each month.

But the distinction between the two is not clear-cut, and there are cases in which a business falls into both categories or neither but is still a stock business.

The following illustration summarises these differences and nuances:

Advantages of a stock business

1. Revenue is stable

One of the biggest benefits of a stock business is it provides a steady income stream. If you can secure a certain number of contracts or members, you can expect a fixed amount of sales each month, making it easier to plan.

2. Continuity is high

Flow-type businesses must encourage repeat purchases after a customer makes an initial purchase. On the other hand, stock businesses are a continuous purchasing model, making it easier to build an ongoing relationship with customers. This helps this type of business increase customer lifetime value (LTV).

3. Managing is easy

Proprietors of stock-type businesses can estimate how much inventory they will need based on their number of contracts and members, making it easier to manage things such as the number of staff needed to handle the workload. The ability to accumulate a wide range of customer data also facilitates product and service development, helping to expand the business. If you hope to sell the business, you can do so more easily than with a flow-based business.

Disadvantages of a stock business

1. Start-up costs are high

It takes a certain amount of money and time to build a stock business’s structure, including advertising and personnel costs. Anyone planning to establish this type of business should have sufficient funds to keep the business running in the initial stages.

2. Profitability takes time

Stock businesses tend to have lower per capita costs because of the fixed price. However, sales will be lower at the start because of the smaller number of contracts and members.

3. Customer cancellation is possible

Even if you successfully gain contracts and members, customers can easily leave because they’re dissatisfied with the service. You’ll need to continue improving your services and increase customer satisfaction to keep your customers.

Types of stock businesses

Subscription

In this model, customers purchase products at regular intervals. Subscriptions are suitable for consumable goods that customers need regularly. Some of the most common subscription purchases are cosmetics and health foods.

Rental

Real estate rental management in the form of rental income from commercial buildings, condominiums, flats, car parks, etc., is a typical example of a stock business.

Delivery

This is a stock-type business that offers video and music distribution at a fixed price.

Service

Lawyers, tax accountants, and labourers are also stock-type professions because they provide their services on a fixed-fee basis as advisory contracts and receive regular revenue.

Consumption type

This model is based on selling a main unit at a low price and then asking customers to continue purchasing the accompanying consumables, such as a water cooler and water, a copier and paper, toner, etc.

Learning

English classes, tutoring, swimming, piano lessons, etc. These are types of stock businesses that generate income through ongoing classes and lessons.

Right-use type

This type of stock business generates revenue from renewable software licences, royalty fees for franchises, and qualification fees.

Insurance

Health insurance, car insurance, life insurance, fire insurance, and other general healthcare services are also a type of stock business.

Infrastructure

Some business models that manage important infrastructure, such as electricity, gas, mobile phone, and internet companies, are stock based.

Stock business success stories

Kumon

Kumon has classrooms throughout Japan and is popular as a tutoring school, especially among families with younger children. The business’s teaching services generate monthly royalties and a stable revenue stream.

Costco

Costco, a membership warehouse supermarket (wholesale and retail), continues to grow in membership each year, despite requiring an annual membership fee. There are several types of memberships.

Xbox

Xbox – the gaming brand launched by Microsoft, one of the world’s leading software manufacturers – offers Xbox Game Pass, a game subscription that lets users play games from a rotating library of titles.

How to run a successful stock business

This article has introduced what a stock business is, how it differs from a flow-type business, and its advantages and disadvantages.

To run a successful stock business, you must be constantly aware of new ways to keep customers using your products and services on an ongoing basis.

Stripe lets you focus on your business by reducing payments-related administration. Stripe Billing provides standard support for many features required for stock-based businesses. Maximise sales and reduce churn by starting billing for ongoing stock business quickly and automating Smart Retries and collections workflows.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.