An increasing number of companies in Germany rely on subscription billing to ensure recurring revenue and customer loyalty. In this article, you will learn how subscription invoices work, what benefits they offer, and how companies can create them quickly with ease.

What’s in this article?

- What is a subscription invoice?

- Which products and services can companies bill via subscription invoices?

- What are the advantages of subscription invoices for companies?

- What information must a subscription invoice contain?

- What to keep in mind about advance payments for subscription invoices?

- What must subscription companies consider regarding cancellations?

- How can companies create subscription invoices?

What is a subscription invoice?

A subscription-based charge is a recurring invoice companies issue to customers for ongoing access to a product or service. These charges occur regularly and at set intervals – for example, monthly, quarterly, or annually. The payment amounts remain consistent based on an agreement or contract between the provider and the end user. The contract also determines the duration of a plan.

Which products and services can companies bill via subscription invoices?

Many industries use subscription invoices. Examples of typical products and services for recurring billing include:

Digital services

- Cloud and software solutions: Many companies offer monthly or annual memberships for their services through licences, such as software-as-a-service (SaaS) for numerous programmes. In many cases, SaaS replaces conventional software installation on private devices.

- Web hosting and domains: Both private and business customers can use web hosting services via subscriptions.

- IT support and maintenance services: IT support service providers offer regular maintenance and support through memberships.

- Streaming services: Subscription models are common for music or video streaming. Customers typically pay a monthly basic fee for streaming services such as Netflix or Spotify.

- Online learning platforms: Educational platforms often provide courses and learning content on a membership basis.

Physical products

- Food subscriptions: With a food subscription, customers can have everyday goods, unique organic and gourmet products, or cooking boxes with the ingredients for a dish sent to them. Additionally, there are membership services for nutritional supplements such as vitamins.

- Drugstore and cosmetic products: Subscription invoices are also suitable for recurring deliveries of drugstore, personal care, and cosmetic products.

- Pet food: Many pet owners subscribe to pet food delivery services to receive regular shipments at home.

- Hobby and specialty boxes: Fitness accessories, books, craft supplies, or art materials are also typical items that customers can order regularly and which companies bill for using subscription invoices.

- Newspapers and magazines: Print media is often available by membership. In this case, companies send newspapers and magazines directly to customers’ homes. However, many publishers also offer their content in digital formats, either in addition to or exclusively.

- Books and audiobooks: The same applies to books and audiobooks. Companies can also ship these physically or distribute them digitally at regular intervals.

Service and membership subscriptions

- Fitness and sports: In many cases, gyms and online training platforms offer monthly or annual memberships.

- Transport and mobility: Public transport, car sharing, bicycle, and e-scooter plans are also suitable for recurring payments and thus subscription invoices.

- Communities: Some networks and specialist platforms offer members exclusive content and access to special services.

What are the advantages of subscription invoices for companies?

Companies benefit from subscription billing in many ways. These include:

- Predictable income: Regular memberships provide companies with a reliable income source, simplifying financial planning.

- Good scalability: Subscription models are flexible, and companies can quickly adapt them to new products, services, or pricing models, allowing them to strategically expand their offerings.

- Efficient processes through automation: Automating the creation and delivery of subscription invoices reduces administrative effort. Moreover, errors in billing are less likely, which saves companies time and money.

- Better customer loyalty: Subscriptions increase satisfaction because users no longer worry about regular re-orders and always have access to the products or services.

- Insights into customer behaviour: Regular billing can provide companies with valuable usage data on behaviour and customer preferences. This information helps them make targeted adjustments and continuously improve their offerings.

What information must a subscription invoice contain?

According to Section 14 of the German VAT Act, subscription invoices require the same mandatory information as one-off invoices. This includes:

- The complete name and address of the recipient of the product or service provider

- Date of the invoice

- The date of delivery of the product or service

- The tax number from the tax office or the VAT identification number from the Federal Central Tax Office

- A consecutive, unique invoice number

- The quantity and type of products delivered or the scope and type of service provided

- Gross and net amount

- The applicable tax rate and the corresponding tax amount or, in the case of a tax exemption, a reference to it

Companies that issue subscription invoices can use the same template for every statement – they only need to adjust each new invoice’s number, date, and service period.

What to keep in mind about advance payments for subscription invoices?

Advance payments are down or partial payments due when purchasing a product or service. For instance, customers can pay monthly or quarterly instalments with an annual plan.

In such a case, the contract must specify exactly when and how much the instalments are due. Companies need to inform end users in advance about fee terms. With flexible subscription models, customers must be able to adjust their advance payments – for example, by pausing or changing the frequency of services.

Companies need to record advance payments correctly as prepayments and pay the value-added tax (VAT) on these upfront amounts upon receipt, not only when providing the service. All advance payments need to have legally compliant documentation. This includes properly archiving all issued invoices.

What must subscription companies consider regarding cancellations?

The subscription contract needs to clearly state and regulate termination conditions. This includes information about cancellation periods, refund policies, and potential fees that might apply in the event of early termination.

Customers have a statutory right of withdrawal, which companies must inform them of per Section 355 and Section 356 of the German Civil Code. This allows them to withdraw their purchase or subscription within 14 days without giving any reason. If the service provider does not provide cancellation instructions on the website or the order confirmation, the right to cancel automatically extends by one year.

The refund policy must be clear if a customer cancels a subscription within the contract period. Depending on their business model, companies could offer partial refunds or credits for future services. Recording this in the contract and communicating it transparently to end users is important. In principle, subscribers need to be able to cancel their ongoing plan quickly and easily.

When a subscriber ends the paid plan, data processing for that customer also ends. Providers must, therefore, ensure that they securely delete personal information, or anonymize it according to legal requirements – unless they must legally store it for a period.

After a cancellation, companies can collect targeted feedback to determine why the end user terminated their plan. This can help them identify potential weak points and improve the service.

How can companies create subscription invoices?

Those that issue recurring invoices to their clients as part of subscriptions do not have to do this manually. The process can be automated because they only need to update a few details, which will save time and money. There are now numerous software solutions for creating automated charges. Companies of all sizes can benefit from Stripe Billing and its versatile tools to manage subscriptions and create invoices. Providers can also structure different pricing models, such as a flat rate, staggered, or usage-based billing. Stripe Billing supports over 135 currencies and numerous payment methods so that all customers can pay in their preferred way. In addition, billing via app partners ensures your invoices are legally compliant.

Companies can establish unique and adaptable charge schedules for each subscription. They can also set up free trial periods and discounts for end users. At the end of the promotion period, the billing system will automatically change to the regular price. Customers who do not make their payments will receive an automatic reminder.

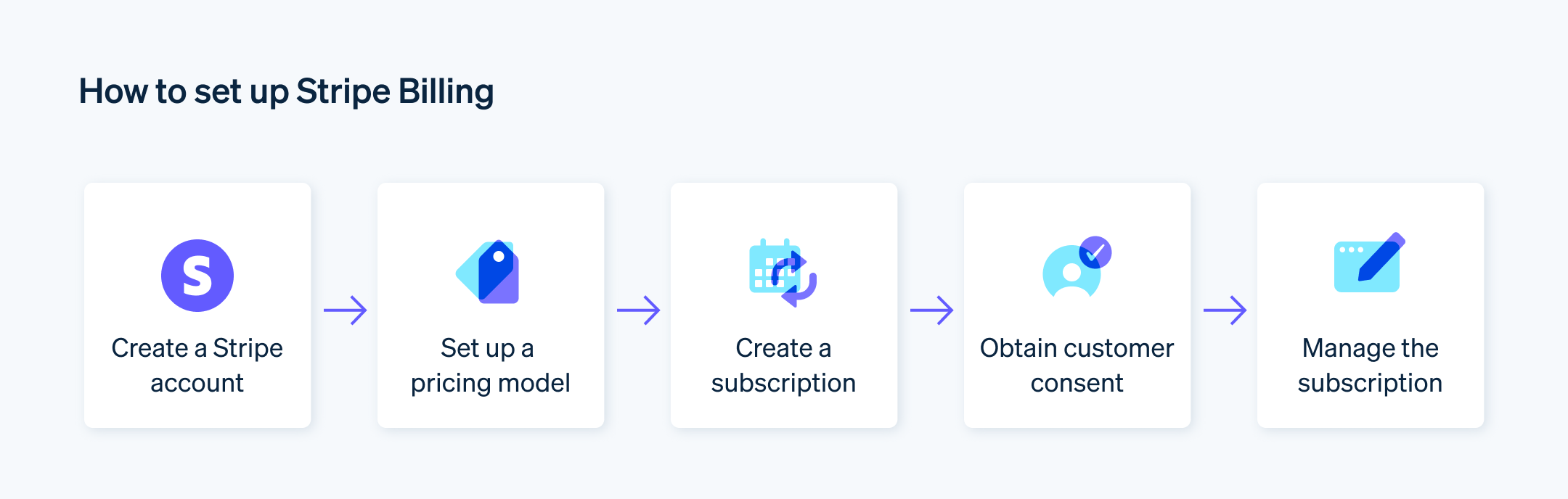

How to set up Stripe Billing

Create invoices and manage subscriptions with Billing in five easy steps:

Create a Stripe account

To use Billing, you must set up a user account with Stripe. Once you have registered and activated the account, you can access the Stripe Dashboard. There, you can create and manage subscriptions and payments.

Structure a pricing model

In the Stripe Dashboard, you can structure individual pricing models and specify prices, currencies, and billing cycles.

Create a subscription

You can now create subscriptions based on the pricing model you have set up. To do this, you must assign both the specific customers and their membership price plan.

Obtain customer consent

The express consent of your customers is a prerequisite for starting the subscription and billing for your products and services. This consent must be obtained and needs to be stored securely.

Manage the subscription

Once active, you can adjust the pricing plan anytime. You can increase or decrease costs as well or provide a discount. Cancelling a subscription is also quick and straightforward with Stripe Billing.

For more detailed information, refer to the introductory article on recurring billing and the setup guide.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.