Previous rules around consumption tax have changed with the introduction of the invoice system. Also known as the “Qualified Invoice System,” even if you know when to start invoicing, there may be times you are unsure when to issue one, depending on the timing of the transaction.

This article will explain the process leading up to the introduction of the Invoice System, when issuing invoices became mandatory, and the transition period.

What’s in this article?

- When did the Invoice System begin?

- When are you required to issue an invoice for a transaction?

When did the Invoice System begin?

The Invoice System was introduced in Japan on October 1, 2023 and is known officially as the Qualified Invoice System.

Many of you may still remember when the Invoice System began. Do you remember what it was like before the Invoice System and consumption tax was introduced? Below is a timeline of the introduction of the Invoice System.

|

Date

|

Events

|

|---|---|

| 1989 | 3% consumption tax introduced |

| 1997 | Consumption tax raised to 5% |

| 2014 | Consumption tax raised to 8% |

| 2019 | Consumption tax raised to 10% + reduced tax rate of 8% introduced |

| 2021 | Invoice system registration applications opened |

| October 2023 | Start of invoice system |

As this timeline shows, consumption tax had existed for quite some time before the Invoice System was introduced in 2023.

The Invoice System ensures that businesses pay consumption tax accurately and is a credit-for-purchase tax method compatible with multiple consumption tax rates. To issue invoices, an organization must be registered as an invoice issuing entity.

The NTA has published a helpful registration application flowchart that provides guidance tailored to an applicant’s situation and is a valuable reference for prospective applicants. If none of the cases in the flowchart apply to you or if you want personalized advice on how to fill out the registration application, please contact the competent tax office.

As a qualified invoice issuer, Stripe can issue qualified invoices that meet transaction requirements. Stripe Invoicing can create and process invoices in minutes, helping business expand and become more efficient.

When are you required to issue an invoice for a transaction?

Invoice issuance period

When will you be required to issue an invoice if the transaction date is September 2023 and the invoice is issued in October 2023?

The invoice requirement is effective for transactions occurring on or after October 1, 2023. It must be issued for the following transactions dated on or after that date.

|

Business segments

|

Transaction details

|

|---|---|

| Sale of goods | Date of shipment, date of acceptance inspection by the client, or any other date deemed reasonable as the date of delivery. |

| Services provided | If the goods must be delivered, the date all of the goods are delivered. If no goods need to be delivered, the date all services are complete. |

If the transaction is before September 30, 2023, no invoice is required. For example, if it takes place in September 2023 and then is invoiced in October 2023, there is no need to issue one.

However, one must be issued if it was in September 2023 and delivery takes place in October 2023.

If unsure, you may also issue invoices that comply with the Invoice System for transactions dated up to September 30, 2023.

Transitioning Invoice Systems

After the Invoice System comes into force, invoices must be retained for consumption tax credits on purchases in most cases.

Still, due to its recent launch, not all businesses can immediately respond to the Invoice System. To prevent confusion with the new system and avoid sudden burdens on businesses, a transition period has been established following the initial launch of the Invoice System. During this time, a fixed percentage amount equivalent to the purchase tax can be deducted even if an invoice is not issued.

Transition period

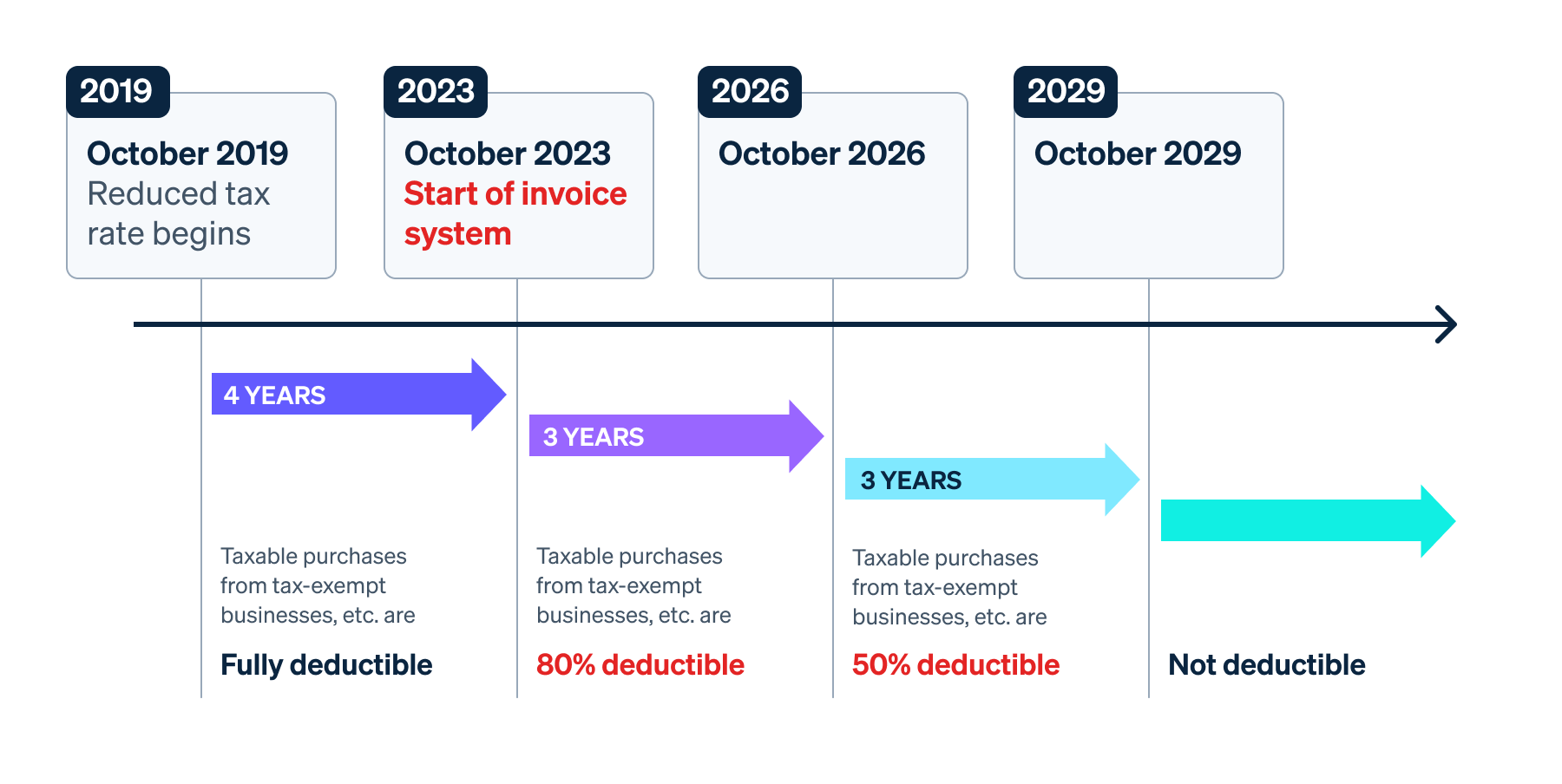

Given the enormous impact of the Invoice System, a six-year transition period has been established that allows a certain percentage of taxable purchases from tax-exempt businesses to be deducted.

In other words, during the three-year period from October 1, 2023, to September 30, 2026, 80% of taxable purchases will be deductible even if the tax-exempt business partner is not registered in the invoicing system and cannot issue an invoice. In addition, for the three years from October 1, 2026, to September 30, 2029, a deduction of 50% of taxable purchases will be allowed. After October 1, 2029, no further deduction will be allowed.

When the Invoice System was introduced, a transition period was established, during which a certain percentage of taxable purchases from tax-exempt companies not registered under it could be deducted. If you are currently a tax-exempt business, consider taking action to determine whether you need to switch to a taxable business.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.