Stripe 的监管状况

问:Stripe 在欧洲是如何监管的?

答: Stripe 在欧洲通过其子公司 Stripe Technology Europe, Limited("STEL")接受监管。STEL 已获得爱尔兰中央银行颁发的电子货币机构 (EMI) 授权(参考号码:C187865),并具备发行电子货币、执行支付交易、发行支付工具以及获取支付交易等相关业务的监管许可。请参阅爱尔兰中央银行登记册,其中确认了 STEL 的监管地位。根据《第二支付服务指令》(PSD2) 和相关欧盟法规,STEL 可在“服务自由”原则下,将其电子货币机构牌照效力扩展至整个欧洲经济区 (EEA) 的所有成员国。通过牌照通行机制,获授权的电子货币机构得以在本国及欧洲经济区 (EEA) 全域内提供金融服务,这表明 STEL 与贵国境内获授权机构具备同等的监管地位。用户还可通过 EBA 登记册中查询 Stripe 信息,该登记册确认了 Stripe 为获授权的 EMI,并列出了其获得牌照许可的国家。

问:我听说 Stripe 在欧洲没有受到全面监管,这是真的吗?

答: 这种说法完全错误。Stripe 通过其子公司 Stripe Technology Europe, Limited (STEL) 已获得爱尔兰中央银行颁发的电子货币机构授权,并具备发行电子货币、执行支付交易、发行支付工具以及获取支付交易等业务的监管许可。根据 PSD2 及相关欧盟法规,STEL 可在“服务自由”原则下,将其电子货币机构牌照扩展至整个欧洲经济区 (EEA) 的所有国家。STEL 与贵国境内获授权机构具备同等的监管地位。

请参阅爱尔兰中央银行的登记册,其中确认了 STEL 的监管地位。用户还可以在 EBA 登记册中查询 Stripe 信息,该登记册确认了 Stripe 为获授权的 EMI,并列出了其获得牌照许可的国家。

作为爱尔兰中央银行授权的电子货币机构,STEL 遵守爱尔兰所有反洗钱 (AML) 规定,并接受爱尔兰中央银行对反洗钱合规性的监督,同时遵守其他欧洲经济区 (EEA) 成员国的相关地方法规。

(针对法国)问:为什么 Stripe 没有出现在法国监管机构的授权支付服务提供商登记册上?

答: 法国监管机构不会在其国内登记册中列明通过牌照通行机制进入法国市场的机构,但这并不影响 STEL 在法国的监管地位。STEL 依据“服务自由”原则进入法国(及其他成员国)市场,因此无需在法国设立实体机构或列入法国国内机构登记册。Stripe 及其产品在法国是合规的。您可以通过查阅爱尔兰中央银行登记册中 STEL 的条目,其中列出了 STEL 已获得牌照可进入的国家,也可以在 EBA 登记册中查询 Stripe 信息,该登记册确认了 Stripe 为获授权的 EMI,并列出了其获得牌照许可的国家(包括法国)。

Connect 的监管状况

问:Connect 是否符合 PSD2?

答: Stripe Connect 在开发时便充分考虑了平台对 PSD2 的合规要求,并已通过欧洲各地监管机构及监管律师的审核。Connect 使平台无需持有或控制平台中客户应向卖家支付的款项。我们为欧洲各地大小数千家平台提供服务,并与当地监管机构(包括法国审慎监管和决议局 (ACPR, Autorité de Contrôle Prudentiel et de Résolution))就 Connect 的运作方式进行了沟通。

我们曾帮助一些平台向欧洲监管机构说明其 Connect 的使用情况。这些监管机构在听取了我们的解释后并没有表示担忧。

具体到法国,我们在法国推出 Connect 之际,我们就 Connect 的运作方式与 ACPR 进行了沟通说明,随后才进行了推广。

为降低法国 Connect 平台被视为提供支付服务或充当 Stripe 中介的风险,法国 Connect 平台需要使用账户令牌。当用户访问平台网站注册时,Stripe 的账户令牌会获取用户的身份信息及其对 Stripe 服务条款的接受情况,并直接将其传输至 Stripe 服务器。账户令牌可确保平台不参与支付服务的提供,且在将此类信息传输给 Stripe 的过程中不承担任何中介角色。

如果您对 Connect 的运作方式有具体疑问,请与我们联系。如涉及法律问题,建议您获取独立的法律意见。有关 Connect 和 PSD2 的更多信息,请参阅我们的指南。

问:Connect Separate Charges and Transfers ("SC&T") 是否符合 PSD2?

答: Stripe Connect 在开发时便充分考虑了平台对 PSD2 的合规要求,并已通过欧洲各地监管机构及监管律师的审核。Connect 使平台无需持有或控制平台中客户应向卖家支付的款项。我们已成功接入数千家大小不一的欧洲平台,并与当地监管机构就 Connect 的运作方式进行了沟通。

尤其是在 SC&T 方面,我们了解到,平台有时会担心自身可能掌控本应支付给其 Connect 子账户的资金。通过 Stripe Connect,平台并不掌控资金,资金而是存放在以 Stripe 名义开设的银行账户中。平台会向 Stripe 提供预先约定的指令,例如向 Connect 子账户进行付款。这些指令体现了平台与 Connect 子账户之间预先约定的合同安排,表明平台并不掌控资金。平台必须获得 Connect 子账户的合同授权,才能代表关联账户向 Stripe 传达指令,且对资金没有自由裁量权。

如果您对 Connect 的运作方式有具体疑问,请与我们联系。如涉及法律问题,建议您获取独立的法律意见。有关 Connect 和 PSD2 的更多信息,请参阅我们的指南。

问:Connect 是否允许平台占有或控制用户资金?

答: Stripe Connect 在开发时便充分考虑了平台对 PSD2 的合规要求,并已通过欧洲各地监管机构及监管律师的审核。Connect 使平台无需持有或控制平台中客户应向卖家支付的款项。我们已成功接入数千家大小不一的欧洲平台,并与当地监管机构(包括 ACPR)就 Connect 的运作方式进行了沟通。

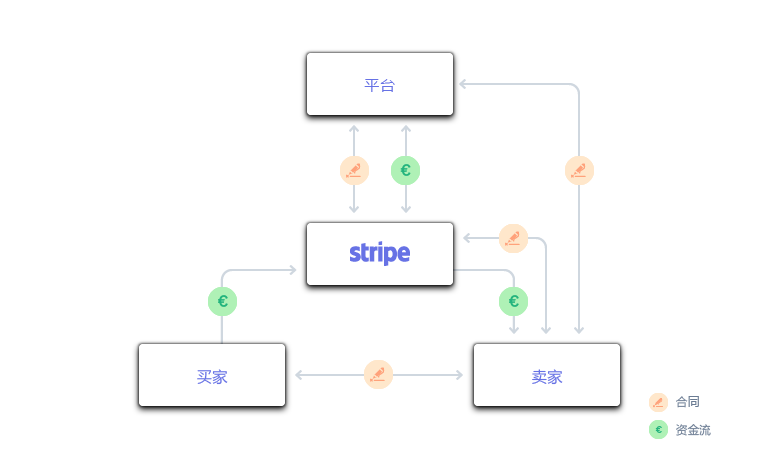

通过 Connect 服务,Stripe 不仅与平台签订合同,还与平台上的底层用户(即 Connect 子账户)建立法律关系。这些关系使 Stripe 能够完成两项结算工作:一是向用户结算款项,二是向平台结算费用。终端客户应支付给用户的款项(即支付给用户的款项)绝不会由平台持有或管控。相反,这些款项会先结算至 Stripe 的专用保障账户,随后再支付:

- 终端客户向用户的关联银行账户支付的款项;以及

- 平台向其银行账户支付的费用

就资金持有而言,平台在任何时候都不会持有用户资金,因为用户资金由 Stripe 存放在指定的保障账户中。平台对这些账户既无访问权也无管理权。

通过 Stripe Connect,平台并不掌控资金,资金而是存放在以 Stripe 名义开设的银行账户中。平台会向 Stripe 提供预先约定的指令,例如向 Connect 子账户进行付款。这些指令体现了平台与 Connect 子账户之间预先约定的合同安排,表明平台并不掌控资金。平台必须获得 Connect 子账户的合同授权,才能代表关联账户向 Stripe 传达指令,且对资金没有自由裁量权。

如果您对 Connect 的运作方式有具体疑问,请与我们联系。如涉及法律问题,建议您获取独立的法律意见。有关 Connect 和 PSD2 的更多信息,请参阅我们的指南。

问:PSD3 会对 Connect 及 PSD2 合规性产生影响吗?

答: PSD3 尚处于早期阶段,仍处于草案形式。不过,根据欧盟委员会已公布的草案内容,我们预估 Connect 及 PSD2 合规性要求不会发生任何变更。PSD2 中部分豁免条款(包括代理商豁免和有限网络豁免)的适用范围可能会被收紧。基于 PSD3 的这一调整方向,许多当前依赖豁免条款的平台可能会发现,与继续沿用豁免方案相比,采用 Connect 服务能够简化其合规义务。

更多信息请参阅 Stripe 就平台与交易市场对 PSD3 的预期发布的指南。

用户作为 Stripe 的代理/中介

问:作为 Connect 平台,我是 Stripe 的代理或中介吗?

答: 不是,Stripe 不认为 Connect 平台是 Stripe 的代理或中介。PSD2 代理关系(即支付服务提供商 (PSP) 指定平台作为其代理的情形)仅适用于平台代表 PSP 自身开展支付服务活动的场景。但 Connect 模式并非如此——平台并未代表 Stripe 从事任何支付服务活动。Connect 服务使平台无需持有或控制终端客户应支付给平台商家/卖家(Connect 子账户)的资金。通常情况下,只有当平台持有或控制用户资金,或直接参与提供支付服务时,才会被视为提供了支付服务。

中介地位因国家而异,但总体而言,Stripe 不认为其任何 Connect 平台构成中介性质,因为 Stripe 与 Connect 子账户建立直接关系,并直接向 Connect 子账户提供支付服务,而非通过平台间接提供。

问:交易市场是否需要获得 PSD2 牌照或被指定为 Stripe 的 PSD2 代理?

A: 交易市场(或任何其他平台)仅在以下情况下需要获得 PSD2 牌照(或豁免)或被指定为 PSD2 代理:向用户提供受监管的支付服务(如果平台持有或控制用户资金,也可能触发此要求)时;或参与提供此类服务时。通过使用 Connect 服务,交易市场可避免持有或控制用户资金,且不会代表 Stripe 提供支付服务,因此无需获得牌照或被指定为 PSD2 代理。

问:(针对法国)作为 Connect 平台,我是 Stripe 的银行与支付服务中介 (IOBSP) 吗?

答: 不是,Connect 平台不是 Stripe 的 IOBSP。这主要是因为 Connect 平台不通过向 Stripe 推荐 Connect 子账户而直接或间接获得 Stripe 的报酬。IOBSP 注册通常适用于经纪人类型的安排,即经纪人通过向金融机构推荐客户而直接获得报酬。Connect 模式并非如此。

此外,平台不参与商家的 Connect 子账户注册流程。该过程通过账户令牌直接通过API完成。因此,平台不构成中介。

问:Stripe 会指定我们为 PSD2 代理吗?另一家支付服务提供商 (PSP) 表示我们需要成为代理,并表示将指定我们为代理。

答: Stripe Connect 使平台无需持有或控制客户应支付给平台商家的资金,且设计上确保您不会因代表 Stripe 提供支付服务而受到监管。因此,您无需被指定为 Stripe 的 PSD2 代理。只有自身从事受监管支付服务的平台才需要成为支付服务提供商 (PSP) 的 PSD2 代理。

平台应慎重考虑是否应被指定为 PSP 的 PSD2 代理,因为这意味着必须遵守以下要求并接受监督:

- 反洗钱 (AML) 与反恐怖主义融资 (CFT) 风险管理: 您需遵守 PSP 的反洗钱/反恐怖主义融资政策及内部控制措施,这可能需投入内部资源(包括时间与人力)并加强管理。

- 监管与监督: PSP 需就您的合规情况向监管机构负责,因此作为其代理计划管理的一部分,将对您业务的此方面行使广泛的审计权与监管职责。PSP 的代理计划同样需要接受监管机构的监督,且可能需根据监管信息请求或审计要求,提供有关其 PSD2 代理的信息。任何被指定的 PSD2 代理必须能够全面、及时地回应与其作为 PSD2 代理所从事活动相关的查询,这将需要投入员工资源、管理时间,而且可能需要活的法律意见支持。

- 资金处理限制: 虽然代理有能力处理商家资金,但这些资金必须严格按照监管要求,存放在独立的隔离账户中,且商家不得动用或使用这些资金。此外,代理处理平台商家所获资金的权限仅适用于指定您为 PSD2 代理的 PSP 所获取的资金。若您同时与多家 PSP 合作进行资金代收,则仅当您成为这些 PSP 的 PSD2 代理时,才能处理它们获取的商家资金,而这无疑会进一步加重您在合规管理方面的负担,并占用更多资源。

与成为 PSP 的 PSD2 代理相比,Stripe Connect 提供了一种更为简便的替代方案,它能让您无需承担成为 PSD2 代理所需履行的广泛监管义务,从而帮助您将宝贵的时间和资源聚焦于核心业务的发展。