Regulatory status of Stripe

Q: How is Stripe regulated in Europe?

A: Stripe is regulated in Europe through its subsidiary Stripe Technology Europe, Limited (“STEL”). STEL is authorised as an electronic money institution, or “EMI,” by the Central Bank of Ireland (reference number: C187865) and has regulatory permissions to issue electronic money, execute payment transactions, issue payment instruments, and acquire payment transactions. Please see the Central Bank of Ireland’s register, which confirms STEL’s regulatory position. STEL passports its electronic money institution licence on a “freedom of services” basis to all countries across the EEA under the Second Payment Services Directive, PSD2, and related EU legislation. Passporting enables authorised electronic money institutions to provide their services in both their home state and throughout the EEA, which means that STEL has equivalent regulatory status as a firm authorised in your country. Users can also search for Stripe on the EBA register, which confirms it is an authorised EMI and lists the countries where the permission is passported.

Q: I have heard that Stripe isn’t fully regulated in Europe—is that true?

A: This is entirely incorrect. Stripe, through its subsidiary Stripe Technology Europe, Limited (“STEL”), is authorised as an electronic money institution by the Central Bank of Ireland and has regulatory permissions to issue electronic money, execute payment transactions, issue payment instruments, and acquire payment transactions. STEL passports its electronic money institution licence on a “freedom of services” basis to all countries across the EEA under PSD2 and related EU legislation. STEL has the equivalent regulatory status as an e-money firm authorised in your country.

Please see the Central Bank of Ireland’s register, which confirms STEL’s regulatory position. Users can also search for Stripe on the EBA register, which confirms it is an authorised EMI and lists the countries where the permission is passported.

As an electronic money institution authorised by the Central Bank of Ireland, STEL complies with all Irish Anti-Money Laundering (AML) requirements and is supervised for AML compliance by the Central Bank of Ireland, and complies with relevant local regulation in other EEA countries.

(French specific) Q: Why does Stripe not appear on the French regulator’s register of authorised payment service providers?

A: The French regulator does not list passporting-in firms on their domestic register. This does not affect STEL’s regulatory position in France. STEL passports into France (and other member states) on a “freedom of services” basis so that it does not need to have a presence in France or be on the domestic register of firms. Stripe and its products are compliant in France. You can verify STEL’s regulatory position in France by reviewing the STEL entry on the Central Bank of Ireland register, which lists all countries STEL passports into, and you can also search for Stripe on the EBA register, which confirms it is an authorised EMI and lists the countries, including France, where the permission is passported.

Regulatory status of Connect

Q: Is Connect compliant with PSD2?

A: Stripe Connect has been developed with platform PSD2 compliance in mind and vetted by regulators and regulatory lawyers across Europe. Connect enables platforms to stay out of possession and control of funds that are owed by customers to sellers on platforms. We provide services to thousands of European platforms, large and small, and have also engaged with local regulators (including the Autorité de Contrôle Prudentiel et de Résolution, or “ACPR,” in France) on how Connect works.

We have helped a number of platforms describe their use of Connect to European regulators. These regulators have not raised concerns following such explanations.

Specifically for France, we engaged with the ACPR around the time of the launch of Connect in France to outline how Connect works, and subsequently proceeded with the rollout.

In order to mitigate risk that French Connect platforms could be interpreted as providing payment services or acting as intermediaries of Stripe, French Connect platforms are required to use account tokens. When a user visits a platform’s website to sign up, Stripe’s account tokens consume the user’s identification information and their acceptance of Stripe’s terms of service and transmits it directly to Stripe’s servers. Account tokens ensure that the platform is not involved in the provision of payment services and has no intermediary role in transmitting this information to Stripe.

If you have specific questions on how Connect works, please reach out to us. If you have legal questions, you may want to obtain independent legal advice. Additional information on Connect and PSD2 is available in our guide.

Q: Is Connect Separate Charges and Transfers (“SC&T”) compliant with PSD2?

A: Stripe Connect has been developed with platform PSD2 compliance in mind and vetted by regulators and regulatory lawyers across Europe. Connect enables platforms to stay out of possession and control of funds that are owed by customers to sellers on platforms. We have onboarded thousands of European platforms, large and small, and also engaged with local regulators on how Connect works.

Particularly in respect to SC&T, we understand that platforms sometimes have concerns that they may come into control of funds owed to their connected accounts. With Stripe Connect, a platform does not have control over the funds, but instead the funds sit in a Stripe-titled bank account. The platform provides pre-agreed instructions to Stripe, such as making a payout to connected accounts. These instructions reflect pre-agreed contractual arrangements between platform and connected account and demonstrate that the platform does not have control over the funds. The platform must be contractually authorised by the connected account to communicate instructions on behalf of the connected account to Stripe and does not have discretionary authority over the funds.

If you have specific questions on how Connect works, please reach out to us. If you have legal questions, you may want to obtain independent legal advice. Additional information on Connect and PSD2 is available in our guide.

Q: Does Connect allow platforms to have possession or control of user funds?

A: Stripe Connect has been developed with platform PSD2 compliance in mind and vetted by regulators and regulatory lawyers across Europe. Connect enables platforms to stay out of possession and control of funds that are owed by customers to sellers on platforms. We have onboarded thousands of European platforms, large and small, and also engaged with local regulators (including the ACPR) on how Connect works.

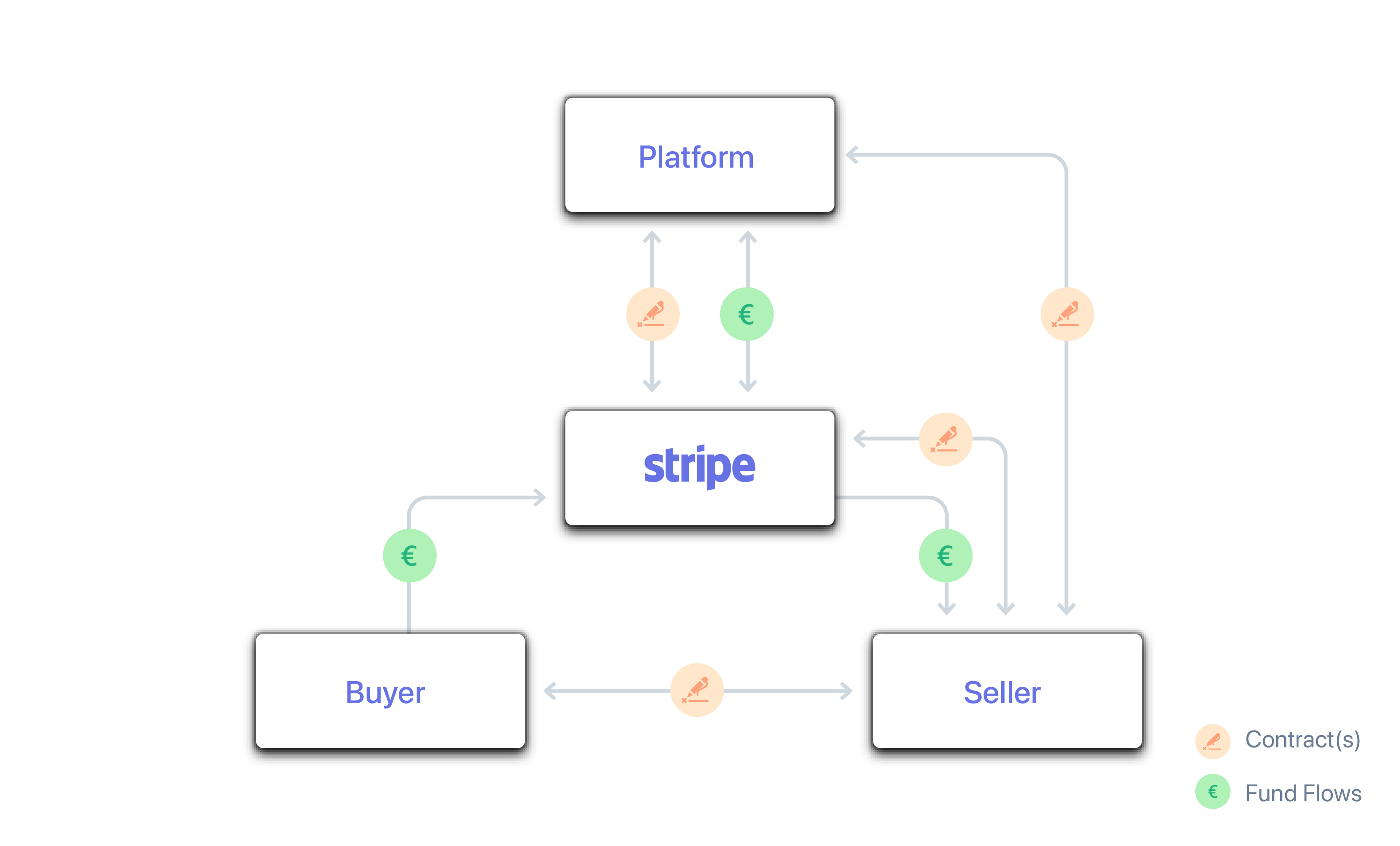

With Connect, Stripe contracts with the platform, but it also establishes a legal relationship with the underlying user (connected account) on the platform. These relationships enable Stripe to settle i) payments to the user and ii) fees to the platform. Funds that are owed by end customers to the user (payments to the user) are never in the possession or control of the platform. Instead, these funds are settled to Stripe’s safeguarding accounts, before payout of:

- the end customer’s payment to the user’s linked bank account, and

- the platform’s fee to the platform’s bank account

In terms of possession, it is clear that the platform does not have possession of user’s funds at any point as user’s funds are held by Stripe in designated safeguarding accounts. The platform does not have access or management rights over those accounts.

With Stripe Connect, a platform does not have control over the funds, as only Stripe has control over the funds held in the Stripe-titled safeguarded bank account. The platform can provide pre-agreed instructions to Stripe, such as making a payout to connected accounts. These instructions reflect pre-agreed contractual arrangements between platform and connected account and demonstrate that the platform does not have control over the funds. The platform must be contractually authorised by the connected account to communicate instructions on behalf of the connected account to Stripe and does not have discretionary authority over the funds.

If you have specific questions on how Connect works, please reach out to us. If you have legal questions, you may want to obtain independent legal advice. Additional information on Connect and PSD2 is available in our guide.

Q: Does PSD3 change anything about Connect and PSD2 compliance?

A: PSD3 is at an early stage and is still in draft form. However, based on the drafts that the European Commission has published, we do not anticipate any changes to Connect and PSD2 compliance. The scope of certain PSD2 exemptions—both the commercial agent and limited network exemptions—is likely to be narrowed. Given that direction of travel under PSD3, many platforms that make use of an exemption might find that Connect simplifies their compliance obligations compared to their current approach of relying on an exemption.

Please see Stripe’s guide on what platforms and marketplaces can expect from PSD3 for more information.

User as an agent/intermediary of Stripe

Q: As a Connect platform, am I an agent or intermediary of Stripe?

A: No, Stripe does not consider Connect platforms to be Stripe’s agents or intermediaries. PSD2 agency (i.e., where a platform is appointed as an agent by a payment service provider (PSP)) is only applicable where the platform is itself carrying out payment services activity on behalf of the PSP. That is not the case with Connect—the platform is not undertaking any payment services activity on behalf of Stripe. Connect enables platforms to stay out of possession and control of funds that are owed by end customers to businesses/sellers (connected accounts) on platforms. Platforms would generally only be considered to be engaged in providing payment services where they are in possession or control of user funds or where they are directly involved in providing payment services.

The status of intermediaries can vary by country, but in general Stripe does not consider any of its Connect platforms to be intermediaries because Stripe has a direct relationship with connected accounts and provides payment services directly to connected accounts, and not via a platform.

Q: Are marketplaces required to have a PSD2 licence or be appointed as a PSD2 agent of Stripe?

A: Marketplaces (or any other platform) require a PSD2 licence (or exemption) or must be appointed as a PSD2 agent only if they are providing regulated payment services to their users (can also arise if platforms are in possession or control of user funds) or participate in the provision of such services. By using Connect, marketplaces can avoid coming into possession or control of user funds and do not otherwise provide payment services on behalf of Stripe, so they do not require a licence or need to be appointed as a PSD2 agent.

Q: (France specific) As a Connect platform, am I an intermédiaire en opérations de banque et en services de paiement (IOBSP) of Stripe?

A: No, Connect platforms are not IOBSPs of Stripe. This is primarily because Connect platforms are not directly or indirectly remunerated by Stripe for introducing connected accounts to Stripe. IOBSP registration typically covers broker-type arrangements where a broker receives direct remuneration for referring a customer to a financial institution. That is not the case with Connect.

Additionally, platforms do not play a role in enrolling businesses as connected accounts. This process occurs directly through the API when using account tokens. Consequently, platforms do not act as intermediaries.

Q: Will you appoint us as a PSD2 agent of Stripe? Another PSP says that we need to be an agent and that they will appoint us as one.

A: Stripe Connect enables platforms to stay out of possession and control of funds that are owed by customers to businesses on their platform and is designed so that you are not regulated providing payment services on behalf of Stripe. Therefore, you do not need to be appointed as a PSD2 agent of Stripe. Only platforms who themselves carry out regulated payment services need to become PSD2 agents of payment service providers (PSPs).

Platforms should carefully consider whether or not they should be appointed as a PSD2 agent of a PSP, as it means being subject to the following requirements and oversight:

- AML and Countering The Financing Of Terrorism (CFT) risk management: You will be required to comply with the PSP’s AML/CFT policies and internal controls, which will likely require internal resourcing (both time and headcount) and management.

- Supervision and oversight: The PSP is responsible to its regulator for your compliance, and therefore will have wide-ranging audit rights and oversight responsibilities over this aspect of your business as part of their management of their agency program. A PSP’s agency program is also subject to supervision and oversight by their regulator and they may be required to provide information about their PSD2 agents in response to a regulatory information request or audit. Any appointed PSD2 agent must be in a position to answer queries regarding their activities as PSD2 agent in a comprehensive and timely manner, which will require employee resources, management time, and potentially legal advice.

- Restrictions on handling funds: While agents have the ability to handle business funds, these funds must be safeguarded in segregated accounts in a highly prescriptive manner—these funds are not available to and cannot be used by your business. Further, the ability to handle funds acquired for businesses on your platform will only apply to funds acquired by the PSP that has appointed you as PSD2 agent. If you use multiple PSPs for acquiring, you will only be able to handle business funds acquired by other PSPs if you become their PSD2 agent, which will increase the compliance and resource burden set out above.

Stripe Connect is a simpler alternative to being appointed as a PSD2 agent of a PSP and helps you avoid the need to comply with the wider range of regulatory requirements associated with PSD2 agency above, which will take away time and resources from focusing on your main business.