Product

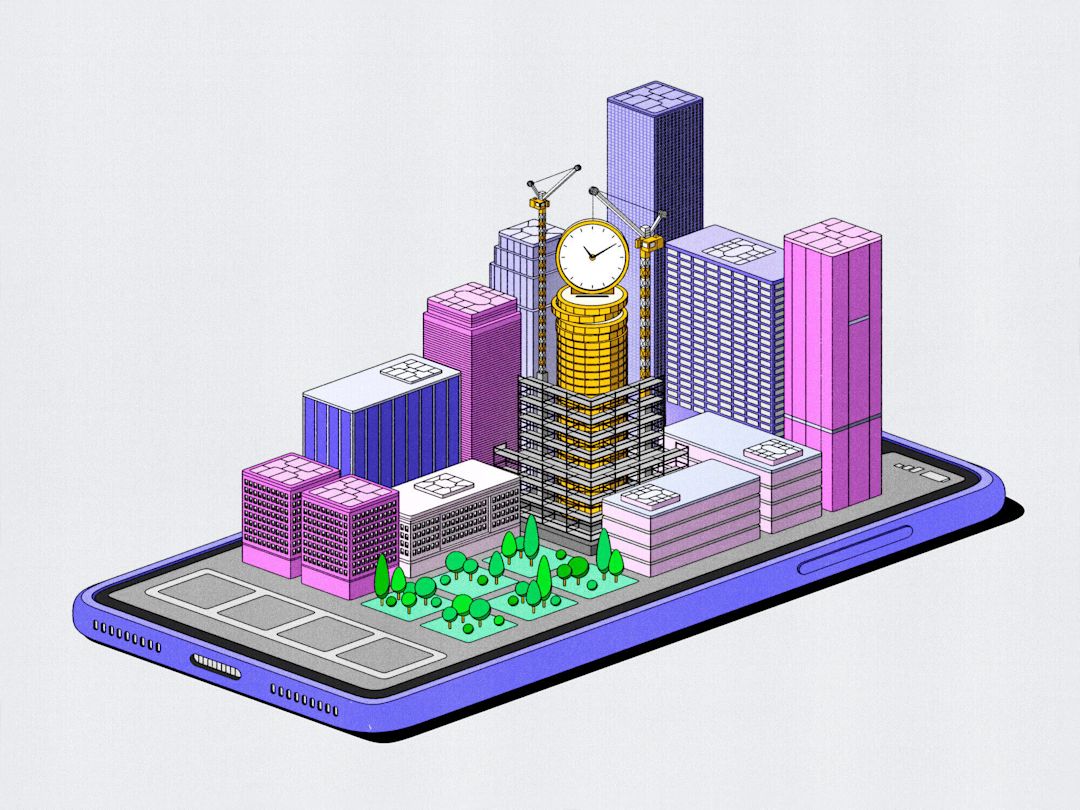

How Stripe is using AI to create personalized checkout experiences

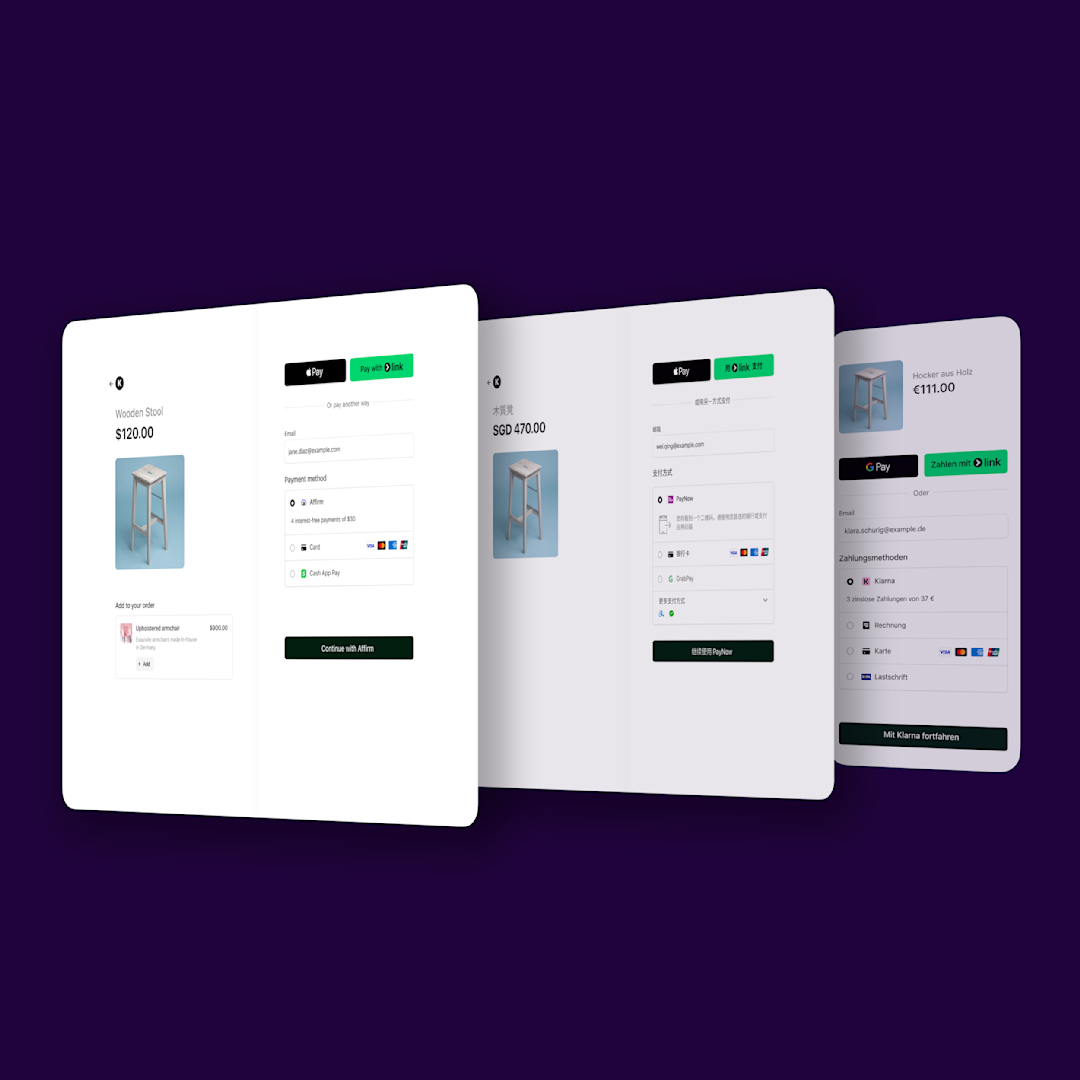

The Optimized Checkout Suite uses AI to personalize the checkout experience—dynamically adjusting everything from payment method ordering to fraud interventions in order to maximize conversion and boost revenue.