ในฐานะผู้ค้าเร่ คุณสามารถจัดหาสินค้าหรือบริการได้ทุกที่ที่ต้องการ คุณสามารถขยายไปสู่พื้นที่ใหม่ๆ และเข้าถึงกลุ่มลูกค้าเพิ่มเติมได้ อย่างไรก็ตาม ข้อกําหนดสําหรับการจดทะเบียนการค้าเร่นั้นเข้มงวดกว่าข้อกําหนดสําหรับธุรกิจแบบประจำที่

ในบทความนี้ คุณจะได้เรียนรู้ว่าการค้าเร่คืออะไร ข้อกําหนดที่ต้องปฏิบัติตาม และวิธีการลงทะเบียน นอกจากนี้เรายังจะแบ่งปันเคล็ดลับที่เป็นประโยชน์เพื่อช่วยให้คุณเริ่มต้นธุรกิจได้อย่างถูกต้อง

เนื้อหาหลักในบทความ

- การค้าเร่คืออะไร

- ตัวอย่างของการค้าเร่มีอะไรบ้าง

- ผู้ค้าเร่ในเยอรมนีต้องปฏิบัติตามข้อกําหนดอะไรบ้าง

- ฉันจะลงทะเบียนเป็นผู้ค้าเร่ได้อย่างไร

- วิธีเริ่มต้นการค้าเร่ของคุณให้ประสบความสําเร็จ

การค้าเร่คืออะไร

ในเยอรมนี การค้าเร่ (การเดินทาง) (รู้จักกันในชื่อ "Reisegewerbe" ในภาษาเยอรมัน) เป็นกิจกรรมเชิงพาณิชย์ประเภทหนึ่งที่ไม่เหมือนใคร เกี่ยวข้องกับการให้บริการหรือขายสินค้านอกสถานที่ถาวร สิ่งนี้ตรงกันข้ามกับธุรกิจประจำที่ เช่น ร้านค้าที่มีหน้าร้านจริง ซึ่งลูกค้ามาหาผู้ค้า

ผู้ค้าเร่ที่เดินทางไปหาลูกค้าหรือเสนอสินค้าในที่สาธารณะ ข้อกําหนดที่สําคัญคือลูกค้าต้องไม่เคยติดต่อผู้ค้าเร่มาก่อน สินค้าหรือบริการจึงถูกนําเสนอโดยไม่มีคำขอหรือคำสั่งซื้อล่วงหน้า

มีข้อยกเว้นบางประการ กิจกรรมเกือบทั้งหมดที่สามารถทําได้ในธุรกิจประจำที่ก็สามารถทําได้ในการค้าเร่

พื้นฐานกฎหมายสําหรับการค้าเร่พบได้ในกฎหมายการค้า โดยเฉพาะในประมวลกฎหมายอุตสาหกรรมของเยอรมนี (GewO) ตัวอย่างเช่น มาตรา 55 ของ GewO สรุปสิ่งที่ถือเป็นการค้าเร่และข้อกําหนดที่ต้องปฏิบัติตามสําหรับการจดทะเบียน

คุณสามารถค้นหาข้อมูลเกี่ยวกับความแตกต่างระหว่างกิจกรรมอิสระและกิจกรรมเชิงพาณิชย์ได้ในบทความของเราเกี่ยวกับ การประกอบอาชีพอิสระในเยอรมนี

ตัวอย่างของการค้าเร่มีอะไรบ้าง

กิจกรรมการค้าเร่ครอบคลุมการขายและบริการแบบเคลื่อนที่ที่หลากหลายให้กับลูกค้าโดยตรง หรือในสถานที่ต่างๆ นี่คือตัวอย่างบางส่วน:

- การจำหน่ายสินค้า: ผู้ค้าเร่สามารถจำหน่ายผลิตภัณฑ์ของตนได้ที่ตลาดนัดประจำสัปดาห์และประจําปี การขายแบบ door-to-door ถือเป็นการค้าแบบเร่ด้วยเช่นกัน ตัวอย่างเช่น พวกเขาสามารถจำหน่ายของใช้ในครัวเรือน ผลิตภัณฑ์ทําความสะอาด และสิ่งทอ

- อาหารและเครื่องดื่ม: บุคคลใดก็ตามที่จำหน่ายอาหารหรือเครื่องดื่มในสถานที่ต่างๆ ก็มีส่วนเกี่ยวข้องกับการค้าเร่เช่นกัน ตัวอย่างทั่วไป ได้แก่ รถตู้ขายขนมขบเคี้ยว หรือรถขายอาหาร

- บริการทำความสะอาดและดูแล: บริการทําความสะอาดเคลื่อนที่ถือเป็นการค้าเร่เช่นกัน ซึ่งรวมถึงการทําความสะอาดและบํารุงรักษาหน้าต่าง พรม หรือยานพาหนะถึงที่ รวมถึงหน้าที่อื่นๆ

- บริการให้คำปรึกษา: ผู้ค้าเร่สามารถทําหน้าที่เป็นที่ปรึกษาเคลื่อนที่ โดยให้คําแนะนําเกี่ยวกับผลิตภัณฑ์ต่างๆ เช่น ประกันภัยหรือเครื่องสําอางที่บ้านของลูกค้าโดยตรง

- บริการหัตถกรรมดั้งเดิม: ช่างฝีมือยังสามารถให้บริการของตนเป็นการค้าเร่ได้ ช่างฝีมือเคลื่อนที่ ได้แก่ ช่างลับคมมีดกรรไกร ช่างทํารองเท้า หรือช่างทําผมที่ให้บริการถึงบ้านของลูกค้าโดยตรง

- บริการด้านความบันเทิง: บุคคลใดก็ตามที่เปิดให้บริการม้าหมุน สนามยิงปืน หรือซุ้มความบันเทิงอื่นๆ ในฐานะนักแสดง ก็จัดเป็นผู้ค้าเร่เช่นกัน นอกจากนี้ยังรวมถึงนักแสดงข้างถนน เช่น นักดนตรี นักเล่นกล หรือนักมายากลที่แสดงในพื้นที่สาธารณะ

ตามมาตรา 56 ของ GewO กิจกรรมบางอย่างเป็นสิ่งต้องห้ามสําหรับการค้าเร่ ตัวอย่างเช่น ห้ามซื้อขายหลักทรัพย์ สลากกินแบ่งสามารถขายได้ในที่สาธารณะเท่านั้น และต้องเป็นส่วนหนึ่งของสลากกินแบ่งที่ได้รับอนุมัติเพื่อการกุศล รวมทั้งห้ามซื้อขายอัญมณี โลหะมีค่า และไข่มุก ข้อจํากัดเดียวกันนี้ยังบังคับใช้กับอุปกรณ์ทางการแพทย์และออร์โธปิดิกส์ เช่น แว่นตา เครื่องช่วยฟังอิเล็กทรอนิกส์ หรือกายอุปกรณ์เสริมที่ช่วยพยุงข้อเท้าและเท้าทางออร์โธปิดิกส์ เบียร์และไวน์อาจขายในภาชนะที่ปิดสนิท เครื่องดื่มแอลกอฮอล์อื่นๆ สามารถขายได้ก็ต่อเมื่อขายเพื่อการบริโภคในสถานที่จากสถานประกอบการที่แน่นอน นอกจากนี้ ห้ามขายสารพิษและสิ่งของที่มีสารพิษ

ผู้ค้าเร่ในเยอรมนีต้องปฏิบัติตามข้อกําหนดอะไรบ้าง

การค้าเร่ในเยอรมนีต้องปฏิบัติตามข้อกําหนดด้านกฎหมายและในทางปฏิบัติที่หลากหลาย เงื่อนไขหลักในการลงทะเบียนคือการได้รับใบอนุญาตอย่างเป็นทางการ ใบอนุญาตนี้ออกให้ในรูปแบบของบัตรการค้าเร่ ซึ่งมักเรียกว่า ใบอนุญาตการค้าเร่ และยืนยันว่าผู้ประกอบการมีคุณสมบัติตรงตามข้อกําหนดเบื้องต้นทางกฎหมาย เมื่อคุณได้รับใบอนุญาตการค้าเร่แล้ว คุณสามารถดําเนินธุรกิจได้ทุกที่ในเยอรมนี สิ่งสําคัญคือต้องพกใบอนุญาตติดตัวไปด้วยตลอดเวลาขณะดําเนินธุรกิจ และแสดงบัตรเมื่อเจ้าหน้าที่ร้องขอ

การจัดตั้งธุรกิจโดยไม่มีใบอนุญาตการค้าเร่

อย่างไรก็ตาม ตามมาตรา 55a ของ GewO ไม่ใช่ผู้ค้าเร่ทุกรายที่จะได้รับใบอนุญาตการค้าเร่ การยกเว้นนี้ใช้กับบุคคลที่ขายสินค้าในงานสาธารณะเป็นครั้งคราวและได้รับอนุญาตเฉพาะจากหน่วยงานที่เกี่ยวข้อง อาหารและสิ่งของในชีวิตประจําวันอื่นๆ สามารถขายได้โดยไม่ต้องมีใบอนุญาตการค้าเร่ หากขายในช่วงเวลาสั้นๆ เป็นประจําในสถานที่เดียวกัน เช่น ผู้ขายที่จำหน่ายผลิตภัณฑ์ของตนในตลาดเดียวกันทุกสัปดาห์ ผู้ค้าเร่ที่เสนอสินค้าและบริการเฉพาะภายในเขตเทศบาลในละแวกบ้านของตนเองไม่จําเป็นต้องมีใบอนุญาตนี้ โดยมีเงื่อนไขว่าเทศบาลมีประชากรน้อยกว่า 10,000 คน

ผู้ค้าที่จำหน่ายผลิตภัณฑ์ที่ปลูกเองที่บ้านจากการเกษตร ป่าไม้ การปลูกพืชผัก การปลูกผลไม้ พืชสวน การเลี้ยงสัตว์ปีก การเลี้ยงผึ้ง อีกทั้งการล่าสัตว์และการตกปลาก็ได้รับการยกเว้นจากข้อกําหนดที่ต้องมีใบอนุญาตการค้าเร่ด้วยเช่นกัน นอกจากนี้ การขายหนังสือ สิ่งพิมพ์อื่นๆ และผลิตภัณฑ์จากนมยังได้รับการยกเว้นจากการปฏิบัติตามใบอนุญาตตามที่ระบุไว้ในมาตรา 4 ของ MilchMargG (พระราชบัญญัติเกี่ยวกับนมและมาการีน) ในกรณีส่วนใหญ่ คุณยังสามารถให้คําแนะนําหรือขายผลิตภัณฑ์ประกันภัยและทำสัญญาออมทรัพย์ของสังคมได้โดยไม่ต้องมีใบอนุญาตการค้าเร่

จะลงทะเบียนเป็นผู้ค้าเร่ได้อย่างไร

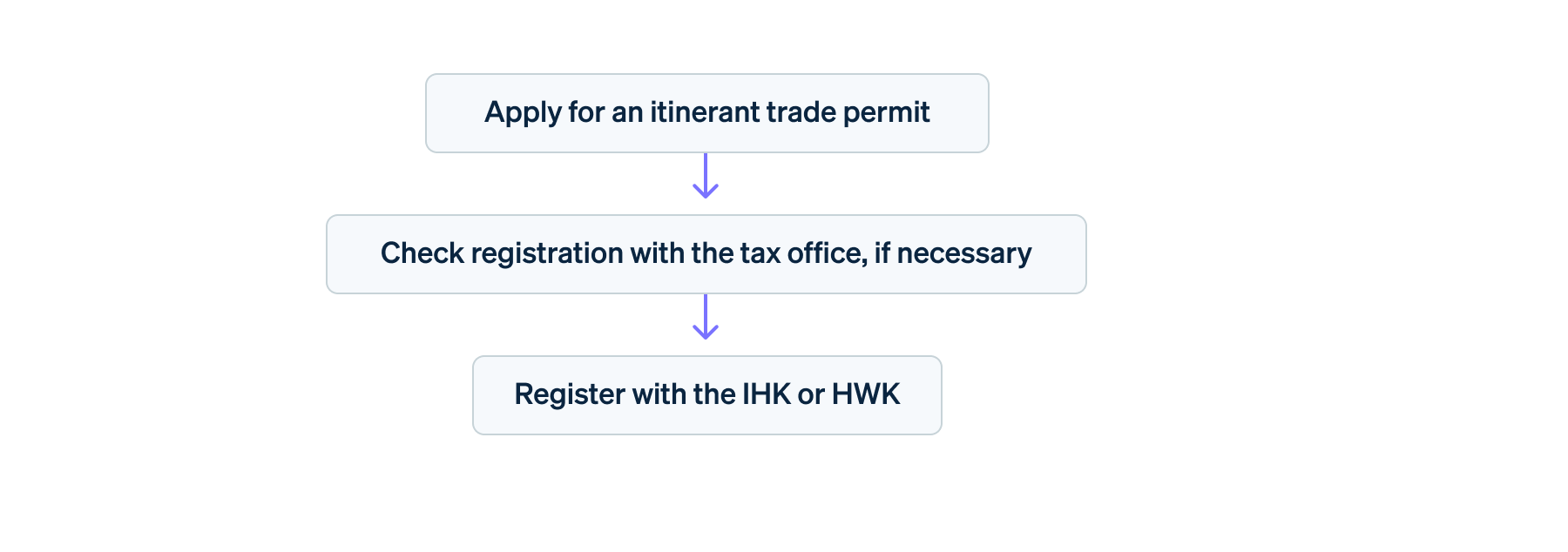

การลงทะเบียนการค้าเร่สามารถทําได้ในไม่กี่ขั้นตอน ขั้นแรก คุณต้องสมัครบัตรการค้าเร่ ซึ่งคุณต้องส่งเอกสารหลายฉบับไปยังสํานักงานการค้าที่เกี่ยวข้อง นอกจากเอกสารระบุตัวตนและรูปถ่ายแล้ว คุณต้องจัดเตรียมข้อมูลจากทะเบียนการค้าส่วนกลางและหนังสือรับรองความประพฤติจากสำนักงานตำรวจ บุคคลที่มีประวัติอาชญากรรมหรือละเมิดกฎระเบียบทางการค้าอาจถูกปฏิเสธการออกใบอนุญาตการค้าเร่ หากธุรกิจของคุณจดทะเบียนพาณิชย์ คุณต้องส่งข้อมูลจากธุรกิจนั้นด้วย นอกจากนี้ คุณจะต้องมีหนังสือรับรองความประพฤติ จากสำนักงานภาษี ใบอนุญาตให้มีถิ่นที่อยู่ (หากมี) และหากซื้อขายอาหาร ให้แสดงหลักฐานใบรับรองการศึกษาที่เป็นไปตามข้อกำหนดพระราชบัญญัติป้องกันการติดเชื้อ

ข้อกําหนดสําหรับการจดทะเบียนการค้าเร่นั้นเข้มงวดกว่าการค้าแบบอยู่กับที่ เนื่องจากเป็นการยากสําหรับเจ้าหน้าที่ในการตรวจสอบและกำกับดูแลผู้ค้าเร่ สํานักงานการค้าจะตรวจสอบเอกสารทั้งหมด แล้วออกใบอนุญาตการค้าเร่ ค่าใช้จ่ายจะแตกต่างกันไป ขึ้นอยู่กับเทศบาลและธุรกิจ โดยปกติแล้ว ค่าธรรมเนียมจะอยู่ระหว่าง 25 ถึง 400 ยูโร

สํานักงานการค้ามักจะแจ้งให้สำนักงานภาษีทราบเกี่ยวกับการจดทะเบียนการค้าเร่ เพื่อความปลอดภัย ให้ตรวจสอบกับสำนักงานภาษีเพื่อยืนยันว่าได้รับข้อมูลที่เกี่ยวข้องแล้ว

สุดท้าย สำนักงานภาษีจะส่งการจดทะเบียนภาษี แบบสอบถาม รายละเอียดอื่นๆ มูลค่าการซื้อขายที่คาดหวังจะต้องรวมอยู่ในแบบสอบถามนี้ ซึ่งสำนักงานภาษีใช้ในการคํานวณจํานวนภาษีที่ต้องชําระ ผู้ค้าเร่ต้องจ่ายภาษีการค้าภาษีมูลค่าเพิ่ม (ภาษีมูลค่าเพิ่ม) และภาษีรายได้ (ถ้ามี) หากคุณต้องการความช่วยเหลือในการคํานวณและรายงานภาษี ให้พิจารณาใช้Stripe Tax ภาษีจะคํานวณจํานวนภาษีที่ถูกต้องโดยอัตโนมัติและให้สิทธิ์การเข้าถึงเอกสารภาษีที่เกี่ยวข้องทั้งหมด ทําให้การยื่นขอคืนภาษีเป็นเรื่องง่ายและรวดเร็ว

ขึ้นอยู่กับกิจกรรมและภาคส่วน ผู้ค้าเร่ต้องลงทะเบียนกับหอการค้าและอุตสาหกรรม (IHK) หรือหอการค้าหัตถกรรม (HWK) ที่เกี่ยวข้อง

สุดท้ายต้องได้รับใบอนุญาตการตั้งแผงขายสินค้าจากสํานักงานรัฐบาลท้องถิ่น (Ordnungsamt) สําหรับแผงขายสินค้าที่วางแผนไว้ หน่วยงานก่อสร้างที่รับผิดชอบ (Bauamt) อาจต้องมีส่วนร่วมด้วย

การลงทะเบียนการค้าเร่: ทีละขั้นตอน

วิธีเริ่มต้นการค้าเร่ของคุณให้ประสบความสําเร็จ

ก่อนลงทะเบียนการค้าเร่ คุณควรตรวจสอบเสมอว่ากิจกรรมของคุณมีคุณสมบัติตรงตามข้อกำหนดการค้าเร่หรือไม่ เส้นแบ่งระหว่างการค้าเร่และธุรกิจแบบประจำที่อาจไม่ชัดเจนได้ เพื่อความแน่ใจ คุณควรติดต่อหอการค้าและอุตสาหกรรมหรือหอการค้าหัตถกรรมในพื้นที่ของคุณ สํานักงานการค้ายังสามารถให้รายละเอียดที่เกี่ยวข้องแก่คุณได้อีกด้วย

คุณควรสร้างแผนธุรกิจก่อนเริ่มต้นเพื่อประเมินความเป็นไปได้ทางเศรษฐกิจของบริษัทของคุณ และกําหนดความต้องการเงินทุน คุณสามารถใช้การวิจัยตลาดเพื่อให้ข้อมูลเชิงลึกเกี่ยวกับขนาดตลาดและความต้องการ และเพื่อระบุคู่แข่งที่เสนอบริการที่คล้ายคลึงกัน ท้ายที่สุดแล้ว การแข่งขันรวมถึงธุรกิจสัญจรอื่นๆ และบริษัทในท้องถิ่น คุณสามารถพัฒนากลยุทธ์ของคุณและกําหนดพื้นที่โฟกัสเฉพาะของคุณที่จัดตั้งขึ้นการวิจัยตลาด ต้นทุนและรายได้ที่คาดการณ์ไว้ควรรวมอยู่ในแผนธุรกิจด้วย คุณอาจต้องดึงดูดนักลงทุนด้วย

โดยทั่วไป ผู้ค้าเร่ควรทําประกันความรับผิดเพื่อป้องกันตนเองจากการเรียกร้องที่อาจเกิดขึ้น สําหรับบุคคลบางคนในอุตสาหกรรมบันเทิง การประกันภัยความรับผิดเป็นข้อบังคับ เช่น ผู้ประกอบการสนามยิงปืน คอกม้า หรือเครื่องเล่นสวนสนุกที่โดยสารผู้คน คุณอาจต้องทําประกันเพิ่มเติม เช่น ประกันอุบัติเหตุหรือการโจรกรรม ทั้งนี้ขึ้นอยู่กับลักษณะของธุรกิจของคุณ

แม้ว่าผู้ค้าเร่ส่วนใหญ่จะใช้ธุรกรรมเงินสดแบบเดิมๆ แต่ก็ควรสํารวจตัวเลือกการชำระเงินที่ทันสมัย ลูกค้าจํานวนมากขึ้นคาดหวังตัวเลือกในการชําระค่าสินค้าและบริการด้วยบัตร การใช้ Stripe Terminal ช่วยให้คุณสามารถรับเครื่องรูดบัตรที่ผ่านการรับรองล่วงหน้า เช่นS700 หรืออุปกรณ์เคลื่อนที่ เช่นBBPOS WisePad 3 หรือคุณสามารถรับการชำระเงินด้วยบัตรโดยใช้สมาร์ทโฟนของคุณร่วมกับTap to Pay สิ่งนี้ทําให้คุณสามารถเสนอการชําระเงินแบบไร้เงินสดให้กับลูกค้าได้ในขณะเดินทาง

สุดท้ายนี้ สิ่งสำคัญคือคุณต้องโปรโมตการค้าเร่ของคุณ อย่างไรก็ตาม กฎระเบียบด้านการค้ากำหนดข้อจำกัดหลายประการเมื่อเทียบกับการค้าขายแบบมีสถานที่ถาวร เนื่องจากคำสั่งซื้อจะทำได้ก็ต่อเมื่อผู้ค้าขายเร่เป็นฝ่ายริเริ่มเท่านั้น โดยอนุญาตเฉพาะการโฆษณาภาพลักษณ์ในเชิงทั่วไปเท่านั้น ตัวอย่างเช่น แผ่นพับต้องไม่ระบุข้อมูลการติดต่อ อนุญาตให้พิมพ์ได้เฉพาะที่อยู่ของผู้ค้าขายเร่ แต่ไม่อนุญาตให้ใส่หมายเลขโทรศัพท์หรือที่อยู่อีเมล

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ