Accept secure SEPA Direct Debit payments in minutes on Stripe

Add SEPA Direct Debit to your Stripe integration to offer customers a simple and safe way to pay directly from their bank account for large or recurring charges.

Reach European customers

SEPA Direct Debit covers 34 countries, reaching over 520 million people across Europe. SEPA Direct Debit is often preferred by European customers for large or recurring payments.

Reduce payment failure

Compared to cards, bank account information is less likely to expire or be declined, which reduces payment failure and involuntary churn for recurring revenue businesses.

Maintain a single integration

Add SEPA Direct Debit to any kind of Stripe integration, including platforms,— and benefit from unified reporting and payouts across payment methods.

Get started quickly and simplify operations

Add SEPA Direct Debit to any Stripe integration for unified monitoring, reporting, and payouts. There’s no application, onboarding, or underwriting process to get started.

How it works

Secure payments for your customers

Bank debits allow you to pull funds directly from your customer’s bank account for one-time or recurring payments. To initiate a bank debit, a customer provides their bank account details during checkout and gives you permission to debit the account by agreeing to a mandate. SEPA Direct Debit gives your buyers a secure option at checkout.

Fully integrated

Get started quickly on Stripe

With Stripe, harness all the benefits of bank debits plus fast deployment, simplified integration maintenance, and unified reporting and payouts. Sepa Direct Debit also works with custom-built payment forms.

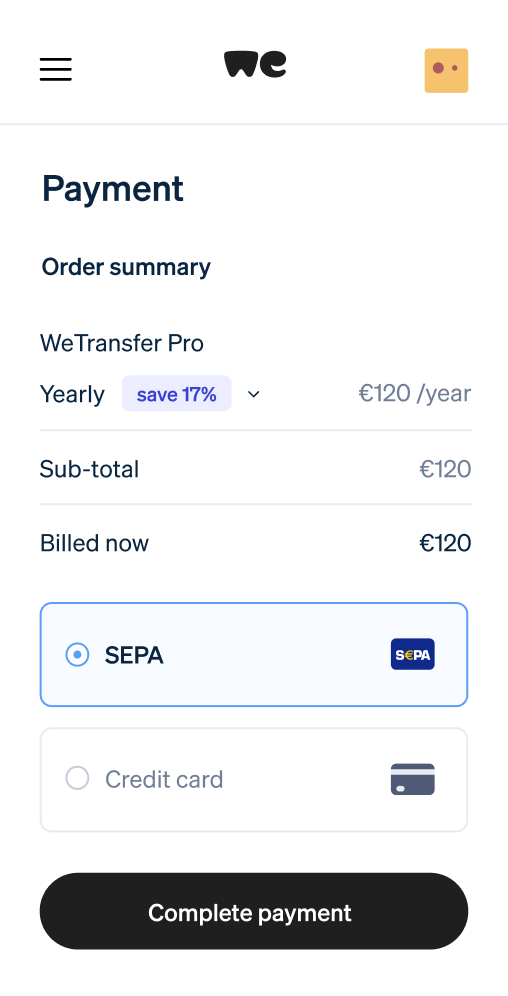

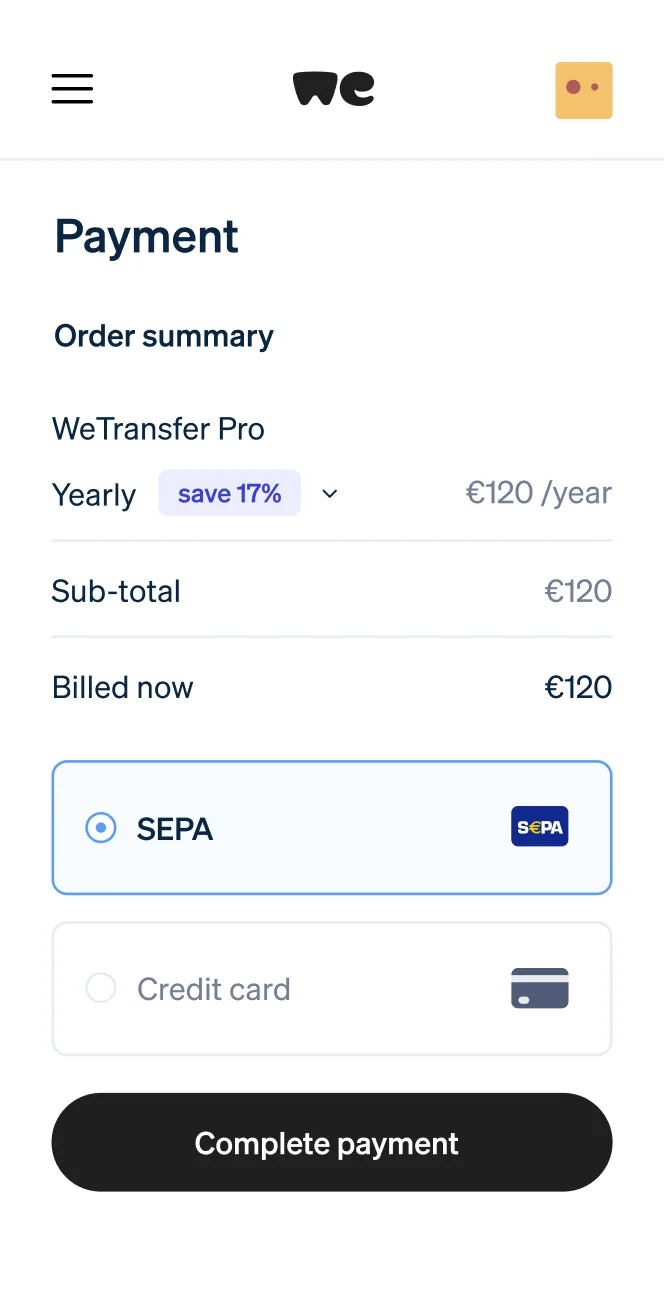

No-code UI options

Enable SEPA Direct Debit right from the Dashboard with Payment Element, Checkout, or Payment Links—no additional integration work required.

For platforms

Through Connect, platforms and marketplaces can easily distribute SEPA Direct Debit with no work required by merchants anywhere in the world.

For one-time or recurring billing

Stripe Invoicing, Billing, and Checkout make it even easier to collect bank debits and hosted mandates reflect your payment terms, and debits are automatically initiated.

|

Traditional flow

|

Stripe

|

|

|---|---|---|

|

Send invoice

|

Manual | Automatic |

|

Review bank statement

|

Manual | Automatic |

|

Notice new customer payment

|

Manual | Automatic |

|

Match payment with invoice

|

Manual | Automatic |

|

Mark invoice as paid

|

Manual | Automatic |

Ready to get started?

There’s no paperwork for eligible businesses to start accepting SEPA Direct Debit on Stripe. Stripe supports SEPA Direct Debit for businesses based in Europe, the UK, the US, Canada, Mexico, Australia, New Zealand, Japan, Hong Kong, and Singapore

Accept other bank debits

Stripe supports bank debits around the world, including ACH Direct Debit in the US and Bacs Direct Debit in the UK

Pricing

Learn more about our transparent per-transaction pricing.