Qu’est-ce que la Loi sur les transactions commerciales spécifiées ? Le gouvernement japonais a adopté cette loi pour protéger les consommateurs contre les transactions malveillantes, qui semblent augmenter d’année en année. Il est très important que les exploitants de sites de commerce électronique comprennent bien cette loi et les mentions obligatoires qui en découlent afin d’accroître la satisfaction de la clientèle et de prévenir les problèmes entre les entreprises et les consommateurs. Cet article explique en détail la Loi sur les transactions commerciales spécifiées et les informations que doivent contenir chacune de ces déclarations, avec des exemples spécifiques.

Sommaire de cet article

- Qu’est-ce que la loi sur les transactions commerciales spécifiées ?

- Quels sont les types de transactions couverts par la Loi sur les transactions commerciales spécifiées ?

- Qu’est-ce que les mentions conformes à la loi sur les transactions commerciales spécifiées ?

- Modèle permettant de créer des mentions conformes à la Loi sur les transactions commerciales spécifiées

- Que faire en cas d’absence de mentions conformes à la Loi sur les transactions commerciales spécifiées ?

Qu’est-ce que la Loi sur les transactions commerciales spécifiées ?

La loi sur les transactions commerciales spécifiées est une « une loi visant à protéger les intérêts des consommateurs ». Afin de protéger les clients contre les sollicitations ou les contrats déloyaux, la loi établit des politiques pour certains types de transactions, des règlements administratifs et des règles, telles qu'une période de réflexion (règles civiles 6).

Réglementations administratives

La Loi sur les transactions commerciales spécifiées établit les règlements suivants pour les entreprises afin de s’assurer que les consommateurs bénéficient des informations appropriées. Les entreprises qui enfreignent cette loi s’exposent à des dispositions administratives, telles qu’une injonction à améliorer leurs pratiques commerciales ou une suspension ou interdiction de leurs activités, mais elles sont également passibles de sanctions.

- Obligation d’indiquer clairement le nom : cette loi oblige les entreprises à indiquer à l’avance à leurs clients leur nom et le fait qu’il s’agit d’une sollicitation.

- Interdiction de sollicitation déloyale : interdit les fausses explications sur les prix et les conditions de paiement, ainsi que les actes visant à intimider les consommateurs ou semer la confusion chez eux.

- Réglementation en matière de publicité : oblige les entreprises à indiquer des informations importantes et interdit la publicité fausse ou exagérée.

- Obligation de remettre un document écrit : à la conclusion du contrat, l’opérateur doit fournir un document écrit décrivant les points essentiels.

Règles civiles

Ces règles visent à réduire les problèmes à venir entre les consommateurs et les entreprises :

- Délai de rétractation (ne s’applique pas aux commandes par courrier) : le client ou l’entreprise peut résilier un contrat sans condition dans les huit jours suivant la demande de conclusion de contrat pour des ventes de porte-à-porte et de télémarketing, les offres de services continus spécifiés et les achats de porte-à-porte, et dans les 20 jours pour les transactions de vente par parrainage et les transactions de vente liées à des opportunités professionnelles. Il n’existe pas de délai de rétractation pour les commandes par courrier.

- Annulation de la déclaration d’intention : si un client a effectué un achat ou conclu un contrat en raison d’informations erronées ou d’une fausse déclaration délibérée de la part d’une entreprise, il peut annuler la déclaration d’intention.

- Limitation des dommages : détermine le montant maximal des dommages-intérêts auxquels une entreprise peut prétendre si un consommateur annule le contrat en cours de route.

Remarque : les règlements administratifs et les règles civiles susmentionnées constituent des éléments représentatifs. Il existe d’autres lignes directrices et règles, qui diffèrent légèrement en fonction du type de transaction décrit ci-après.

Quels sont les types de transactions couverts par la Loi sur les transactions commerciales spécifiées ?

La Loi ne s’applique pas à toutes les entreprises. Les types de transactions assujettis à la réglementation en vertu de cette loi sont les suivants :

- Vente en visite

- Commande par courrier

- Télémarketing

- Transactions de vente par parrainage

- Offre de service continu spécifié

- Transactions de vente liées à des opportunités professionnelles

- Vente en visite

Vente en visite

On parle de vente en visite lorsqu’une entreprise se rend au domicile d’un consommateur pour vendre des produits ou conclure un contrat. Les autres types de ventes en visite comprennent les achats et les contrats dans des lieux qui ne sont pas considérés comme des magasins, tels que les centres communautaires, les cafés et les rues, ainsi que les commandes sur appel et sur rendez-vous.

Commande par courrier

L'administration fiscale considère les ventes suivantes comme des commandes par correspondance : les transactions annoncées sur les sites web de la Communauté européenne, à la télévision, dans les journaux, dans les magazines, etc. Les entreprises qui exploitent des sites web communautaires doivent inclure une déclaration fondée sur la loi relative aux transactions commerciales spécifiées.

Télémarketing

Lorsqu’une entreprise appelle un consommateur et le sollicite pour acheter un produit ou faire une demande de conclusion de contrat, il s’agit de ventes de télémarketing. C’est également le cas si le consommateur raccroche dans un premier temps et fait la demande de conclusion de contrat à une date ultérieure, s’il décide d’acheter le produit via cette méthode. Lorsqu’une entreprise utilise des réseaux sociaux, des courriers, des services de messagerie, des télécopies, des dépliants, des brochures, etc., pour inciter les clients à appeler et à faire des demandes de biens ou de contrats, il s’agit également de ventes de télémarketing.

Transactions de vente par parrainage

Dans le cas des transactions de vente par parrainage (« vente pyramidale » ou « marketing multi-niveaux »), l’entreprise recrute des personnes, qui recrutent ensuite de nouveaux commerciaux, élargissant ainsi l’organisation commerciale en amont de la chaîne. Les recruteurs bénéficient, par exemple, d’une compensation financière lorsqu’ils recrutent d’autres personnes.

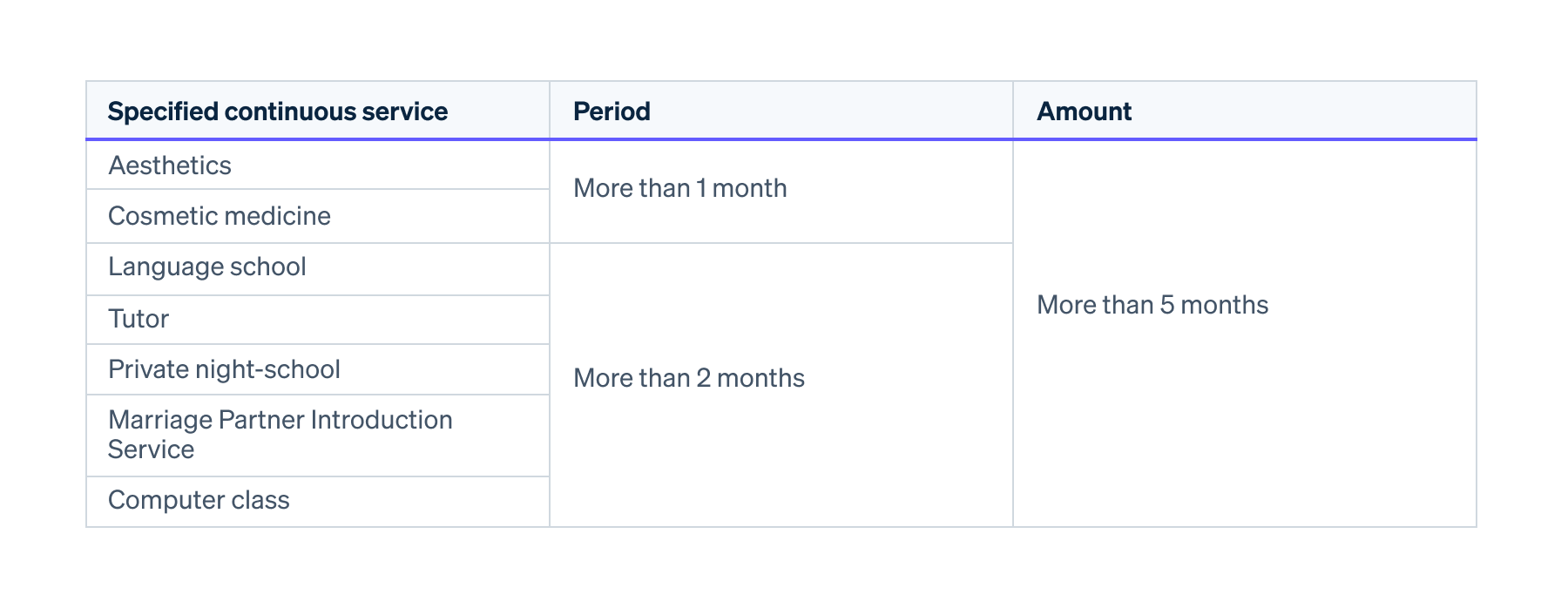

Offre de services continus spécifiés

Il s’agit de la prestation de services pour une période de temps dépassant une certaine durée et pour une contrepartie dépassant un certain montant. Consultez le tableau ci-dessous pour plus de détails.

Actuellement, les sept services suivants sont désignés comme des services continus spécifiés :

Transactions de vente liées à des opportunités professionnelles

Il s’agit de transactions dans lesquelles l’entreprise propose au consommateur une opportunité de travail, avant de lui imposer l’achat de biens ou de services. Cette pratique, qui consiste pour une entreprise à obliger une personne à acheter un ordinateur, un logiciel ou d’autres articles à des fins de travail à domicile, est connue par les consommateurs sous le nom de « travail interne » ou d’activité de « contrôle ».

Vente en visite

Il s’agit d’une transaction dans le cadre de laquelle une entreprise se rend au domicile ou sur le lieu de travail d’un consommateur pour l’inciter à acheter des biens. Ces dernières années, il y a eu des cas d’« achats forcés », par exemple lorsqu’une entreprise impose à un client l’achat de métaux précieux ou d’autres articles alors qu’il a déjà déclaré qu’il ne voulait pas le faire.

En fonction de leur nature, ces transactions peuvent enfreindre la Loi sur les transactions commerciales spécifiées.

Qu’est-ce que les mentions obligatoire conforme à la loi sur les transactions commerciales spécifiées ?

Les règlements administratifs prévoient l’obligation de publicité pour les commandes par courrier. L’article 11 de la loi stipule qu’une entreprise doit toujours afficher clairement les différents éléments publicitaires sous forme de mentions.

Une mention conforme à la Loi sur les transactions commerciales spécifiées est un résumé facile à comprendre des informations qu’une entreprise doit divulguer aux consommateurs lorsqu’elle vend des produits ou des services.

Dans le cas des commandes par courrier, cette déclaration est nécessaire car les clients ne peuvent vérifier les conditions commerciales ou contractuelles qu’à travers les publicités lorsqu’ils achètent des biens ou des services.

Mais si vous ne faites pas de publicité, avez-vous vraiment besoin de mentions conformes à la Loi sur les transactions commerciales spécifiées ? Certains pourraient le penser. Pourtant, ici le terme « publicité » diffère légèrement du concept général, comme les pages de relations publiques et les bannières sur Internet ou les publicités dans les journaux. Comme l’a déclaré l’Agence de la consommation, une publicité est un avis ou une annonce « où l’intention de l’entreprise d’accepter une offre de conclusion de contrat est clairement exprimée sur le site Web, et où le client est en mesure de faire une offre de conclusion de contrat grâce à cette représentation ». En d’autres termes, les pages de produits et d’applications des sites de commerce électronique relèvent également de la catégorie des publicités, et les entreprises doivent donc y inclure une déclaration conforme à la Loi. Les entreprises doivent fournir ces informations quel que soit le type d’activité, individuel ou collectif, ou la taille du site de commerce électronique. Il convient donc de veiller à décrire et à divulguer ces informations correctement, conformément aux lignes directrices de la Loi sur les transactions commerciales spécifiques.

Voyons maintenant plus en détail les informations que doit contenir une mention conforme à la Loi.

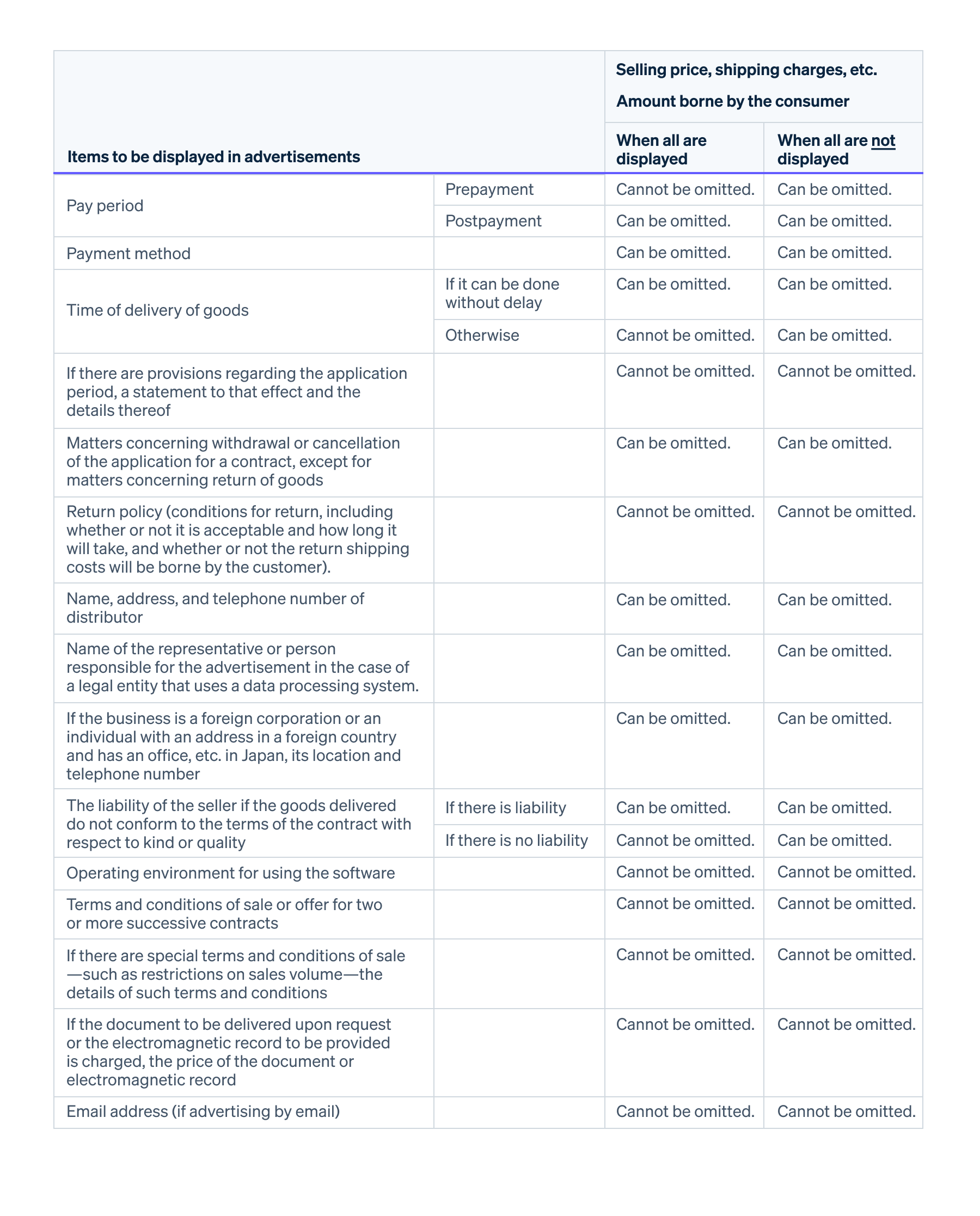

Étant donné que les publicités se présentent sous différents formats et styles, et que les espaces utilisés varient, il peut s’avérer difficile d’afficher tous les éléments requis par la Loi sur les transactions commerciales spécifiées.

Par conséquent, si vous remplissez les conditions, vous pouvez omettre l’étiquetage de certains produits. Veuillez vous référer au tableau ci-dessous pour connaître les éléments que vous pouvez exclure.

Si vous êtes une entreprise individuelle, que vous utilisez votre maison comme bureau et que vous ne souhaitez pas afficher votre adresse et votre numéro de téléphone sur votre site Web, veuillez consulter l’Agence de la consommation pour voir si vous pouvez laisser de côté ces informations si vous remplissez les conditions susmentionnées.

Cependant, l’omission de cette exigence est possible à une condition : « Le site doit indiquer dans la publicité qu’il fournira sans délai un document décrivant ces éléments (dans le cas d’un site de commerce électronique, un e-mail est également acceptable) sur demande du client, et qu’il fournira sans délai ces documents dès la demande effective. » C’est pourquoi il est nécessaire de vérifier si votre site remplit cette condition.

S’il est difficile de répondre aux exigences en raison de la nature de votre activité, une autre solution peut consister à utiliser une adresse et un numéro de téléphone de bureau virtuel.

Pour plus d’informations sur les questions relatives à l’affichage publicitaire dans le cas de la commande par courrier, veuillez consulter le « Guide de la Loi sur les transactions commerciales spécifiées, questions-réponses sur la publicité par courrier » de l’Agence de la consommation. Cette page présente différentes situations.

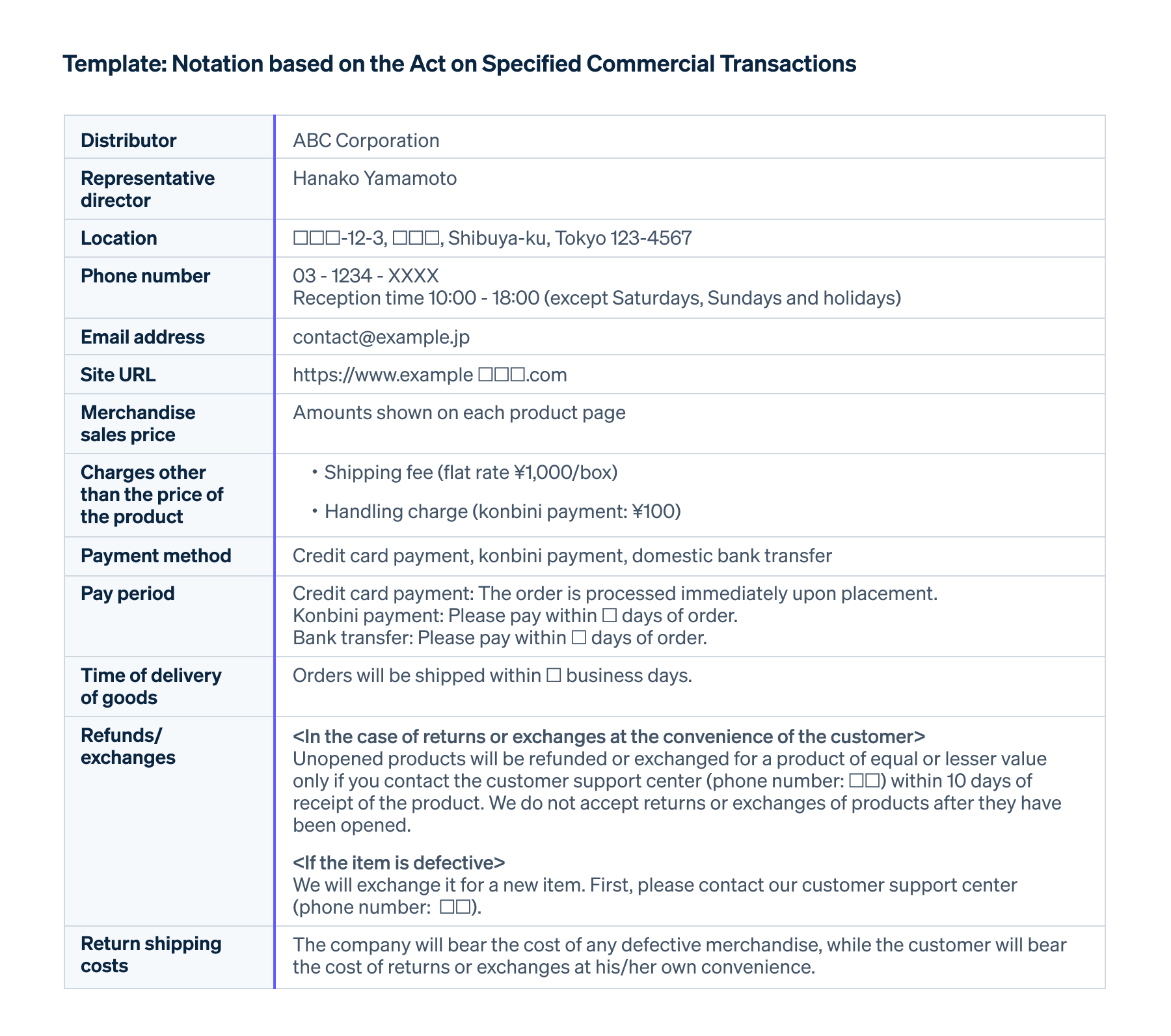

Modèle permettant de créer des mentions conformes à la loi sur les transactions commerciales spécifiées

Consultez le modèle ci-après ainsi que les informations sur l’affichage de la publicité ci-dessus, puis créez une « mention conforme à la Loi sur les transactions commerciales spécifiées » qui reflète le contenu des services de votre entreprise.

Que faire en cas d’absence de mentions conformes à la Loi sur les transactions commerciales spécifiées ?

Certaines entreprises ont subi des conséquences pour avoir omis d’afficher une mention conforme à la Loi sur les transactions commerciales spécifiées.

Par exemple, dans le cas des commandes par courrier, supposons que l’entreprise ne remplisse pas les conditions requises pour proposer un délai de rétractation. Néanmoins, en raison des très nombreux problèmes liés aux retours, vous devez publier les déclarations requises conformément à la Loi sur les retours. Si vous ne publiez pas de mention à ce propos, vous devez accepter sans condition les retours des consommateurs.

De même, supposons que l’affichage d’une application spécifique (par exemple, l’écran de confirmation finale d’une commande sur un site de commerce électronique) soit incomplet ou faux. Dans ce cas, vous devrez annuler une transaction ou procéder à un remboursement, ce qui constituera une lourde charge pour votre entreprise.

Veillez à respecter les directives et à énoncer clairement les spécificités afin de garantir une transaction fluide.

Dans cet article, nous sommes revenus en détail sur la Loi sur les transactions commerciales spécifiées, et nous avons expliqué comment inclure une déclaration conforme à celle-ci. Pour les entreprises qui exploitent des sites de commerce électronique, cette loi est fondamentale non seulement pour éviter les problèmes avec les consommateurs, mais aussi pour établir une relation de confiance.

Le gouvernement a mis à jour la Loi sur les transactions commerciales spécifiées le 1er juin 2022 (révision spéciale du code de commerce). L’affichage de certains nouveaux éléments sur l’écran de confirmation finale des clients était obligatoire après cette date.

Les pages de support de Stripe Comment créer et afficher une page de « Déclarations commerciales » et Directives de la version révisée de la Loi sur les transactions commerciales spécifiées décrivent en détail ces nouveaux éléments à prendre en compte. Nous recommandons aux nouveaux titulaires de comptes Stripe et à ceux qui ont commencé à utiliser des comptes Stripe avant la révision de la loi de vérifier à nouveau les informations nécessaires en se référant à ces pages.

Le contenu de cet article est fourni à des fins informatives et pédagogiques uniquement. Il ne saurait constituer un conseil juridique ou fiscal. Stripe ne garantit pas l'exactitude, l'exhaustivité, la pertinence, ni l'actualité des informations contenues dans cet article. Nous vous conseillons de solliciter l'avis d'un avocat compétent ou d'un comptable agréé dans le ou les territoires concernés pour obtenir des conseils adaptés à votre situation.