Ninety-four percent of the top European ecommerce businesses we analysed had at least five basic errors in their checkout, adding unnecessary friction for customers.

Close to 40% of European customers we surveyed said they have doubled or more than doubled their online shopping in the past year. While this increase in demand presents a huge opportunity for online businesses, it also puts more pressure on companies to successfully capitalise on this potential and offer the best customer experience. However, we found that some of the biggest ecommerce companies in Europe often overlook one crucial step to making a sale: the checkout flow.

We partnered with Edgar, Dunn & Company to analyse the top 800 ecommerce businesses across France, Germany, Italy, the Netherlands, Poland, Spain, Sweden, and the UK and found that 94% of checkouts had at least five basic errors. Some of the most common issues include poor card information formatting and error handling, not offering popular payment methods, and not allowing customers to save their payment method for future use. On their own, these issues may seem small. But, when combined, they add up to a needlessly difficult checkout experience for customers and lost sales.

This report analyses the checkouts of the top ecommerce and subscription businesses across Europe and details the most common checkout errors, categorised into four sections:

- Checkout form design

- Mobile optimisation

- Localisation

- Buyer trust and security

The report also explores why these checkout issues matter, how to prevent them from happening in your checkout flow, and how Stripe can help.

Checkout form design

European customers expect a fast, intuitive payment experience, with 21% saying they would abandon a purchase if it took more than one minute to check out. However, 44% of customers we surveyed said that, on average, it takes them more than three minutes to complete a purchase and 17% blame a long and complicated checkout as the reason for abandoning an order in the past year.

The highest performing checkouts are made up of dozens of small optimisations executed seamlessly—for example, displaying descriptive error messaging when customers enter the wrong payment information, supporting address auto-complete, and allowing customers to save their payment information for future use. In a separate Stripe study, we found that offering address auto-complete can increase conversion by close to 0.8%, and using specific error messaging can increase retry rates following a decline by as much as 3.5% (for example, changing the message from “your card was declined” to “your card was declined; try a different card”). These increases may seem small, but they can quickly add up—especially for ecommerce businesses with high transaction volume.

The top four checkout form errors

- 42% of top businesses made at least three mistakes when formatting payment information or displaying error messages; these mistakes include not alerting customers when they entered an invalid card number or tried to pay with an expired card

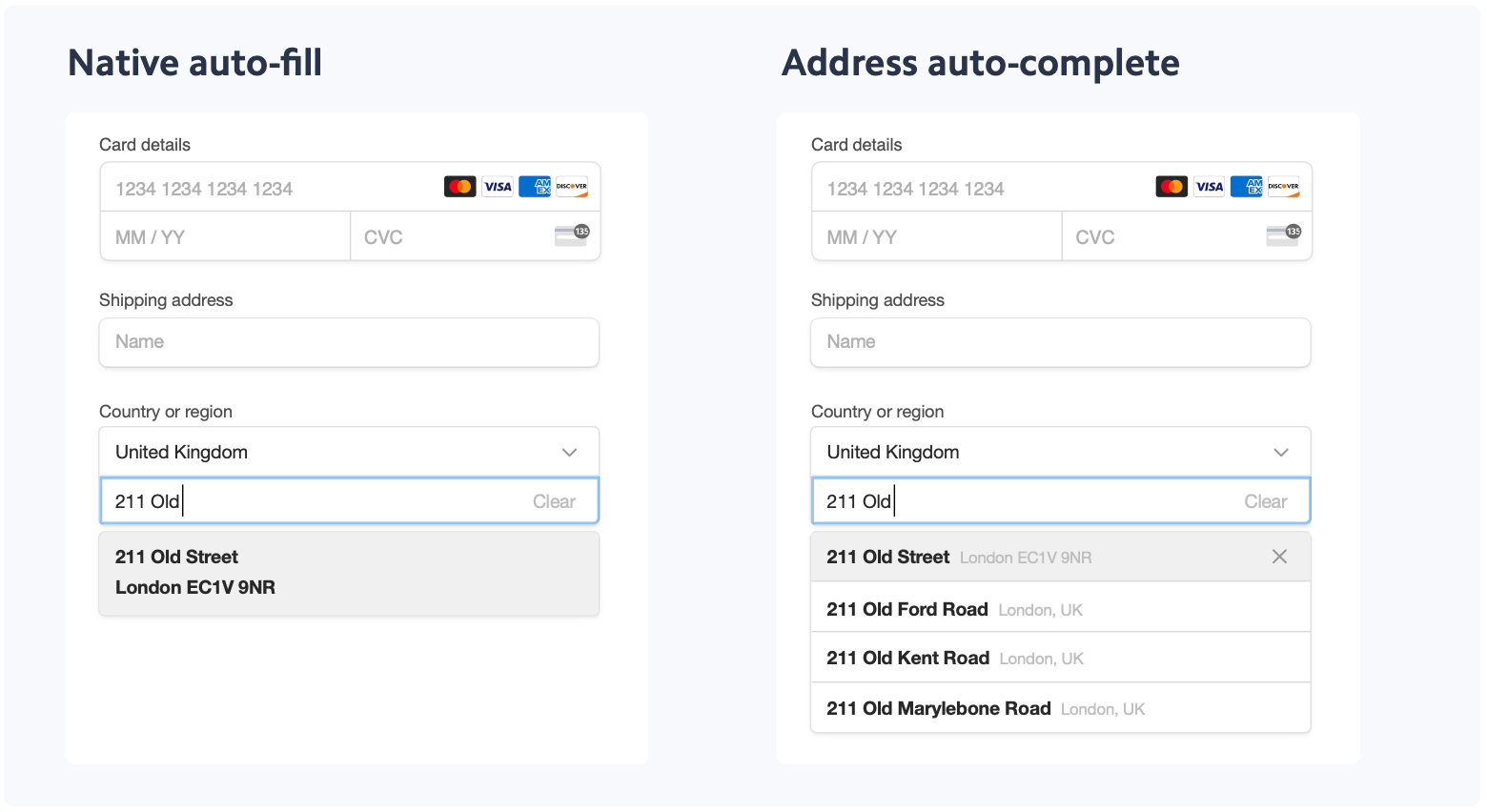

- 61% didn’t support address auto-complete and 9% supported neither address auto-complete nor native autofill

- 10% of checkouts didn’t default to letting customers use their billing address as their shipping address

- 75% didn’t allow customers to save their payment information for future use

Checklist: How to design an optimised checkout form

-

Error messaging: Highlight payment information errors in real time.

-

Number formatting: Add spacing to card numbers, displaying them in blocks of four to six digits for easier data entry.

-

Default address: Use the same billing and shipping address by default unless customers want to manually add a different shipping address.

-

Address auto-complete and auto-fill: Optimise address collection by supporting both native auto-fill (which uses information saved in a customer’s browser) as well as address auto-complete (which enables typeahead completion).

-

Saved payment information: Allow customers to save their payment information for future use so they can check out with just one click.

Mobile optimisation

Thirty-seven percent of customers we surveyed said they do more than half of their shopping from a mobile device, with 58% saying it’s “very” or “extremely” important for a website to be mobile friendly. If your checkout flow isn’t tailored to a smaller screen—for example, if the checkout page doesn’t automatically adjust to the size of the device—customers are more likely to abandon the checkout flow completely. In fact, while more than 50% of ecommerce traffic comes from smartphones, carts are abandoned on mobile at more than twice the rate of desktops.

Almost all the checkouts we analysed understood the importance of a mobile-first shopping experience, with 99% of checkouts adapting to a mobile screen size. This was an increase from a similar study we ran in 2020, when 96% of checkouts we analysed adapted to a smaller screen. However, this widespread adoption of mobile best practices only applies to the top ecommerce businesses. When we surveyed customers, 8% said they abandoned a purchase in the past year due to a lack of responsive formatting. This suggests that mobile optimisation is not yet a best practice in the ecommerce industry as a whole.

Supporting digital wallets, such as Apple Pay or Google Pay, can help expedite the shopping experience on mobile. A separate Stripe analysis found that more than 25% of European customers have either Apple Pay or Google Pay enabled on their device, creating the opportunity for businesses to offer a one-click payment experience that, on average, is three times faster than having to manually enter payment details.

The top three mobile optimisation errors

- 89% of checkouts we analysed did not support Apple Pay

- 85% of checkouts did not support Google Pay

- 20% failed to surface a numeric keypad to enter card information on mobile

Checklist: How to optimise for mobile

-

Responsiveness: Ensure your form automatically resizes to the smaller screen.

-

Keypad: Display a numerical keypad when customers are prompted to enter their card information.

-

Wallets: Offer mobile wallet payment methods, and ideally only surface them if you know they have been set up by your customer and are usable on their current device.

Localisation

While European businesses have more opportunities to reach global shoppers, it can also be challenging to identify the right payment methods and currencies for your customer base. For example, 15% of customers we surveyed said they abandoned a purchase in the last year because their preferred payment method wasn’t available. As a result, businesses should adapt the payment methods they offer to their customer’s location. For example, only 40% of online payments in Europe are made using debit or credit cards—bank transfers are the most popular payment method in Germany, and almost one-third of Italian customers prefer to pay with a digital wallet.

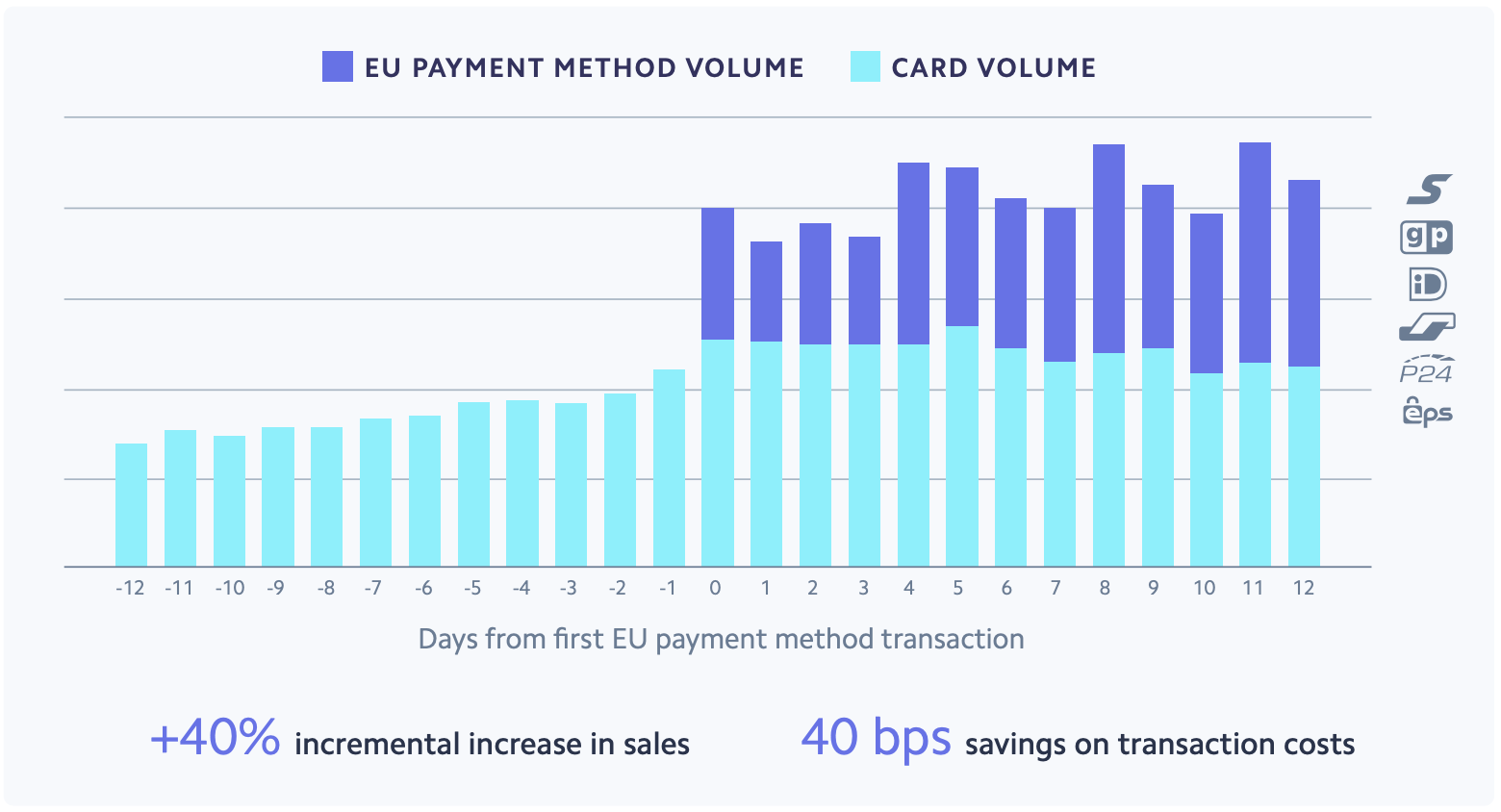

Offering the right payment methods can significantly increase conversion rates and reduce costs. In a separate Stripe study, we analysed the impact of accepting popular European payment methods in Austria, Belgium, Germany, the Netherlands, and Poland. By enabling these methods, businesses saw a 40% incremental increase in sales, and transaction fees were reduced by 0.4 percentage points (while these cost-savings may sound small, they can quickly add up).

In a separate Stripe analysis, we estimated the increase in net-new sales that could result from adopting a local payment method. We first predicted a business’s sales volume if they had never adopted that payment method. Then, we analysed the difference between actual sales volume and our predicted volume.

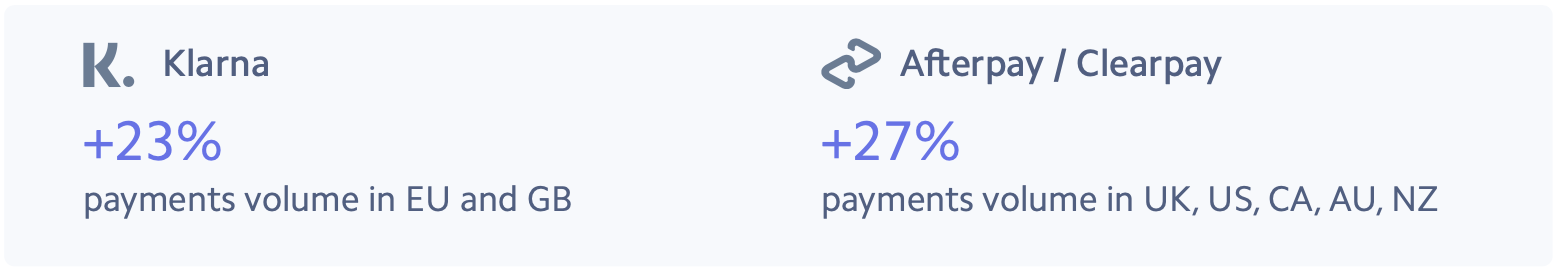

Supporting the right payment methods doesn’t only apply when expanding internationally; it can also be a way to offer your customers extra flexibility and convenience, especially for larger purchases. For example, buy now, pay later services let customers immediately finance purchases and pay them back in fixed installments over time and can result in an increase in sales.

We found that the best checkouts focused less on the number of payment methods supported and more on offering the right combination of payment options. This is reflected in our analysis, with the majority of ecommerce companies offering a total of four payment methods in addition to international cards. When we looked at the top ecommerce businesses with a presence in multiple markets, the number of payment methods they offered did not increase. Instead, they successfully adapted their payment methods on a per-country basis to optimise for local conversion. For example, the same ecommerce business would offer giropay for German customers, iDEAL for Dutch customers, and Przelewy24 for Polish customers.

Local payment methods among top European ecommerce sites

- UK: 10% offered Clearpay; 35% offered Klarna

- Germany: 35% bank debit; 30% giropay; 44% Klarna; 22% SOFORT

- Netherlands: 95% iDEAL

- Poland: 48% bank transfer; 74% BLIK; 35% Przelewy24

Checklist: How to localise your checkout experience

-

Language and currency: Identify the top countries in which you want to sell, and make sure you localise the checkout experience by translating the page and displaying local currency.

-

Dynamic fields: Change the payment fields to capture the right information for each country. For example, if your form recognises a UK card, you should dynamically add a field for postcode.

-

Local payment methods: Dynamically surface the right payment methods in your checkout depending on where your customers are located or which device they’re using.

-

Installments: Consider offering buy now, pay later services if you have a high average order value and if they’re popular where your customers are based.

Buyer trust and security

The customers we surveyed said a “secure” website had the biggest impact on a “positive” shopping experience, and 11% said they have abandoned a website in the past year because it didn’t seem secure. However, going through additional security steps after customers confirm an order adds extra friction and negatively impacts their experience.

As a result, businesses have to find the right balance between validating a customer’s identity and managing strong customer authentication (SCA) requirements when required by the cardholder’s bank and adding too many steps in the checkout flow that could lead to lost sales.

Ecommerce businesses can promote buyer trust and security during the account creation process prior to checkout. For example, allow customers to check out as a guest, reducing the amount of personal information you collect and store. If you do require customers to log in to complete a purchase, give customers the ability to create an account or log in by connecting to their existing social media accounts. This keeps their personal information stored in the social media profile, rather than on your website, and helps expedite the checkout process.

The top three buyer trust and security errors

- 41% of checkouts did not allow customers to check out as a guest

- 85% did not allow customers to create an account by connecting to a social media profile

- 8% of checkouts did not display an order summary that could be easily adjusted

Checklist: How to increase buyer trust

-

Security visuals: Display security visuals, such as a padlock, to reinforce that the page is secure.

-

Cart recaps: Show a summary of all items ordered to instill confidence.

-

Card brand: Automatically display an icon for the card brand (such as Visa or Mastercard) after the card number is entered.

-

Guest checkout: Allow customers to check out as a guest.

-

Account creation: Let customers create an account by connecting to their social media profile.

-

SCA: Manage European SCA requirements by dynamically applying card authentication and 3D Secure when required by the cardholder’s bank.

Checkout best practices for subscription businesses

The subscription business model is on the rise: An increasing number of companies are turning toward subscription models as they offer the ability to create a reliable revenue stream. In addition, consumers have grown accustomed to signing up for digital subscriptions, with our survey showing that, on average, European consumers pay for two active subscriptions.

Like ecommerce companies that process one-time payments, subscription businesses should prioritise the same checkout optimisations we’ve covered: checkout form design, mobile optimisation, localisation, and buyer trust and security. However, there are additional optimisation opportunities that are unique to subscription businesses.

The top three checkout best practices for subscription businesses

- 44% were offered a free trial

- 53% let customers enter a coupon code directly on the checkout page

- The majority of subscription businesses offered reusable payment methods, such as wallets and direct debit

How Stripe can help

Our analysis shows that basic checkout issues are widespread, even among the top companies across Europe that likely have dedicated teams focused on conversion rates.

When optimising your checkout flow, you could try to prevent issues on your own and divert development resources to focus solely on your checkout experience. Or, you could leverage a pre-built, hosted payments page like Stripe Checkout.

Stripe Checkout was designed with conversion best practices in mind, allowing businesses of all sizes to design seamless checkout flows that are optimised for mobile and cater to an international audience. It combines all of Stripe’s front-end, design, and analytics expertise to offer a seamless payments experience, allowing you to integrate in minutes to securely accept payments.

- Designed to reduce friction: Help your customers quickly and easily complete the checkout process by letting them auto-fill card and address information, adjust item quantities or enter promotional codes directly from the checkout page, and pay in just one click. Stripe Checkout also helps customers spot errors in real time with card validation, card brand identification, and descriptive error messages.

- Optimised for mobile: The checkout form is designed to be fully responsive and work across any device. It displays a numeric keypad to make it easier for customers to enter their card information and comes with Apple Pay and Google Pay built in, without any additional registration or domain validation required. And, Stripe Checkout will only surface mobile wallets when Stripe knows that they’ve been correctly set up by your customer.

- Seamless support for payment methods: With Stripe Checkout, you can add payment methods by changing a single line of code, creating localised payment experiences for your entire customer base. Stripe allows you to quickly add and scale payment method support without filling out multiple forms or following one-off onboarding processes.

- Built for global: Stripe Checkout supports more than 25 languages and 135 currencies, so your customers around the world can see the checkout form that’s right for them. You can decide which local payment methods to surface, or rely on Stripe to dynamically display the right payment methods based on IP, browser locale, cookies, and other signals.

- Increased buyer trust and security: The checkout form can handle European SCA requirements and dynamically apply authentication when required by the cardholder’s bank or when fraud is suspected. Stripe Checkout also supports the simplest method of PCI validation with a pre-filled SAQ A, and it triggers CAPTCHA only when we suspect card testing attacks to protect you from fraud.

If you would like to build your own custom checkout form, you can use Stripe Elements, a set of rich, pre-built UI components. Like Stripe Checkout, Stripe Elements also offer mobile optimisation, real-time validation, autofill, localisation, and front-end formatting. Learn more about Stripe Elements.

Methodology

In 2020, we analysed 450 of the top ecommerce companies in seven European countries (France, Germany, Italy, the Netherlands, Spain, Sweden, and the UK). In 2021, we expanded our analysis to include more ecommerce businesses as well as subscription businesses, more European countries, and new testing criteria, including errors related to buyer trust and security.

In this 2021 report, Stripe partnered with Edgar, Dunn & Company to select the top 100 ecommerce websites (for a total of 800) in France, Germany, Italy, the Netherlands, Poland, Spain, Sweden, and the UK based on online sales volume from Statista. Adult entertainment platforms or online gambling websites were not included in the analysis. After determining the relevant websites, each one was tested for pre-defined errors by placing a product in the shopping cart to simulate an online purchase and, in some cases, using a VPN to complete the checkout process to mimic customers based in different countries. Checkouts were tested for a total of 26 criteria related to checkout form design, mobile optimisation, localisation, and buyer trust and security.

We also analysed the top 200 global subscription companies based on online website traffic from Crunchbase, focusing on B2C subscription websites offering digital content.

Lastly, we surveyed 800 consumers in Europe to uncover insights around current shopping behaviours and trends, payment preferences, and factors that affect the checkout experience.