The reverse charge procedure applies when goods and services are supplied abroad. Businesses with international operations need to study the process in detail, as it significantly affects value-added tax (VAT) obligations and invoicing.

However, the reverse charge also applies in some domestic cases. In this article, you will learn what a reverse charge is, which countries and services use it, and why it was introduced. We will also explain how to create a correct reverse charge invoice.

What’s in this article?

- What is the reverse charge procedure?

- When is the reverse charge procedure used?

- Why does the reverse charge procedure exist?

- In which countries is the reverse charge procedure applied?

- How to correctly invoice with the reverse charge procedure

What is the reverse charge procedure?

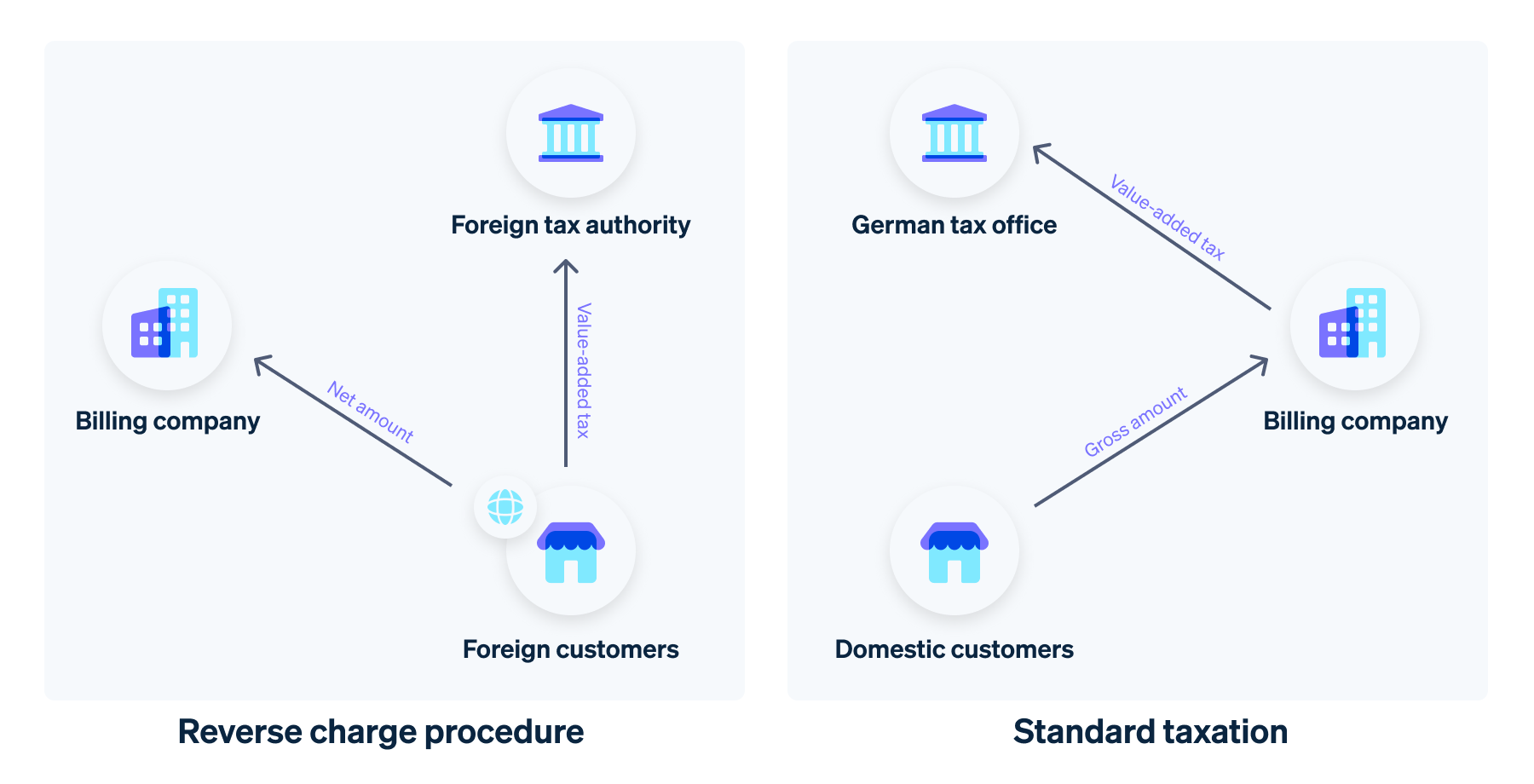

The reverse charge procedure is a regulation that is anchored in German and European VAT law on the basis of Article 196 of the German VAT Act (UStG). In most cross-border supplies of goods and services between taxable companies, the tax liability is shifted to the recipient. The companies that normally invoice a service pay the VAT to the tax office. Still, under the reverse charge system, there are special instances where VAT is paid not by the company providing the service but by the company receiving it. This means that service providers are only allowed to show net amounts on their invoices. The legal basis for the reverse charge procedure is Section 13b of the UStG.

The procedure is also used domestically in certain unique cases, such as construction and cleaning services. This is because these sectors are particularly vulnerable to VAT fraud. To avoid the VAT being paid by the company receiving the service (but not by the company providing it), the tax liability is sometimes transferred to the service recipient, who is usually a domestic customer with a right of deduction.

Reverse charge procedure vs. Standard taxation

When is the reverse charge procedure used?

In general, a reverse charge is only possible in the B2B sector, i.e. when companies provide services to other companies. Private individuals are excluded from the reverse charge procedure. Another important requirement is that the service in question must be taxable in Germany. If these conditions are met, the provisions of Section 13b(1) and (2) of the UStG apply.

A reversal of the tax liability is possible for the following services:

- Works or other services carried out by a company established abroad (works are understood to mean the supply of items for the processing or treatment of which the supplying companies use materials that they have procured on their own)

- Delivery of objects assigned as security outside insolvency proceedings, i.e. the ownership of a movable object is transferred from the debtor to the creditor without any change in the ownership

- Sales that fall under the real estate transfer tax act (RETT)

- Purchase of construction services – such as work involving the construction, repair, alteration, or removal of buildings – when the recipients themselves provide construction services on an ongoing basis

- Supplies of gas via the natural gas network, and electricity

- Supplies of gold and gold plating

- Supplies of mobile phones, tablet computers, games consoles, and integrated circuits with a value of at least €5,000 and other telecommunications services

- Cleaning of buildings and their parts – when the service recipients themselves are providers of building cleaning services

Does the reverse charge procedure also apply to small businesses?

The reverse charge procedure does not apply to companies that use the small business regulation according to Section 19 of the UStG. It is better for them to purchase their services domestically, as they have to pay the VAT themselves. Small businesses are obliged to pay the VAT for the third country to the German tax office using the reverse charge procedure. Even so, they cannot claim the amount as input tax.

Why does the reverse charge procedure exist?

The reverse charge procedure was introduced for several reasons, both preventive and practical:

- Avoiding VAT fraud: One of the main reasons for introducing the reverse charge mechanism is so-called carousel fraud. Businesses exploit loopholes in cross-border VAT legislation: when goods or services are traded between countries, the buyers claim input tax, but the traders do not pay the VAT included. The reverse charge mechanism prevents companies in the recipient country from receiving a VAT refund without paying it first.

- Simplifying cross-border business: For businesses in the EU that supply services or goods across borders, the reverse charge mechanism makes it easier to manage VAT obligations. Businesses operating in other EU countries don't have to worry about registering and paying VAT in every country where they provide services. This reduces administrative burdens and simplifies accounting for businesses that operate internationally.

- More efficient processes: The value chain often involves multiple players in many industries, including construction. A reverse charge reduces the need for individual suppliers to pay VAT and later receive a refund. Instead, the final recipients bear the responsibility, making the process more efficient and reducing potential sources of error in tax collection.

- Simplification for the tax office: The reverse charge procedure also simplifies the work of the German tax authorities, as they do not have to enforce tax claims abroad. The same is true for their counterparts in other countries. In this way, the reverse charge procedure relieves the tax authorities.

In which countries is the reverse charge procedure applied?

The reverse charge procedure is common in many countries, especially in the EU and countries with well-developed VAT systems. Here are some examples:

European Union

Under certain conditions, the reverse charge procedure is applied in all EU member countries. The legal basis for this is Council Directive 2006/112/EC, which is binding for all EU countries.

Great Britain

Since the United Kingdom left the EU on 31 January 2020, cross-border shipment of goods to England, Scotland, and Wales are no longer subject to the European VAT Directive as of 1 January 2021.

Deliveries to the UK will now generally be considered tax-free export deliveries. In individual cases, the value of goods in the shipment will determine the VAT treatment. Small shipments with a net sales price of less than £135 are exempt from customs duties and import sales tax. Nevertheless, they are subject to standard UK VAT.

This depends on whether the goods are being sent to customers or businesses. Small B2C shipments must contain UK VAT on the invoice. Therefore, the supplying company must register for VAT in the UK and pay the tax accordingly. This does not apply if the sale is made via an online platform, in which case the marketplace operator must pay the VAT.

Different rules apply to business customers: the reverse charge applies to small B2B supplies. This means that the business receiving the service pays VAT in the UK. The reverse charge does not apply to services provided to private individuals, but in the B2B segment, it applies to specific services such as consultancy or marketing.

Other third countries

Reverse charge is also used for cross-border supplies in many third countries, including Australia, Canada, Singapore, Switzerland, and the United States. However, the rules are not uniform, so companies need to always check on a case-by-case basis.

To be on the safe side, it’s always best to consult a professional. Stripe Tax automatically calculates the correct tax amount. This means that companies no longer have to inform themselves about the VAT regulations in other countries. In addition, Stripe Tax allows you to collect and report taxes on worldwide payments and centrally access all the documents you need for tax refunds at any time.

How to correctly invoice with the reverse charge procedure

A reverse charge procedure differs from a standard invoice in two key ways. Firstly, such an invoice might only show net amounts, i.e. no VAT is shown. Second, it must clearly indicate the application of the reverse charge procedure. For this purpose, it is sufficient to add the words “Tax Liability of the Service Recipient” or “Reverse Charge” on invoices in English.

In addition, the mandatory information listed in Section 14 of the UStG must be included on the invoice. This includes, in particular:

- Full name and address of the company providing the product or service

- Full name and address of the recipient of the product or service

- Date of the invoice

- Date of delivery of the product or service

- Tax number issued to the performing company by the tax office or the VAT identification number issued by the Federal Central Tax Office (BZSt)

- A consecutive, unique invoice number

- Quantity and type of products delivered or the scope and type of service provided

For further information on invoicing, please refer to the relevant article.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.