Wherever cashless payments are made in Germany, payment service providers (PSPs) are needed. They handle financial transactions between companies and their customers. PSPs are, therefore, just as important for online shops as they are for retailers or the hospitality industry.

In this article, you will learn what a PSP is, how it works, and what you should consider when choosing one.

What is this article about?

- What is a payment service provider?

- How does payment processing work?

- What makes a good payment service provider?

- How do I choose a suitable payment service provider?

- The advantages of Stripe as a payment service provider

What is a payment service provider?

A payment service provider (PSP) or payment provider is a company that provides technical solutions to securely and efficiently process payments between buyers and sellers.

There are several types of payment providers in Germany. Payment gateways are used for online payments. As a technological interface, they enable the online payment process. At the point of sale in a store or restaurant, card payments can be processed through PSPs. With Stripe Terminal, for example, you can offer cashless payments with card readers or on mobile devices and implement them directly in your accounting.

If you run an online shop, you can use a PSP to offer a variety of payment methods, from purchasing on account to credit card and PayPal transactions. This allows buyers to choose the payment method that suits them best.

In physical retail or hospitality, PSPs enable you to accept credit and debit cards as well as e-wallets such as Google Pay and Apple Pay. Freedom of choice in the payment process is important for many customers, and card payments in stores are a must.

How does payment processing work?

If you want to make cashless payments, you need a PSP. They are important to e-commerce and physical businesses, simplifying complex processes and reducing risk. Corporations, startups, small businesses, and retailers benefit from fast processing and satisfied customers. Shoppers can choose from a variety of secure payment methods.

Freelancers or self-employed individuals also use PSPs to pay invoices digitally. The same applies to platform operators – such as marketplaces or booking portals – that can bundle payment transactions via the services offered.

For international companies, PSPs handle currency conversions and simplify cross-border payments. Non-profit organisations and educational institutions use them to accept donations and fees.

PSPs offer customers freedom of choice when it comes to payment processing. Businesses also benefit from the reputation of large and well-known PSP brands. Working with a well-known service provider conveys respectability and trustworthiness. This is especially true in online commerce. When you sell online, you also save time and gain peace of mind because the PSP checks the creditworthiness of your buyers. In addition, sensitive banking data is not processed through your webshop, but through the provider’s infrastructure.

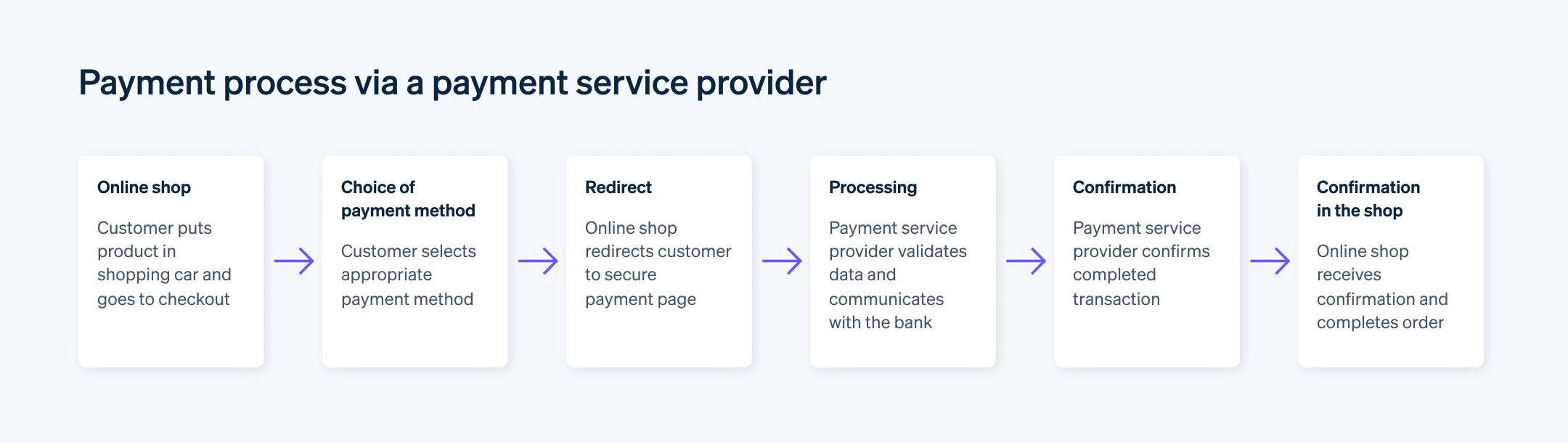

When a customer wants to pay online in a store, they enter their information directly with the PSP on the payment page. The payment provider verifies the information is correct and the customer is creditworthy. Next, the PSP encrypts the customer’s information, authorises the transaction, and forwards the payment. The service provider uses various technologies to protect sensitive information, such as tokenisation.

In physical stores or restaurants, the PSP also provides terminals for digital payments by credit card or e-wallet.

Many providers also offer additional features. These include fraud detection, currency conversion, and reporting. In this way, PSPs ensure fast, reliable, and secure payments and simplify complex processes.

What makes a good payment service provider?

A good PSP is reliable and secure and offers an easy-to-use, flexible system. It also ensures smooth transactions with no downtime. Versatility is also important: a good provider will support multiple payment methods, including international options. Transparent cost structures eliminate hidden fees.

Depending on your business, other features – such as currency conversion, revenue and financial automation tools, and flexible subscription models – can add significant value. In addition, solution-oriented customer service is available 24/7 to help resolve issues quickly.

Overall, streamlined payment processes can help reduce operating costs, create new revenue streams, and use payments as a growth driver. The best way to achieve these benefits is with the right service provider.

How do I choose a suitable payment service provider?

The selection criteria for your PSP varies depending on your intended use, company size, and buyer base. At the same time, there are some universal criteria that help to identify a suitable PSP:

Functionality and flexibility: Make sure the PSP fully supports the payment options relevant to your customers. It should also have the flexibility to support your growth, such as international expansion or changing customer needs.

Reliability and security: Reliability is especially important because even minimal downtime directly affects your revenue and reputation. Stripe is the only major payment processor to publish uptime for the entire platform. With 99.999% uptime, Stripe is an industry leader.

Integration experience (especially online): Ideally, the payment functionality is integrated directly into your store. This simplifies processes and increases operational efficiency. A good PSP will take care of the integration for you and make sure you can easily make changes or additions later.

Customer support: For troubleshooting, product advice, and smooth implementation, you need fast access to expert support. Ideally, it should be available around the clock. Depending on your individual needs, you can agree on different levels of support from your PSP.

Cost optimisation: Digital payments are subject to network fees, which vary by agreement. A good payment provider will ensure that your acceptance costs are as low as possible and provide transparency into network cost drivers. The best way to do this is to provide the most accurate transaction-level data possible, including network and settlement fees.

Worldwide availability: If your business operates internationally, your provider must be able to support your needs in every country. It is important to be able to easily enable new payment methods without additional integration or the need to register as a local business. This allows you to bring products to market faster and generate new revenue streams.

Risk management: Whether it’s fraud or disputed payments, your PSP should have the tools and expertise to best protect you and your customers. Fraud prevention is best achieved by integrating solutions directly into the payment flow, using machine learning models that have been trained on fraudulent activity based on billions of transactions.

Reconciliation: A good PSP will provide you with automated and consistent reconciliation of your financial metrics. This includes timely transaction reports and custom reports you can use for analysis and evaluation.

This checklist with useful tips for a request for proposal (RFP) provides a comprehensive overview of the PSP selection process.

The advantages of Stripe as a payment service provider

As an all-in-one payments platform, Stripe gives you all the tools you need for your business’s payments and financial processes – online and offline, around the world. In addition, Stripe provides unified omnichannel experiences and integrated financial services to make it easy to get more out of payments. Stripe’s customers range from startups to global enterprises. In Germany, every second DAX 40 company uses Stripe, including E.ON and BMW as well as leading German startups such as Free Now, Personio, and N26.

In “The Forrester Wave™ Merchant Payment Providers Q2 2022”, Stripe was again named a leader among PSPs, receiving the highest possible score in the “Strategy” category and the highest possible score in the “Vision” criterion, compared to 11 companies evaluated by Forrester. In 2024, Stripe again received top marks in more criteria than any other evaluated provider.

Solutions for every business model: A selection

More than 300,000 businesses around the world use Stripe Billing, Stripe’s recurring billing and subscription solution. Its counterpart is Stripe Invoicing, which allows you to simplify and automate your invoicing and speed up your accounting processes.

With Stripe Payments, you can easily accept payments online and in-person anywhere in the world. This is made possible by a single payment solution with access to over 100 payment methods and fast, one-click checkout.

Many businesses struggle with the challenge of staying compliant. In addition, tax laws are constantly changing, making many businesses hesitant to expand internationally. Stripe Tax automatically calculates and collects taxes worldwide, making it an invaluable tool for cross-border commerce.

At the same time, Stripe Radar provides built-in fraud protection, giving you a cutting-edge payments technology solution that is constantly being trained and improved by machine learning on data from millions of businesses worldwide.

Improved payment processes on multiple levels

Stripe also helps you automate your payments and finances to optimise costs. This happens simultaneously on multiple levels. On the one hand, improved payment processes lead to lower operating costs. At the same time, you can increase your conversion rate – and your revenue. It also creates a seamless customer experience, thanks to Stripe’s modern online and in-person payment capabilities. Stripe’s platform supports more than 135 currencies and 47 countries. This also makes it easy for you to quickly expand into new markets.

Depending on your business’s needs, Stripe’s products can be customised to meet your specific requirements – whether it’s your own card programme with Stripe Issuing, platform and marketplace payments with Stripe Connect, or Stripe Revenue Recognition to automate your accounting.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.