The One-Stop Shop (OSS) declaration enables companies to report their value-added tax (VAT) liability for cross-border supplies and services to private individuals in the European Union via a single portal.

In this article, you will learn what an OSS declaration is and which transactions you can declare. We also explain how to submit and correct OSS declarations and what deadlines apply.

What’s in this article?

- What is an OSS declaration?

- What transactions can I declare via the OSS?

- How do I submit OSS declarations?

- What are the deadlines for OSS declarations?

- How can I correct an OSS declaration?

What is an OSS declaration?

An OSS declaration is a central component of the OSS procedure the EU established to simplify VAT processing for cross-border deliveries, sales, and resources to private individuals (B2C) within the EU. Since 2021, online retailers who sell goods or services to private individuals in several EU countries can report their transactions via the central OSS portal. Since that time, it is no longer necessary to register for VAT in each country individually.

Companies can use OSS declarations to report and transmit all relevant VAT amounts to the responsible tax authorities. The declaration contains detailed information on the sale of goods or services, tax amounts, and destination countries. This allows the tax authority to collect directly at the time of purchase, and companies pay VAT to the respective member states where the buyers reside. The OSS declaration enables companies to fulfil their fiscal obligations while minimising administrative burdens efficiently.

Detailed information on the OSS procedure, including the requirements, how it works, and the new regulations as part of the VAT in the Digital Age (ViDA) initiative, can be found in our article on OSS.

What transactions can I declare via the OSS?

Participation in the OSS is voluntary for online retailers. If you decide to do so and, therefore, not register for VAT in several EU countries, you can declare the following activities via the OSS:

- Intracommunity distance sales of goods to private individuals in other EU member states

- Deliveries of goods from an EU warehouse by a company not based in the EU to European private individuals

- Services for customers in other EU countries

- Electronic offerings and telecommunications, television, and radio services for private users in other EU countries

Additionally, companies must use digital platforms to declare VAT via the OSS if they act as an electronic interface and support supplies of goods within a member state by a taxable entity not established in the EU.

In principle, the OSS applies exclusively to B2C transactions. The OSS procedure excludes sales to companies (B2B).

One prerequisite for OSS use is an annual turnover of more than €10,000 net. Below this delivery threshold, turnover taxation occurs in the traders’ country of origin. It is exclusively above this threshold that VAT liability applies in the target countries, and the possibility of using the OSS applies.

How do I submit OSS declarations?

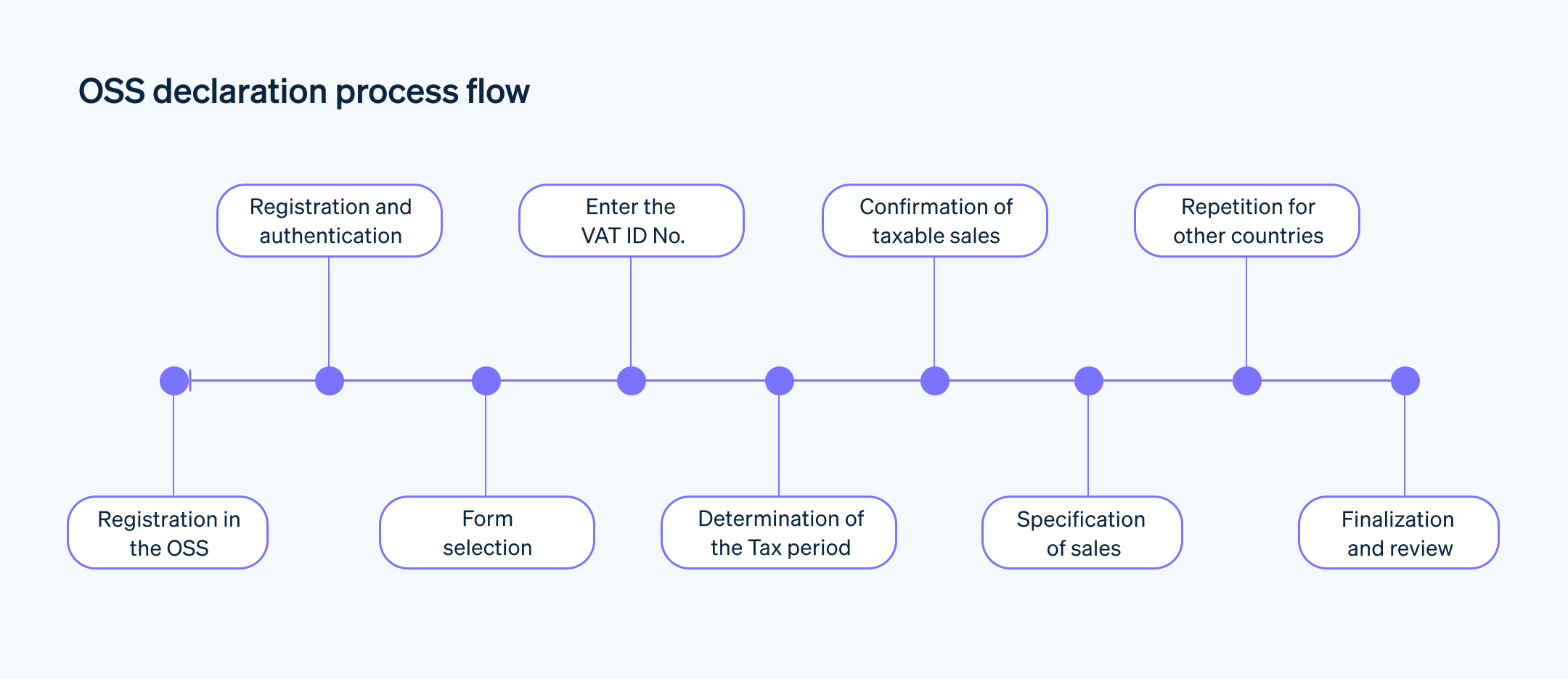

Submitting OSS declarations takes just a few steps.

OSS registration

You need to register before you can use the OSS procedure; each EU member state has its portal for OSS registration. German companies can do this via the BOP online portal of the Federal Central Tax Office (BZSt). If you want to participate in this procedure, you must notify the BZSt before the start of the relevant tax period. Sign-up takes place after providing information about the company, such as the VAT identification number, using a certificate file, which you can download.

Registration and authentication

Click the “Log in now” button to access the BOP portal. To authenticate, you must upload your certificate file and enter the associated password. Finally, confirm the process by clicking on “Login.”

Form selection

In the “My BOP” menu, navigate to “Forms and Services” and select “All Forms.” In the “International Tax” section, you will find the option “One-stop-shop (OSS) for companies based in the EU – EU regulation (formerly mini-one-stop-shop).” Click on “Tax return for the OSS EU declaration” for the desired tax period. Then, confirm the privacy notice to continue.

Entering the VAT identification number

Enter your VAT identification number (without the country code “DE”) in the next step.

Determination of the tax period

Select the period for the OSS declaration. Since you must submit it quarterly, specify the relevant year and quarter.

Confirmation of taxable sales

Now indicate whether you have generated taxable sales in the selected period. If this is not the case, you must still provide data for this period in the form of a so-called “zero declaration.”

Statement of sales

Declare your taxable sales and any corrections if necessary. To do this, select the target country and enter the transactions from deliveries of goods you made from your home region. Assign these to the appropriate sales tax rates, either “Reduced” or “Standard.” Finally, save the entered data by clicking on “Apply entry.” If you have made sales with additional rates, you can also enter these.

In addition, you can specify deliveries that you have made from another EU country to the specified destination. For example, this might happen if you own a warehouse outside your home region. To do this, you must enter the country of origin of the delivery and information about the supplier of the goods.

Companies can easily make mistakes when calculating their turnover because they must consider the different tax rates in each EU country.

Stripe Tax can help as it automatically calculates the correct tax amount. You can also quickly determine whether you exceed the delivery threshold of €10,000. Stripe Tax allows you to collect and declare your taxes for global payments. You will also receive access to all relevant tax documents.

Repetition for other countries

If you have produced sales subject to VAT in other EU countries, select the relevant target territories and enter your transactions as described above.

Final steps and review

Finally, check all information carefully. If everything is correct, you can submit the OSS declaration. The BZSt will notify you within a few days whether it accepts your statement and will email you a corresponding confirmation.

OSS declaration process flow

What are the deadlines for OSS declarations?

You must always submit your OSS returns by the end of the month following each calendar quarter, which serves as the tax period for the OSS declaration. Below, you will find an overview of the entire process.

- First quarter: 30 April

- Second quarter: 31 July

- Third quarter: 31 October

- Fourth quarter: 31 January of the following year

How can I correct an OSS declaration?

If you need to correct an OSS declaration that’s been submitted, you can do so easily via the BZSt’s BOP portal. The form has a special section that breaks down the corrected information by tax period and EU member state.

Until now, corrections had to be made in a subsequent OSS declaration. However, this regulation was adjusted as part of the ViDA package adopted by the European Council in November 2024. Since then, OSS declarations can be corrected until the submission cut-off, i.e., the respective deadline’s expiry.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.